Thread (Long ⚠️):

Simple explanation about #ElliottWave principles and targets for each wave.

Also, analysis of major indices #SPX, #DowJones, #Nasdaq, #SGXNifty, #Nifty50 and #BankNifty.

[1/n]

Simple explanation about #ElliottWave principles and targets for each wave.

Also, analysis of major indices #SPX, #DowJones, #Nasdaq, #SGXNifty, #Nifty50 and #BankNifty.

[1/n]

#ElliottWave

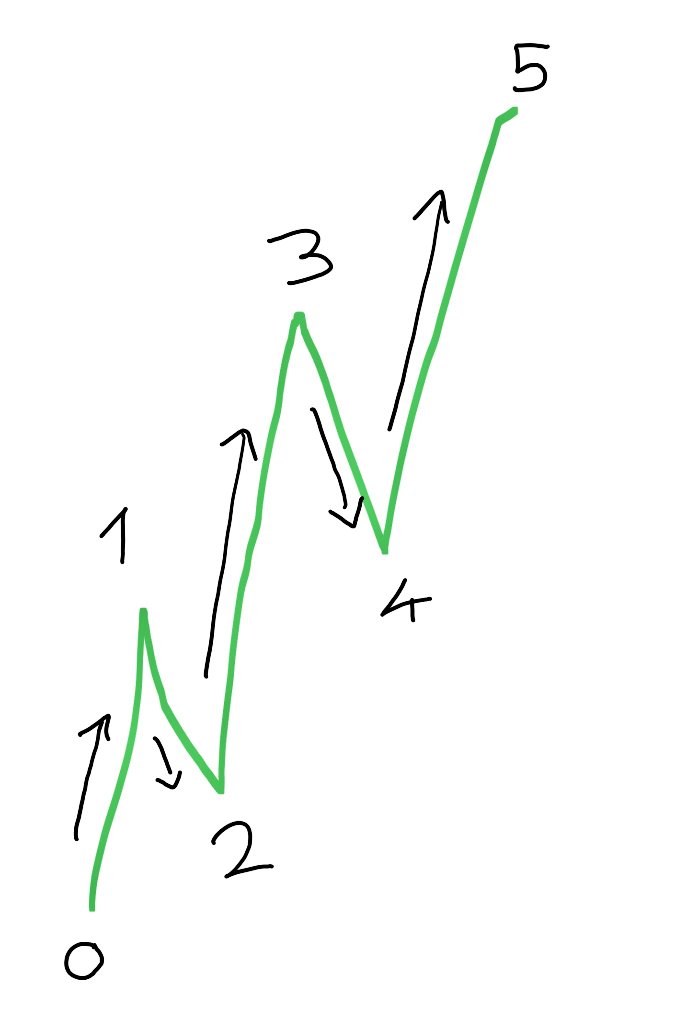

The prices move in impulse phase followed by corrective phase.

Impulse phase has total 5 waves - 1,2,3,4,5 - out of which 1,3,5 move in the direction of trend and 2,4 move in counter direction of trend.

Wave 2 corrects Wave 1.

Wave 4 corrects Wave 3.

[2/n]

The prices move in impulse phase followed by corrective phase.

Impulse phase has total 5 waves - 1,2,3,4,5 - out of which 1,3,5 move in the direction of trend and 2,4 move in counter direction of trend.

Wave 2 corrects Wave 1.

Wave 4 corrects Wave 3.

[2/n]

#ElliottWave

Cardinal rule 3:

Wave 3 cannot be shortest wave amongst Waves 1,3,5. In other words, Wave 1 or Wave 5 has to be shorter than Wave 3.

[5/n]

Cardinal rule 3:

Wave 3 cannot be shortest wave amongst Waves 1,3,5. In other words, Wave 1 or Wave 5 has to be shorter than Wave 3.

[5/n]

#ElliottWave

If any of the cardinal rules is breached, the existing wave count is invalid and must be considered again.

For example, if Wave 2 goes below Wave 1, point 0 has to be shifted to original point 2.

This is applicable when any of the other rules is breached.

[6/n]

If any of the cardinal rules is breached, the existing wave count is invalid and must be considered again.

For example, if Wave 2 goes below Wave 1, point 0 has to be shifted to original point 2.

This is applicable when any of the other rules is breached.

[6/n]

#ElliottWave

Corrective phase has minimum 3 waves - A,B,C - out of which A,C move in the direction of trend and B move in counter direction of trend.

