Let's look at Russian crude oil & petroleum product flows after 7 months of war.

Did the six sanction packages as announced by the European Commission already have an effect on exports?

1/n #Russia #OOTT @kittysquiddy @UrbanKaoboy @kingofcrude @AndurandPierre @AzizSapphire

Did the six sanction packages as announced by the European Commission already have an effect on exports?

1/n #Russia #OOTT @kittysquiddy @UrbanKaoboy @kingofcrude @AndurandPierre @AzizSapphire

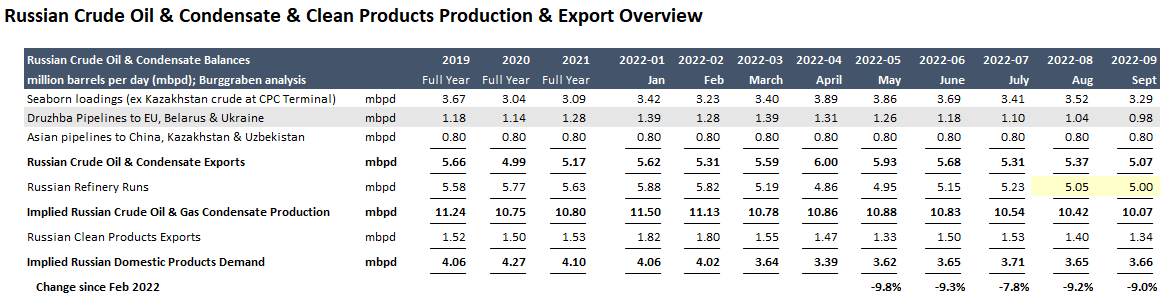

Upfront, we collect a lot of data in real time and yet, we have to make certain assumptions. Such cells are marked in yellow for ease of reference.

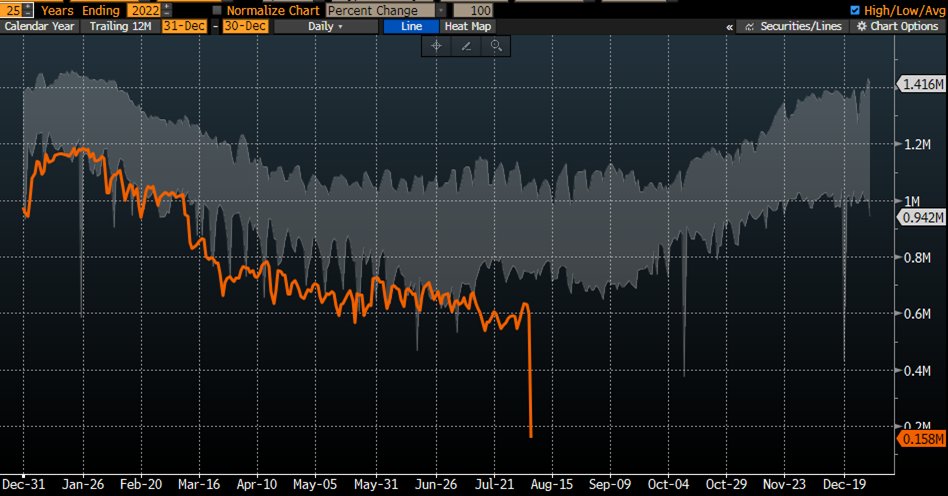

On that basis, implied Russian crude production has reduced by as much as 1.5mbpd since January 2022 - a lot.

2/n

On that basis, implied Russian crude production has reduced by as much as 1.5mbpd since January 2022 - a lot.

2/n

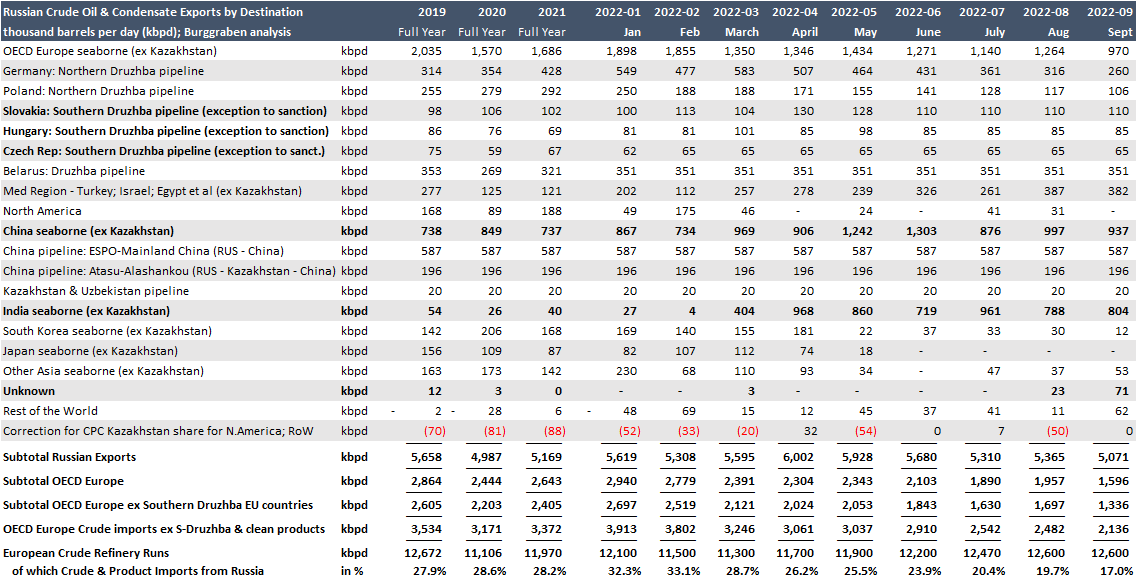

Who is buying less, who is buying more RUS crude?

OECD Europe buys 1.4mbpd less crude (sanction in Dec); Japan & Korea also down 250kbpd.

China up 100-150kbpd (little; they like diversifiction);

India up from 40 to 800kpbd;

Med Region up 150-200kbpd.

3/n

OECD Europe buys 1.4mbpd less crude (sanction in Dec); Japan & Korea also down 250kbpd.

China up 100-150kbpd (little; they like diversifiction);

India up from 40 to 800kpbd;

Med Region up 150-200kbpd.

3/n

Note that other Asian buyers (ex China; India; Japan; South Korea) also reduced Russian crude buying (mainly Thailand left) likely because of their own economic contractions.

Meanwhile, neither Africa or Latin America can replace European purchasing power.

4/n

Meanwhile, neither Africa or Latin America can replace European purchasing power.

4/n

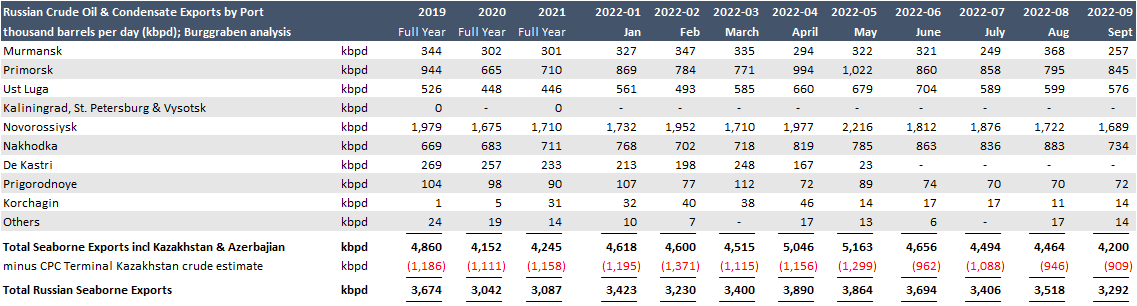

Production is for beginners, export logistics for the pros.

Let's look at logistics:

De Kastri in the Sea of Japan served Japan & Korean clients and is now "unemployed".

Nakhodka serves 800kbpd imports of China in Asia and is maxed out.

5/n

Let's look at logistics:

De Kastri in the Sea of Japan served Japan & Korean clients and is now "unemployed".

Nakhodka serves 800kbpd imports of China in Asia and is maxed out.

5/n

Net of Kazakh CPC crude exports at Novorossiysk, Russia therefore has to re-direct 2.5mbpd from West to East.

1mbpd does so already ($22 discount) which leaves 1.5mbpd to do same - hard.

With Asia contracting, IMHO only a China SPR restock can temporarily help.

6/n

1mbpd does so already ($22 discount) which leaves 1.5mbpd to do same - hard.

With Asia contracting, IMHO only a China SPR restock can temporarily help.

6/n

But as I explained before, it does not need a price cap. The market did and will continue to do the work already.

