#Cardano just embraced the #Vasil upgrade

Its the right time to look back at the groundbreaking successes of #Cardano

A novel consensus protocol based on Proof of stake (PoS) is one of them

So let's compare & contrast the PoS of #Cardano with PoS of #Ethereum 🧵👇

Its the right time to look back at the groundbreaking successes of #Cardano

A novel consensus protocol based on Proof of stake (PoS) is one of them

So let's compare & contrast the PoS of #Cardano with PoS of #Ethereum 🧵👇

Since the #Shelly upgrade in 2020,

#Cardano is running on a PoS-based consensus protocol named Ouroborus

It is the first provably secure PoS-based consensus protocol

and the 1st blockchain protocol based on peer-reviewed research

Running without a glitch for the past 2 years

#Cardano is running on a PoS-based consensus protocol named Ouroborus

It is the first provably secure PoS-based consensus protocol

and the 1st blockchain protocol based on peer-reviewed research

Running without a glitch for the past 2 years

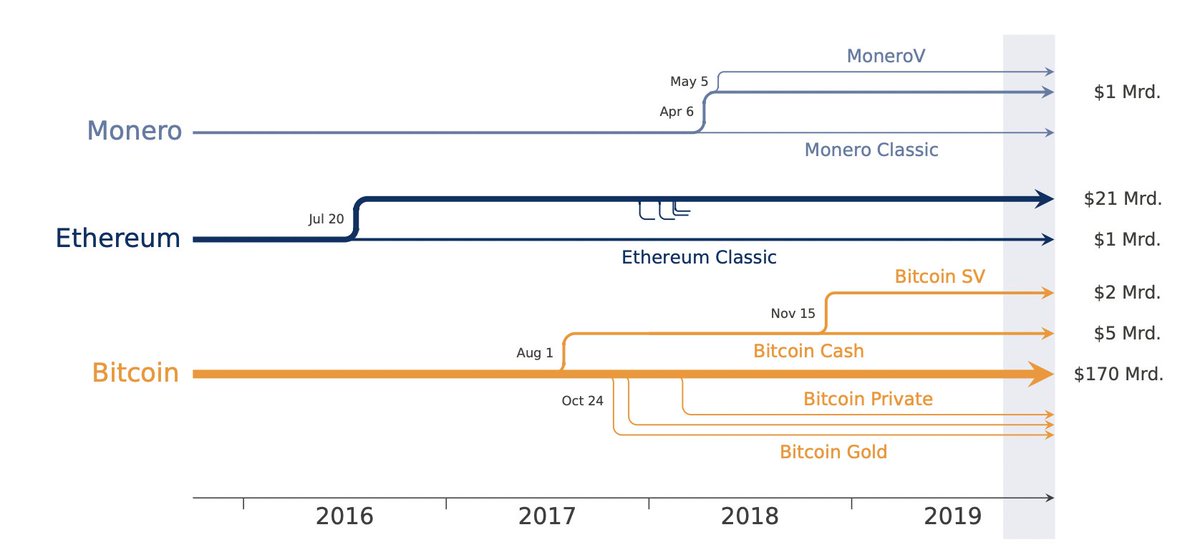

After years of development,

the Ethereum Merge happened on September 15, 2022

The transition from PoW to PoS was enabled

by merging the old PoW Ethereum mainnet with a separate PoS-based blockchain called the Beacon Chain

Which now exists as one chain

the Ethereum Merge happened on September 15, 2022

The transition from PoW to PoS was enabled

by merging the old PoW Ethereum mainnet with a separate PoS-based blockchain called the Beacon Chain

Which now exists as one chain

Post-merge, there was widespread misinformation

which was propagated mostly by #Bitcoin maximalists

Implying, #Ethereum PoS is somehow the industry standard for PoS-based blockchains

Ignoring the nuances and features of other PoS-based protocols, especially #Cardano 👇

which was propagated mostly by #Bitcoin maximalists

Implying, #Ethereum PoS is somehow the industry standard for PoS-based blockchains

Ignoring the nuances and features of other PoS-based protocols, especially #Cardano 👇

First of all: What is Proof-of-Stake?