Wave B corrects Wave A.

[7/n]

Corrective phase has minimum 3 waves - A,B,C - out of which A,C move in the direction of trend and B move in counter direction of trend.

Wave B corrects Wave A.

[7/n]

#ElliottWave

Corrective phase ABC can have following variations:

Pic 1: ZigZag

Pic 2: Flat

Pic 3: Expanded Flat

Pic 4: Running Flat

[8/n]

Corrective phase ABC can have following variations:

Pic 1: ZigZag

Pic 2: Flat

Pic 3: Expanded Flat

Pic 4: Running Flat

[8/n]

#ElliottWave

Difference between corrective ABC variations:

ZigZag: Moves in a zigzag pattern

Flat: Moves in a flat channel

Expanded Flat: Wave B & C exceeds Wave 5 & C extremes respectively

Running Flat: Wave B exceeds Wave 5 extreme; Wave C doesn't reach Wave A extreme

[9/n]

Difference between corrective ABC variations:

ZigZag: Moves in a zigzag pattern

Flat: Moves in a flat channel

Expanded Flat: Wave B & C exceeds Wave 5 & C extremes respectively

Running Flat: Wave B exceeds Wave 5 extreme; Wave C doesn't reach Wave A extreme

[9/n]

#ElliottWave

Corrective phase can have following other formations:

Pic 1: ABCDE

Pic 2: ABCXABC (aka WXY / double threes)

Pic 3: ABCXABCXABC (aka WXYXZ / triple threes)

[10/n]

Corrective phase can have following other formations:

Pic 1: ABCDE

Pic 2: ABCXABC (aka WXY / double threes)

Pic 3: ABCXABCXABC (aka WXYXZ / triple threes)

[10/n]

#ElliottWave

As corrective phase has many possible variations, it is difficult to know which variation will come once basic ABC is completed.

This is why it is difficult to trade once ABC pattern is over & until new formation of subwaves 12345 of major wave 1 is formed.

[11/n]

As corrective phase has many possible variations, it is difficult to know which variation will come once basic ABC is completed.

This is why it is difficult to trade once ABC pattern is over & until new formation of subwaves 12345 of major wave 1 is formed.

[11/n]

#ElliottWave

Corrective waves 2 & 4 of impulse phase 12345 follow the variations mentioned under corrective phase variations in above tweet.

An important aspect of Wave 2 & 4:

If Wave 2 was a simple correction (i.e., zigzag), wave 4 will be complex one and vice versa.

[12/n]

Corrective waves 2 & 4 of impulse phase 12345 follow the variations mentioned under corrective phase variations in above tweet.

An important aspect of Wave 2 & 4:

If Wave 2 was a simple correction (i.e., zigzag), wave 4 will be complex one and vice versa.

[12/n]

#ElliottWave

Impulse phase Wave 1:

Target: Normally reaches Base of previous wave B or 38.2-61.8% retracement of previous ABC

Important: Wave 1 must have 5 subwaves (abcde)

[13/n]

Impulse phase Wave 1:

Target: Normally reaches Base of previous wave B or 38.2-61.8% retracement of previous ABC

Important: Wave 1 must have 5 subwaves (abcde)

[13/n]

#ElliottWave

Impulse phase Wave 2:

Target: Normally retraces to 38.2-61.8% of Wave 1

Important: Wave 2 can retrace max 100% of Wave 1 but cannot go below it (Cardinal rule 1)

[14/n]

Impulse phase Wave 2:

Target: Normally retraces to 38.2-61.8% of Wave 1

Important: Wave 2 can retrace max 100% of Wave 1 but cannot go below it (Cardinal rule 1)

[14/n]

#ElliottWave

Impulse phase Wave 3:

Target: Normally 100-161.8% of Wave 1 length. If extended, it can also be 261.8-361.8%.

Important: Wave 3 cannot be shortest amongst wave 1,3,5. If wave 3 is shorter than wave 1, wave 5 will be shorter than wave 3 (cardinal rule 3)

[15/n]

Impulse phase Wave 3:

Target: Normally 100-161.8% of Wave 1 length. If extended, it can also be 261.8-361.8%.

Important: Wave 3 cannot be shortest amongst wave 1,3,5. If wave 3 is shorter than wave 1, wave 5 will be shorter than wave 3 (cardinal rule 3)

[15/n]

#ElliottWave

Impulse phase Wave 4:

Target: At least 23.6%, normally 38.2% retracement of Wave 3. In strong markets only upto 14% of Wave 3.

Important: Wave 4 cannot go below extreme of Wave 1 (cardinal rule 2)

[16/n]

Impulse phase Wave 4:

Target: At least 23.6%, normally 38.2% retracement of Wave 3. In strong markets only upto 14% of Wave 3.

Important: Wave 4 cannot go below extreme of Wave 1 (cardinal rule 2)

[16/n]

#ElliottWave

Impulse phase Wave 5:

Target: 100% - 161.8% of Wave 1 or Wave 3 length.

Important: Wave 5 normally exceeds Wave 3 but can fail in exceeding Wave 3 as well to reach its target. This conincides with RSI divergence with price.

[17/n]

Impulse phase Wave 5:

Target: 100% - 161.8% of Wave 1 or Wave 3 length.

Important: Wave 5 normally exceeds Wave 3 but can fail in exceeding Wave 3 as well to reach its target. This conincides with RSI divergence with price.

[17/n]

#ElliottWave

Corrective phase Wave A:

Target: 38.2% - 61.8% retracement of Wave 5.

Important: If wave 5 was a triangle, retraces to subwave 2 of wave 5.

[18/n]

Corrective phase Wave A:

Target: 38.2% - 61.8% retracement of Wave 5.

Important: If wave 5 was a triangle, retraces to subwave 2 of wave 5.

[18/n]

#ElliottWave

Corrective phase Wave B:

Target:

Zigzag: 38.2-61.8% retracement of Wave A

Flat: 100% retracement of Wave A

Expanded flat: 138.2% retracement of Wave A

Important: Avoid trading during this wave!!

[19/n]

Corrective phase Wave B:

Target:

Zigzag: 38.2-61.8% retracement of Wave A

Flat: 100% retracement of Wave A

Expanded flat: 138.2% retracement of Wave A

Important: Avoid trading during this wave!!

[19/n]

#ElliottWave

Corrective phase Wave C:

Target: At least 61.8%, normally 100% and possibly 161.8% of Wave A

Important: Can get extended to ABCDE, ABCXABC or ABCXABCXABC pattern. Start of next Impulsive phase can be confirmed after compeltion of (1-5) subwaves of wave 1.

[20/n]

Corrective phase Wave C:

Target: At least 61.8%, normally 100% and possibly 161.8% of Wave A

Important: Can get extended to ABCDE, ABCXABC or ABCXABCXABC pattern. Start of next Impulsive phase can be confirmed after compeltion of (1-5) subwaves of wave 1.

[20/n]

#ElliottWave

Some inportant things to consider:

1. Wave 1,3,5,C must have 5 subwaves.

2. Wave 2,3,B must have 3 subwaves.

3. Wave A can have 3 or 5 subwaves.

[21/n]

Some inportant things to consider:

1. Wave 1,3,5,C must have 5 subwaves.

2. Wave 2,3,B must have 3 subwaves.

3. Wave A can have 3 or 5 subwaves.

[21/n]

#ElliottWave

#SPX

Current: Trading into Bearish Impulsive phase Wave 5. RSI<30.

Next: Either towards 3607 (completion of Wave5) or towards 3300 (completion og extended wave 5) or towards 3827-3884 (Wave A).

#SPX

Current: Trading into Bearish Impulsive phase Wave 5. RSI<30.

Next: Either towards 3607 (completion of Wave5) or towards 3300 (completion og extended wave 5) or towards 3827-3884 (Wave A).

#ElliottWave

#Nasdaq

Current: Trading into Bearish Impulsive Phase wave 5. RSI<30.

Next: Either towards 10736 (completion of Wave 5) or towards 9489 (completion of extended wave 5) or towards 11774-11928 (Wave A).

#Nasdaq

Current: Trading into Bearish Impulsive Phase wave 5. RSI<30.

Next: Either towards 10736 (completion of Wave 5) or towards 9489 (completion of extended wave 5) or towards 11774-11928 (Wave A).

#ElliottWave

#DowJones

Current: Trading into Bearish Impulsive Wave 5. RSI < 30.

Next: Either towards 28756 (completion of wave 5) or towards 26440 (completion of extended wave 5) or towards 30493-31048 (wave A).

#DowJones

Current: Trading into Bearish Impulsive Wave 5. RSI < 30.

