1/ Following the very interesting post of @TheDeFinvestor

I used to breakdown my PF every month to confirm my PF Objective is still on track.

Let's show what my PF looks like, and what will be my next moves:

https://twitter.com/TheDeFinvestor/status/1587512141015154689?s=20&t=j0WeZxJeRqTa-ycwKcUE3g

I used to breakdown my PF every month to confirm my PF Objective is still on track.

Let's show what my PF looks like, and what will be my next moves:

2/ Portfolio objective

Are you wondering how to build a PF?

I was inspired by @thedefiedge and his amazing thread:

So that was my objective at the beggining of 2022. How does it look like now after hitting this Bear Market?

Are you wondering how to build a PF?

I was inspired by @thedefiedge and his amazing thread:

https://twitter.com/thedefiedge/status/1508475727552811009?s=20&t=Kios_pWdfmpYH8tGqXHZLw

So that was my objective at the beggining of 2022. How does it look like now after hitting this Bear Market?

3/ Portfolio Breakdown

Conclusion: More stable, less low/medium risk, more high risk 🧐

=> Actions: Need to rebalance high risk to medium or low risk project

Conclusion: More stable, less low/medium risk, more high risk 🧐

=> Actions: Need to rebalance high risk to medium or low risk project

Stable: +27% -> Mainly due to market condition + additional injected capital

Tips: 50% swapped in $EUR stable

Farmed on @VelodromeFi : 15% APR

Lend/Borrow on @GranaryFinance for Airdrop

Tips: 50% swapped in $EUR stable

Farmed on @VelodromeFi : 15% APR

Lend/Borrow on @GranaryFinance for Airdrop

Low Risk: -15% -> DCA on $ETH / $SNX / $AAVE

DCA on $ETH -> Ultrasound Money, L2 are paying fees in $ETH, and when volume will come back, $ETH fees will skyrocket on Mainnet

Farming solution: Anything without IL

Lending on @TarotFinance or @sentimentxyz

LP on @VelodromeFi

DCA on $ETH -> Ultrasound Money, L2 are paying fees in $ETH, and when volume will come back, $ETH fees will skyrocket on Mainnet

Farming solution: Anything without IL

Lending on @TarotFinance or @sentimentxyz

LP on @VelodromeFi

DCA on $SNX since break of 1,5Y downtrend: @synthetix_io V3 brings a lot of innovation, and the ecosystem keeps growing, with transaction fees going to $SNX Stakers + on-going Derivatives narratives

Farming solution: Staking on Synthetix #Optimism

Farming solution: Staking on Synthetix #Optimism

https://twitter.com/Subli_Defi/status/1561817177782722561?s=20&t=Ir-9Qshj9sn6ehSxKcF-yA

DCA on $AAVE since break of 1,5Y downtrend: I think this interview summarizes why i'm bullish on @AaveAave & since $GHO stablecoin could bring value to stakers

Really looking forward to CCIP from @chainlink to be able to stake out of Mainnet

Really looking forward to CCIP from @chainlink to be able to stake out of Mainnet

https://twitter.com/alpha_pls/status/1586724435784089603?s=20&t=Ir-9Qshj9sn6ehSxKcF-yA

Medium Risk: -30% => Reduced exposure until market stabilizes

High Risk: +17% -> Mainly Early investment on new projects

All @aladdindao DAO Projects: $ALD / $CTR / $CLEV built on top of $CRV, $CVX, $FRAX

$VELO : Farming through Bribes

All @aladdindao DAO Projects: $ALD / $CTR / $CLEV built on top of $CRV, $CVX, $FRAX

$VELO : Farming through Bribes

https://twitter.com/Subli_Defi/status/1575771090860638208

$GNS: Perp narratives + Deployment on Arbitrum soon

$BTRFLY: Real yield

$BTRFLY: Real yield

https://twitter.com/Subli_Defi/status/1555669085064683522?s=20&t=6IR3WsuszRC5a2Glv-9VFg

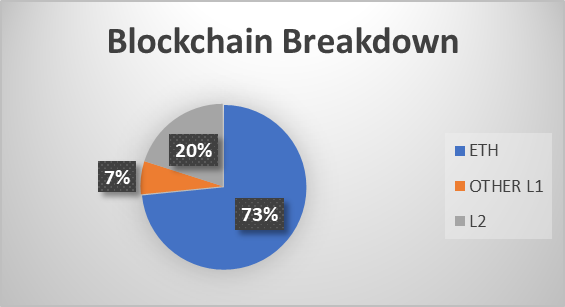

4/ Blockchain Breakdown

I'm always surprised that 3/4 of my MF except stable is on #Ethereum. But definitively smart money is still on L1.

L2 include: #Arbitrum / #Optimism / #Polygon / #Metis

Still holding some assets on #FTM but reduced quite a bit since Spring '22

I'm always surprised that 3/4 of my MF except stable is on #Ethereum. But definitively smart money is still on L1.

L2 include: #Arbitrum / #Optimism / #Polygon / #Metis

Still holding some assets on #FTM but reduced quite a bit since Spring '22

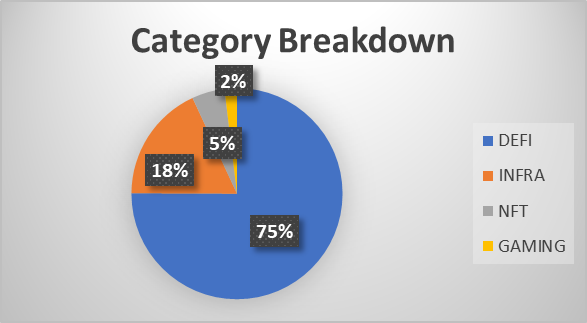

5/ Category Breakdown:

Infra is 100% $ETH

Of course, my PF is focused on projects i follow, so #DEFI

Infra is 100% $ETH

Of course, my PF is focused on projects i follow, so #DEFI

6/ Conclusion and future moves:

1- I need to lower my risk profile and switch investment to lower risk asset => I will continue to DCA on $ETH and taking profit on high risk assets as soon as i can

I want also to maintain approx 40% stable to buy futur dips

1- I need to lower my risk profile and switch investment to lower risk asset => I will continue to DCA on $ETH and taking profit on high risk assets as soon as i can

I want also to maintain approx 40% stable to buy futur dips

2- Will certainly invest long term on more derivatives project.

$GMX has already made his 1st leg up, so that $GNS, so not really happy to buy at this price.

I'm looking then at these 2 projects built on top of SNX (Flywheel effect):

$KWENTA: Perp Protocol

$LYRA: Options

$GMX has already made his 1st leg up, so that $GNS, so not really happy to buy at this price.

I'm looking then at these 2 projects built on top of SNX (Flywheel effect):

$KWENTA: Perp Protocol

$LYRA: Options

And finally, a recent asset added to my list will be

$YFI: V3 + tokenomics change veYFI that will lead to institutions deploying their funds to buy and lock $YFI for 10x boost rewards

Recent video here:

$YFI: V3 + tokenomics change veYFI that will lead to institutions deploying their funds to buy and lock $YFI for 10x boost rewards

Recent video here:

7/ It's a personal analysis of my PF and nothing said above is Financial Advice

I recommend to set such PF objective based on your risk profile, and PF value.This will prevent being driven by too many emotions 😀

If you like this thread, thks to retweet:

I recommend to set such PF objective based on your risk profile, and PF value.This will prevent being driven by too many emotions 😀

If you like this thread, thks to retweet:

https://twitter.com/Subli_Defi/status/1587784623299477505?s=20&t=KkN_WKl-DUImbZgmEUF3yA

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh