To find your next 100x, you must find high-quality low-caps before everyone else.

I have compiled a list of the BEST altcoins & protocols that have been consistently growing over the years till date 🧵

Like/RT for others🤍

I have compiled a list of the BEST altcoins & protocols that have been consistently growing over the years till date 🧵

Like/RT for others🤍

#Arbitrum

Arbitrum is a layer-2 functionality, developed by Offchain Labs.

It seeks to solve the congestion that the #ETH has been experiencing by improving how smart contracts are validated

The project has seen massive growth & use case since its launch.

Arbitrum is a layer-2 functionality, developed by Offchain Labs.

It seeks to solve the congestion that the #ETH has been experiencing by improving how smart contracts are validated

The project has seen massive growth & use case since its launch.

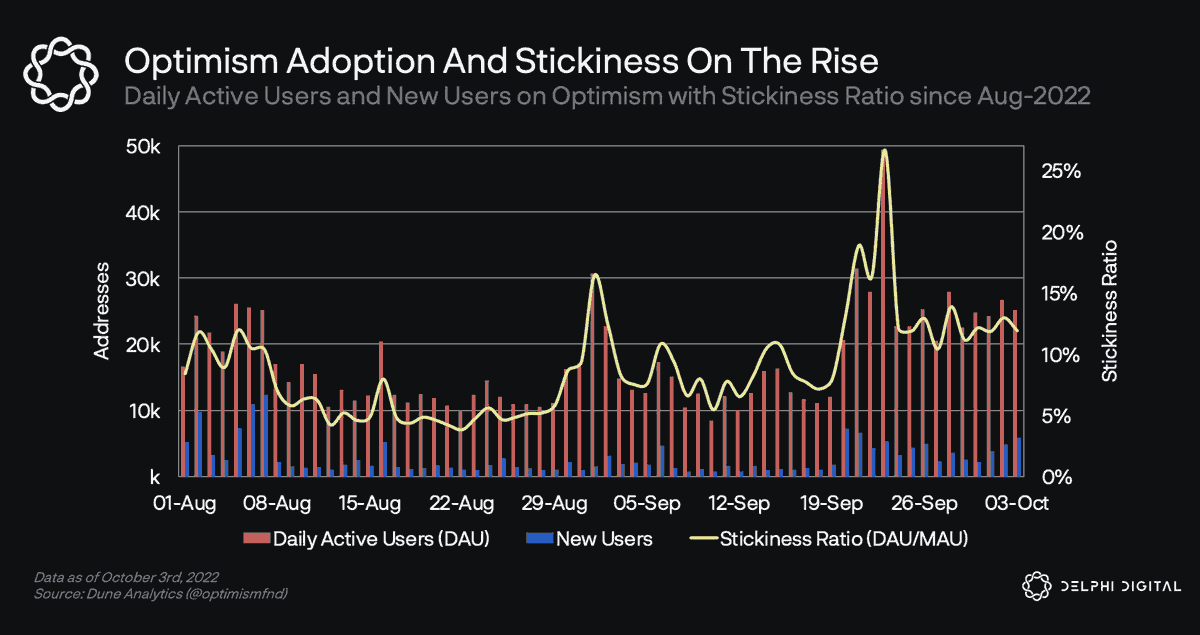

$OP

Has to be one of my favorite protocols on this list. Even tho arbitrum is in the lead I believe $OP will have a fair share of the market.

The protocol has been designed from the ground up to be scalable, secure, and efficient.

Has to be one of my favorite protocols on this list. Even tho arbitrum is in the lead I believe $OP will have a fair share of the market.

The protocol has been designed from the ground up to be scalable, secure, and efficient.

$DYDX

Any project that earns a lot of revenue is gold and according to

@tokenterminal

$DYDX is third in earning revenue which is why I'm bullish on this protocol

The data speaks for itself👇

Any project that earns a lot of revenue is gold and according to

@tokenterminal

$DYDX is third in earning revenue which is why I'm bullish on this protocol

The data speaks for itself👇

$LDO

With the narrative of #LSD becoming hot. I believe $LDO will be a winner in this category. With a Mcap of 2B and almost 85% of its Mcap in circulation, I believe this has a lot more room for growth

With the narrative of #LSD becoming hot. I believe $LDO will be a winner in this category. With a Mcap of 2B and almost 85% of its Mcap in circulation, I believe this has a lot more room for growth

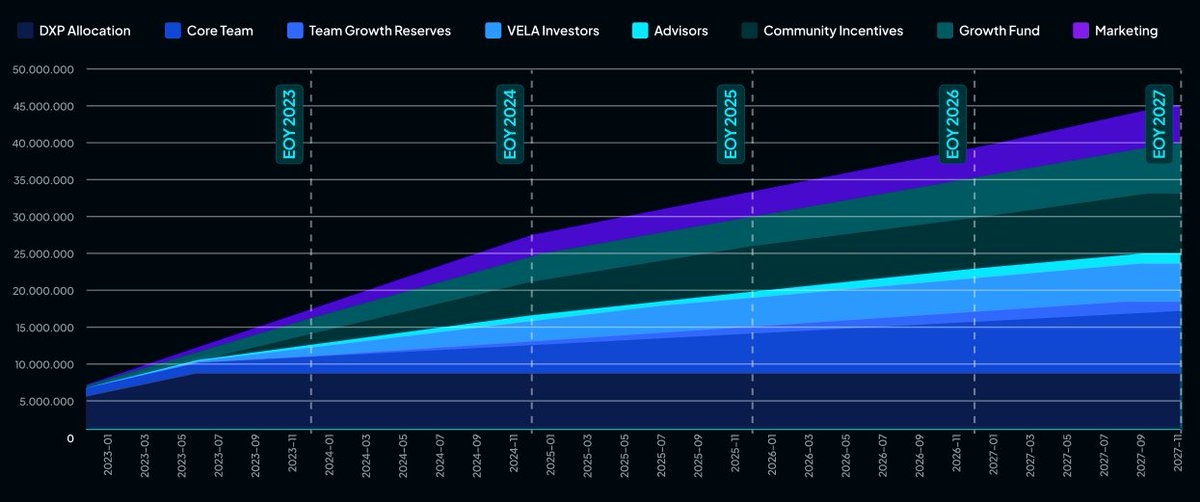

$VELA - @vela_exchange

$Luna destroyed life and completely rekt'd the crypto space. The positive side of this event?

perp DEX's became more popular.

$Vela has shown massive strength in restoring trust in investors and making it more secure to trade

$Luna destroyed life and completely rekt'd the crypto space. The positive side of this event?

perp DEX's became more popular.

$Vela has shown massive strength in restoring trust in investors and making it more secure to trade

https://twitter.com/cyrilXBT/status/1625912907190894616

$TRIAS

It aims to build trust in all machines that produce data, such as self-driving cars, manufacturing machines, Dapps, and more.

It does this by providing firm assurance that these machines will always perform the way they are supposed to and process the correct data.

It aims to build trust in all machines that produce data, such as self-driving cars, manufacturing machines, Dapps, and more.

It does this by providing firm assurance that these machines will always perform the way they are supposed to and process the correct data.

https://twitter.com/cyrilXBT/status/1602344506497671168

$CHNG

#CHNG is fueled by Fusion - offers coded financial services one tap away.

It is the gateway to #Defi automated finance: the foundation of the upcoming internet-of-value revolution.

#CHNG is fueled by Fusion - offers coded financial services one tap away.

It is the gateway to #Defi automated finance: the foundation of the upcoming internet-of-value revolution.

https://twitter.com/cyrilXBT/status/1565363599832489984

$AZERO

#AZERO is a privacy-enhancing, Proof-of-Stake public blockchain with instant finality.

With a Mcap of only 300M there's a lot of room for massive growth. A breakdown on the project here

#AZERO is a privacy-enhancing, Proof-of-Stake public blockchain with instant finality.

With a Mcap of only 300M there's a lot of room for massive growth. A breakdown on the project here

https://twitter.com/1373665408193036293/status/1546207914007957505

$HUM - @hummusdefi

is a next Gen Decentralized AMM for Stableswaps. Providing some amazing features:

• No impermanent loss risk for liquidity providers

• Single-sided liquidity provision

• Ultra-low slippage for traders

A full breakdown on $HUM

is a next Gen Decentralized AMM for Stableswaps. Providing some amazing features:

• No impermanent loss risk for liquidity providers

• Single-sided liquidity provision

• Ultra-low slippage for traders

A full breakdown on $HUM

https://twitter.com/1411274211444854785/status/1629112225742090241

$JASMY

#Jasmy achieves this through a personal data locker and the storage of files using the InterPlanetary File System (IPFS).

This mechanism distributes data across users in a peer-to-peer network.

#Jasmy achieves this through a personal data locker and the storage of files using the InterPlanetary File System (IPFS).

This mechanism distributes data across users in a peer-to-peer network.

$ROSN - @RoseonExchange

$ROSN is the entire ecosystem covering our developments in simplifying our user's crypto journey.

Recently rebranding from $ROSN to $ROSX is accessible via mobile (Android or iOS)

$ROSN is the entire ecosystem covering our developments in simplifying our user's crypto journey.

Recently rebranding from $ROSN to $ROSX is accessible via mobile (Android or iOS)

https://twitter.com/MoonKing___/status/1631278453117919232

@RoseonExchange $KAS

$Kas is the fastest and most scalable Level 1, instant confirmation transaction layer ever built on a proof-of-work engine.

With Mcap sitting at 236M. I'm confident this project has a lot of room to grow.

$Kas is the fastest and most scalable Level 1, instant confirmation transaction layer ever built on a proof-of-work engine.

With Mcap sitting at 236M. I'm confident this project has a lot of room to grow.

https://twitter.com/1373665408193036293/status/1563226691568545792

Btw I recently created a FREE TG channel finding hot narratives, and altcoins and sharing interesting things I find on the web.

Feel free to join -> t.me/+CuGQgufhkk0xY…

Feel free to join -> t.me/+CuGQgufhkk0xY…

If you appreciate the effort, here's the first tweet below

Please RT/like if you found this thread interesting 👇

Thank you 🫂 🤍

Please RT/like if you found this thread interesting 👇

Thank you 🫂 🤍

https://twitter.com/1373665408193036293/status/1631363298951086080

• • •

Missing some Tweet in this thread? You can try to

force a refresh