#Fed day: the down/up reaction of #stocks shows something here for both hawks & doves.

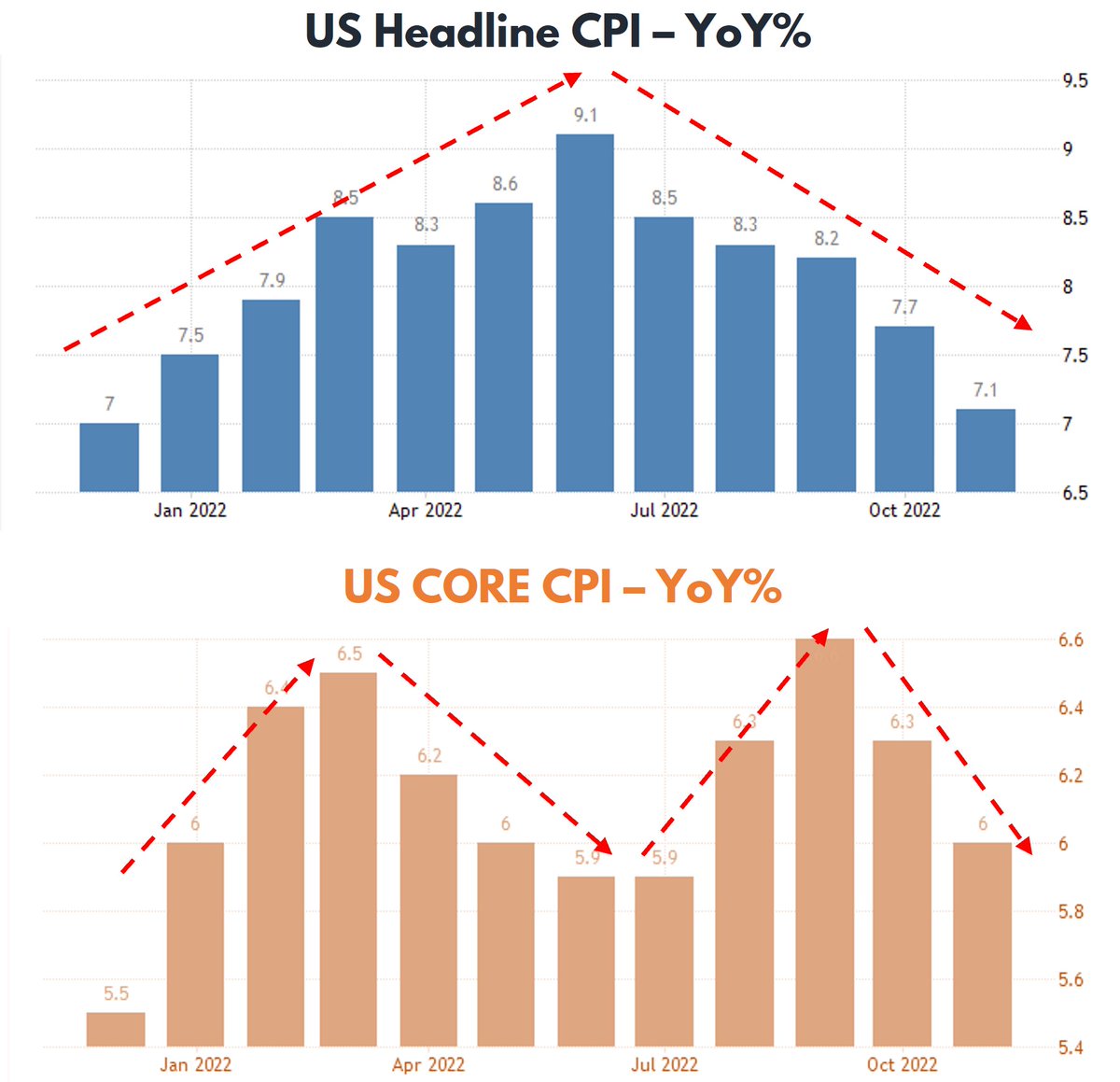

For me (looking ahead), the Fed faces a dilemma in 1H '23. Cool/negative goods/energy inflation but still strong wage gains given tight labor.

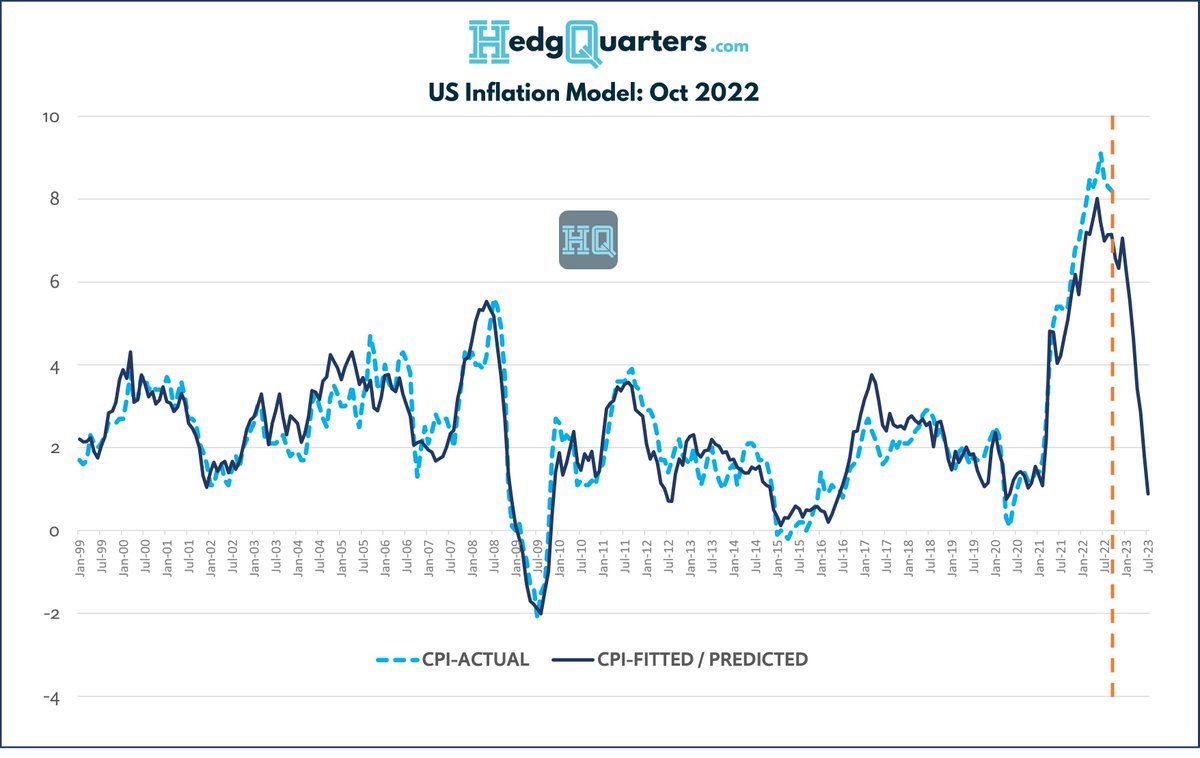

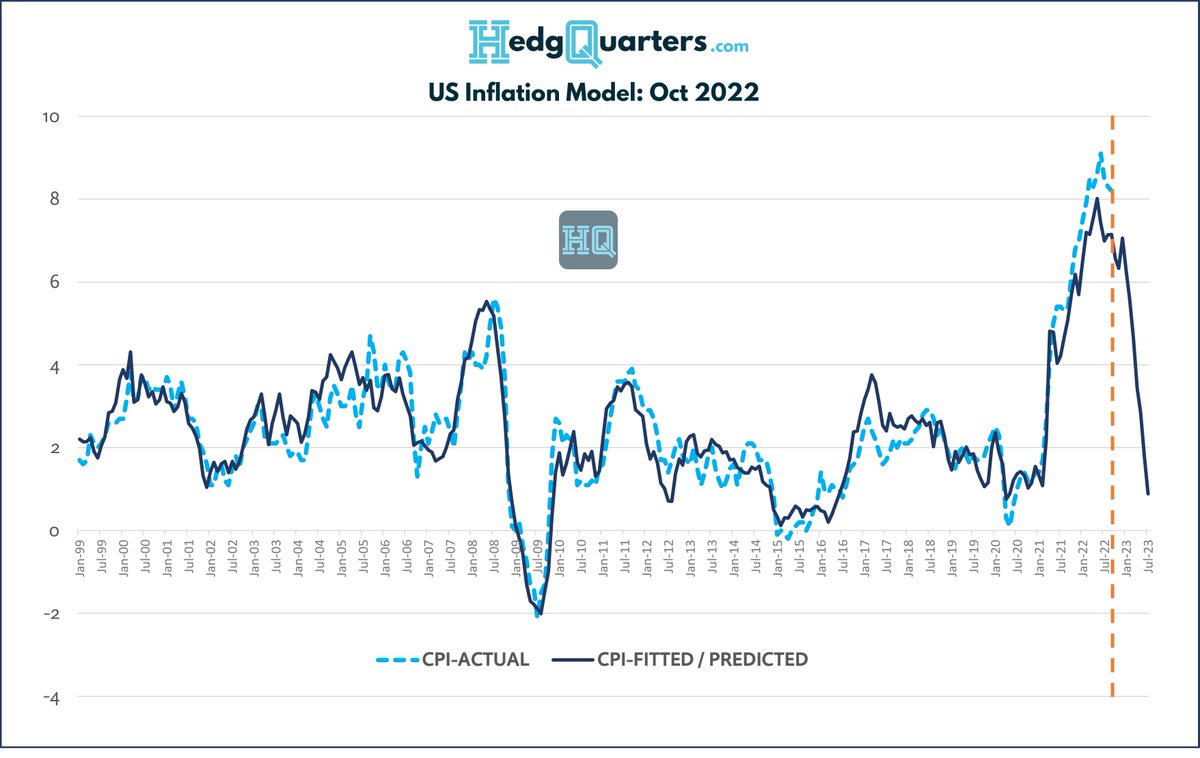

Headline CPI...

#macro

For me (looking ahead), the Fed faces a dilemma in 1H '23. Cool/negative goods/energy inflation but still strong wage gains given tight labor.

Headline CPI...

#macro

will fall (particularly in Q1), potentially to even ~5% by March data, but wage gains will see medium term services & core inflation drivers inconsistent in the Fed's lens with a sustainable return to 2-3% target.

So Mr Mkt is saying based on history, the Fed never keeps...

So Mr Mkt is saying based on history, the Fed never keeps...

rates at peak for long (ie the market assumes rate cuts soon after the peak).

But we need to consider that perhaps this time, with the labor pool down due to COVID and structural labor tightness, the #Fed may be FORCED to keep rates at the peak plateau for longer...

But we need to consider that perhaps this time, with the labor pool down due to COVID and structural labor tightness, the #Fed may be FORCED to keep rates at the peak plateau for longer...

than expected given the time it takes to create up to 3m jobs slack in the economy.

Ie as headline CPI normalizes in '23, we may reach a point where headline CPI falls below core and a widening gap appears.

All the markets attention right now is on headline CPI, I'm saying...

Ie as headline CPI normalizes in '23, we may reach a point where headline CPI falls below core and a widening gap appears.

All the markets attention right now is on headline CPI, I'm saying...

to shift your focus to Core and use that as your primary metric to forecast a rate path. As the chart shows, its likely to present a very different picture and will become a key source of debate in markets next year.

The crossover point is looking like it will be about the

The crossover point is looking like it will be about the

March '23 release (mid Apr) or April release based on the current MoM rates of each metric and the prior comparatives that will cycle out.

Once we get a crossover, the debate will intensify about rate cuts that are already prices for 2H '23.

The is important for #stocks. Why?

Once we get a crossover, the debate will intensify about rate cuts that are already prices for 2H '23.

The is important for #stocks. Why?

The 1yr Fwd P/E on the #SPX has now risen to ~19x. This is inconsistent with rates of 5%, and makes sense only with a lens that markets are looking through peak rates for a quick pivot and fall.

Hence as expectations for the peak plateau duration lengthen...

Hence as expectations for the peak plateau duration lengthen...

the more likely it becomes, that the #SPX Fwd P/E ratio reverts to levels more consistent with higher for longer rates.

This will not happen due to EPS increases because of financial conditions affecting earnings - it will happen because equities prices fall.

There will be...

This will not happen due to EPS increases because of financial conditions affecting earnings - it will happen because equities prices fall.

There will be...

multiple catalysts on this journey - it will not happen all at once.

-Banks will start to report rising delinquencies after Q1

-Transport stocks will have horrible Q1 23 post Xmas earnings

-Retailers will show a post Xmas revenue hangover as the consumer pays off bloated CC's...

-Banks will start to report rising delinquencies after Q1

-Transport stocks will have horrible Q1 23 post Xmas earnings

-Retailers will show a post Xmas revenue hangover as the consumer pays off bloated CC's...

-Builders will have worked through backlogs by end Q1 '23 and be laying off staff

This will all start to change the picture, but remember there's potential 3m excess jobs to work through before we get some balance in labor S/D.

Thats going to take most of the year.

This will all start to change the picture, but remember there's potential 3m excess jobs to work through before we get some balance in labor S/D.

Thats going to take most of the year.

• • •

Missing some Tweet in this thread? You can try to

force a refresh