[#CMC 2023 #crypto Playbook] - According to CMC 🚀

Using interesting findings from our data with collaborations from other research entities, we analyze what happened in 2022, and what the #crypto key theses are going into 2023.💪

<1/10>

coinmarketcap.com/alexandria/art…

Using interesting findings from our data with collaborations from other research entities, we analyze what happened in 2022, and what the #crypto key theses are going into 2023.💪

<1/10>

coinmarketcap.com/alexandria/art…

1⃣ #DeFi

Some themes to follow for the next year from @Uniswap & @TrustWallet

🔹How DeFi UX/UI improves to bring more new #crypto users into the sector

🔹How both education and infrastructure will grow

🔹Whether #DEXs can eat significantly into #CEXs market share.

<2/10>

Some themes to follow for the next year from @Uniswap & @TrustWallet

🔹How DeFi UX/UI improves to bring more new #crypto users into the sector

🔹How both education and infrastructure will grow

🔹Whether #DEXs can eat significantly into #CEXs market share.

<2/10>

2⃣ #NFTs & #GameFi

@Sfermion_ & @naavik_co look at what we can expect

from NFTs and GameFi in 2023.

For NFTs in particular, there is a movement towards greater adoption of #Layer2 ,as well as expectations of new integrations between AI and NFTs.

<3/10>

@Sfermion_ & @naavik_co look at what we can expect

from NFTs and GameFi in 2023.

For NFTs in particular, there is a movement towards greater adoption of #Layer2 ,as well as expectations of new integrations between AI and NFTs.

<3/10>

3⃣ Regulations

@apcoworldwide & @BlockchainforEU see the future of

#cryptocurrency regulations.

Their insights will touch on the future of #CBDCs and how central banks can make them work.

<4/10>

@apcoworldwide & @BlockchainforEU see the future of

#cryptocurrency regulations.

Their insights will touch on the future of #CBDCs and how central banks can make them work.

<4/10>

4⃣Adoption

#CMC conducted an in-depth analytical interview with @cz_binance touching on the basis for #crypto adoption and what will bring in the next wave.

His answer?

👉 Product improvements are more important than regulation.

<5/10>

#CMC conducted an in-depth analytical interview with @cz_binance touching on the basis for #crypto adoption and what will bring in the next wave.

His answer?

👉 Product improvements are more important than regulation.

<5/10>

5⃣ #BUILD

@BinanceResearch, @ConsenSys, @SlowMist_Team & @jump_ looks into:

🔹Increase in on-chains sleuths and better analytics tools

🔹New types of #decentralized governance in DAOs

🔹How L1s can stay competitive

🔹How L2s can gain more mindshare

<6/10>

@BinanceResearch, @ConsenSys, @SlowMist_Team & @jump_ looks into:

🔹Increase in on-chains sleuths and better analytics tools

🔹New types of #decentralized governance in DAOs

🔹How L1s can stay competitive

🔹How L2s can gain more mindshare

<6/10>

6⃣ Investment

@dragonfly_xyz @compoundfinance and

@GSR_io look at where investors will be directing their capital in 2023.

One theme will be an increased focus on risk management when conducting due diligence, particularly in the field of #DeFi.

<7/10>

@dragonfly_xyz @compoundfinance and

@GSR_io look at where investors will be directing their capital in 2023.

One theme will be an increased focus on risk management when conducting due diligence, particularly in the field of #DeFi.

<7/10>

7⃣ Industry

While @nansen_ai covers the importance of on-chain analytics, the @ACJRnetwork examines how journalists and the media, in general, have dealt with covering very intricate and technical stories for both the #crypto

native and a wider audience.

<8/10>

While @nansen_ai covers the importance of on-chain analytics, the @ACJRnetwork examines how journalists and the media, in general, have dealt with covering very intricate and technical stories for both the #crypto

native and a wider audience.

<8/10>

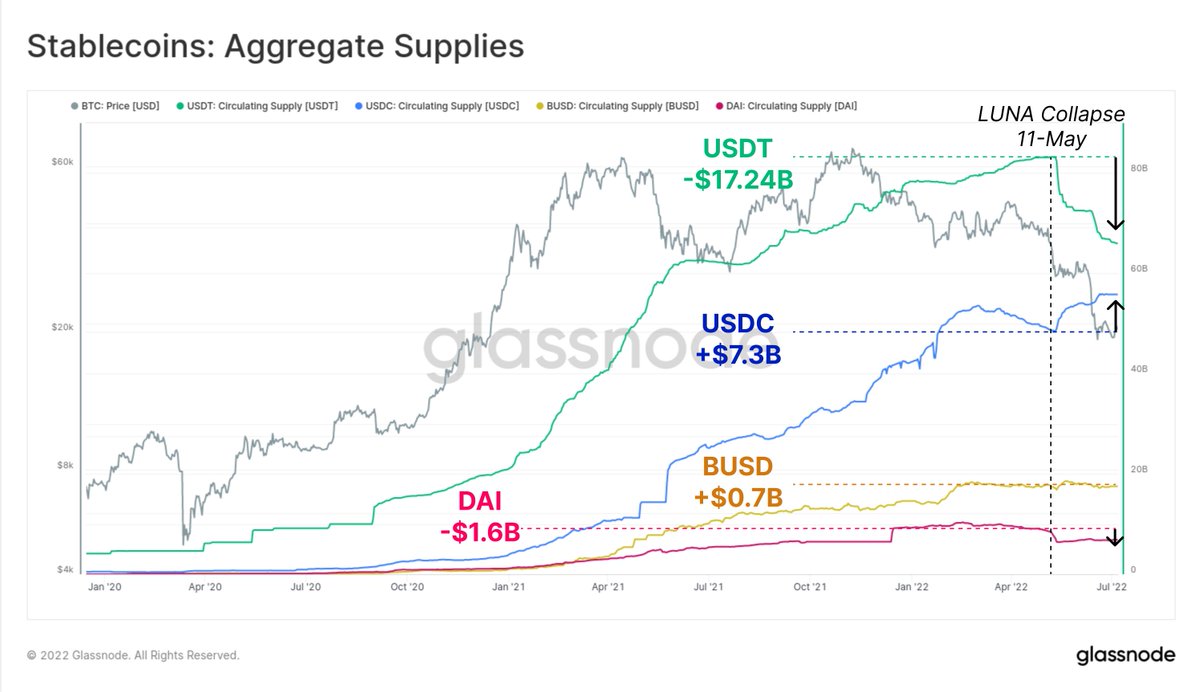

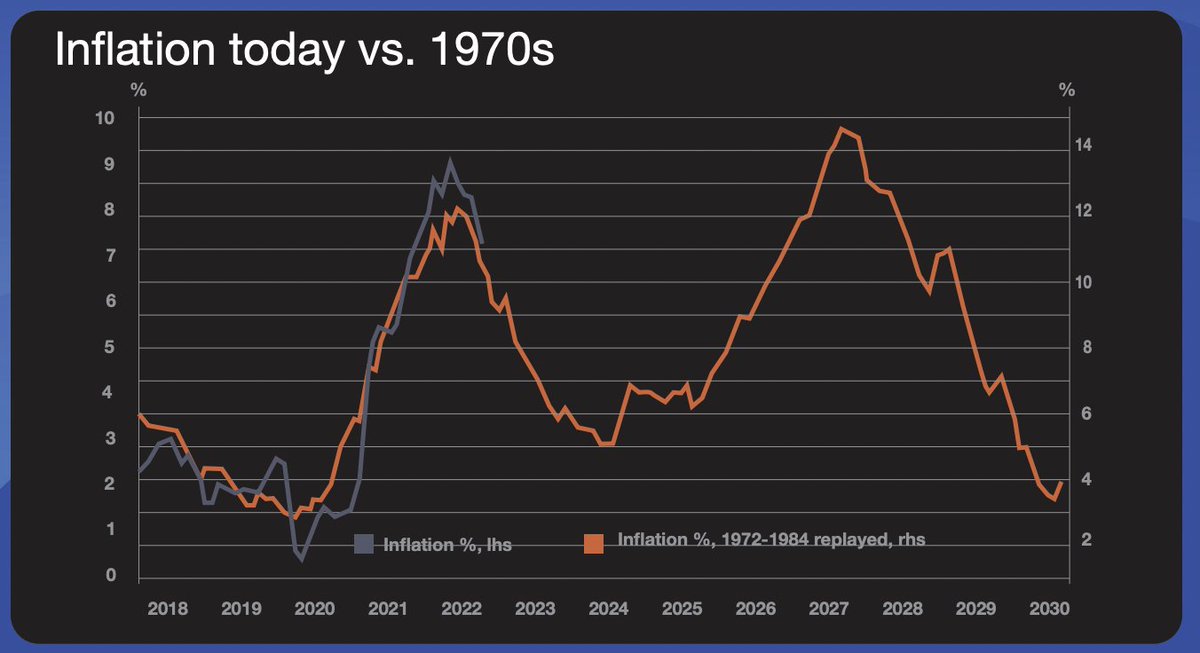

8⃣ Market

🔹 @QCPCapital looks at how inflation

in the market has affected #cryptomarket

🔹 @glassnode turns its attention to how institutional players arriving have affected the markets and market

making in general.

<9/10>

🔹 @QCPCapital looks at how inflation

in the market has affected #cryptomarket

🔹 @glassnode turns its attention to how institutional players arriving have affected the markets and market

making in general.

<9/10>

For the deepest knowledge of the overall market in 2022, along with insights on what's coming for #crypto in 2023, make sure you download #CMC's Playbook PDF version 😉

👉 Details: s3.coinmarketcap.com/uploads/2023-c…

<10/10>

👉 Details: s3.coinmarketcap.com/uploads/2023-c…

<10/10>

• • •

Missing some Tweet in this thread? You can try to

force a refresh