1/ WHAT EUROPEAN CENTRAL BANK HAS IN MIND FOR THEIR #CBDC PILOT?

I read through the onboarding package.

TL;DR: ECB copies #bitcoin and makes a centralised version of it.

👇👇👇

I read through the onboarding package.

TL;DR: ECB copies #bitcoin and makes a centralised version of it.

👇👇👇

2/ First the sources: the information is available on ECB site. More information in this good post by by @Finextra

finextra.com/pressarticle/9…

finextra.com/pressarticle/9…

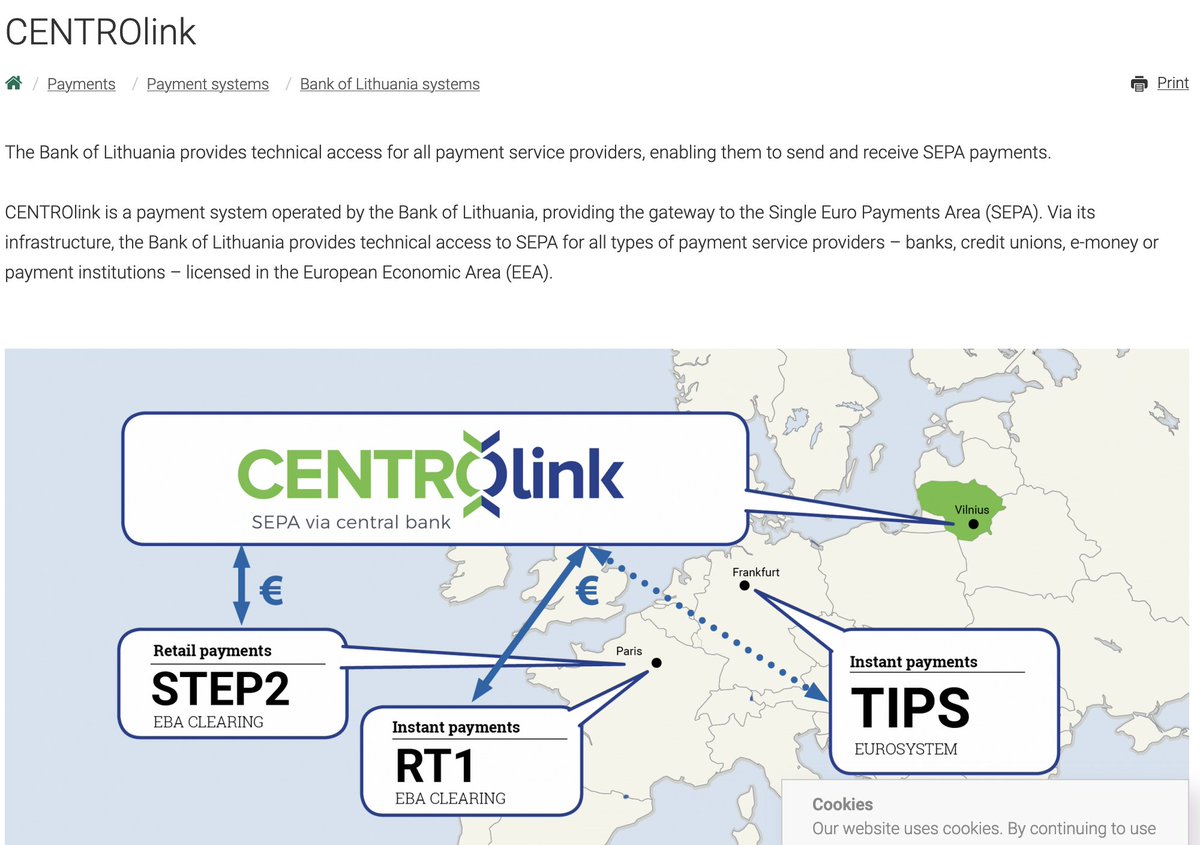

3/ I do not envy the position of ECB

- US companies Visa and Mastercard dominate retail payments in Europe

- ECB hates crypto

- Politicals keep yelling "innovate"

- ECB is bureaucratic organisation and has little talent to innovate

- US companies Visa and Mastercard dominate retail payments in Europe

- ECB hates crypto

- Politicals keep yelling "innovate"

- ECB is bureaucratic organisation and has little talent to innovate

4/ "Do something" - well, something ECB indeed did.

Does it make sense? Keep reading...

Does it make sense? Keep reading...

5/ THE GOOD

👇👇👇

👇👇👇

6/ As a retail user, or "consumer", you will get access to central bank money.

This money is 100% safe as long as the Euro system does not fall.

This money is 100% safe as long as the Euro system does not fall.

7/ There is no need for bank deposit insurance by your government because if ECB-connected central banks fall it is literally game over for Euro.

The deposit insurance of ECB is called NATO.

The deposit insurance of ECB is called NATO.

8/ But does central bank money matter?

No. Because as said before any retail deposits are already covered by states.

No. Because as said before any retail deposits are already covered by states.

9/ For whom it would matter would be businesses that need to manage more cash than is within 100k EUR deposit insurance. However if businesses move their business account away from banks, then a lot of local banks will die.

10/ Also, consumers and businesses, in the EU and outside, already can access to central bank money. If you use any eMoney license provider that gives them an IBAN from a central bank directly, e.g. Central Bank of Lithuania.

11/ Furthermore I am happy of at least attempting innovate. By copying Bitcoin UTXO scheme and applying it for central bank deposits, at least ECB is trying!

Big kudos for the anonymous middle managers in ECB who push for this.

Big kudos for the anonymous middle managers in ECB who push for this.

12/ There is "some" element of anonymity. ECB tries to make a system where the central bank does not directly see the owners of the transaction.

However in practice they are just shifting the liability to a "wallet service" akin a bank replacement.

However in practice they are just shifting the liability to a "wallet service" akin a bank replacement.

13/ THE BAD

"Doing right things wrong." The closed innovation model has proven failed many times past.

"Doing right things wrong." The closed innovation model has proven failed many times past.

14/ "The Eurosystem’s technical onboarding package for digital euro

prototyping" ... "but without restricting their innovation potential. "

prototyping" ... "but without restricting their innovation potential. "

15/ The ECB does not understand what drives software development innovation - what fintech is all about.

The drivers include

- Open source

- Open data

- Open transactions

The drivers include

- Open source

- Open data

- Open transactions

16/ For more background and history of open innovation and its drivers you can find my blog post here

tradingstrategy.ai/blog/most-effi…

tradingstrategy.ai/blog/most-effi…

17/ This design document feels a bit like:

- "We need to do something"

- "Let's add few more middlemen and copy some ideas"

- "We need to do something"

- "Let's add few more middlemen and copy some ideas"

18/ I am not sure what problems this CBDC system attempts to solve, but it is unlike to 1) making transactions simpler 2) disintermediate middleman 3) reduce costs

19/ 4) foster innovation and thus 5) unlikely to dethrone Visa/Mastercard in retail payments and online payments restoring Euro areas financial sovereignity.

20/ As a taxpayer, I did not see any mention that any of the deliverables of this pilot project would be open source. ECB is funded by central banks that are funded by EU taxes. My money, your money.

21/ European Union has an #opensource strategy

ec.europa.eu/info/departmen…

The key infrastructure of governments is where open source would play the most important role. Open source is not mentioned in any of the ECB's documents.

ec.europa.eu/info/departmen…

The key infrastructure of governments is where open source would play the most important role. Open source is not mentioned in any of the ECB's documents.

22/ Open source would be important because of conflict of interest with tax payer funding to assess the quality of projects, but also because of #infosec security community and open security research, it would be crucial that all deliveries are open source.

23/ This is especially important what comes to cryptography. We have a long history of failed closed source products using cryptography wrong.

24/ Overall the project has the smell "consultantware" written all over it... moving public funds to the pockets of a few consulting companies without any or little accountability.

25/ ECB stems its control from authority, not competence. They hate the idea of any public criticism and making deliverables open would expose any potential incompetence.

26/ Bureaucrats in Frankfurt have only downside, not any upside for the success of this project. Thus better to keep the lid on.

But this best interest of bureaucrats will not unleash any innovation similar to Linux, Internet that would eventually topple Visa locally.

But this best interest of bureaucrats will not unleash any innovation similar to Linux, Internet that would eventually topple Visa locally.

27/ THE UGLY

Bitcoin is dead. Long live the Bitcoin.

👇👇👇

Bitcoin is dead. Long live the Bitcoin.

👇👇👇

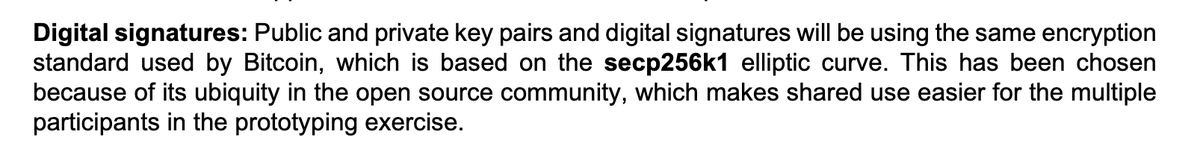

28/ This ECB #CBDC pilot is a #Bitcoin clone with custodial wallet providers and a single centralised server.

29/ It's a pilot, I get it.

There is even disclaimer that custodial model is probably not the model to go forward with.

There is even disclaimer that custodial model is probably not the model to go forward with.

30/ But as long as APIs are hidden behind the regulatory compliance wall and any developer with Github account cannot start poking them directly, there is not going to be innovation or even fair competition.

31/ The ECB pilot model is just effectivly replacing banks with wallet services that have proprietary APIs to a centralised settlement service. Then slap Bitcoin UTXO model on it.

32/ There is no discussion about interoperability or user rights, or benefits CDBD will bring to the users.

33/ - Wallet service provides do not give your own keys

- They can block your transaction

- Tthey will see all your transactions (merchant codes, etc.) so they can spy your consumer profile like credit card companies do.

- They can block your transaction

- Tthey will see all your transactions (merchant codes, etc.) so they can spy your consumer profile like credit card companies do.

34/ There is a lack of understanding of what makes any public blockchain so powerful. You can choose between 500+ wallets (so many because open source and open ledger) and move your keys between them.

35/ - The lack of vendor lock in guarantees consumer rights

- Decentralised system guarantees resiliency against cyberattacks, Internet malfunctioning etc.

- Decentralised system guarantees resiliency against cyberattacks, Internet malfunctioning etc.

36/ Remember, Bitcoin has not been down for the last 7 years.

37/ THE VERY UGLY

Does the left hand know what right hand is doing?

👇👇👇

Does the left hand know what right hand is doing?

👇👇👇

38/ Last week ECB's very publicly attacked #Bitcoin.

Now ECB is copying Bitcoin, down to its hashing function.

Now ECB is copying Bitcoin, down to its hashing function.

https://twitter.com/moo9000/status/1597910540638380032

39/ For fuck sake.... at least if you disagree with Bitcoin politically and see it as a failure, give it some proper credit and say aloud "cryptocurrencies have created innovation."

It's not so hard.

It's not so hard.

40/ Elsewhere: India is taking it a notch further with anonymous (to some amounts) and true peer-to-peer CBDC

41/ Also: Regulated EUR stablecoins are coming.

euroe.com from @EUROemoney

Unlike ECBs consultware, open stablecoins are supported and integrated by 500+ wallets and 50M+ users and 20k+ SW developers out of the box.

euroe.com from @EUROemoney

Unlike ECBs consultware, open stablecoins are supported and integrated by 500+ wallets and 50M+ users and 20k+ SW developers out of the box.

42/ FIN

Let's see something good comes from ECB's pilot. There are many reasons to be skeptical about their apporach, they are not software people and not engaged with right parties. But at least they are trying.

Let's see something good comes from ECB's pilot. There are many reasons to be skeptical about their apporach, they are not software people and not engaged with right parties. But at least they are trying.

• • •

Missing some Tweet in this thread? You can try to

force a refresh