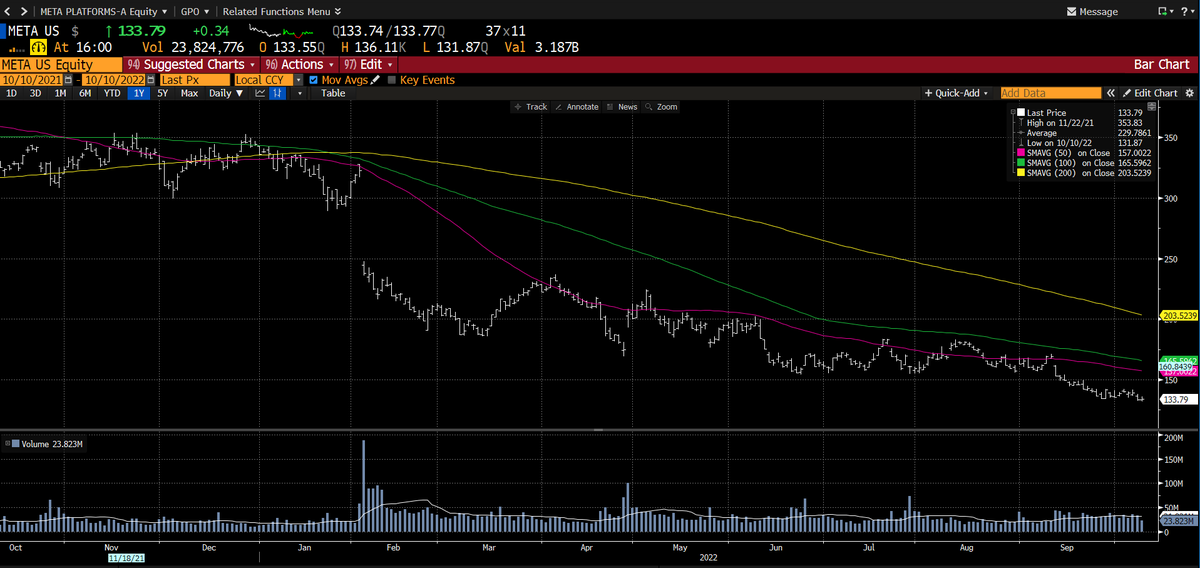

(1/12) Understanding mega cap companies helps us understand the broader #market because they have such an outsized impact on the indices people track and invest in. Yesterday we talked about big / ad #tech ( $GOOG $META) and today we are talking #retail.

(2/12) People forget that Walmart $WMT and Amazon $AMZN are the largest companies in the world by sales...

Heck, the US has a massive per capita #GDP thanks in large part to the #consumer / American's buying a lot of stuff.

Heck, the US has a massive per capita #GDP thanks in large part to the #consumer / American's buying a lot of stuff.

(3/12) So lets take a look at the state of retail from the top down (macro / economy level) and then from the bottom up (micro / company level)…

We are bottoms up investors, but pay close attention to the macro as an overlay (and just out of interest!).

We are bottoms up investors, but pay close attention to the macro as an overlay (and just out of interest!).

(4/12) On the macro, we saw a big drop in US Redbook Weekly Retail Sales this morning - down to +8.3% y/y, which is a major slowdown from last week at +12.3%.

(5/12) This is the lowest number in over two years and doesn’t normalize for price (sales = price * volume), so volume is likely negative y/y.

(6/12) A very noteworthy deceleration, which, if it holds may be a sign of another shoe to drop in consumer demand.

(7/12) On the micro, Amazon has started the Prime “Early Access” sales, ahead of the Black Friday / Cyber Monday sales launching next month. And we’ve heard they may also be exploring another event sale…

(8/12) This is Jassy & Co. telling us that the consumer is under pressure and needs a deal in order to buy…plus it needs to try to drive outsized sales to avoid a big slowdown in Q4. We'll see.

(9/12) Competitors are stepping up their deals as well with Target $TGT starting Black Friday deals, and Walmart highlighting new rollbacks.

(10/12) We’ve been writing about #inventory issues since the beginning of the year and the #promotional cadence is now rapidly accelerating.

(11/12) After looking through Prime deals today, one standout was the athletic space, with $ADS, $UA, and $CROX seeing discounts.

(12/12) For the record, we don’t like those #brands (prefer $PUMA $NKE $LULU). And we don’t like those stocks. Lots of excess inventory to work through!

• • •

Missing some Tweet in this thread? You can try to

force a refresh