People have been calling out @kucoincom and @cryptocom to be next CEX downfall. Trust in CEXes has hit all-time lows and CEX outflows have hit highs.

Here's a thread on how you can on/off-ramp without CEXes🧵 ->

Here's a thread on how you can on/off-ramp without CEXes🧵 ->

1/17

Traditionally, you had 2 options:

(1) CEX

(2) Non-CEX

With the risk of CEXes being a ticking timebomb, we'll focus on non-CEX on-ramping

Traditionally, you had 2 options:

(1) CEX

(2) Non-CEX

With the risk of CEXes being a ticking timebomb, we'll focus on non-CEX on-ramping

2/17

MoonPay 🌖

@moonpay enables users to purchase #stablecoins (TRC & ERC20), #BTC, #ETH (Arb, Op, Polygon, zkSync) and a bunch of other Altcoins using various payment methods.

The following are countries not supported for on-ramping: tinyurl.com/Moonpay-support

MoonPay 🌖

@moonpay enables users to purchase #stablecoins (TRC & ERC20), #BTC, #ETH (Arb, Op, Polygon, zkSync) and a bunch of other Altcoins using various payment methods.

The following are countries not supported for on-ramping: tinyurl.com/Moonpay-support

3/17

The crypto purchased will be directly credited to your non-custodial wallet.

⚠ BUT

Customers have had their Bank accounts frozen or are blocking MoonPay transactions because they are crypto-related(reddit.com/r/SafeMoon/com…)

Here's a way to potentially get around that:

The crypto purchased will be directly credited to your non-custodial wallet.

⚠ BUT

Customers have had their Bank accounts frozen or are blocking MoonPay transactions because they are crypto-related(reddit.com/r/SafeMoon/com…)

Here's a way to potentially get around that:

4/17

Personally, I've been using Prepaid Virtual Debit Cards without much friction.

Revolut has the function to create single-use disposable prepaid virtual cards.

It's essentially a burner card (ie. use and dump) and are not traceable

Personally, I've been using Prepaid Virtual Debit Cards without much friction.

Revolut has the function to create single-use disposable prepaid virtual cards.

It's essentially a burner card (ie. use and dump) and are not traceable

5/17

Off-ramping with MoonPay is slightly more difficult since they don't support a lot of countries.

Link to unsupported countries: support.moonpay.com/hc/en-gb/artic…

Off-ramping with MoonPay is slightly more difficult since they don't support a lot of countries.

Link to unsupported countries: support.moonpay.com/hc/en-gb/artic…

6/17

Off-ramping with MoonPay can only be done to a bank account. Revolut can also be used to facilitate off-ramping since they are essentially a digibank.

Off-ramping with MoonPay can only be done to a bank account. Revolut can also be used to facilitate off-ramping since they are essentially a digibank.

7/17

Ramp 🗻

@RampNetwork is another non-CEX fiat to crypto On/Off-ramping solution. They offer stablecoins, BTC, altcoins, similarly on vaious chains.

Ramp 🗻

@RampNetwork is another non-CEX fiat to crypto On/Off-ramping solution. They offer stablecoins, BTC, altcoins, similarly on vaious chains.

8/17

On-ramping can be done in a similar way through Revolut since banks may reject crypto-related transactions.

On-ramping can be done in a similar way through Revolut since banks may reject crypto-related transactions.

9/17

Ramp's off-ramp integration with projects is currently still being built.

But from what I understand, their retail off-ramp is only available in the US, as outlined in this blog posted by them: blog.ramp.network/off-ramp-is-li…

Ramp's off-ramp integration with projects is currently still being built.

But from what I understand, their retail off-ramp is only available in the US, as outlined in this blog posted by them: blog.ramp.network/off-ramp-is-li…

10/17

Paxos 📀

@PaxosGlobal is another option for On/Off-ramping without CEXes. They are different from MoonPay and Ramp as Paxos is a regulated custodian stablecoin issuer.

Paxos powers 3 USD-backed stablecoins - Paxos Dollar ($USDP), $BUSD and Huobi USD ($HUSD)

Paxos 📀

@PaxosGlobal is another option for On/Off-ramping without CEXes. They are different from MoonPay and Ramp as Paxos is a regulated custodian stablecoin issuer.

Paxos powers 3 USD-backed stablecoins - Paxos Dollar ($USDP), $BUSD and Huobi USD ($HUSD)

11/17

The minting process is similar to that of #USDT or #USDC.

1) Send USD to Paxos' bank accout

2) Paxos mints the stablecoins

3) Paxos holds your USD 1:1 to the amount of stablecoins minted.

4) When you redeem USD, the stablecoins are burned.

The minting process is similar to that of #USDT or #USDC.

1) Send USD to Paxos' bank accout

2) Paxos mints the stablecoins

3) Paxos holds your USD 1:1 to the amount of stablecoins minted.

4) When you redeem USD, the stablecoins are burned.

12/17

Paxos holds USD reserves in FDIC-insured bank acounts and they are heavily regulated by NYSDFS.

AML/KYC processes are stringent and needs to be done before you are allowed to mint Paxos-issued stablecoins (the KYC process is a pain in the ass)

Paxos holds USD reserves in FDIC-insured bank acounts and they are heavily regulated by NYSDFS.

