UK business activity surged back into life in February, according to the flash PMI, displaying renewed growth after six months of decline. The composite PMI rose from 48.5 to 53.0, registering the strongest expansion since last June and smashing expectations of a reading of 49.2

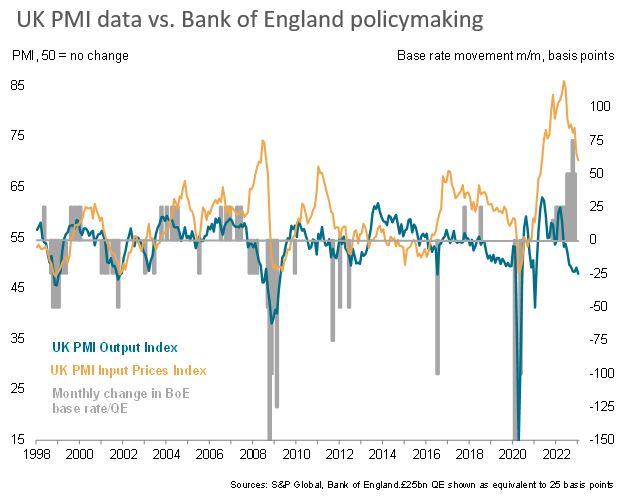

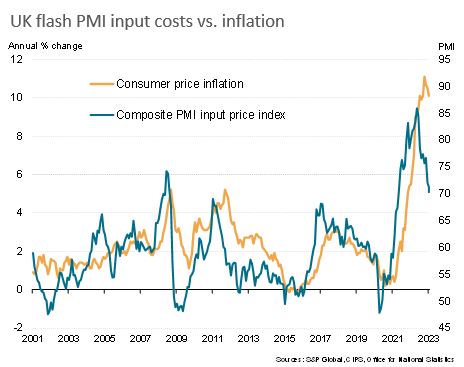

UK PMI input cost gauges also fell further, but only slightly to remain elevated. So #CPI #inflation should continue to moderate, but the Bank of England's 2% target still seems a long way off

Here's the latest UK PMI data on output and prices charted against Bank of England #MPC policy decisions. Hard to see them taking a pause from tightening policy in March!

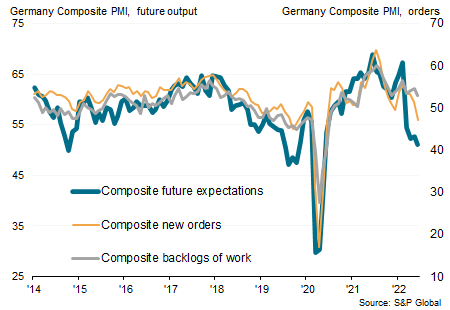

They key area of concern to UK policymakers is the stickiness of #inflation in the service sector, charted here form the latest February flash PMIs

• • •

Missing some Tweet in this thread? You can try to

force a refresh