Daily Currency 🧵- Nov 11th, 2022

$DXY #DXY

Huge moves happening, some that require attention. Starting with the dollar, we saw this blow through momo yesterday and continue to fall this morning. To get a solid trend shift, we're going to need to see some components shift too!

$DXY #DXY

Huge moves happening, some that require attention. Starting with the dollar, we saw this blow through momo yesterday and continue to fall this morning. To get a solid trend shift, we're going to need to see some components shift too!

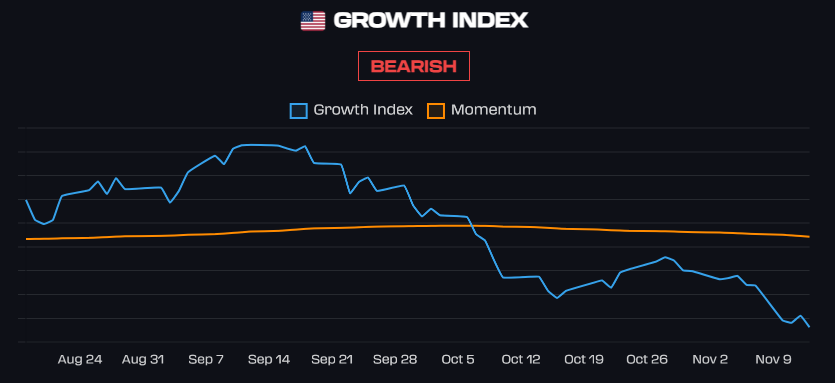

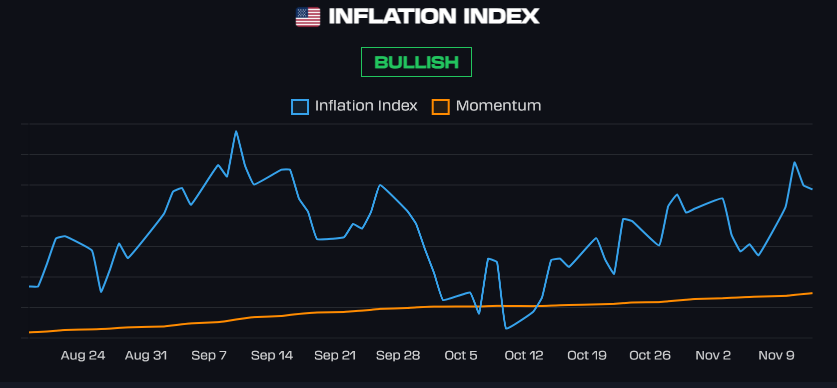

A trend shift in the dollar will add more confirmation to the Risk-On regime, which has been brewing under the surface for over a month now. Market Illiquidity improving is supporting the narrative of a possible shift. This really comes down to how the major components trade...

$EUR (largest $DXY component)

The EUR was able to blow through parity and get a good squeeze going in the last two days. We still have some distance to momo, a failure to break there will give very low confidence of a DXY trend shift sticking.

$EURUSD #EURUSD #USDEUR $USDEUR

The EUR was able to blow through parity and get a good squeeze going in the last two days. We still have some distance to momo, a failure to break there will give very low confidence of a DXY trend shift sticking.

$EURUSD #EURUSD #USDEUR $USDEUR

$JPY (2nd largest $DXY component)

The Yen was able to blast through the wall and head for momo. We still have some room to cover and if we can't get through there it's going to be really hard for the EUR to carry DXY all alone. Big component.

$JPYUSD #JPYUSD $USDJPY #USDJPY

The Yen was able to blast through the wall and head for momo. We still have some room to cover and if we can't get through there it's going to be really hard for the EUR to carry DXY all alone. Big component.

$JPYUSD #JPYUSD $USDJPY #USDJPY

$GBP (3rd largest $DXY component)

The pound has been less volatile than the other components and continues to slowly make higher highs and lows. The EUR actually has less distance % wise to momo now than this! 👀

$GBPUSD #GBPUSD $USDGBP #USDGBP

The pound has been less volatile than the other components and continues to slowly make higher highs and lows. The EUR actually has less distance % wise to momo now than this! 👀

$GBPUSD #GBPUSD $USDGBP #USDGBP

• • •

Missing some Tweet in this thread? You can try to

force a refresh