1/n Why should you #ElectricityBill witness 30% #Inflation ?. Per Media reports, Private power utilities seek up to 30% hike in tariff in Mumbai/ Here are the details.

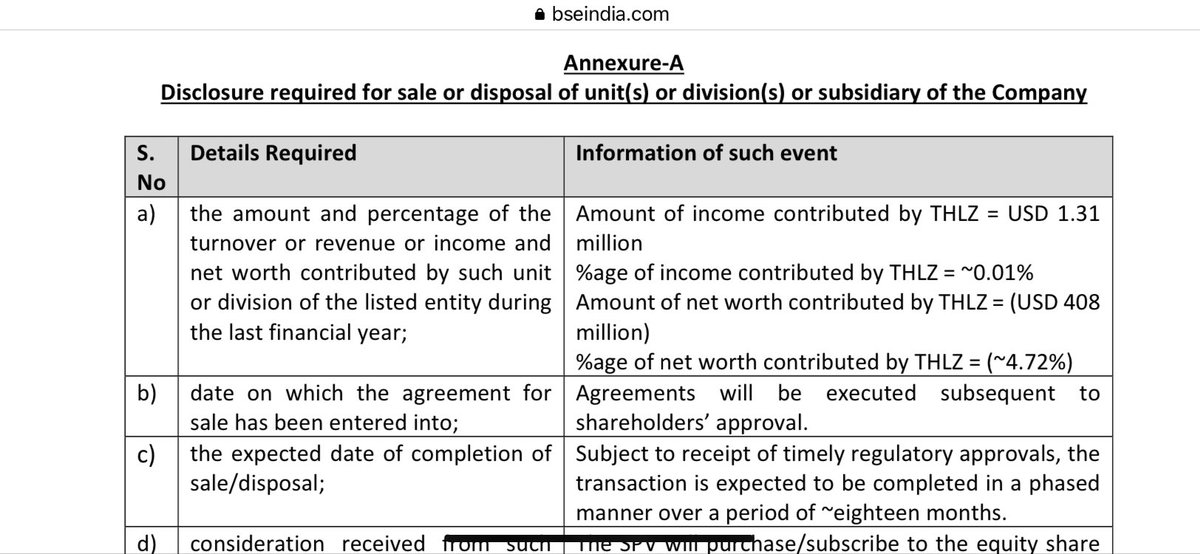

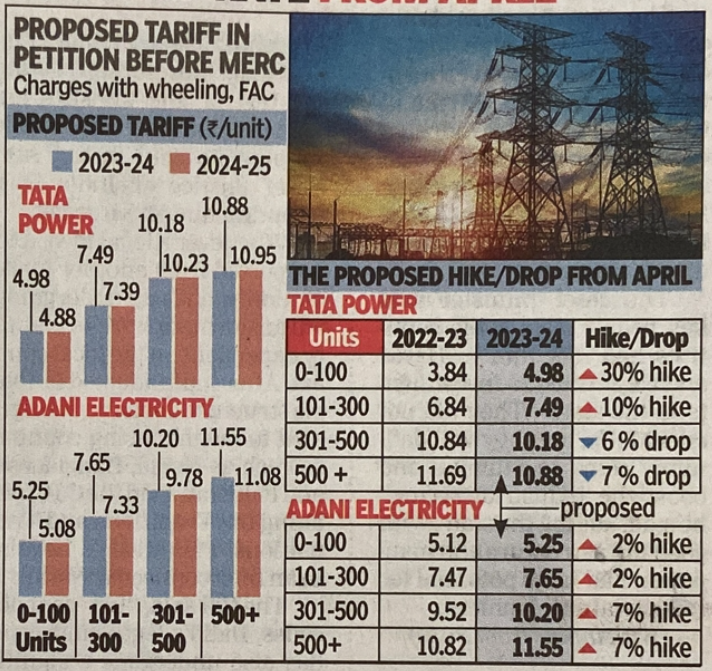

2/n In Short @Adani Electricity has proposed a 2-7% hike in tariffs (more expensive vs Tata Power to start with) across consumption buckets and Tata Power 10-30% hike for low-end consumers and 6-7% drop for high-end customers in petitions filed before Maharashtra Regulator MERC

3/n "The proposed hike of 30% for consumers living in slums and chawls in 0-100 units category may sound alarming. .this is rationalization of tariff. Our tariff was very low in this category and over Rs1/unit less than the rival (Adani)" @TataPower

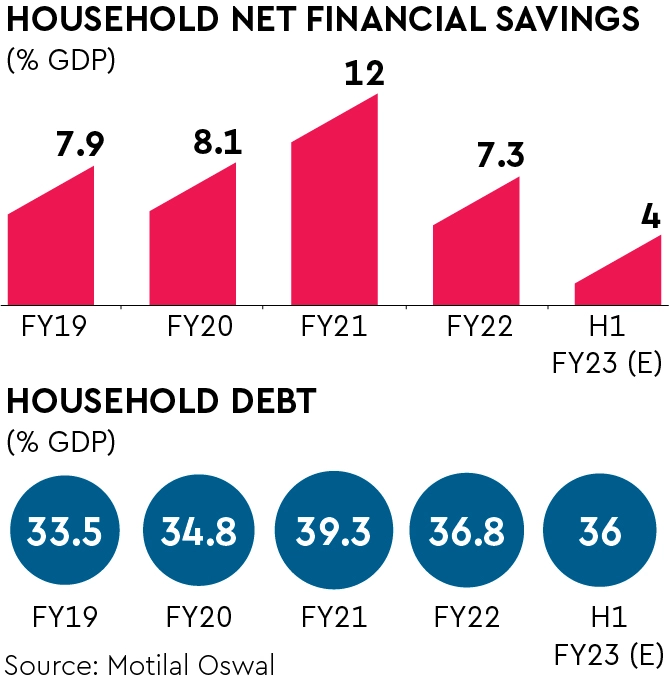

4/ BUT the most important Question, is WHY is our POWER BILL INFLATING. Most of (85%+) Indian Power comes from Thermal and Hydro even though they make up only 60% of the Capacity. COAL INDIA supplies Subsidized COAL whose price has increased by JUST 2% since 2018 #JUST2PERCENT

The Central Power Regulator discloses 3 bits of information. (1) Methodology for Compilation of Coal Price Index applicable for Power Sector (2) Coal India Limited Price Notifications (3) Coal Price Index applicable for Power Sector. LINK TO THIS: cercind.gov.in/coal_price.html

As you can see that since 2016, the Price of Thermal Coal Supplied by Coal India to the POWER SECTOR has barely increased. Coal India supplies 80% of Indias Coal Requirement. It can potentially supply 90% if allowed IMHO

SO WHY ARE MY ELECTRICITY BILLS GOING UP Year After Year ?

SO WHY ARE MY ELECTRICITY BILLS GOING UP Year After Year ?

If you liked this TWEET, pls #RETWEET and make the govt Accountable

https://twitter.com/TheFactFindr/status/1617531650992398341

• • •

Missing some Tweet in this thread? You can try to

force a refresh