7/n

7/n

https://twitter.com/BurggrabenH/status/1579144808781602816?s=20&t=SPgRBqbCLYlKCA3FmzTLPQ

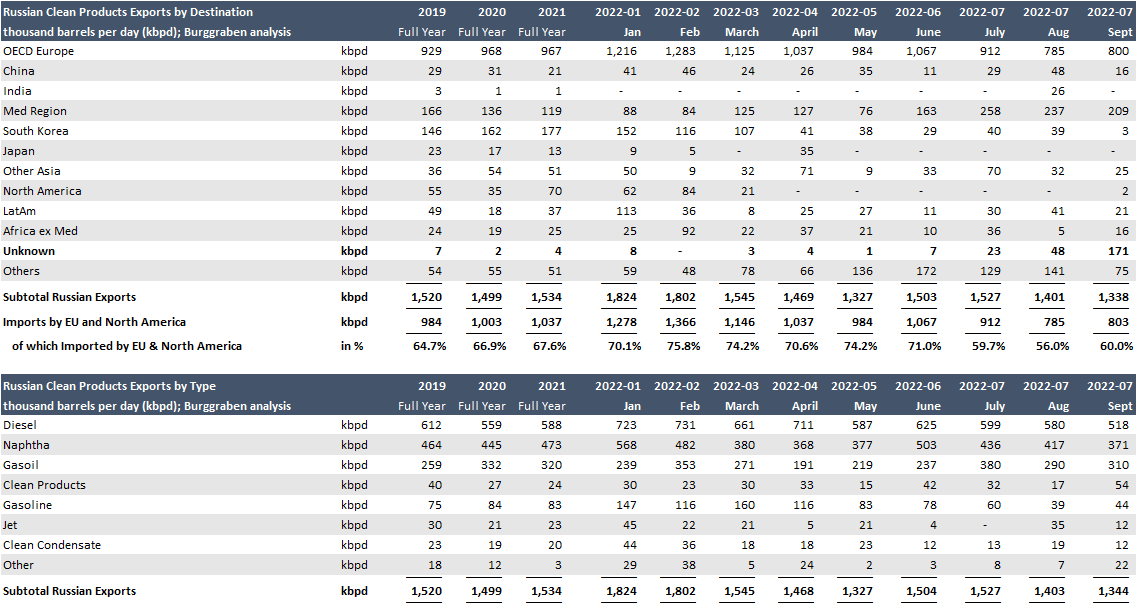

OECD Europe also purchased 70% of RUS petroleum products.

That was convenient: EU's refinery system is historically "short" 1mbpd diesel, "long" 1mbpd gasoline.

But products may be even harder to re-shuffle -> EU bought 400kbpd less (Feb sanction) with little replacement.

8/

That was convenient: EU's refinery system is historically "short" 1mbpd diesel, "long" 1mbpd gasoline.

But products may be even harder to re-shuffle -> EU bought 400kbpd less (Feb sanction) with little replacement.

8/

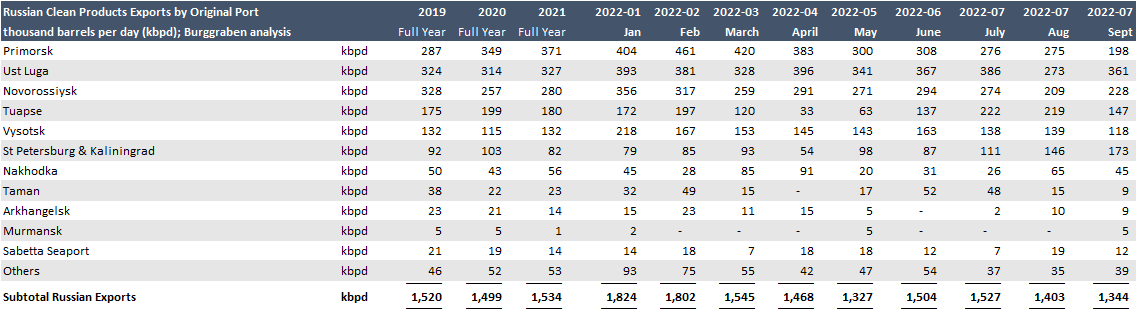

Asia doesn't need products. China has excess capacity while logistics matter here too.

95% of RUS products come out of Europe (Baltic Sea, some Actic). Which buyers will buy 800kbpd Baltic products I ask myself?

I don't see much re-shuffling here going forward either.

8/n

95% of RUS products come out of Europe (Baltic Sea, some Actic). Which buyers will buy 800kbpd Baltic products I ask myself?

I don't see much re-shuffling here going forward either.

8/n

The world may lose up to 3mbpd crude & products come March 2023.

Some may be compensated by OPEC (not sure), some by reduced demand. Yet, it looks the physical market will be well supported - the last thing Fed/ECB want.

Inflation > rates up > stocks down. Buckle up!

9/n Thx

Some may be compensated by OPEC (not sure), some by reduced demand. Yet, it looks the physical market will be well supported - the last thing Fed/ECB want.

Inflation > rates up > stocks down. Buckle up!

9/n Thx

• • •

Missing some Tweet in this thread? You can try to

force a refresh