Educational Thread: How to ride a trend in this #Altcoin market. Liquidity hops from 1 narrative to the next, so be sure to understand

I'm going to use $ETH in July as an example. This is also relevant to the current $FET traders.

All dependent on $BTC being stable

I'm going to use $ETH in July as an example. This is also relevant to the current $FET traders.

All dependent on $BTC being stable

Step 1: Wait for #Bitcoin to be in a stable area. Very few altcoin runs can happen if $BTC is heavily volatile and downtrending. Alts are going to die (as we've seen) if this happens and it's a tough environment to trade in.

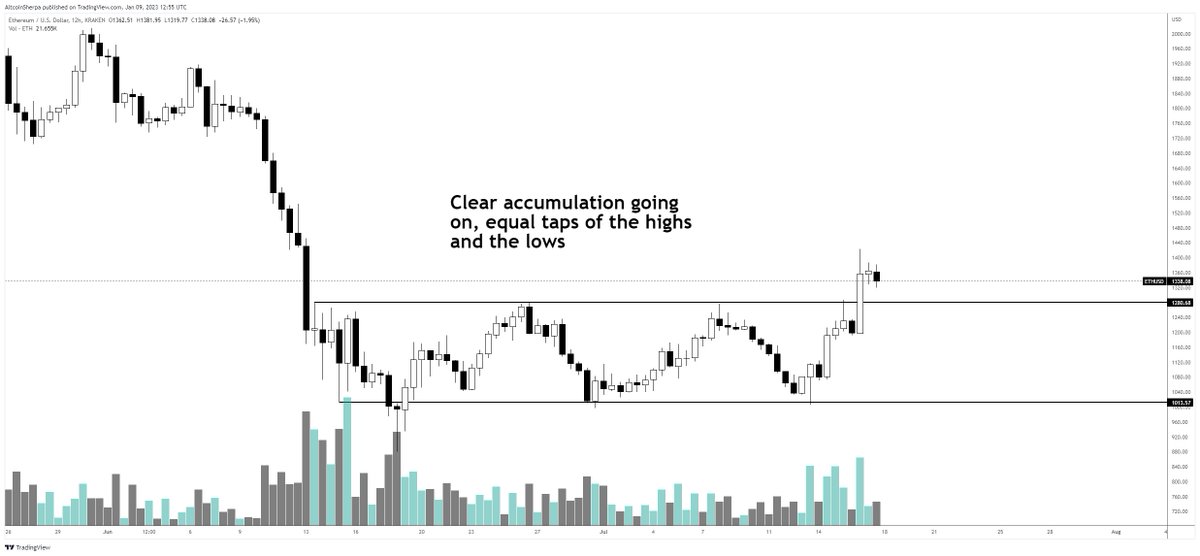

Here we see #Ethereum chopping around and finding a short term bottom. Accumulation is always easy in hindsight and we saw equal highs and lows in this example. This was, in fact, the $ETH bottom.

Step 2: Find the market leader. This doesn't necessarily mean OVERALL market leader, it means the leader of the specific sector (though usually the biggest gainer will be the market leader).

In this case, it was $ETH. What was the narrative? ETH 2.0, a huge network upgrade, probably the biggest one in its existence.

You have to understand the leader and what it does. If you don't understand the 'fundamentals' of the coin, you need to research and read.

You have to understand the leader and what it does. If you don't understand the 'fundamentals' of the coin, you need to research and read.

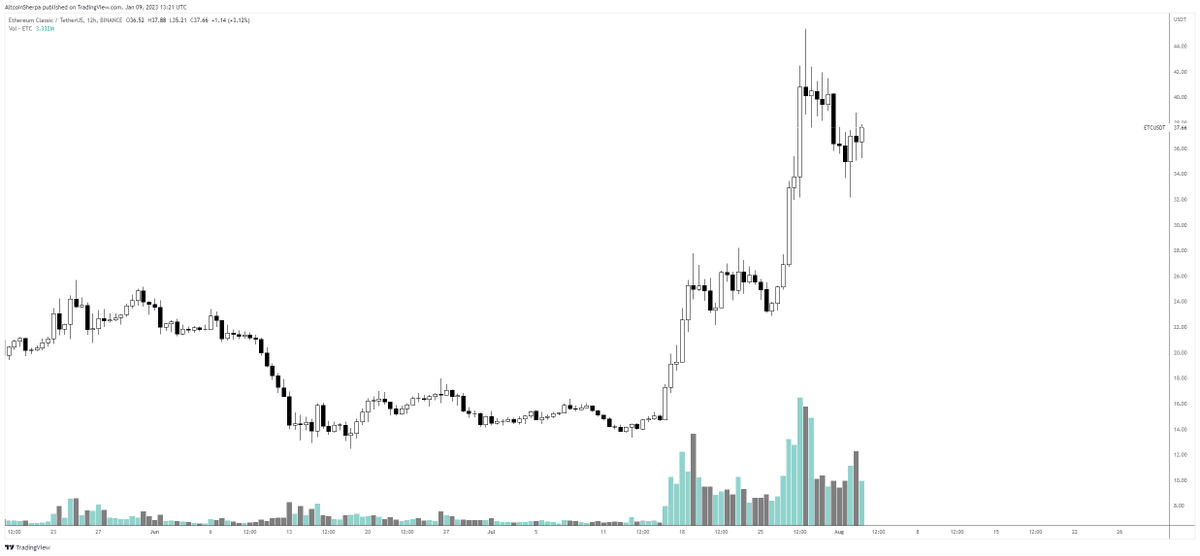

Step 3- after you identify the market leader is to find the lagging coins that are associated with the market leader. In the case of $ETH doing really well, it was $ETC, $LDO, $OP and a few others. Anything #Ethereum related did very very well.

So, $ETH is starting to escape its range and dominate the market. Usually the market leader sucks all liquidity from other coins and all attention is going to be on that sector for the time being. Stuck in your $SNX long while it chops in a 1% range? Don't be that guy.

Ok, so the market leader is going hard. There are a few ways you can play this; each with their own pros/cons. If you're a big trader (you prob dont even need this thread bc you already know all of this), you should probably just trade the leader. It's going to have the most liq

It's simple in this case: Buy the dips, sell the rips. Compounding your position can be good and also let your position sit a bit longer than normal; this is the market leader after all. You got lucky in seeing it.

The other strategy is to buy the lagging coins. ETH mooning w. ETH 2.0 narrative and ETC is up 1%? You can easily buy ETC and sell the next day. Many such relationships in this market (see: DOGE/SHIB, SAND/MANA, etc).

The downside to buying the lagging coin is that it usually won't outperform (ofc lots of exceptions) and it is mostly going to be at the mercy of the leader. But you can assume that the slower money is going to the lagging coins / brothers of the leader.

How do you find the relationships? Stop being lazy and start researching and begging people for advice. Understanding the altcoin relationships /fundamentals is 50%+ of the game right now IMO.

Ok, so back on point. The leader is going nuts, you can see the lagging coins start to do well too. Check out $OP $ETC $LDO around this time. Many of these actually outperformed $ETH in this circumstance (which makes sense given the MC)

Ride this trend as hard as you can. You can use a variety of strategies, some of which I listed above (compounding, trailing stops, etc). But if you are early in a hot sector, be sure to ride it. There's a reason why you got in early and it's not for that 3 % gain.

The trend is usually only as good as the leader. Once the leader starts to falter and pull back/ go into the distribution phase, that's when it's starting to get near the end of the narrative.

here is the end of the $ETH trend for that time being- same notes/examples you can find in every single other chart out there. Ofc this is much easier to see in hindsight rather than in real time. Lower highs, higher sell volume, lows getting taken out, etc.

Once the leader starts to pull back, lagging coins do as well. Downtrends don't happen overnight; they usually are a slow drawn out process and it's death by a thousand cuts. Distribution takes a longer time and you slowly bleed all profits back as a retail investor.

How's this apply to current market conditions? Check out $FET. #FetchAI is going to be the future of everything according to their fanboys. We all know how this is going to end, though. Crypto fundamentals are mostly a joke and not rooted in reality.

Why did FET move? Probably because of ChatGPT. AI is going to be a very interesting thing but I don't see crypto AI being very ready for this yet. It's more moving off narrative and I expect lots of copycat scams to pop up as well.

Look at the lagging coins like $OCEAN. Fantastic run but it's going to really have a similar result as these other coins - it'll go down as soon as FET starts to pull back. Late longers are going to get punished, not knowing they are too late to the trend/narrative

Then liquidity will end here, price will slowly grind down and the narrative will be done for a while. The leader will grind back all of its gains, the late longers will capitulate and sell their buys, and you will see it go all the way back down to the origin of the pump.

So, to summarize:

1- btc is stable

2- Find the market leader + understand why its moving + narrative behind it

3- Find the lagging coins

4- Decide what strategy you want to use

5- Wait for the leader to pull back

6-Laggards will die

7- Find the next narrative and hop on early

1- btc is stable

2- Find the market leader + understand why its moving + narrative behind it

3- Find the lagging coins

4- Decide what strategy you want to use

5- Wait for the leader to pull back

6-Laggards will die

7- Find the next narrative and hop on early

Hope you enjoyed this thread. It's important to be selective with the coins you trade in this market + understand the reasons why you are doing so. Trading old shitcoins w. zero narrative is dumb, don't do it. Liquidity is so fragmented and low that it's a waste of time. GL

• • •

Missing some Tweet in this thread? You can try to

force a refresh