The LSD narrative hasn't faded even with new trends popping up in the crypto world.

This 🧵 will cover $LDO $FXS $RPL $ANKR $FIS $BNC $PSTAKE and these projects' performance in the liquid staking sector.

Are you ready for an interesting month for @ethereum?

This 🧵 will cover $LDO $FXS $RPL $ANKR $FIS $BNC $PSTAKE and these projects' performance in the liquid staking sector.

Are you ready for an interesting month for @ethereum?

1/ We'll talk about:

🔹 The current state of LS space

🔹 $LDO

🔹 $SWISE

🔹 $FXS

🔹 $RPL

🔹 $ANKR

🔹 $FIS

🔹 $BNC

🔹 $PSTAKE

🔹 Which LSD token has the strongest correlation to $ETH price?

🔹 Are stakers in profit?

🔹 The current state of LS space

🔹 $LDO

🔹 $SWISE

🔹 $FXS

🔹 $RPL

🔹 $ANKR

🔹 $FIS

🔹 $BNC

🔹 $PSTAKE

🔹 Which LSD token has the strongest correlation to $ETH price?

🔹 Are stakers in profit?

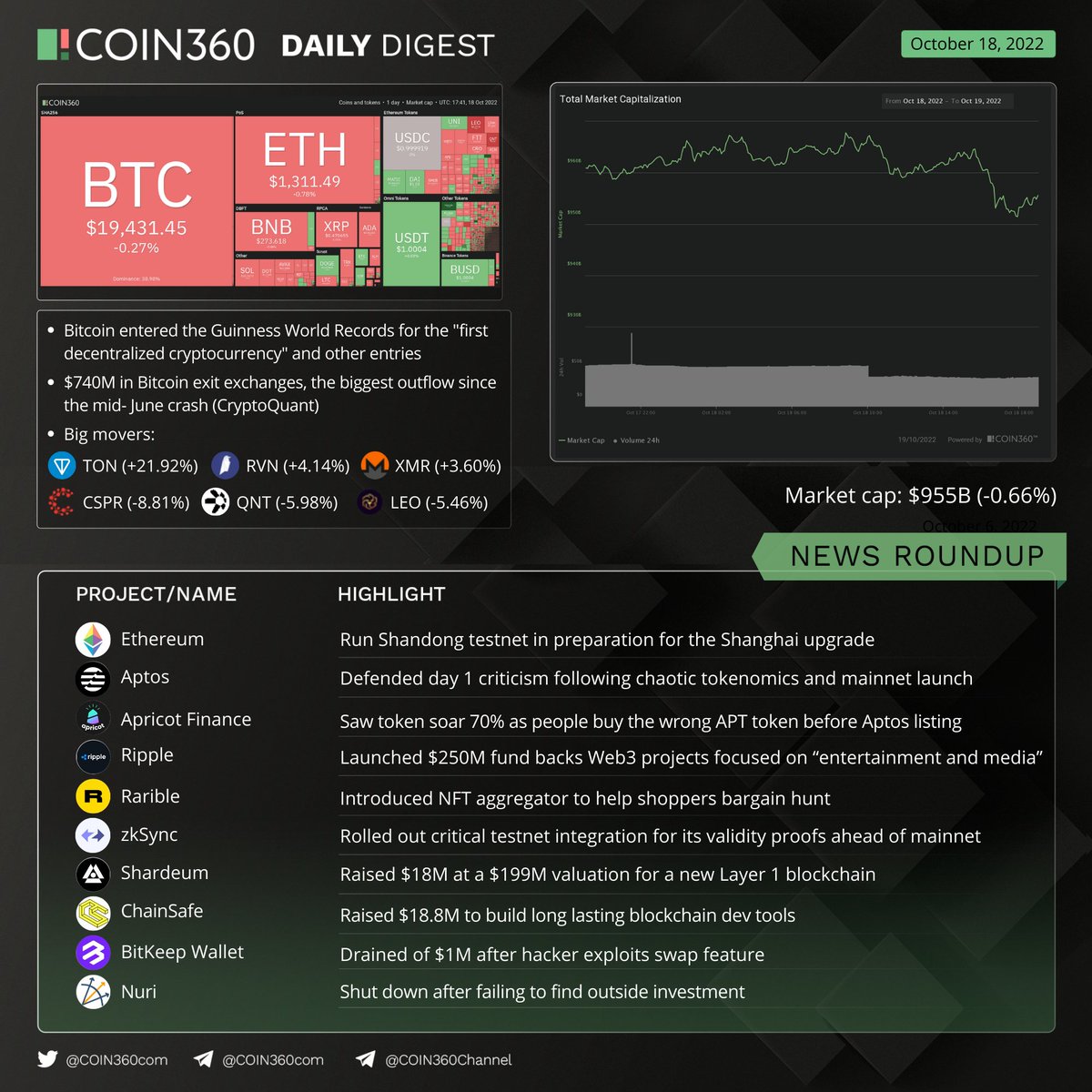

2/ 🔹 The current state of LS space:

• 16,495,303 $ETH deposited (>$27B at current price)

• 515,478 validators

• 95,954 depositors

• 13.69% of $ETH supply staked

• >69K $ETH inflow on Jan. 23 (@ethereum devs finalized first shadow fork for Shanghai)

• 16,495,303 $ETH deposited (>$27B at current price)

• 515,478 validators

• 95,954 depositors

• 13.69% of $ETH supply staked

• >69K $ETH inflow on Jan. 23 (@ethereum devs finalized first shadow fork for Shanghai)

3/ 🔹 @LidoFinance $LDO:

• #1 entity by market share: 29.24%

• 4,822,496 $ETH staked

• 150,703 validators

• TVL +36.92% in 30D, +5.31% in 7D (#1 on @DefiLlama)

• Amount of $ETH staked = 2.3x stakefish (6M), 4.2x RocketPool (1M), 2.9x Kraken (1W)

• #1 entity by market share: 29.24%

• 4,822,496 $ETH staked

• 150,703 validators

• TVL +36.92% in 30D, +5.31% in 7D (#1 on @DefiLlama)

• Amount of $ETH staked = 2.3x stakefish (6M), 4.2x RocketPool (1M), 2.9x Kraken (1W)

4/ -> strong dominance

• 4.9% APR

• $stETH holders: 156,872 (+3.5% in 15D)

• Jan 2023 revenue: $3.34M

• $LDO: +84.58% in 30D, -4.24% in 7D, -4.30% in 24H

• $LDO holders: 27,897 (+6.1% in 30D)

• 54.5% of holders making money

• 4.9% APR

• $stETH holders: 156,872 (+3.5% in 15D)

• Jan 2023 revenue: $3.34M

• $LDO: +84.58% in 30D, -4.24% in 7D, -4.30% in 24H

• $LDO holders: 27,897 (+6.1% in 30D)

• 54.5% of holders making money

5/ 🔹 @stakewise_io $SWISE:

• #14 entity by market share: 0.44%

• 72,704 $ETH staked

• 2,272 validators

• TVL +34.68% in 30D, +4.64% in 7D (#5 on @DefiLlama)

• #15 project by amount of $ETH staked in the past 6M (1.4% of Lido), #11 in 1M, #10 in 1W (0.5% of Lido)

• #14 entity by market share: 0.44%

• 72,704 $ETH staked

• 2,272 validators

• TVL +34.68% in 30D, +4.64% in 7D (#5 on @DefiLlama)

• #15 project by amount of $ETH staked in the past 6M (1.4% of Lido), #11 in 1M, #10 in 1W (0.5% of Lido)

6/

• 5.53% APR

• $sETH2 holders: 4,497 (+1.8% in 30D)

• $SWISE: +33.63% in 30D, -1.95% in 7D, -4.89% in 24H

• $SWISE holders: 2,447 (+15.8 in 30D)

• 37.4% of holders making money

• 5.53% APR

• $sETH2 holders: 4,497 (+1.8% in 30D)

• $SWISE: +33.63% in 30D, -1.95% in 7D, -4.89% in 24H

• $SWISE holders: 2,447 (+15.8 in 30D)

• 37.4% of holders making money

7/ 🔹 @fraxfinance $FXS:

• #13 entity by market share: 0.49%

• 80,736 $ETH staked

• 2,523 validators

• TVL +126% in 30D, +13.46% in 7D (#4 on @DefiLlama)

• #3 project by amount of $ETH staked in past 1M (18% of Lido) & #5 in 1W

• 7.6% APR $sfrxETH, 8.28% APR $frxETH/$ETH

• #13 entity by market share: 0.49%

• 80,736 $ETH staked

• 2,523 validators

• TVL +126% in 30D, +13.46% in 7D (#4 on @DefiLlama)

• #3 project by amount of $ETH staked in past 1M (18% of Lido) & #5 in 1W

• 7.6% APR $sfrxETH, 8.28% APR $frxETH/$ETH

8/

• $frxETH holders: 334 (+76.7% in 30D)

• $sfrxETH holders: 954 (+78.6% in 30D)

• 14.59 $ETH in frxETH balance sheet as of Feb. 3

• $FXS: +118.48% in 30D, +3.56% in 7D, -5.23% in 24H

• $FXS holders: 12,047 (+8.5% in 30D)

• 58.1% of holders making money

• $frxETH holders: 334 (+76.7% in 30D)

• $sfrxETH holders: 954 (+78.6% in 30D)

• 14.59 $ETH in frxETH balance sheet as of Feb. 3

• $FXS: +118.48% in 30D, +3.56% in 7D, -5.23% in 24H

• $FXS holders: 12,047 (+8.5% in 30D)

• 58.1% of holders making money

9/ 🔹 @Rocket_Pool $RPL:

• #9 entity by market share: 2.29%

• 378,720 $ETH staked

• 11,803 validators

• TVL +58.14% in 30D, +7.21% in 7D (#3 on @DefiLlama)

• #4 project by amount of $ETH staked in the past 6M (25% of Lido), #2 in 1M (23% of Lido), #4 in 1W (17% of Lido)

• #9 entity by market share: 2.29%

• 378,720 $ETH staked

• 11,803 validators

• TVL +58.14% in 30D, +7.21% in 7D (#3 on @DefiLlama)

• #4 project by amount of $ETH staked in the past 6M (25% of Lido), #2 in 1M (23% of Lido), #4 in 1W (17% of Lido)

10/

• 4.5 to 7.8%+ APR

• $RETH holders: 9,541 (+8.6% in 30D)

• $RPL: +96.80% in 30D, +6.29% in 7D, -0.53% in 24H

• $RPL holders: 5,930 (+26% in 30D)

• 79.3% of holders making money

• 4.5 to 7.8%+ APR

• $RETH holders: 9,541 (+8.6% in 30D)

• $RPL: +96.80% in 30D, +6.29% in 7D, -0.53% in 24H

• $RPL holders: 5,930 (+26% in 30D)

• 79.3% of holders making money

11/ 🔹 @ankr $ANKR

• #17 entity by market share: 0.34%

• 56,448 $ETH staked

• 1,764 validators

• TVL +31.82% in 30D, +4.35% in 7D (#7 on @DefiLlama)

• #18 project by amount of $ETH staked in the past 6M (0.09% of Lido), #17 in 1M (0.02% of Lido)

• #17 entity by market share: 0.34%

• 56,448 $ETH staked

• 1,764 validators

• TVL +31.82% in 30D, +4.35% in 7D (#7 on @DefiLlama)

• #18 project by amount of $ETH staked in the past 6M (0.09% of Lido), #17 in 1M (0.02% of Lido)

12/

• 4.08% APY

• $ankrETH holders: 2,131 (+1% in 2W)

• $ANKR: +76.31% in 30D, +0.01% in 7D, -1.79% in 24H

• $ANKR holders: 39,585 (-14% in 30D)

• 32.4% of holders making money

• 4.08% APY

• $ankrETH holders: 2,131 (+1% in 2W)

• $ANKR: +76.31% in 30D, +0.01% in 7D, -1.79% in 24H

• $ANKR holders: 39,585 (-14% in 30D)

• 32.4% of holders making money

13/ 🔹 @StaFi_Protocol $FIS:

• N/A entity by market share, but it could rank #25 if tracked

• 17,911 $ETH staked

• 541 validators

• TVL +52.12% in 30D, +4% in 7D

• 3.6% APR (stakers), 5.23% APR (validators)

• N/A entity by market share, but it could rank #25 if tracked

• 17,911 $ETH staked

• 541 validators

• TVL +52.12% in 30D, +4% in 7D

• 3.6% APR (stakers), 5.23% APR (validators)

14/

• $rETH holders: 393

• $FIS: +49.12% in 30D, -7.61% in 7D, -5.53% in 24H

• $FIS holders: 2,127 (+1.1% in 15D)

• 28.1% of holders making money

• $rETH holders: 393

• $FIS: +49.12% in 30D, -7.61% in 7D, -5.53% in 24H

• $FIS holders: 2,127 (+1.1% in 15D)

• 28.1% of holders making money

15/ 🔹 @BifrostFinance $BNC:

• N/A entity by market share, but it could rank #26 if tracked

• 17,682 $ETH staked

• N/A validators

• TVL +6% since Jan 16, +1.4% in 7D

• 8.09% APY

• $vETH holders: 906

• $BNC: +215.8% in 30D, -20.3% in 7D, -8.8% in 24H

• $BNC holders: 3,447

• N/A entity by market share, but it could rank #26 if tracked

• 17,682 $ETH staked

• N/A validators

• TVL +6% since Jan 16, +1.4% in 7D

• 8.09% APY

• $vETH holders: 906

• $BNC: +215.8% in 30D, -20.3% in 7D, -8.8% in 24H

• $BNC holders: 3,447

16/ 🔹 @pStakeFinance $PSTAKE:

• N/A entity by market share, but it could rank #43 if tracked

• 54.11 $ETH staked

• N/A validators

• TVL +18% in 30D, +3.3% in 7D

• 4.05% APR

• $stkETH holders: 57

• N/A entity by market share, but it could rank #43 if tracked

• 54.11 $ETH staked

• N/A validators

• TVL +18% in 30D, +3.3% in 7D

• 4.05% APR

• $stkETH holders: 57

17/

• $PSTAKE: +81.27% in 30D, +10.43% in 7D, +7.82% in 24H

• $PSTAKE holders: 16,864 (-14.6% in 30D)

• 5.6% of holders making money

• $PSTAKE: +81.27% in 30D, +10.43% in 7D, +7.82% in 24H

• $PSTAKE holders: 16,864 (-14.6% in 30D)

• 5.6% of holders making money

18/ 🔹 Which LSD token has the strongest correlation to $ETH price?

Ranking by overall volatility:

#SETH2 > $stETH > $rETH > #ankrETH > $RETH > #CRETH2

CRETH2 is @CreamdotFinance's token, but it isn't mentioned here.

Ranking by overall volatility:

#SETH2 > $stETH > $rETH > #ankrETH > $RETH > #CRETH2

CRETH2 is @CreamdotFinance's token, but it isn't mentioned here.

19/ 🔹 Are stakers in profit?

As per the charts below, the majority of stakers are under the water.

In terms of $ETH, only 38.9% of them are in profit.

In terms of dollars, the number is reduced to 19.6%.

Will there be selling pressure when #Ethereum allows withdrawals? Hm...

As per the charts below, the majority of stakers are under the water.

In terms of $ETH, only 38.9% of them are in profit.

In terms of dollars, the number is reduced to 19.6%.

Will there be selling pressure when #Ethereum allows withdrawals? Hm...

20/ Some takes:

- Strongest dominance: @LidoFinance

- Fastest growing: @fraxfinance

- Juicy yields: @fraxfinance or @BifrostFinance

- Biggest gainer (30D): $BNC

- Biggest % holders in profit: $RPL

- Biggest number of holders: $ANKR

- LS token w/ the most use cases: $stETH

- Strongest dominance: @LidoFinance

- Fastest growing: @fraxfinance

- Juicy yields: @fraxfinance or @BifrostFinance

- Biggest gainer (30D): $BNC

- Biggest % holders in profit: $RPL

- Biggest number of holders: $ANKR

- LS token w/ the most use cases: $stETH

21/ 🔹 Don't wanna miss the move of prominent LSD platforms?

The most effective way is to keep track of their development through data. We have some resources for you:

• @DuneAnalytics:

・General:

@hildobby_: dune.com/hildobby/eth2-…

dune.com/ratedw3b/Eth2-…

The most effective way is to keep track of their development through data. We have some resources for you:

• @DuneAnalytics:

・General:

@hildobby_: dune.com/hildobby/eth2-…

dune.com/ratedw3b/Eth2-…

22/

・Lido:

@k06a: dune.com/k06a/lido-fina…

@LidoFinance: dune.com/lido/lido-dash…

・Frax:

facts.frax.finance/frxeth/balance…

@DefiMochi: dune.com/defimochi/frxe…

@struct3r: dune.com/struct3r/frax-…

@CulStory: dune.com/seba/Frax

@0xOuija: dune.com/0xouija/0xOuija

・Lido:

@k06a: dune.com/k06a/lido-fina…

@LidoFinance: dune.com/lido/lido-dash…

・Frax:

facts.frax.finance/frxeth/balance…

@DefiMochi: dune.com/defimochi/frxe…

@struct3r: dune.com/struct3r/frax-…

@CulStory: dune.com/seba/Frax

@0xOuija: dune.com/0xouija/0xOuija

23/

・Bifrost:

bifrost-finance.medium.com/eth-shanghai-u…

・RocketPool:

dune.com/KIV/Rocketpool

@Luismjohnston: dune.com/luismjohnston

@NickDGarcia: dune.com/NDGcrypto/Rock…

・Ankr:

dune.com/ankr/ankr-liqu…

・pStake:

dune.com/shini/pStake-F…

・Bifrost:

bifrost-finance.medium.com/eth-shanghai-u…

・RocketPool:

dune.com/KIV/Rocketpool

@Luismjohnston: dune.com/luismjohnston

@NickDGarcia: dune.com/NDGcrypto/Rock…

・Ankr:

dune.com/ankr/ankr-liqu…

・pStake:

dune.com/shini/pStake-F…

24/ And more valuable data from: @DefiLlama @dexguru @ScopeProtocol alongside @COIN360com!

A big thank you to all the people/team that provided data for this thread 👏

A big thank you to all the people/team that provided data for this thread 👏

25/ Want to have an eye on these tokens? Add them to your watchlist on Coin360 👇

coin360.com/coin/lido-dao-…

coin360.com/coin/frax-shar…

coin360.com/coin/rocket-po…

coin360.com/coin/ankr-ankr

coin360.com/coin/stafi-fis

coin360.com/coin/bifrost-b…

coin360.com/coin/pstake-fi…

coin360.com/coin/lido-dao-…

coin360.com/coin/frax-shar…

coin360.com/coin/rocket-po…

coin360.com/coin/ankr-ankr

coin360.com/coin/stafi-fis

coin360.com/coin/bifrost-b…

coin360.com/coin/pstake-fi…

26/ Tagging some #DeFi leaders for visibility:

@thedefiedge

@milesdeutscher

@ThorHartvigsen

@Crypto_McKenna

@0xKofi

@DefiIgnas

@rektdiomedes

@JackNiewold

@OnChainWizard

@Dynamo_Patrick

@blocmatesdotcom

@TaikiMaeda2

@Route2FI

If you want to learn more about DeFi, follow them!

@thedefiedge

@milesdeutscher

@ThorHartvigsen

@Crypto_McKenna

@0xKofi

@DefiIgnas

@rektdiomedes

@JackNiewold

@OnChainWizard

@Dynamo_Patrick

@blocmatesdotcom

@TaikiMaeda2

@Route2FI

If you want to learn more about DeFi, follow them!

27/ That's a wrap!

If you enjoyed this thread:

1. Follow us @COIN360com for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow us @COIN360com for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/COIN360com/status/1621465291057205248?s=20&t=FJC3H3kKPMWWTc9J-yd96A

Small correction - I ranked these tokens in the following order: least volatility -> most volatility.

Sorry for the unclear wording 🙏

Sorry for the unclear wording 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh