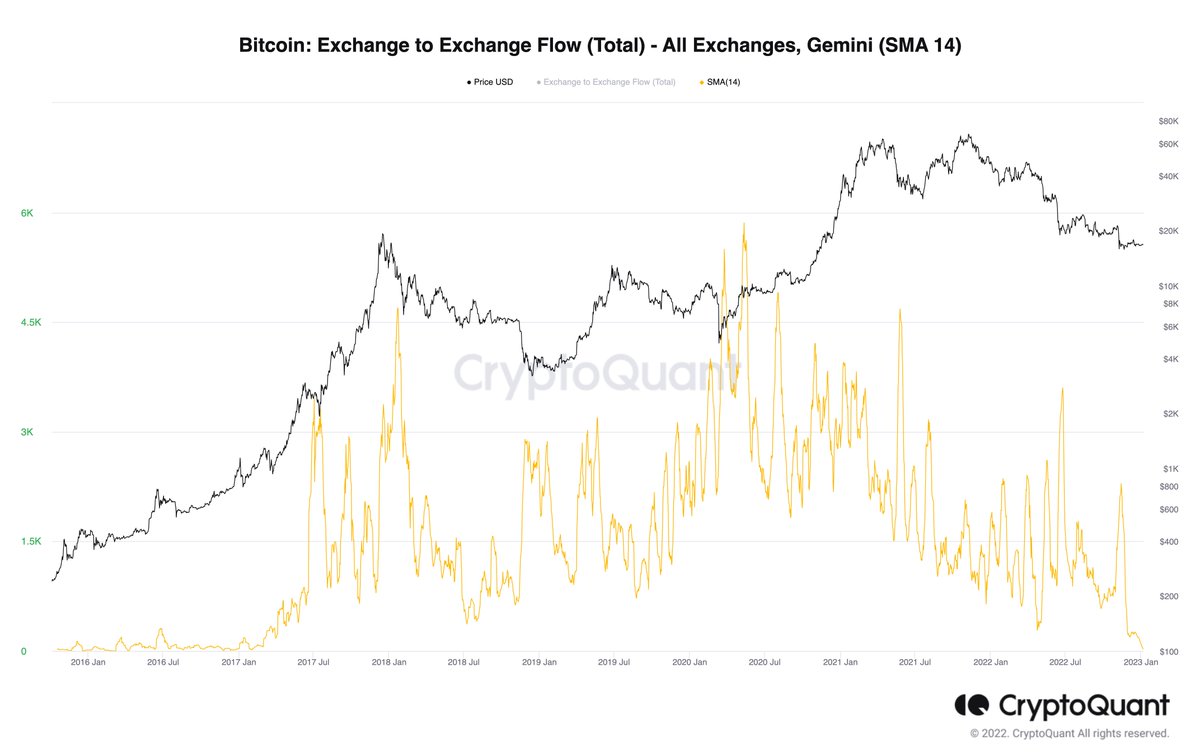

From an on-chain perspective, Gemini has been experiencing declining exchange activity:

1- Cryptocurrency reserves (BTC, ETH, and stablecoins reserves are at multi-year lows),

1- Cryptocurrency reserves (BTC, ETH, and stablecoins reserves are at multi-year lows),

2- BTC deposits from other exchanges into Gemini (a sign of users avoiding sending their money to Gemini)

3- Trading volume (BTC trading volume was down 52% YoY in December 2022 and is just a fraction of what it was in previous years).

To follow the above and other metrics related to Gemini Exchange, visit our Gemini Exchange Analysis Dashboard 👇

cryptoquant.com/dashboard/63b4…

cryptoquant.com/dashboard/63b4…

Follow us on Telegram and LinkedIn:

💡 Daily on-chain insights: t.me/cryptoquant_of…

🔔 Live Alerts: t.me/cryptoquant_al…

LinkedIn: linkedin.com/company/crypto…

💡 Daily on-chain insights: t.me/cryptoquant_of…

🔔 Live Alerts: t.me/cryptoquant_al…

LinkedIn: linkedin.com/company/crypto…

I hope you've found this thread helpful.

Follow us @cryptoquant_com for more.

Like/Retweet the first tweet below if you can:

Follow us @cryptoquant_com for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/cryptoquant_com/status/1611373291532587009

• • •

Missing some Tweet in this thread? You can try to

force a refresh