An argument for why the Gambler's Fallacy, the Recency Bias, and Conditional Heteroskedasticity could set up an attractive asymmetric return profile ahead of Wednesday's US inflation (#CPI) data ...

🧵 1/n

🧵 1/n

Headline CPI is forecasted to come in at 6.5% YoY, compared to 7.1% the month before. CPI has clearly been trending downward since June 2022, which is positive for the #economy and risky assets as it puts a ceiling on how high the #FederalReserve has to raise rates.

2/n

2/n

The Gambler's Fallacy & Recency Bias:

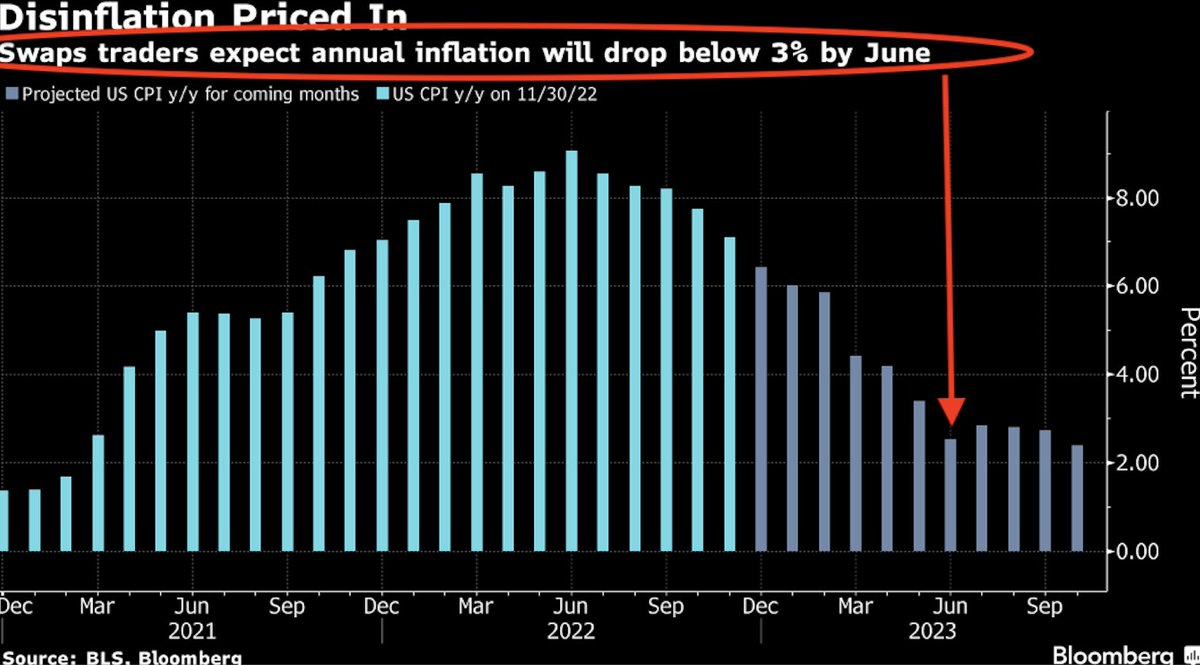

CPI swaps indicate that CPI should be approx. 2.5% (!) this June. This seems to be an example of the "Gambler's Fallacy"; a misunderstanding of #probabilities in which people wrongly project reversal towards a long-term mean.

3/n

CPI swaps indicate that CPI should be approx. 2.5% (!) this June. This seems to be an example of the "Gambler's Fallacy"; a misunderstanding of #probabilities in which people wrongly project reversal towards a long-term mean.

3/n

Enter "Recency Bias": It seems the market is extrapolating the recent positive CPI data.

The #market might be right but forecasting #inflation is no easy task. One year ago economists forecasted CPI would be at 3% (!) today. Consensus of 2.5% by June might be doable but ...

4/n

The #market might be right but forecasting #inflation is no easy task. One year ago economists forecasted CPI would be at 3% (!) today. Consensus of 2.5% by June might be doable but ...

4/n

... it definitely seems like it's at the optimistic end of possible CPI outcomes!⚠️

This could leave the market vulnerable to a negative surprise in CPI, especially when we take into account that previously, on the day CPI has been released, the market seems to ...

5/n

This could leave the market vulnerable to a negative surprise in CPI, especially when we take into account that previously, on the day CPI has been released, the market seems to ...

5/n

... have been reacting to how CPI printed compared to the forecast and NOT to the prior month's/trend's data.

Conditional Heteroskedasticity:

CPI exhibits conditional heteroskedasticity, i.e., non-constant #variance ...

6/n

Conditional Heteroskedasticity:

CPI exhibits conditional heteroskedasticity, i.e., non-constant #variance ...

6/n

... basically, that means there is a random component to forecasting CPI, especially when CPI is at elevated levels as the #variability is greater here.

The forecasted CPI value is often the center of a distribution of possibilities, but as CPI is a random variable ...

7/n

The forecasted CPI value is often the center of a distribution of possibilities, but as CPI is a random variable ...

7/n

... it can take on any value that falls within the range of its #distribution.

E.g., if CPI comes in 0.2 greater than expected, it will still fall within a 95% confidence range, meaning a statistical test would show it is statistically NOT different from the expected value.

8/n

E.g., if CPI comes in 0.2 greater than expected, it will still fall within a 95% confidence range, meaning a statistical test would show it is statistically NOT different from the expected value.

8/n

An asymmetric return profile:

As the market might be overly optimistic about the pace of slowing inflation, AND as the market reacts to how CPI data lines up compared to the #forecast, which is influenced by a random component, I believe we’re facing an event with ...

9/n

As the market might be overly optimistic about the pace of slowing inflation, AND as the market reacts to how CPI data lines up compared to the #forecast, which is influenced by a random component, I believe we’re facing an event with ...

9/n

... an asymmetric return profile that could be attractive to #trade!

If CPI comes in worse than the forecast, I think the market reaction will be more severe (a larger #selloff) than if CPI comes in better than the forecast (a small #rally, if any). I.e., asymmetric! 🤩

10/n

If CPI comes in worse than the forecast, I think the market reaction will be more severe (a larger #selloff) than if CPI comes in better than the forecast (a small #rally, if any). I.e., asymmetric! 🤩

10/n

Therefore, statistically, it should be attractive to reduce beta/risk ahead of the CPI data if you don't have a clear view on how CPI will print compared to the forecast - which to a large degree is random!

Friday’s rally in $SPY and $UST bonds on the back of weaker than

11/n

Friday’s rally in $SPY and $UST bonds on the back of weaker than

11/n

... expected wage growth (which I think could be short-lived) further supports my thesis the market might be ripe for a move lower if a catalyst like a negative CPI surprise shows up.

I'll be by buying puts on $SPY, and I'll be switching some $TLT exposure to $TIPS.

12/12

I'll be by buying puts on $SPY, and I'll be switching some $TLT exposure to $TIPS.

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh