🧵1/Ω

Now that #JosephDePaolo has suddenly resigned as CEO of $SBNY under a cloud of money laundering/fraud related smoke (he banked #Binance under a nonexistent Seychelles company which is illegal) here's a recording of an earnings call where he claims to not know who FTX is.

Now that #JosephDePaolo has suddenly resigned as CEO of $SBNY under a cloud of money laundering/fraud related smoke (he banked #Binance under a nonexistent Seychelles company which is illegal) here's a recording of an earnings call where he claims to not know who FTX is.

🧵2/Ω

In the aftermath of the #FTXplosion DePaolo, one of two CEOs of "crypto friendly" banks in the United States, would like you to believe that he has no idea what this "#FTX" thing is.

SBF was easily the most famous dude in finance at that moment and a CUSTOMER AT HIS BANK

In the aftermath of the #FTXplosion DePaolo, one of two CEOs of "crypto friendly" banks in the United States, would like you to believe that he has no idea what this "#FTX" thing is.

SBF was easily the most famous dude in finance at that moment and a CUSTOMER AT HIS BANK

🧵3/Ω

Maybe he really was that clueless. Would explain how so much #Binance money got laundered through his bank and how $SBNY ended up being #Tether's banker.

Maybe he really was that clueless. Would explain how so much #Binance money got laundered through his bank and how $SBNY ended up being #Tether's banker.

https://twitter.com/ExkrementKoin/status/1624622168985198595

🧵4/Ω

In interviews with #AlanLane, criminal mastermind behind $SI, the other "crypto friendly" bank, strongly implies that $USDC / @Circle's cash reserves are held at $SBNY as well as other stable coins.

Deposits are already collapsing.

When more go...

vidarresearch.substack.com/p/sbny-q422-re…

In interviews with #AlanLane, criminal mastermind behind $SI, the other "crypto friendly" bank, strongly implies that $USDC / @Circle's cash reserves are held at $SBNY as well as other stable coins.

Deposits are already collapsing.

When more go...

vidarresearch.substack.com/p/sbny-q422-re…

🧵5/Ω

The "analyst" quoted in @CoinDesk saying the sudden departure of DePaolo from $SBNY is no biggie is a joke. I've heard the earnings calls. Not one "analyst" ever asked SBNY about #Binance or money laundering.

& no one has ever mentioned succession

The "analyst" quoted in @CoinDesk saying the sudden departure of DePaolo from $SBNY is no biggie is a joke. I've heard the earnings calls. Not one "analyst" ever asked SBNY about #Binance or money laundering.

& no one has ever mentioned succession

https://twitter.com/Cryptadamist/status/1626442893140406274

🧵6/Ω

Funny because $SBNY made it pretty clear in their SEC filings that "the ability to engage in txns across multiple jurisdictions, and the anonymous nature of the transactions, can make digital assets vulnerable to fraud, money laundering, tax evasion and cybersecurity risks"

Funny because $SBNY made it pretty clear in their SEC filings that "the ability to engage in txns across multiple jurisdictions, and the anonymous nature of the transactions, can make digital assets vulnerable to fraud, money laundering, tax evasion and cybersecurity risks"

🧵7/Ω

(If you keep reading you will see $SBNY acknowledge the Fed never actually said they could do what they were doing with digital assets)

(If you keep reading you will see $SBNY acknowledge the Fed never actually said they could do what they were doing with digital assets)

🧵8/Ω

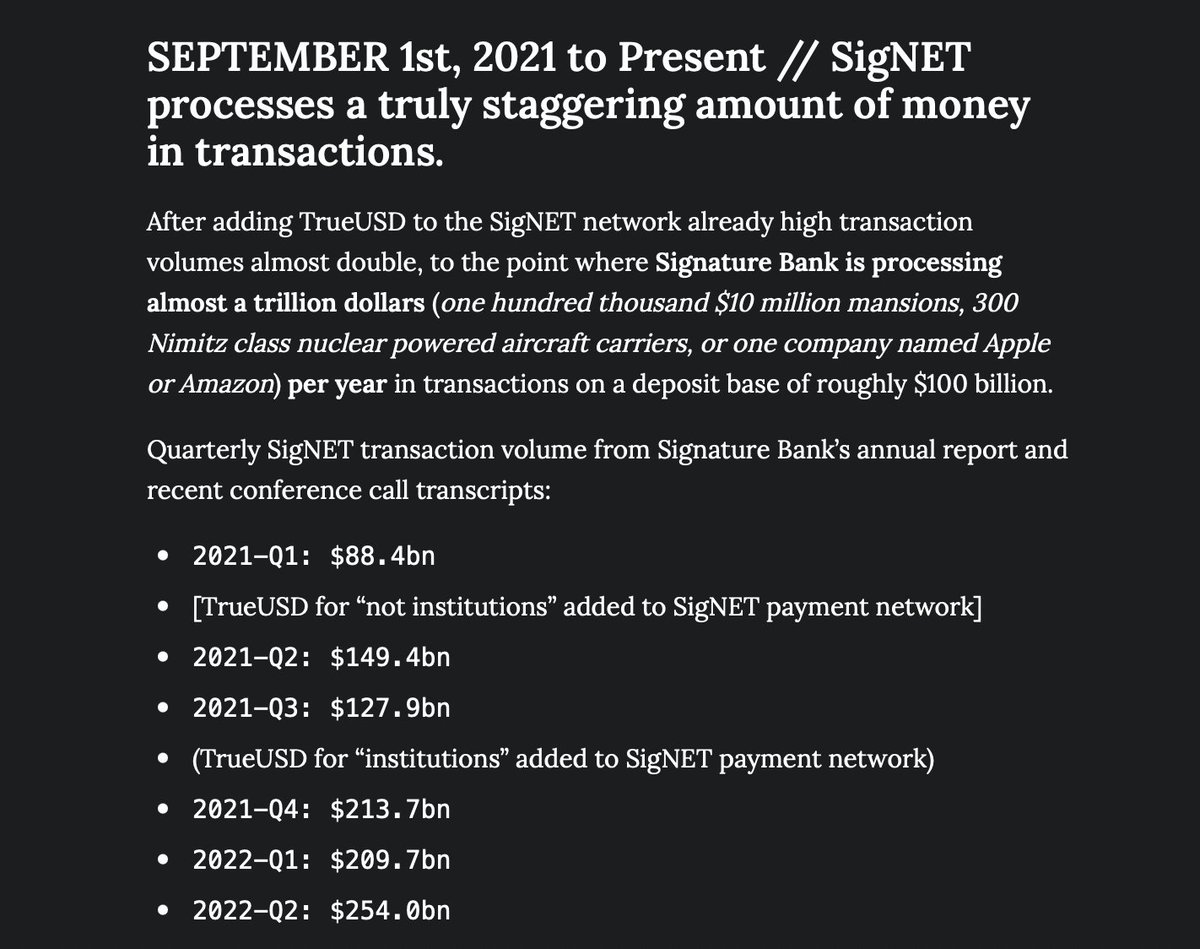

$SBNY's "SigNET" system currently moves $1 TRILLION PER YEAR in an entirely unapproved way.

I and others strongly suspect that $SBNY is going to be outed as the biggest money laundering hub in the American banking system.

Ever.

$SBNY's "SigNET" system currently moves $1 TRILLION PER YEAR in an entirely unapproved way.

I and others strongly suspect that $SBNY is going to be outed as the biggest money laundering hub in the American banking system.

Ever.

🧵9/Ω

Here's an article I published back in November detailing more of the connections between $SBNY, #Binance, #FTX, #SBF, the notorious scammer #JustinSun, and all kinds of other crooks.

cryptadamus.substack.com/p/signature-ba…

Here's an article I published back in November detailing more of the connections between $SBNY, #Binance, #FTX, #SBF, the notorious scammer #JustinSun, and all kinds of other crooks.

cryptadamus.substack.com/p/signature-ba…

🧵10/Ω

It's worth pointing out that unlike $SI, $SBNY was a functioning bank of some size pre-crypto. What was their main business? Commercial real estate.

GL!

It's worth pointing out that unlike $SI, $SBNY was a functioning bank of some size pre-crypto. What was their main business? Commercial real estate.

GL!

https://twitter.com/TwainsMustache/status/1628100452435755023

🧵11/Ω

Worth adding that when #JosephDePaolo has no idea who this #FTX company was despite it being literally the most famous company in all of finance at that moment in late November, this is how many bank accounts #SBF had at $SBNY.

Worth adding that when #JosephDePaolo has no idea who this #FTX company was despite it being literally the most famous company in all of finance at that moment in late November, this is how many bank accounts #SBF had at $SBNY.

🧵12/Ω

BTW on the last earnings call $SBNY claimed that #FTX had not actually integrated with them. Which is odd, because:

BTW on the last earnings call $SBNY claimed that #FTX had not actually integrated with them. Which is odd, because:

https://twitter.com/FTX_Official/status/1444715450256932865

🧵13/Ω

I have to wonder if the reason $SBNY's executives are saying "#FTX never integrated with #SigNET (SBNY's shady probably illegal payment network)" is because it was technically only #AlamedaResearch who had a #SigNET account...

Remember who these SBNY bros are anon.

I have to wonder if the reason $SBNY's executives are saying "#FTX never integrated with #SigNET (SBNY's shady probably illegal payment network)" is because it was technically only #AlamedaResearch who had a #SigNET account...

Remember who these SBNY bros are anon.

• • •

Missing some Tweet in this thread? You can try to

force a refresh