AML/KYC processes are stringent and needs to be done before you are allowed to mint Paxos-issued stablecoins (the KYC process is a pain in the ass)

13/17

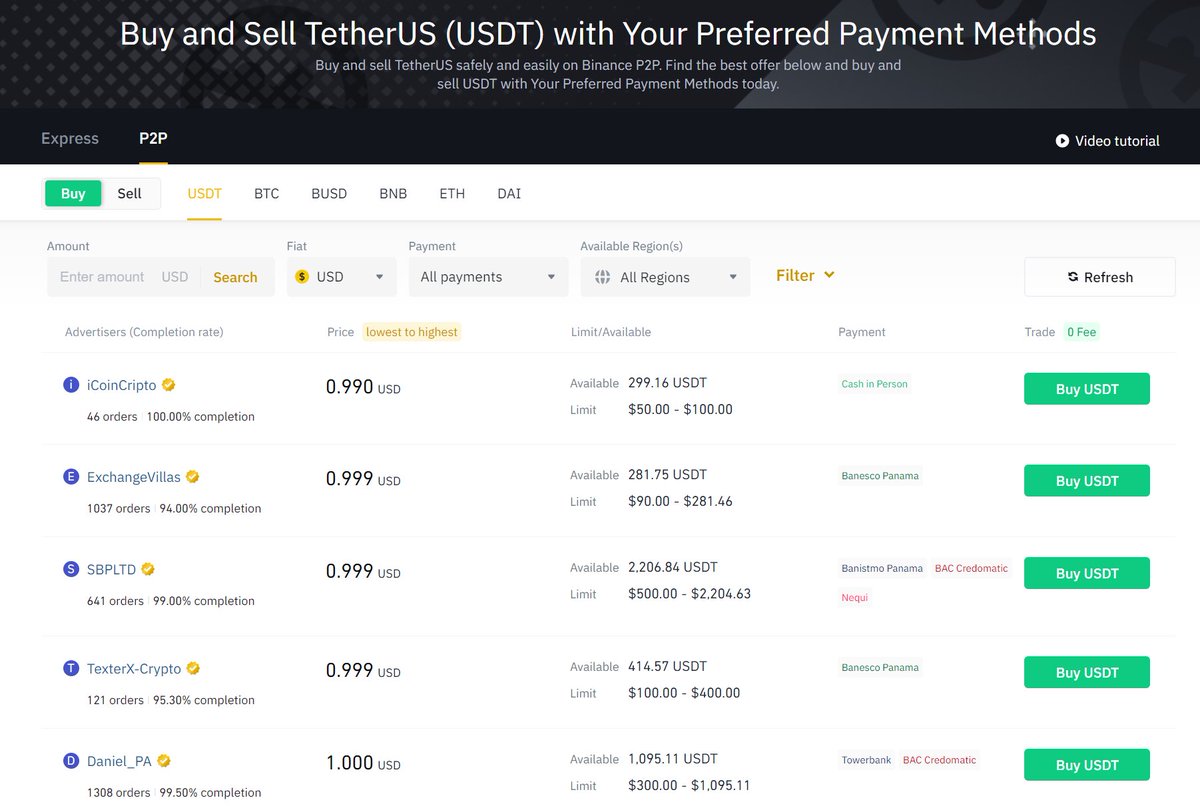

P2P 👬

P2Ps are a great decentralized on/off-ramping option, but are custodial options as these services are mostly offered of exchanges.

Yes. I realized this thread is about non-CEX on/off-ramping solutions. But P2P might be the only decentralized fiat-to-crypto method.

P2P 👬

P2Ps are a great decentralized on/off-ramping option, but are custodial options as these services are mostly offered of exchanges.

Yes. I realized this thread is about non-CEX on/off-ramping solutions. But P2P might be the only decentralized fiat-to-crypto method.

14/17

The best part about this solution is that it's relatively cheap or even free.

Just ensure that you withdraw your crypto into a non-custodial wallet right after you receive it.

The best part about this solution is that it's relatively cheap or even free.

Just ensure that you withdraw your crypto into a non-custodial wallet right after you receive it.

15/17

Some pretty good options for P2P:

@okx @binance @HuobiGlobal @Bybit_Official

If you're looking to dodge the KYC, Huobi allows for KYC-less P2P transactions, but there will be a limit to how much you can deposit.

Some pretty good options for P2P:

@okx @binance @HuobiGlobal @Bybit_Official

If you're looking to dodge the KYC, Huobi allows for KYC-less P2P transactions, but there will be a limit to how much you can deposit.

16/17

I hope you've found this thread helpful. If so, please leave a ♥ and RT 🙏

Follow me @0xsurferboy for more insightful threads.

I hope you've found this thread helpful. If so, please leave a ♥ and RT 🙏

Follow me @0xsurferboy for more insightful threads.

https://twitter.com/0xsurferboy/status/1602166381264265216

17/17

Tags for awareness😁

@ramahluwalia @adamscochran @thebitsian @RampNetwork @0xStrider @VANalyzooor @AnalystDC @Crypto_Analyst @JonnyMoeTrades @anambroid @SecretsOfCrypto @DefiIgnas

Tags for awareness😁

@ramahluwalia @adamscochran @thebitsian @RampNetwork @0xStrider @VANalyzooor @AnalystDC @Crypto_Analyst @JonnyMoeTrades @anambroid @SecretsOfCrypto @DefiIgnas

#crypto #stablecoin #USDT #USDC #BTC #ETH #Metamask #Monero #FTX #BlockFi #binance #busd #Arbitrum #MAGIC #SBF #Cryptocurency

• • •

Missing some Tweet in this thread? You can try to

force a refresh