Did you know where the potentially largest #uranium mines are in the world? Do you know the company that has the most upside in Sweden reinstating uranium mining? $AEE

This scoping study level project has a sub $20/lb AISC given the huge credits from Nickel, Molybdenum and V.

This scoping study level project has a sub $20/lb AISC given the huge credits from Nickel, Molybdenum and V.

Reality check:

Low grade #uranium mines with massive secondary credits = low AISC outcomes

The option value of the Swedish assets to be built into $AEE's stockprice for $5-8 of NPV is 10-20c over the next 1-5 months.

Low grade #uranium mines with massive secondary credits = low AISC outcomes

The option value of the Swedish assets to be built into $AEE's stockprice for $5-8 of NPV is 10-20c over the next 1-5 months.

You have been warned $AEE

$URNM entry coupled with #uranium Mining ban removal = satisfactory result

$URNM entry coupled with #uranium Mining ban removal = satisfactory result

What is so interesting about $AEE's Swedish Battery Metals project is that the Credits are so large that in a #commodity boom these grow at a higher rate than inflation pushing down the all in sustaining cost per pound for #uranium or #vanadium whichever is the primary output.

If it's a #vanadium project:

The primary resource value in the ground is $20bn Vs full credits of over $50bn = negative cost to extract post credits

If it's a #uranium project:

The primary value is $30bn Vs full credits of $40bn

$AEE

The primary resource value in the ground is $20bn Vs full credits of over $50bn = negative cost to extract post credits

If it's a #uranium project:

The primary value is $30bn Vs full credits of $40bn

$AEE

Content:

10bn pounds of #vanadium

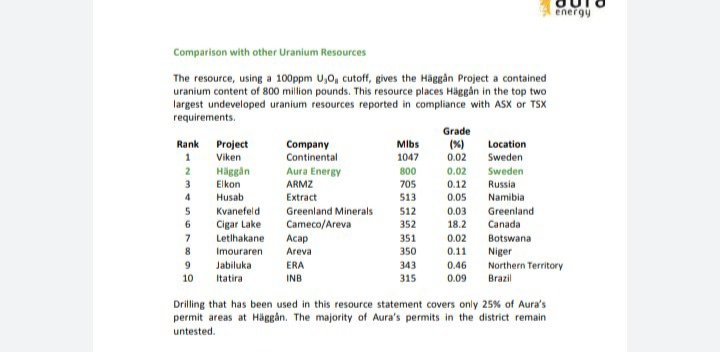

800m pounds of #uranium

1.6bn pounds of #nickel

1.1bn pounds of #molybdenum

2.2bn pounds of #zinc

This is a monster ESG mine in the making....supplying essential metals for the transition.

$AEE

10bn pounds of #vanadium

800m pounds of #uranium

1.6bn pounds of #nickel

1.1bn pounds of #molybdenum

2.2bn pounds of #zinc

This is a monster ESG mine in the making....supplying essential metals for the transition.

$AEE

• • •

Missing some Tweet in this thread? You can try to

force a refresh