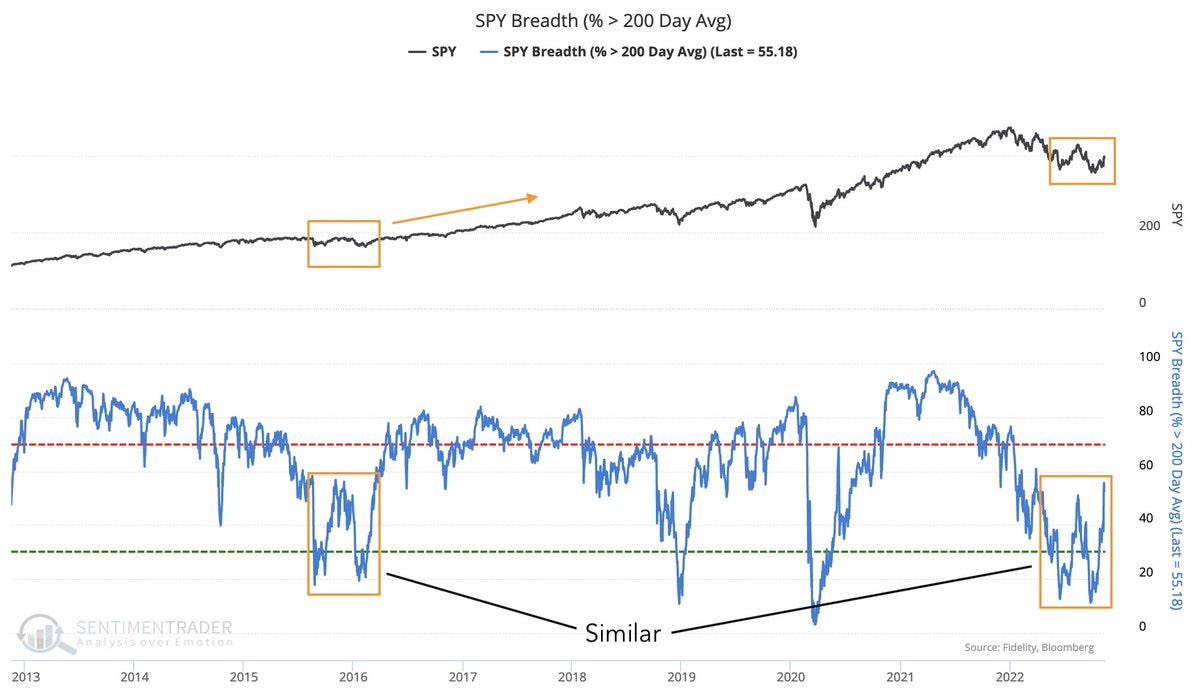

This chart is shows current market breadth. Note that macro setup was very different in 2015/16 ; massive stimulus outside US and the Fed paused after 1 hike. We narrowly avoided recession, and inflation was not an issue (deflation was).

This is very different from what we have now so don’t draw any hasty parallels and stay vigilant. #ES #investing

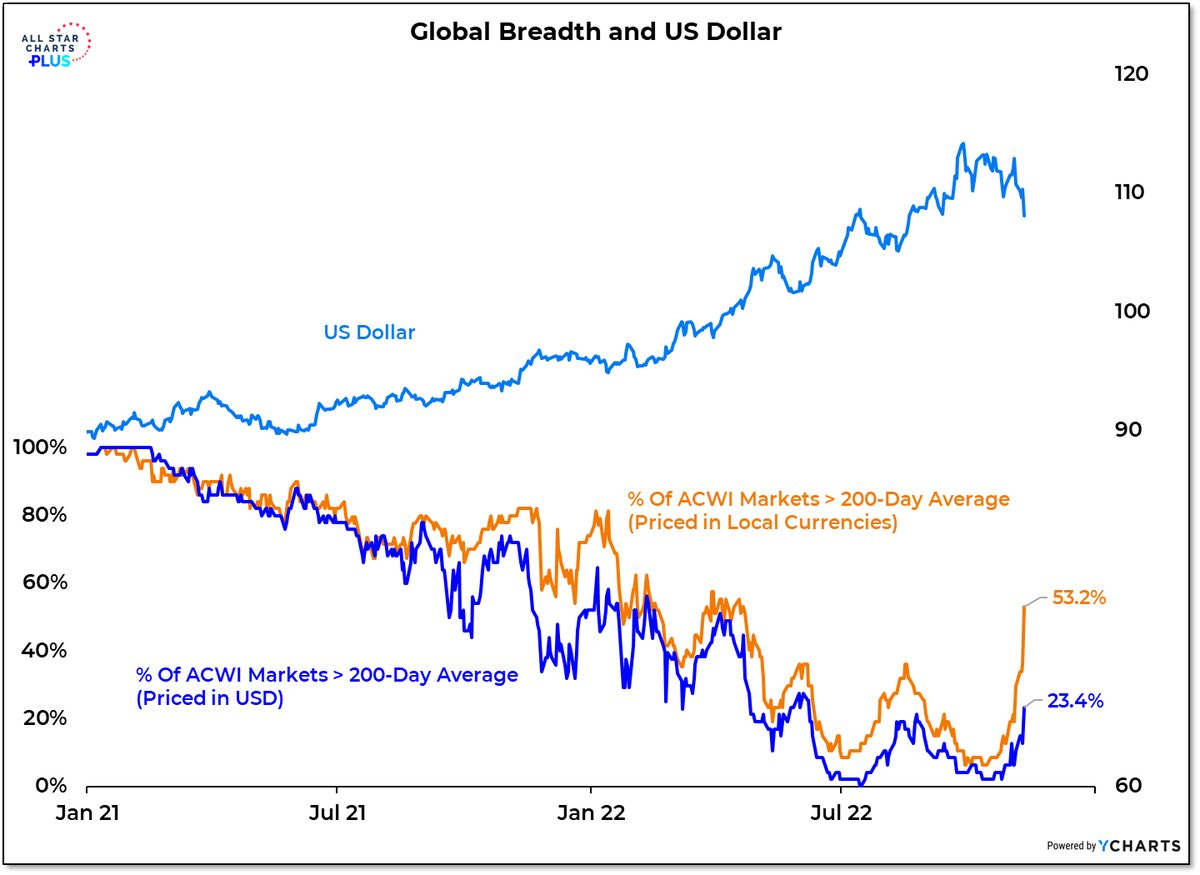

The key STILL is the dollar. Weaker dollar means less pressure on world economy means higher stock prices and good for Bitcoin. I wish it were that easy. To me it looks like #markets got ahead of themselves since October 1.

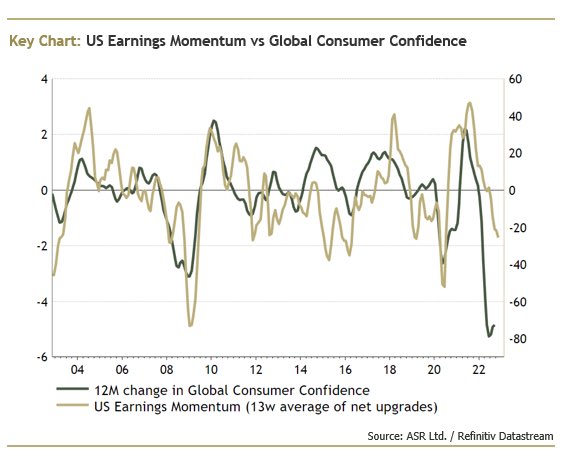

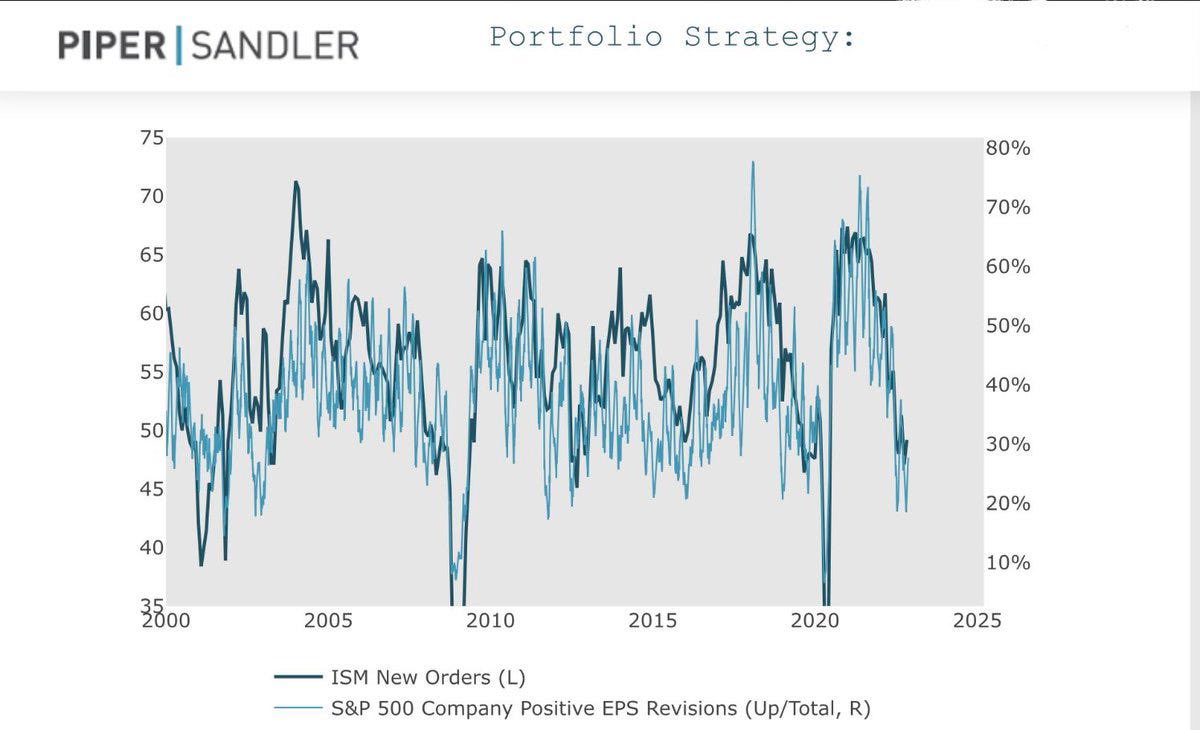

Earnings still point down and so do new manufacturing orders. The big shock may yet come (?) it still depends on the geopolitical conditions ie #WarInUkraine

• • •

Missing some Tweet in this thread? You can try to

force a refresh