#CoinGecko 2022 Annual Crypto Industry Report 📊

2022 was a tumultuous year for #crypto - NFTs and DeFi are among the hardest hit sectors, while stablecoins had a mixed performance.

Here are 8 key highlights you shouldn't miss 👇

2022 was a tumultuous year for #crypto - NFTs and DeFi are among the hardest hit sectors, while stablecoins had a mixed performance.

Here are 8 key highlights you shouldn't miss 👇

1) #Crypto market was mainly in consolidation after Q2 ↔️

• Q2 2022 was the most brutal period with the largest drawdown, due to the Terra/LUNA crash.

• Total crypto market cap started the year at $2.3T, dropped below $1T in Q2, and ended the year 64.1% lower at $829B.

• Q2 2022 was the most brutal period with the largest drawdown, due to the Terra/LUNA crash.

• Total crypto market cap started the year at $2.3T, dropped below $1T in Q2, and ended the year 64.1% lower at $829B.

2) Stablecoins gained crypto dominance, but suffered net outflows 🪙

• Investors turned to safer assets, with $USDT, $USDC, and $BUSD increasing in dominance in the market.

• The stablecoins market slid 16.6%, with most losses during the $UST collapse in May.

• Investors turned to safer assets, with $USDT, $USDC, and $BUSD increasing in dominance in the market.

• The stablecoins market slid 16.6%, with most losses during the $UST collapse in May.

3) #FTX contagion impacted over 1M and counting 🦠

• The FTX collapse led to widespread losses, impacting around 1M depositors, creditors and investors.

• While many companies and institutions have already fallen, it is likely that more are expected to follow suit in 2023.

• The FTX collapse led to widespread losses, impacting around 1M depositors, creditors and investors.

• While many companies and institutions have already fallen, it is likely that more are expected to follow suit in 2023.

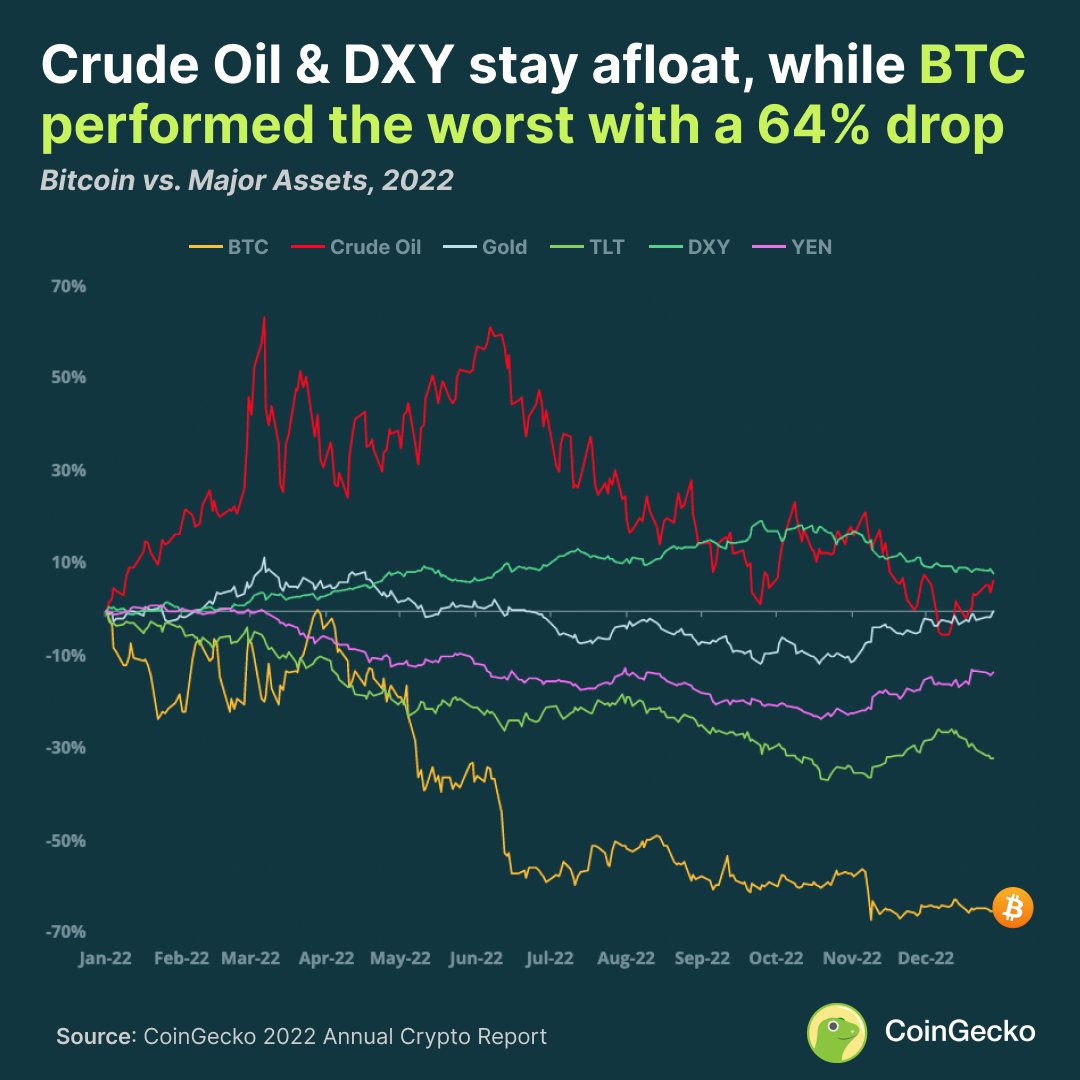

4) #BTC performed the worst among major assets 📉

• Major assets performed poorly and ended with yearly price returns in the red, except for crude oil and the US Dollar Index (DYX).

• Bitcoin recorded the steepest decline of 64.2%, which was almost twice that of NASDAQ (-34%).

• Major assets performed poorly and ended with yearly price returns in the red, except for crude oil and the US Dollar Index (DYX).

• Bitcoin recorded the steepest decline of 64.2%, which was almost twice that of NASDAQ (-34%).

5) $ETH staking grew QoQ ahead of Ethereum upgrades 🐼

• Total staked #ETH closed the year at 15.8M, up from 8.8M.

• Following #Ethereum's successful Merge and in anticipation of the Shanghai upgrade, total staked ETH posted notable growth of 12.5% in Q4.

• Total staked #ETH closed the year at 15.8M, up from 8.8M.

• Following #Ethereum's successful Merge and in anticipation of the Shanghai upgrade, total staked ETH posted notable growth of 12.5% in Q4.

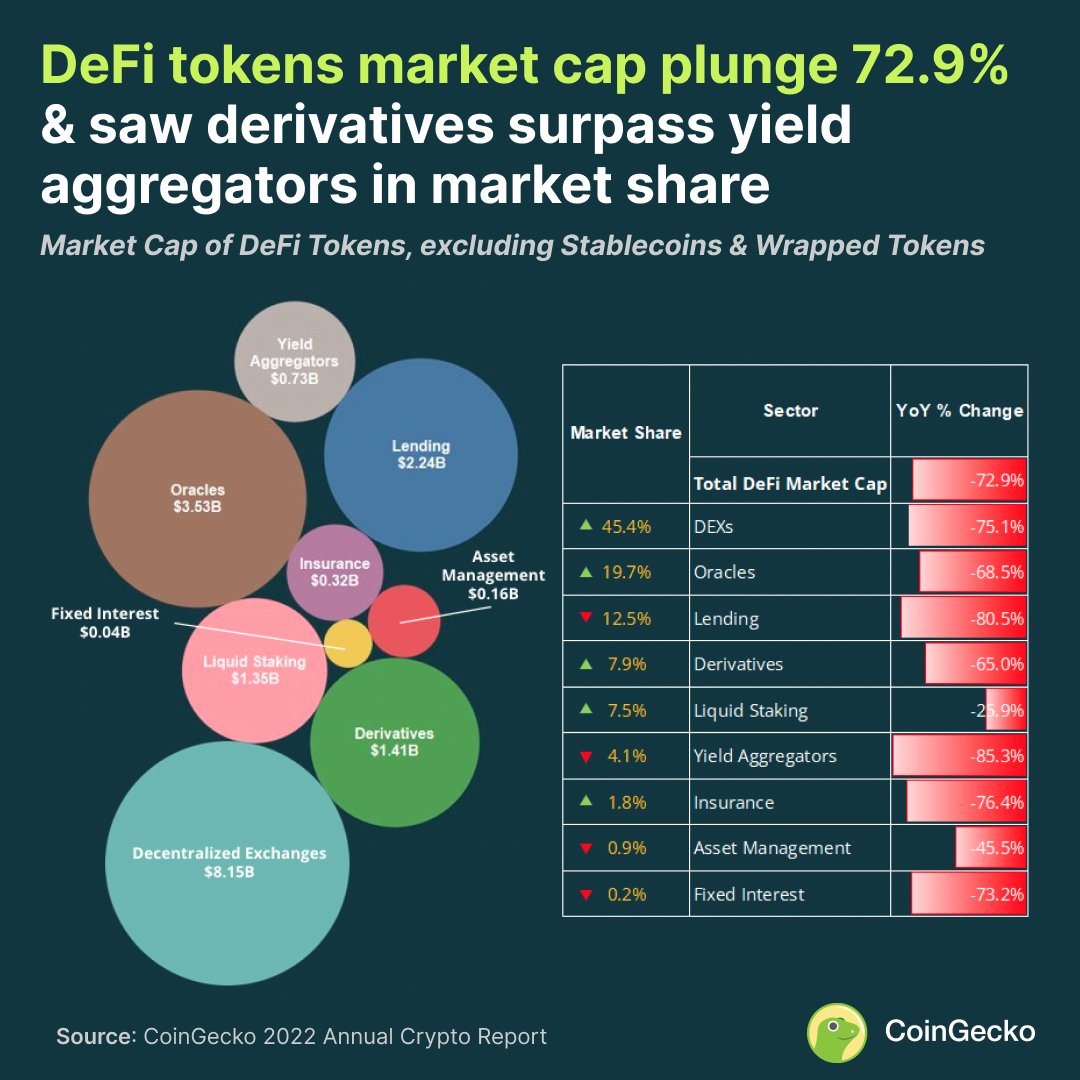

6) #DeFi sector still reeling from major setbacks ❌

• The market cap of DeFi tokens plummeted by 72.9% YoY to $17.9B.

• Lending protocols and yield aggregators were the worst-performing verticals for the year, due to inflated valuations and capital withdrawals.

• The market cap of DeFi tokens plummeted by 72.9% YoY to $17.9B.

• Lending protocols and yield aggregators were the worst-performing verticals for the year, due to inflated valuations and capital withdrawals.

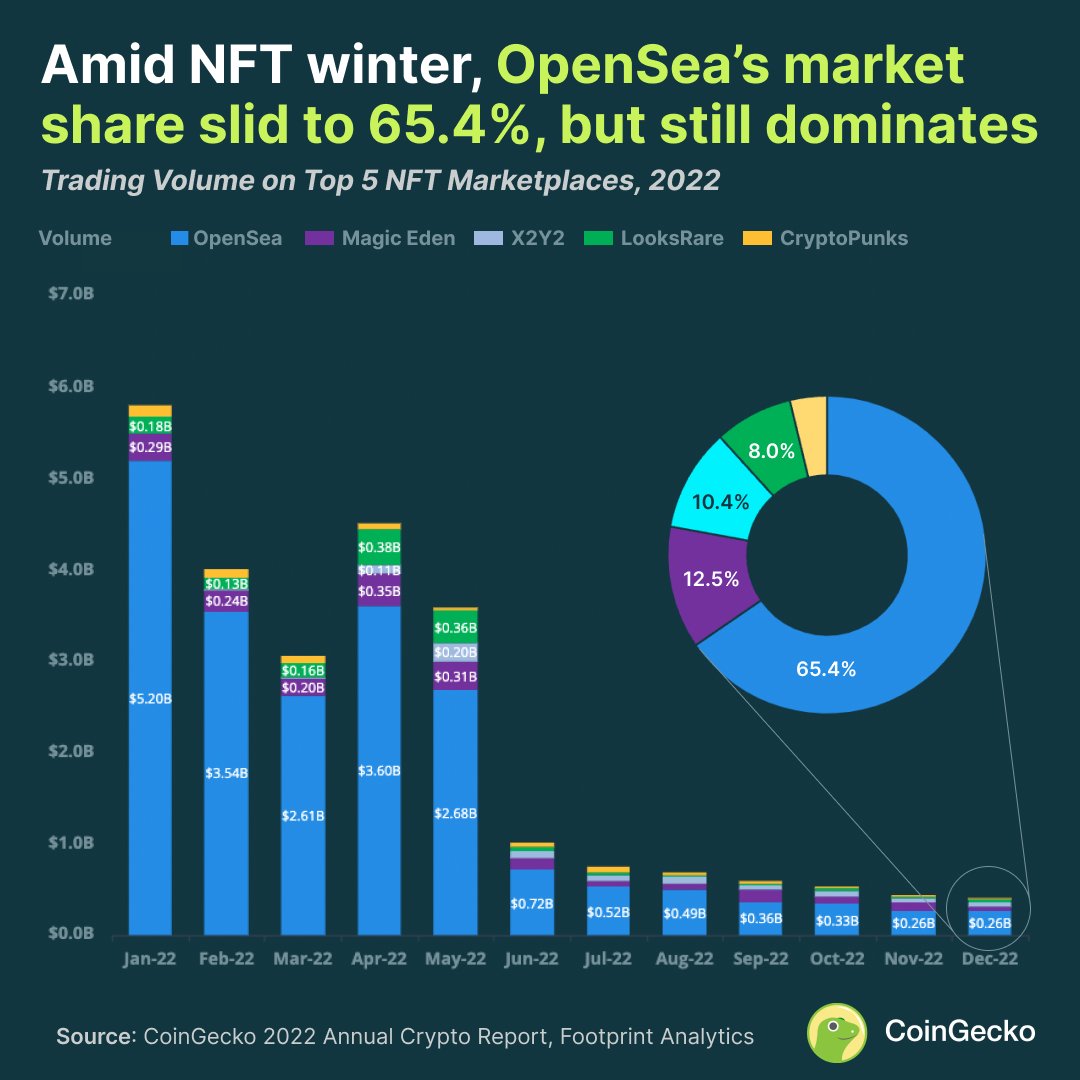

7) @opensea defends leading position amid NFT winter ❄️

• Top 5 NFT marketplaces’ trading volume plunged by 93.1% from $13.3B in Q1 to $1.5B in Q4.

• Despite the rise of #SolanaNFTs on @MagicEden, OpenSea dominates with a market share of 65.4%.

• Top 5 NFT marketplaces’ trading volume plunged by 93.1% from $13.3B in Q1 to $1.5B in Q4.

• Despite the rise of #SolanaNFTs on @MagicEden, OpenSea dominates with a market share of 65.4%.

8) Spot trading declined to all-year lows in December 😰

• Spot trading volume on the top 10 exchanges sank 67.3% to an all-year low of $0.46T in Dec 2022.

• Despite #FTX’s collapse highlighting centralization risks, the CEX to DEX trading ratio remained relatively unchanged.

• Spot trading volume on the top 10 exchanges sank 67.3% to an all-year low of $0.46T in Dec 2022.

• Despite #FTX’s collapse highlighting centralization risks, the CEX to DEX trading ratio remained relatively unchanged.

That's all we're spilling for now, Geckos! Check out the full report by tapping on the link below ⬇️

A big shoutout to @1inch for sponsoring our 2022 Annual Crypto Report! #1inch is a DEX aggregator that aims to provide the best crypto prices for traders.

gcko.io/9sunbzk

A big shoutout to @1inch for sponsoring our 2022 Annual Crypto Report! #1inch is a DEX aggregator that aims to provide the best crypto prices for traders.

gcko.io/9sunbzk

• • •

Missing some Tweet in this thread? You can try to

force a refresh