Just like PoW,

PoS is a component of a consensus mechanism that protects it from Sybil attacks

Here a validator is chosen to verify transactions based on the tokens they have staked in the network as a form of collateral

Just like PoW,

PoS is a component of a consensus mechanism that protects it from Sybil attacks

Here a validator is chosen to verify transactions based on the tokens they have staked in the network as a form of collateral

A Sybil attack is a security threat

where one person or an entity tries to take over and control the network by creating multiple accounts or nodes

PoS significantly increases the cost of attack,

as an attacker would have to buy an overwhelming quantity of tokens to stake

where one person or an entity tries to take over and control the network by creating multiple accounts or nodes

PoS significantly increases the cost of attack,

as an attacker would have to buy an overwhelming quantity of tokens to stake

PoS is an umbrella term used to specify the Sybil resistance mechanism,

and there are significant differences in the flavors of the PoS mechanism used by different blockchains

That's why it's essential to compare and contrast the difference between #Cardano and #Ethereum

and there are significant differences in the flavors of the PoS mechanism used by different blockchains

That's why it's essential to compare and contrast the difference between #Cardano and #Ethereum

So lets compare the PoS of Cardano with the PoS of Ethereum

For a general understanding of the differences & its effects on decentralization, we are focusing on the following areas

• Slashing

• locking period

• Custodial Staking

• Participation Threshold

Ok, let's dig in!

For a general understanding of the differences & its effects on decentralization, we are focusing on the following areas

• Slashing

• locking period

• Custodial Staking

• Participation Threshold

Ok, let's dig in!

1. Slashing (#Ethereum) / No Slashing (#Cardano)

What is slashing?

Slashing is a tool used by some PoS-based blockchains to prevent malicious behavior

and making network participants more accountable by enforcing monetary penalties

What is slashing?

Slashing is a tool used by some PoS-based blockchains to prevent malicious behavior

and making network participants more accountable by enforcing monetary penalties

https://twitter.com/FsjalDoesCrypto/status/1570311141049663488

As sophisticated as it sounds,

Ethereum validators risk staking penalties, with up to 100% of staked funds at risk if validators fail

and 99% of the time, honest actors were at the receiving end of slashing due to technical errors

Ethereum validators risk staking penalties, with up to 100% of staked funds at risk if validators fail

and 99% of the time, honest actors were at the receiving end of slashing due to technical errors

https://twitter.com/benjaminion_xyz/status/1334881186003492864

As slashing is a punitive mechanism that leads to the loss of funds,

the risk slashing overweighs the incentive of getting yields

This may hold people or entities back from fully participating in the network

This disincentivizes staking and results in low network participation

the risk slashing overweighs the incentive of getting yields

This may hold people or entities back from fully participating in the network

This disincentivizes staking and results in low network participation

Slashing is a controversial & unproven approach that negatively affects mostly honest network participants

Basically,

Once you stake your ETH, you give up your rights over your ETH to the Ethereum network

Bankless boys make the point pretty clear 👇

Basically,

Once you stake your ETH, you give up your rights over your ETH to the Ethereum network

Bankless boys make the point pretty clear 👇

In contrast

#Cardano’s implementation of PoS doesn’t use slashing

#Cardano has a unique reward-sharing scheme that incentivizes shareholders to behave rationally

Anyone can participate in the network without the fear of losing or giving up the property rights of their ADA

#Cardano’s implementation of PoS doesn’t use slashing

#Cardano has a unique reward-sharing scheme that incentivizes shareholders to behave rationally

Anyone can participate in the network without the fear of losing or giving up the property rights of their ADA

At the end of the day

#Ethereum disincentivizes network participation by slashing

Cardano incentivizes staking & network validation by rewarding honest actors

Resulting in high network participation & decentralization of the network,

making #Cardano more resistant to attacks

#Ethereum disincentivizes network participation by slashing

Cardano incentivizes staking & network validation by rewarding honest actors

Resulting in high network participation & decentralization of the network,

making #Cardano more resistant to attacks

2. Infinite Locking Period(#Ethereum)/No Locking Period(#Cardano)

As of now

the locking period for your staked ETH is infinite

After the merge, you cannot unlock your ETH

Even the core developers are not sure about the schedule of protocol change that would enable unlocking

As of now

the locking period for your staked ETH is infinite

After the merge, you cannot unlock your ETH

Even the core developers are not sure about the schedule of protocol change that would enable unlocking

At the end of the day,

you cannot unstake your staked ETH, and it can also get slashed

This adds a lot of uncertainty to the process of participating in the network,

Resulting in a low level of participation which is reflected in the low staking ratio

you cannot unstake your staked ETH, and it can also get slashed

This adds a lot of uncertainty to the process of participating in the network,

Resulting in a low level of participation which is reflected in the low staking ratio

In contrast,

PoS of #Cardano has no locking period

Meaning,

you can move your staked ADA anytime you like without penalty or restriction

This makes network participation easier and uncomplicated

This is reflected in the high staking ratio of #Cardano

PoS of #Cardano has no locking period

Meaning,

you can move your staked ADA anytime you like without penalty or restriction

This makes network participation easier and uncomplicated

This is reflected in the high staking ratio of #Cardano

3. High Participation Threshold(Ethereum)/Low Participation Threshold (Cardano)

Cardano makes no compromise on inclusive accountability

Cardano allows anyone to run a validator node without requiring a minimum amount of ADA

the minimum staking requirement is 5.5 ADA (2.49 USD)

Cardano makes no compromise on inclusive accountability

Cardano allows anyone to run a validator node without requiring a minimum amount of ADA

the minimum staking requirement is 5.5 ADA (2.49 USD)

In contrast

Ethereum requires a minimum of 32 ETH($40937) for running a validator node

This is a pretty high participation threshold for many

This, with slashing & an infinite locking period, will scare off most of the well-intentioned people from participating in the network

Ethereum requires a minimum of 32 ETH($40937) for running a validator node

This is a pretty high participation threshold for many

This, with slashing & an infinite locking period, will scare off most of the well-intentioned people from participating in the network

4. Custodial Staking (#Ethereum)/ Non-Custodial Staking (#Cardano)

The risk of

• Slashing

• Infinite Locking Period and

• High Participation Threshold

have resulted in a situation that incentivizes custodial staking of ETH

The risk of

• Slashing

• Infinite Locking Period and

• High Participation Threshold

have resulted in a situation that incentivizes custodial staking of ETH

So what is custodial staking?

Custodial staking is similar to delegation, except you don't actually own your crypto

For eg: If you "only" have 5 ETH ($6408) :D,

because of some arbitrary limit set in the protocol, you are not qualified to participate directly in the network

Custodial staking is similar to delegation, except you don't actually own your crypto

For eg: If you "only" have 5 ETH ($6408) :D,

because of some arbitrary limit set in the protocol, you are not qualified to participate directly in the network

If you still want to stake

You must depend on staking services like Lido or exchanges like Coinbase or Kraken

Practically giving up the control of your ETH to a smart contract or an exchange

With also an inherent risk of slashing with a smart contract vulnerability or a bug

You must depend on staking services like Lido or exchanges like Coinbase or Kraken

Practically giving up the control of your ETH to a smart contract or an exchange

With also an inherent risk of slashing with a smart contract vulnerability or a bug