Next: Either towards 28756 (completion of wave 5) or towards 26440 (completion of extended wave 5) or towards 30493-31048 (wave A).

#ElliottWave

#Nifty50

Current: Trading into Bullish Impulsive Phase Wave 4 (Flat/Expanded/Running flat) and its subwave C. RSI ~ 41.

Next: Towards 17166 (38.2% retracement of Wave 3) or towards 16673 (61.8% rrtracement of Wave 3)and then towards 19300 (completion of Wave 5).

#Nifty50

Current: Trading into Bullish Impulsive Phase Wave 4 (Flat/Expanded/Running flat) and its subwave C. RSI ~ 41.

Next: Towards 17166 (38.2% retracement of Wave 3) or towards 16673 (61.8% rrtracement of Wave 3)and then towards 19300 (completion of Wave 5).

#ElliottWave

#BankNifty

Current: Trading into Bullish Impulsive Phase Wave 4 (Zigzag) and its subwave C. RSI ~ 46.

Next: Towards 39022 (38.2% retracement of Wave 3) or towards 37281 (61.8% retracement of Wave 3) and then towards 46409 (completion of Wave 5).

#BankNifty

Current: Trading into Bullish Impulsive Phase Wave 4 (Zigzag) and its subwave C. RSI ~ 46.

Next: Towards 39022 (38.2% retracement of Wave 3) or towards 37281 (61.8% retracement of Wave 3) and then towards 46409 (completion of Wave 5).

#ElliottWave

#SGXNifty

Current: Trading into Bullish Impulsive Phase Wave 4 (Expanded Flat) and its subwave C. RSI ~ 38.

Next: Towards 16661 (61.8% retracement of Wave 3; Already bounced sharply from 38.2%) or towards 19334 (completion of Wave 5).

#SGXNifty

Current: Trading into Bullish Impulsive Phase Wave 4 (Expanded Flat) and its subwave C. RSI ~ 38.

Next: Towards 16661 (61.8% retracement of Wave 3; Already bounced sharply from 38.2%) or towards 19334 (completion of Wave 5).

It is evident from above tweets that the structures of #SPX, #DowJones and #Nasdaq are quite different than #Nifty50 and #BankNifty. Also the fall in US indexes may be a good opportunity for FIIs to invest aggressively in Indian markets.

#ElliottWave

#ElliottWave

As long as #Nifty50 holds above 17166 on 26.09 and 27.09, reaching 19300 is a strong possibility.

Breach of 17166 will drag it down towards 16673.

My personal views about #Nifty, #BankNifty and all other US indexes for next 3-4 weeks are bullish.

Breach of 17166 will drag it down towards 16673.

My personal views about #Nifty, #BankNifty and all other US indexes for next 3-4 weeks are bullish.

Please note that all the above tweets are for educational purpose only. Please consult your finance advisor before taking any trades based on them.

If you like the thread, please retweet and share the information to others as much as possible.

[n/n]

#Nifty50

#Nifty

#BankNifty

If you like the thread, please retweet and share the information to others as much as possible.

[n/n]

#Nifty50

#Nifty

#BankNifty

#Nifty50 aternate views only for education purpose and my own reference.

If #Nifty sustains above 17241 on 26/27 Sept,

Target 1 (Pic1): 18624 by 03 Nov (+/- 2)

Target 2 (Pic2): 19479 by 25 Nov (+/-2)

If breaches 17241 on DCB, then 16713 on the downside before Target 1/2.

If #Nifty sustains above 17241 on 26/27 Sept,

Target 1 (Pic1): 18624 by 03 Nov (+/- 2)

Target 2 (Pic2): 19479 by 25 Nov (+/-2)

If breaches 17241 on DCB, then 16713 on the downside before Target 1/2.

#BankNifty aternate views only for education purpose and my own reference.

If it sustains above 39020 on 26/27 Sept,

Target 1 (Pic1): 43579 by 01 Nov (+/- 2)

Target 2 (Pic2): 46397 by 24 Nov (+/-2)

If breaches 39020 on DCB, then 37281 on the downside before Target 1/2.

If it sustains above 39020 on 26/27 Sept,

Target 1 (Pic1): 43579 by 01 Nov (+/- 2)

Target 2 (Pic2): 46397 by 24 Nov (+/-2)

If breaches 39020 on DCB, then 37281 on the downside before Target 1/2.

• • •

Missing some Tweet in this thread? You can try to

force a refresh