Looks like @coinbase just partnered up with @optimismFND in the L2 arms race! Let's take a glance at the current most important person in the room: @buildonbase!

1/🧵

1/🧵

2/🧵 Why is it a big deal? Some bullet points:

→ Coinbase is the biggest American exchange, and they'll onboard their 110m+ users into #DeFi

→ It'll be their on-chain base of operations

→ They'll build a bridge from Base to most L1s, L2s, and non-EVMs like #BTC and #SOL

→ Coinbase is the biggest American exchange, and they'll onboard their 110m+ users into #DeFi

→ It'll be their on-chain base of operations

→ They'll build a bridge from Base to most L1s, L2s, and non-EVMs like #BTC and #SOL

3/🧵 @coinbase and @optimismFND first worked together helping develop #EIP4844, an update that will rise #ETH's TPS to 1,000, as a way to allow L2s to achieve exponential cost savings, making crypto affordable for mainstream users.

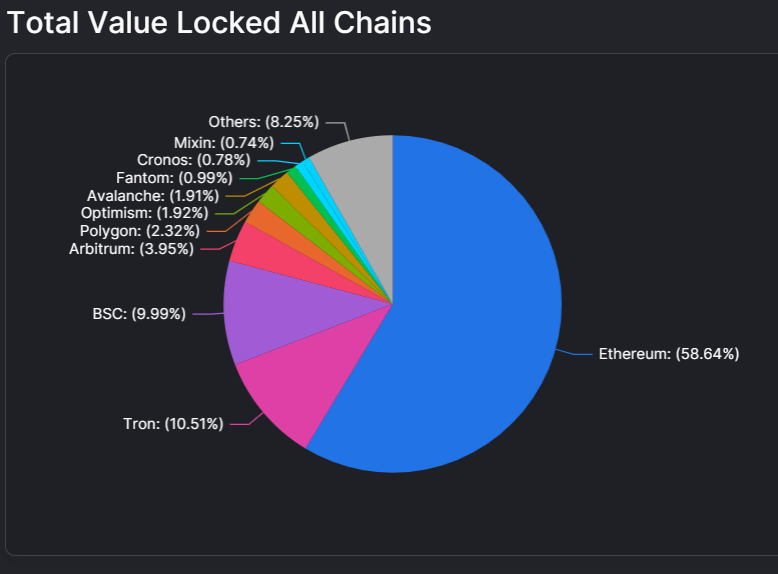

4/🧵 Base is the first project to build on top of Optimism's Superchain - a network of L2 chains seeking to make launching an L2 as trivial as creating an #ETH smart contract.

How? By sharing security, a communication layer, and an open-source tech stack with all L2s in it.

How? By sharing security, a communication layer, and an open-source tech stack with all L2s in it.

5/🧵 @buildonbase sees itself as a bridge, aiming to simplify the on-chain experience for new users and allow them access to products on other chains in the simplest way.

This means that users will have access to #Coinbase products and as many other chains as possible!

This means that users will have access to #Coinbase products and as many other chains as possible!

6/🧵 OP wants to build a chain to kill all chains, standardizing and allowing them to be interchangeable. Developers won't just be building apps for Base or Optimism, but for the #superchain as a whole. Talk about #interoperable!

7/🧵 As a consequence of that, a portion of Base transaction fees will go towards the Optimism Collective Treasury, which aims to keep building the #superchain bigger and integrating more L2s within it.

8/🧵 But is it bullish?

Big teams like @SushiSwap are already pledging support for the new chain. Looks like major DEXes already have their sights set on being the first ones to arrive on it. I'd be getting ready for a @buildonbase season soon!

Big teams like @SushiSwap are already pledging support for the new chain. Looks like major DEXes already have their sights set on being the first ones to arrive on it. I'd be getting ready for a @buildonbase season soon!

9/END🧵

All in all, it sounds like a positive thing for crypto: Raising interoperability, onboarding new users, and making #ETH better are always a green light for us!

Like and follow for more! We'll be cooking up something of our own... #SOON.

All in all, it sounds like a positive thing for crypto: Raising interoperability, onboarding new users, and making #ETH better are always a green light for us!

Like and follow for more! We'll be cooking up something of our own... #SOON.

• • •

Missing some Tweet in this thread? You can try to

force a refresh