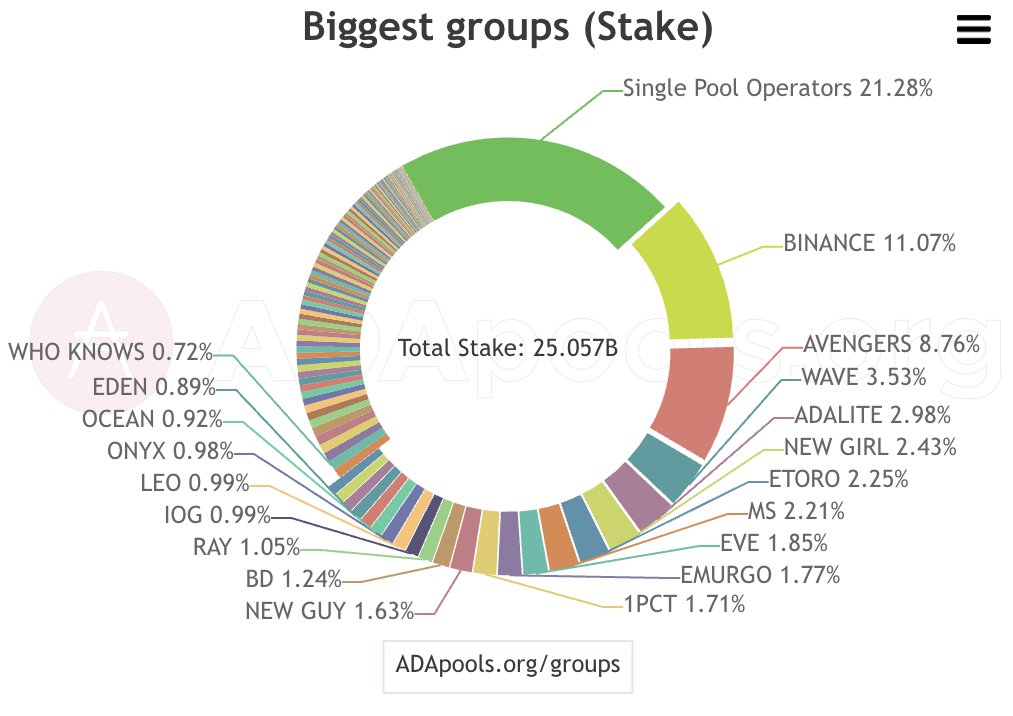

All of these factors contributed to more and more people giving up control of their ETH

to entities like Lido and centralized exchanges like Coinbase

This has resulted in the centralization of the Ethereum network

Currently, three entities control more than 51% of the network

to entities like Lido and centralized exchanges like Coinbase

This has resulted in the centralization of the Ethereum network

Currently, three entities control more than 51% of the network

In contrast

Cardano has

• No Risk of Slashing

• A Low Participation Threshold &

• No Token Locking Period for Staking

Resulting in a situation where protocol incentivizes non-custodial staking

Where you participate in the network without giving up your property rights

Cardano has

• No Risk of Slashing

• A Low Participation Threshold &

• No Token Locking Period for Staking

Resulting in a situation where protocol incentivizes non-custodial staking

Where you participate in the network without giving up your property rights

This well-thought-out incentive mechanism

and a better user experience with staking has positively influenced the decentralization of #Cardano network

Currently,

it would take the collaboration of 24 entities to control more than 51% of the network

Credits: @adapools_org

and a better user experience with staking has positively influenced the decentralization of #Cardano network

Currently,

it would take the collaboration of 24 entities to control more than 51% of the network

Credits: @adapools_org

Basically,

Cardano approaches blockchain development methodologically and scientifically,

developing a PoS-based blockchain from scratch,

which is running flawlessly since 2020

This drastically differs from starting the journey as a PoW blockchain & merging into a PoS chain

Cardano approaches blockchain development methodologically and scientifically,

developing a PoS-based blockchain from scratch,

which is running flawlessly since 2020

This drastically differs from starting the journey as a PoW blockchain & merging into a PoS chain

TL;DR:

#Cardano has a superior PoS mechanism that incentivizes network participation

Resulting in a high degree of network decentralization

Whereas Ethereum disincentivizes network participation

Resulting in a situation where 3 entities could control 53% of the entire network

#Cardano has a superior PoS mechanism that incentivizes network participation

Resulting in a high degree of network decentralization

Whereas Ethereum disincentivizes network participation

Resulting in a situation where 3 entities could control 53% of the entire network

I thank @DiMoneymindset for the support in finishing this thread.

a special thanks to @StakeWithPride for motivating me to write this thread, who is very active in educating about #Cardano; please give him a follow

a special thanks to @StakeWithPride for motivating me to write this thread, who is very active in educating about #Cardano; please give him a follow

@DiMoneymindset @StakeWithPride That's a wrap!

If you found this thread helpful:

1. Follow me @Soorajksaju2 for more educational content

2. RT the tweet below to share this thread with your audience

If you found this thread helpful:

1. Follow me @Soorajksaju2 for more educational content

2. RT the tweet below to share this thread with your audience

https://twitter.com/842288538238484480/status/1563512472211898369

If you like Threads like this, you might enjoy our weekly newsletter: Just The Metrics.

A 5-minutes, easy-to-understand newsletter about crypto fundamentals to stay up to date & be better crypto investors 📈

Subscribe here👇

…st-the-metrics-newsletter.beehiiv.com

A 5-minutes, easy-to-understand newsletter about crypto fundamentals to stay up to date & be better crypto investors 📈

Subscribe here👇

…st-the-metrics-newsletter.beehiiv.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh