A Costly 10,800 CRORE MISTAKE Committed by @LICIndiaForever on just one #AdaniGroup Stock ? A Co-incidence ?

A longish #THREAD so stay with me. Kindly #RETWEET if you find this interesting.

A longish #THREAD so stay with me. Kindly #RETWEET if you find this interesting.

https://twitter.com/RaviBhandari83/status/1578675708851027968

Today LIC owns 45.8mn shares of #AdaniEnterprises worth 18000cr making them the Single largest Buyer and Single Biggest Non-Promoter Holder with 15% of the Free Float. Return on this holding is STELLAR.

So what was the Rs10,800cr Mistake ?

So what was the Rs10,800cr Mistake ?

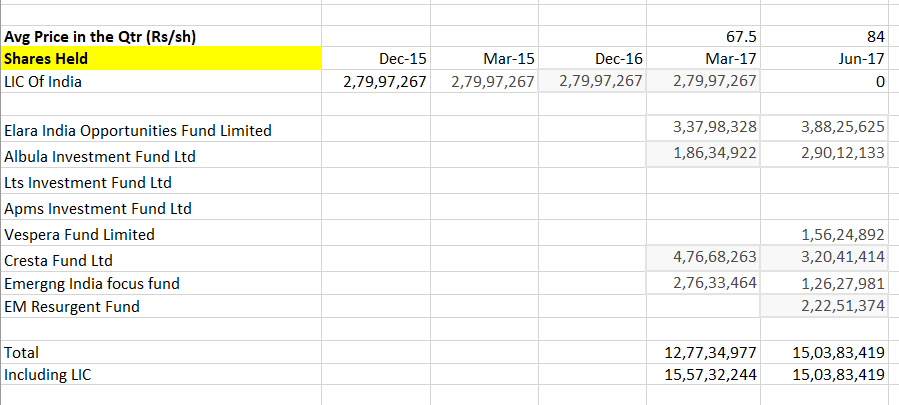

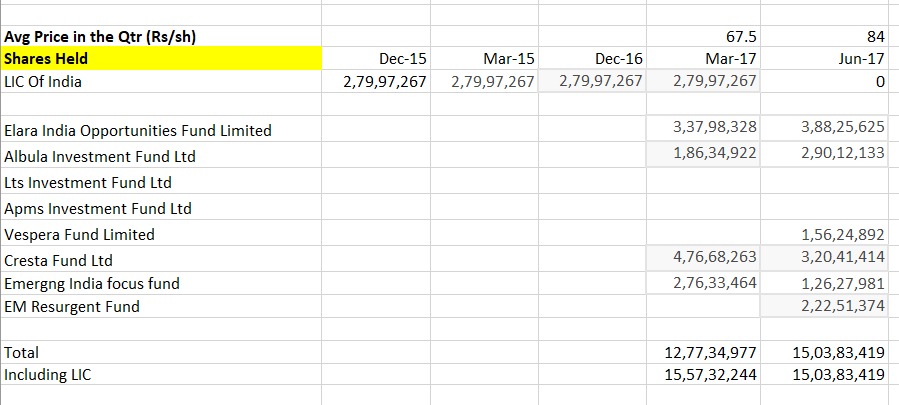

Back in 2017 March, LIC owned ~28mn Shares (Worth Rs11000cr at todays CMP of Rs3961).

By June 2017, LIC holding was REDUCED TO ZERO and it netted LIC just Rs235cr (Rs2.35bn) at an appx price of Rs84/sh

By June 2017, LIC holding was REDUCED TO ZERO and it netted LIC just Rs235cr (Rs2.35bn) at an appx price of Rs84/sh

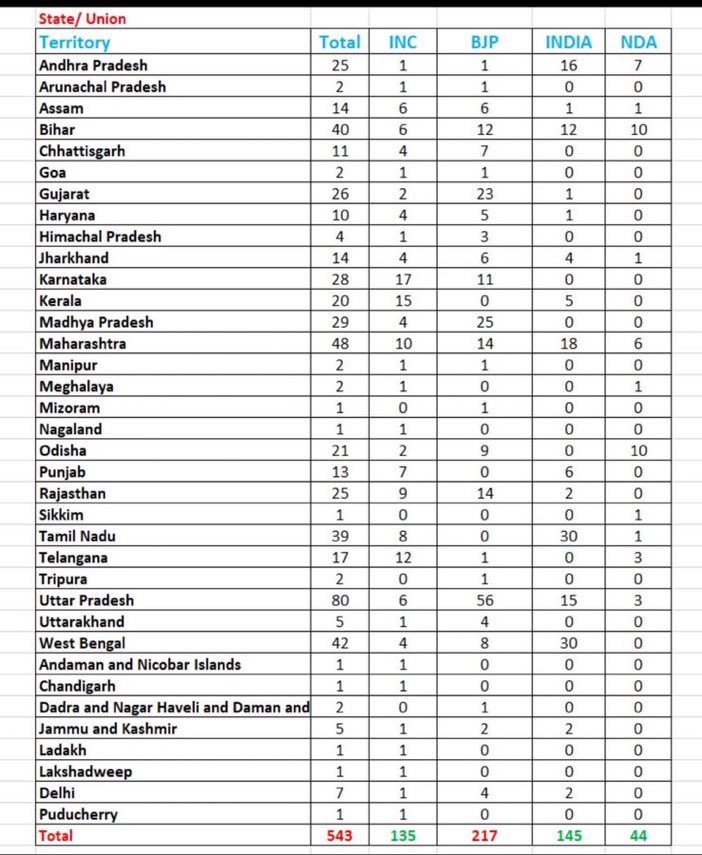

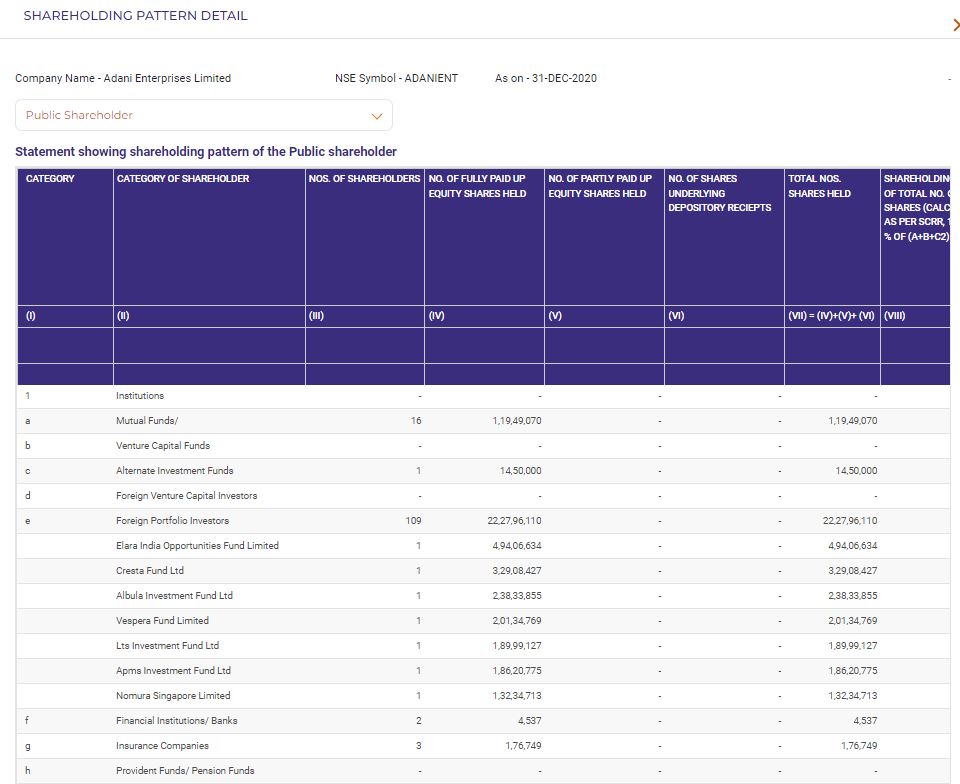

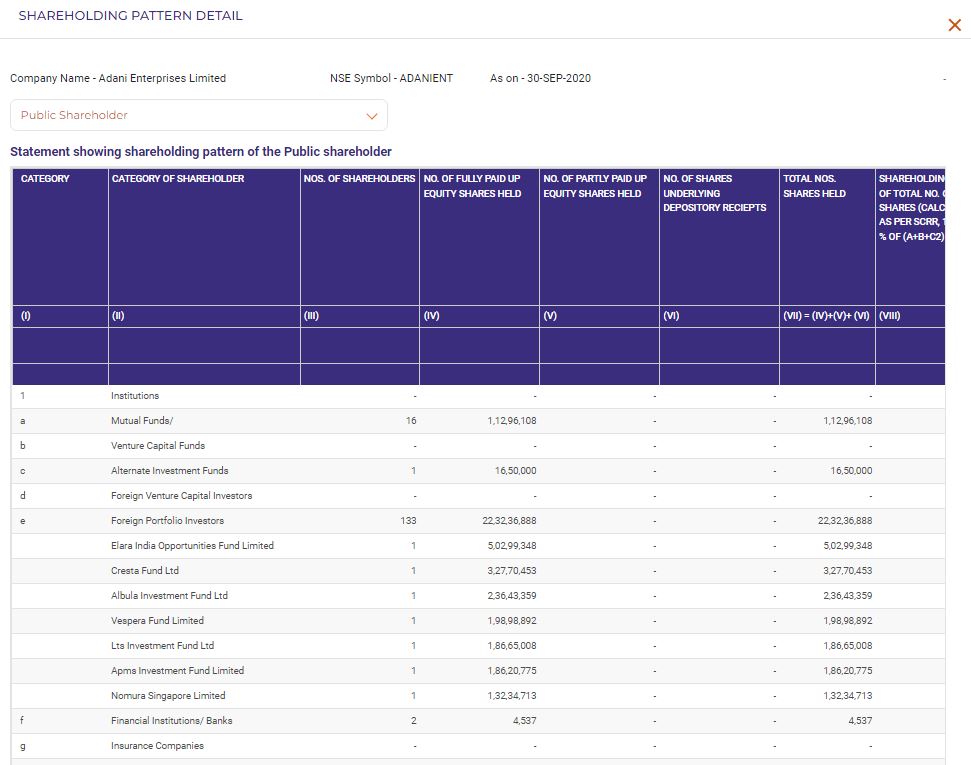

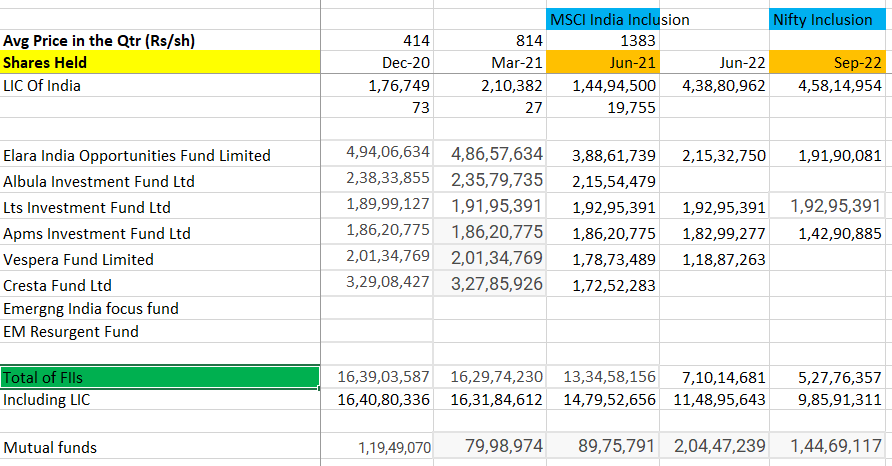

Almost all these shares that were sold by LIC between April 2017 to June 2017 was absorbed by a group of FIIs which has been very strong Long Term Holders of Adani Group stocks so much so, that some of them hold as much as 90% of their Portfolio ONLY IN ADANI GROUP COMPANIES

As you can see from the table in the previous tweet, LIC used to Own ~28mn shares before they sold out, while the set of FIIs held 127mn shares which eventually went up to 150mn shares absorbing almost what ever LIC Sold. Clearly a CONTRARIAN BET by the FIIs

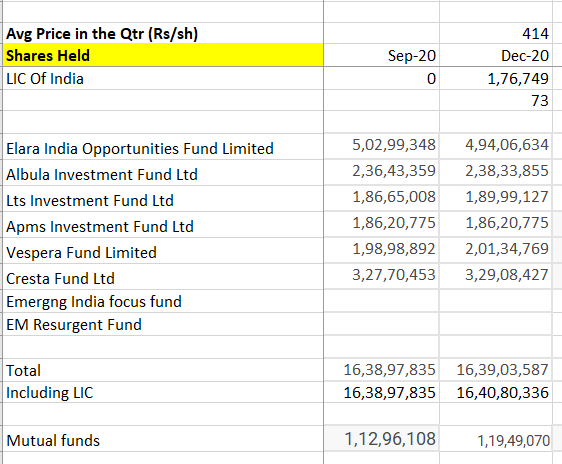

Lets Move forward now, after almost 42 months of @LICIndiaForever selling the #AdaniEnterprises Shares, in the thick of COVID or Dec-20 Qtr, LIC decided they may have made a mistake & started BUYING #AdaniEnterprises shares at Rs414/sh (recall, they sold their stake at ~Rs84/sh)

By Dec-20, the group of FIIs who bet big bucks on #AdaniGroup had already increased their stake from 150mn shares to ~164mn shares. Smart...

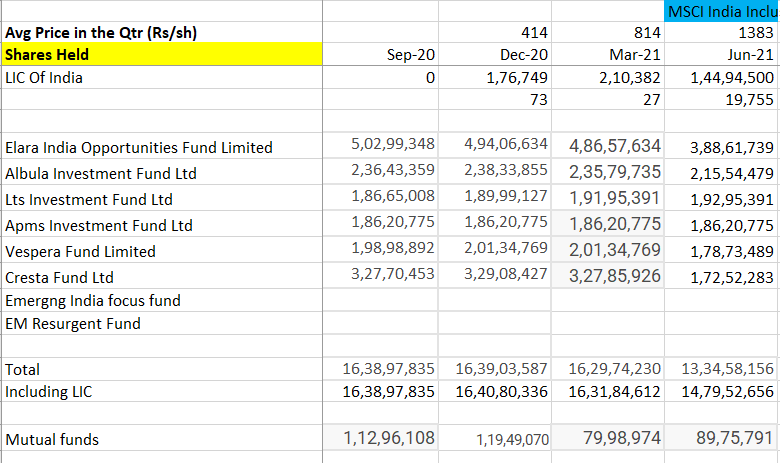

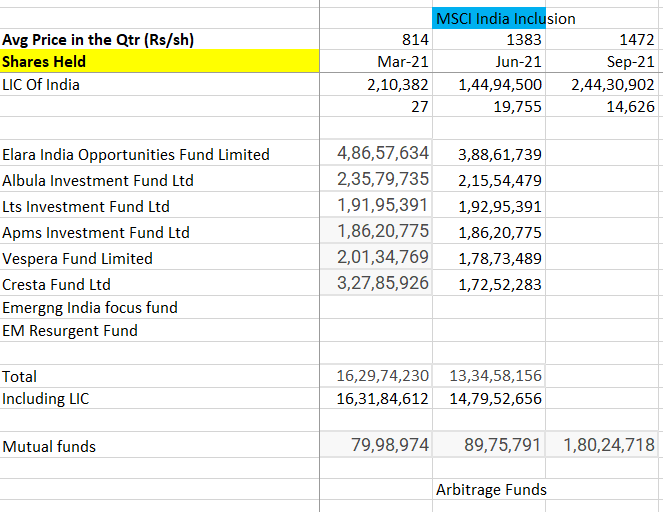

Starting Dec-2020 Quarter onwards, LIC initiated their fresh position in #AdaniEnterprises and increased it to 14.4mn shares by June-2021 by that time, the quarterly average prices was close to Rs1380/sh (Remember they sold at Rs84/sh).

MSCI included #AdaniEnterprises in May-21

MSCI included #AdaniEnterprises in May-21

For those who are Indian Stock market veterans who track @MSCI_Inc Index Inclusions, its become a joke behind closed doors of how Stocks move strangely into the run-up to an MSCI Inclusion even if fundamentals don't justify. Stocks Temporarily peak on INCLUSION DAY (May-21 End)

As you can see from the Shareholding pattern, the Adani friendly FIIs sold Heavily into the MSCI Rebalance Event in May-2021 offloading about 30mn Shares (~16% of their holding).

Meanwhile LIC Continued to build its position from 210k Shares to 14mn shares (Avg px 1300+)

Meanwhile LIC Continued to build its position from 210k Shares to 14mn shares (Avg px 1300+)

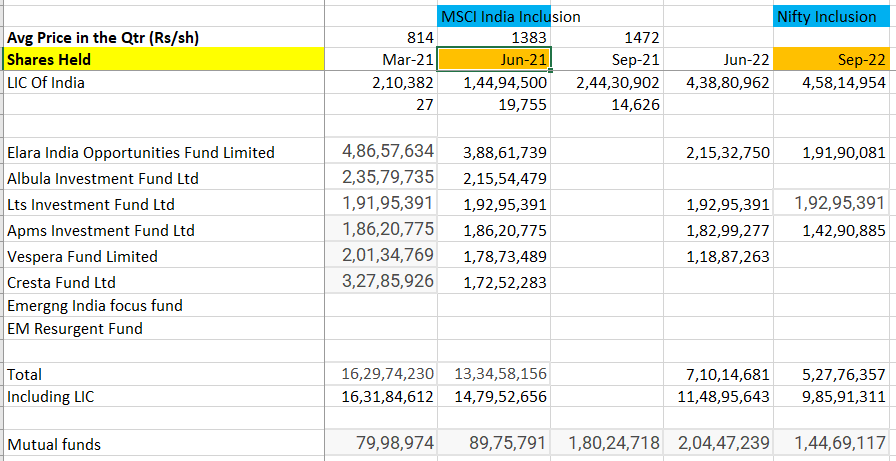

Quarter After Quarter even post the MSCI Inclusion event of May-21, LIC kept Accumulating #AdaniEnterprises regardless of Fundamental Valuations (Chart Included) and #AdaniEnterprises continued its Stellar Price Journey ~270% from ~Rs1400 to ~Rs3900 by Sept-22 intime for NIFTY50

So what was the Rs10,800 Crore Lost Opportunity I was referring too ?

Recall, LIC Had 28mn Shares Of #AdaniEnterprises to Start with. It sold it for ~Rs84/sh and it bought all those shares back and even more (own 45.8mn shares today)

28mn X (Rs3961 less Rs84) = Rs10800cr.

Recall, LIC Had 28mn Shares Of #AdaniEnterprises to Start with. It sold it for ~Rs84/sh and it bought all those shares back and even more (own 45.8mn shares today)

28mn X (Rs3961 less Rs84) = Rs10800cr.

What Extra Did @LICIndiaForever pay to buy back those shares ?

They Spent Almost Rs5700cr to Accumulate their first 28mn shares between Dec-20 to Nov-21 Apprx while they sold these shares in Jun-2017 Quarter for ~Rs240cr .... So thats an incremental cash burn of Rs5450cr

They Spent Almost Rs5700cr to Accumulate their first 28mn shares between Dec-20 to Nov-21 Apprx while they sold these shares in Jun-2017 Quarter for ~Rs240cr .... So thats an incremental cash burn of Rs5450cr

FINALLY, and most interestingly, Even while the shares continue to rally up with LIC buying, the ONLY SELLER for all these shares was the FIIs whose entire India bet was Adani Group stocks & almost controlled the entire Foreign Non Promoter Float of #AdaniEnterprises.

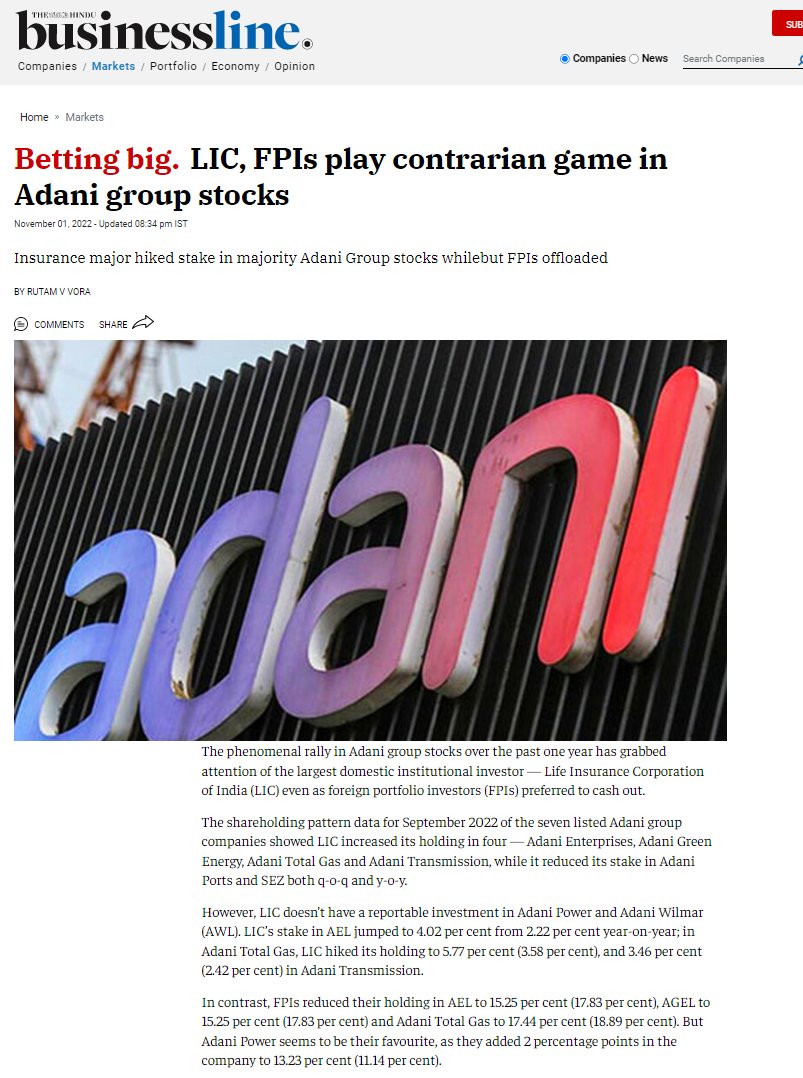

Which draws attention to an Aptly Published Article recently by the @thehindubiz on "Betting big. LIC, FPIs play contrarian game in Adani group stocks"

@LICIndiaForever has a fiduciary duty to its Shareholders & Policy Holders. They effectively deprived both parties a gain of Rs10800 CRORE by Selling #AdaniEnterprises with Haste to a set of FIIs & 42 months later buying back those shares (effectively) from the same set of FIIs

@LICIndiaForever If you liked this thread, kindly #RETWEET (just a like does not help). Also share your comments

https://twitter.com/TheFactFindr/status/1589679927179513857

@threadreaderapp unroll

Someone asked about the Fundamentals of #AdaniGroup

https://twitter.com/TheFactFindr/status/1562343340317630465

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh