So one thing I've learnt if you are a money launder or scammer stay away from #vatfraud. Ripping off citizen's is low risk but if you tax authorities they will hunt you down. check @nicolaborzi article.

ilfattoquotidiano.it/in-edicola/art…

ilfattoquotidiano.it/in-edicola/art…

European #vatfraud appears to be such a small world. reading through the article I recognised the reference to a MTIC VAT fraud scheme.

As it was #vatfraud that brought down #dannybarrs

founder of #globaltransactionservices and his associated #onestopshop favoured by #ponzi promoters for almost a decade.

founder of #globaltransactionservices and his associated #onestopshop favoured by #ponzi promoters for almost a decade.

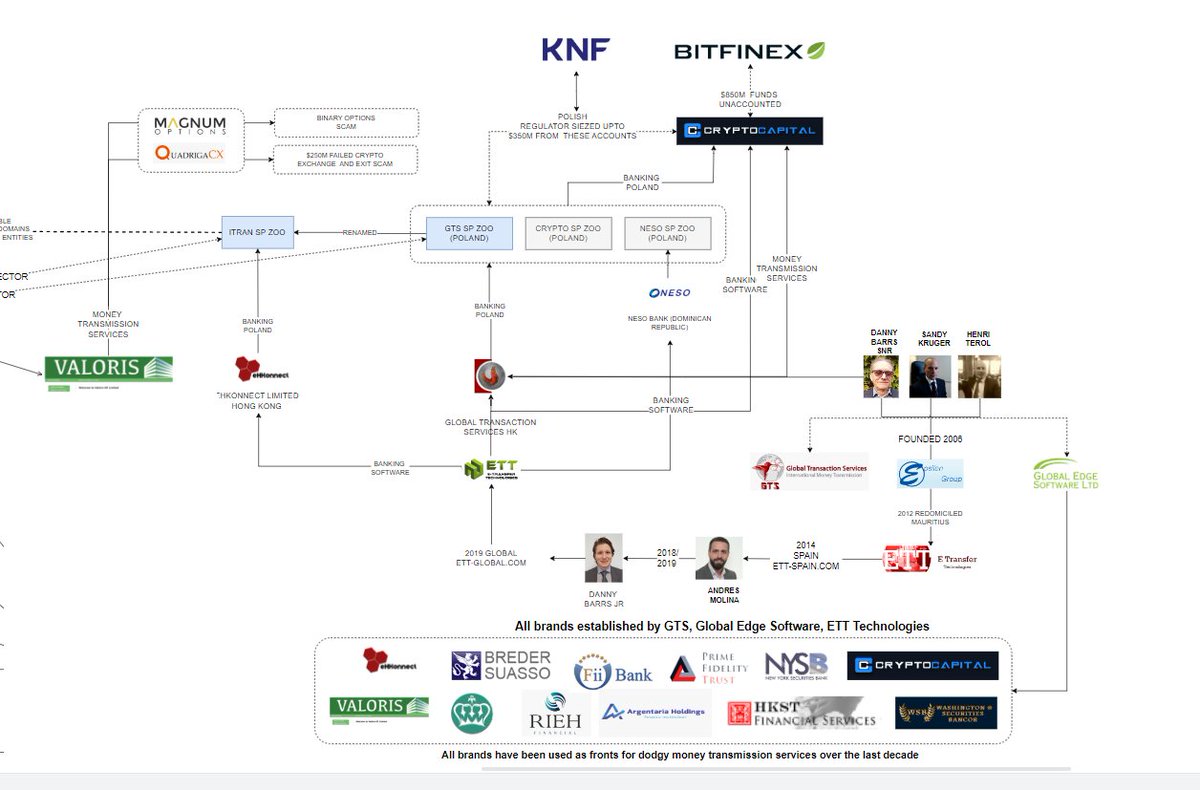

There wasn't just one #dannybarrs there was two senior and junior. Here's an old network graph of them. as you can see they are embedded in some of the best frauds in recent history.

Let me just zoom out a little so you can see the high quality brands they pre-built that dodgy promoters could purchase off-the shelf.

There's some cracking stories behind most of these 'brands' mostly well before #crytpo

I'm pretty certain it was jnr aka #bitfan2013 that convinced snr it #crypto was the future.

I'm pretty certain it was jnr aka #bitfan2013 that convinced snr it #crypto was the future.

peeps may remember #bitfan2013 from the hugely successful #havelockpartners which minted some of the earliest #cryptodumpster's

one of those dumpster's was #cryptocapital #bitfan2013 words of wisdom on #reddit inspired Panamanian based entrepreneur #ozyosef founder of #1btcxe to move into the money transmission business.

I'd love to reminisce about the rise and fall of #cryptocapital in #panama back in the days when Stuart Hoegner was counsel for #coinapult and #bitfinex was a customer/partner back in 2015 when coinapult was hacked and then a few months later was folded into #cryptocapital

I just don't have time to cover all those wonderful moment's in its history.

Lets get back to the riveting topic of #vatfraud

Lets get back to the riveting topic of #vatfraud

#dannybarrs empire stumbled and crumbled back in 2015 when both snr and jnr (aka bitfan2013) got a sent off to the #bighouse after getting stitched up for #vatfraud in the uk.

@ncsmiff covered Barrs and GTS at great length back in the day

nakedcapitalism.com/2016/10/perfec…

@ncsmiff covered Barrs and GTS at great length back in the day

nakedcapitalism.com/2016/10/perfec…

With the impending holiday to the big house the Barrs looked to offload some of its assets and the #cryptocapital crew appear to be the ones that stepped up. No doubt the #globaltransactionservices brand was well cooked by then. Looking for a new jurisdiction

and home to continue their rampant fraud. They found a safe haven and like minded peeps in #zug. Being the branding genius they are to sweep away the sins of the past the new #cryptocapital parent co was named global trade solutions with the catchy gts.services domain.

so to stay under the radar #ozyosef put a bunch of his mates on the board and used his sister #ravidyosef as bagholder.

His partner in crime the infamous #ivanmolina appears to have stuck one his relatives on the management team of the backend banking software company #ett

fucking genius.

fucking genius.

i keep digressing.....

back to the purpose of the tweet....#vatfraud and how ironic that #pagasia was knee's deep in the same type of #vatfraud as #gts and #dannybarrs was thrown in jail for facilitating.

back to the purpose of the tweet....#vatfraud and how ironic that #pagasia was knee's deep in the same type of #vatfraud as #gts and #dannybarrs was thrown in jail for facilitating.

But that's nothing compared to just how spooky of a co-incidence that #cryptocapital ends up at this address in #zug

I'm going to have to jump off the soapbox and get back to work. More tomorrow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh