Thread 🧵 on Ripple $XRP

#Ripple is a cryptocurrency, which aims to enable “fast, scalable, and stable”and nearly free cross-border payments of any size with no chargebacks through their real-time gross settlement system (RTGS), currency exchange, and remittance network.

#Ripple is a cryptocurrency, which aims to enable “fast, scalable, and stable”and nearly free cross-border payments of any size with no chargebacks through their real-time gross settlement system (RTGS), currency exchange, and remittance network.

First released in 2012, #Ripple fundamentally differs from #Bitcoin.

#BITCOIN relies on a network of “miners” who run code that validates transactions and keeps the network secure. The network incentivizes the miners by rewarding them with bitcoins as incentives.

#BITCOIN relies on a network of “miners” who run code that validates transactions and keeps the network secure. The network incentivizes the miners by rewarding them with bitcoins as incentives.

But in case of Ripple, “mining” does not generate new coins. All of the 100 billion coins (XRP) were released by the network in 2012. The creators of the XRP coins kept 20 billion and gave the rest to the company.

Since then, Ripple has been methodically distributing tokens to its clients, but it still holds nearly 50 billion in an escrow account.

Who are these clients?

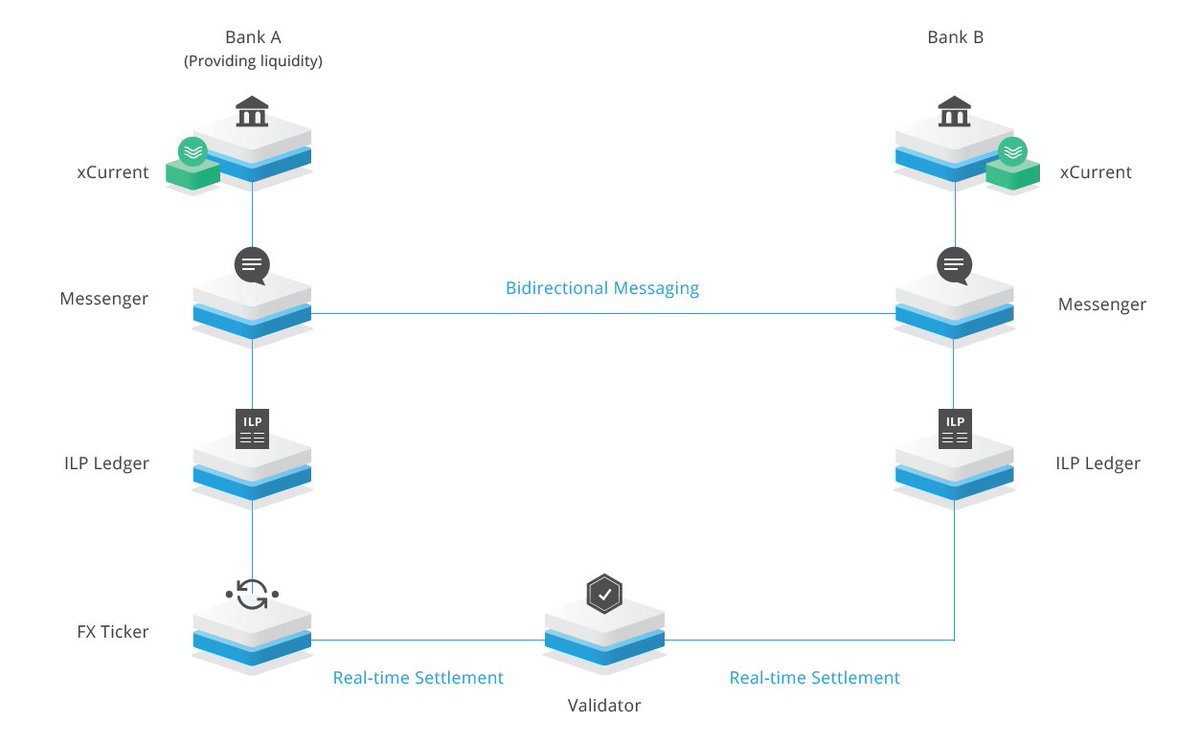

Essentially, banks and regulated financial institutions. #Ripple’s distributed open-source internet protocol consensus ledger helps its clients to integrate #Ripple into their own systems.

Essentially, banks and regulated financial institutions. #Ripple’s distributed open-source internet protocol consensus ledger helps its clients to integrate #Ripple into their own systems.

A Simple & Real-World Example of How Ripple Works:

On Jan, 2018, Ripple partnered with MoneyGram (a cross-border money transfer company) who are now using $XRP to speed up and reduce the cost of transferring money by using Ripple’s xRapid payment network.

On Jan, 2018, Ripple partnered with MoneyGram (a cross-border money transfer company) who are now using $XRP to speed up and reduce the cost of transferring money by using Ripple’s xRapid payment network.

The status quo is that when you send money (in one currency; USD for example) to another currency (let’s say, #Nigerian Naira NGN) using MoneyGram or banks, this conversion takes several business days and involves multiple stakeholders who get their cut.

Ripple changes this by acting as a central currency, $XRP.

So now if you were to send $USD to your friend in #NIGERIA (NGN), the US bank would trade $USD for $XRP and then trade $XRP for NGN.

#Ripple acts a central currency.

So now if you were to send $USD to your friend in #NIGERIA (NGN), the US bank would trade $USD for $XRP and then trade $XRP for NGN.

#Ripple acts a central currency.

The reverse process would happen from the #Nigerian bank receiving the $USD.

How does #Ripple Differ from Bitcoin or #Ethereum?

#Ripple’s protocol consensus algorithm differs from Bitcoin’s full node and #Ethereum’s smart contracts.

How does #Ripple Differ from Bitcoin or #Ethereum?

#Ripple’s protocol consensus algorithm differs from Bitcoin’s full node and #Ethereum’s smart contracts.

Ripple validates transactions and recommends its clients to use a list of identified, trusted participants to validate their transactions.

Also, known as the Unique Node List (UNL); each server maintains a unique node list — a set of other trusted nodes.

Also, known as the Unique Node List (UNL); each server maintains a unique node list — a set of other trusted nodes.

Only the votes of the other members of the UNL of are considered when determining consensus.

The UNL represents a subset of the network which when taken collectively, is trusted not to collude in an attempt to defraud the network.

The UNL represents a subset of the network which when taken collectively, is trusted not to collude in an attempt to defraud the network.

Cryptocurrencies are against centralized governing institutions who currently control the bulk of the global financial industry. Ripple is considered to be a form of centralization as majority of coins are held by the owners and consensus is determined by a fixed set of nodes.

#Ripple’s big bet is that $XRP will become a “bridge currency” that financial institutions use to settle cross-border payments faster and more cheaply than they do now using global payment networks with its fees and slower process.

#Ripple, claims it can settle 1,500 transactions per second: 24 hours a day, seven days a week, 52 weeks a year.

The Ripple Consensus Ledger (the thing that all of Ripple’s clients are using) is designed to allow value transfer between different currencies with a sort of hopping between different market makers.

This happens without the utility of any XRP. $XRP tokens were designed as a way for many market makers to make a paring with — thus allowing for many transactions to occur with only one hop: Currency 1 → $XRP → Currency 2.

If you find this helpful please Like, Retweet and Follow

• • •

Missing some Tweet in this thread? You can try to

force a refresh