The next big thing for #crypto? Interoperability. In order to truly connect the entire world, different blockchains need to be able to exchange data and assets.

In this thread, we'll take a look at how close we are to achieving it, and who is helping us to do so!

1/🧵

In this thread, we'll take a look at how close we are to achieving it, and who is helping us to do so!

1/🧵

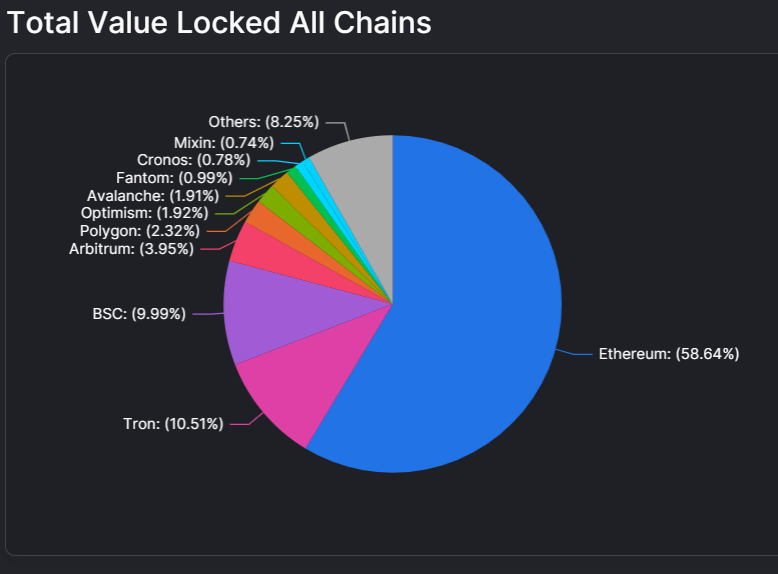

While there are dozens of Layer 1s solving a myriad of different issues, you can't use both simultaneously or easily. A #web2 equivalent of it would be having to use one browser to access Google Docs, and another one just to purchase something on Amazon!

2/🧵

2/🧵

The worst part is that in order to use different chains, you have to send your liquidity around with either:

a) On-chain bridges, which are relatively unsafe (look at how many exploits we've had last year!)

b) Using centralized exchanges and spending unnecessary fees.

3/🧵

a) On-chain bridges, which are relatively unsafe (look at how many exploits we've had last year!)

b) Using centralized exchanges and spending unnecessary fees.

3/🧵

Not only that, but protocols have to waste time trying to develop integrations for each chain, fragmenting their liquidity and spending time and effort all the while their users get less liquidity, more risk, and pay more fees.

4/🧵

4/🧵

While we're still far from perfect interoperability, there are quite a few promising solutions both here and on the horizon. Let's talk about a few of them:

• IBC

• Sidechains

• "Superchains"

• Herodotus

• Layer Zero

5/🧵

• IBC

• Sidechains

• "Superchains"

• Herodotus

• Layer Zero

5/🧵

- IBC

The Inter-blockchain communication protocol is built by @cosmos. It allows users to access all IBC chains, meaning you can stake, trade, and use protocols for many chains in one spot.

While big chains like #BNB are compatible with it, others, like #BTC/#ETH aren't.

6/🧵

The Inter-blockchain communication protocol is built by @cosmos. It allows users to access all IBC chains, meaning you can stake, trade, and use protocols for many chains in one spot.

While big chains like #BNB are compatible with it, others, like #BTC/#ETH aren't.

6/🧵

- Sidechains

First built on #ETH, sidechains are separate chains that are independent of their main chain, connected by a bridge.

Side chains are different than the main chain, and can have different consensus algorithms, as they're built for different reasons (cont.)

7/🧵

First built on #ETH, sidechains are separate chains that are independent of their main chain, connected by a bridge.

Side chains are different than the main chain, and can have different consensus algorithms, as they're built for different reasons (cont.)

7/🧵

such as having a higher TX throughput. However, they usually have trade-offs: they sacrifice some decentralization/ or security to achieve their goals.

8/🧵

8/🧵

- Superchains

By @optimismFND, the Superchain is reminiscent of IBC: It is a network of chains built on their L2 stack. Chains within it can freely transfer data from one another, but has the same disadvantage as #IBC: it's only interoperable between their own #L2 chains.

9/🧵

By @optimismFND, the Superchain is reminiscent of IBC: It is a network of chains built on their L2 stack. Chains within it can freely transfer data from one another, but has the same disadvantage as #IBC: it's only interoperable between their own #L2 chains.

9/🧵

- Herodotus

@HerodotusDev gives access to on-chain data coming from all #Ethereum layers. This means that they can provide proof you own 10ETH in #Optimism, for example, so theoretically you should be able to spend that on any chain without the need for bridging.

10/🧵

@HerodotusDev gives access to on-chain data coming from all #Ethereum layers. This means that they can provide proof you own 10ETH in #Optimism, for example, so theoretically you should be able to spend that on any chain without the need for bridging.

10/🧵

- LayerZero

@LayerZero_Labs lets dApps in other chains communicate, with a twist: They don't use any intermediaries, meaning that messages are transmitted directly and seamlessly.

Their first implementation? @StargateFinance, is an exchange that allows multichain swaps!

11/🧵

@LayerZero_Labs lets dApps in other chains communicate, with a twist: They don't use any intermediaries, meaning that messages are transmitted directly and seamlessly.

Their first implementation? @StargateFinance, is an exchange that allows multichain swaps!

11/🧵

We've looked at quite a few protocols superficially because there wouldn't be enough space to do a full analysis of each and every one of them.

We'll make up for it: tomorrow, we will be publishing a thread on @chainlink's #CCIP protocol and delving deeper!

12/🧵

We'll make up for it: tomorrow, we will be publishing a thread on @chainlink's #CCIP protocol and delving deeper!

12/🧵

With that in mind, the talented people back at @AlchemyPlatform made a good list of protocols working toward interoperability! Take a look here: alchemy.com/best/blockchai…

13/🧵

13/🧵

If you liked the information we provided, drop a like and a cheeky follow and keep up with us! We don't just do threads, we also build cool stuff! See ya!

14/END🧵

14/END🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh