1/ With a market cap of $1.18 trillion, #Alphabet (#Google) is world’s fourth most valuable public company.

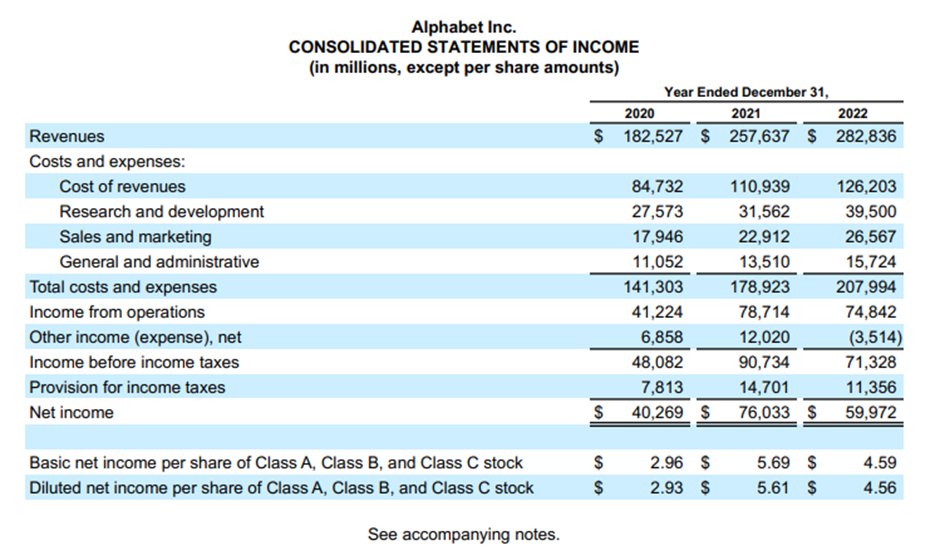

It delivered a revenue of ~$283 billion in FY22 (Dec YE) and is a top 20 company globally in terms of revenue. (~number 17th)

Here is a thread exploring #Alphabet.

It delivered a revenue of ~$283 billion in FY22 (Dec YE) and is a top 20 company globally in terms of revenue. (~number 17th)

Here is a thread exploring #Alphabet.

3/ Here is a market cap history chart. Alphabet’s market cap is ~$1.18 trillion (fourth largest in the world).

For context, largest is #Apple ($2.3 trillion), followed by #Microsoft ($1.8 trillion), #SaudiAramco ($1.8 trillion)

For context, largest is #Apple ($2.3 trillion), followed by #Microsoft ($1.8 trillion), #SaudiAramco ($1.8 trillion)

4/ The company’s revenue was $55 billion in 2013, $111 billion in 2017. It closed 2022 at $283 billion. Here is a look at historical revenue growth for Google.

5/ How does Google make money? Its main source of revenue is Google Services ($253 bn) which delivers both performance and brand advertising. The other key source is Google Cloud ($26 bn) which offers Cloud infrastructure to clients.

Here is Alphabet’s revenue across segments.

Here is Alphabet’s revenue across segments.

6/ Now to better understand the market it operates in, here is a chart showing global ad spend by category. To note that Digital Ads was a $100 billion market in 2013. By 2022, it had grown to $557 billion! tinyurl.com/4szxeda6

7/ This growth is mind-boggling, especially since this share is all a new addition (traditional channels continue at the same clip, perhaps shrinking a little).

This translates to the changing shape & mix of Marketing expenses across all the businesses of the world -new and old

This translates to the changing shape & mix of Marketing expenses across all the businesses of the world -new and old

8/ Google is the largest player in this space with $254 bn Ad revenue (2022). Facebook revenue is $116 bn, almost all of it from advertising. We saw Amazon Advertising revenue were at $38 bn in 2022.

These are the top players in this market which has grown five fold in nine yrs

These are the top players in this market which has grown five fold in nine yrs

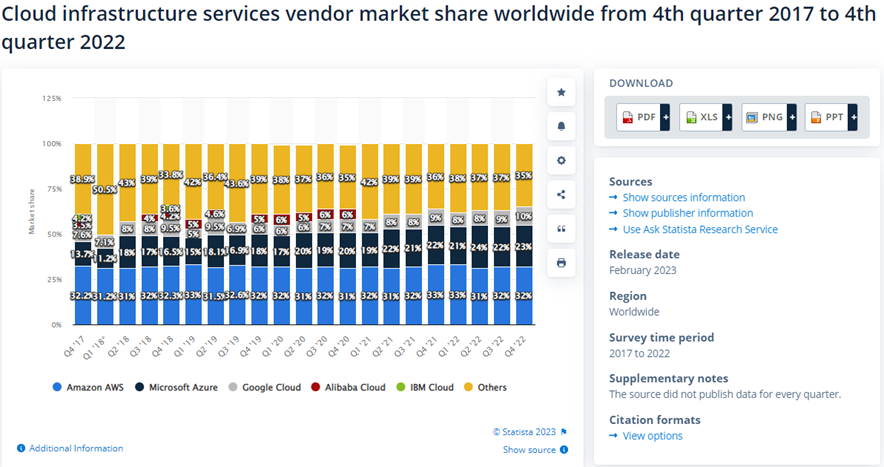

9/ The market that Google Cloud ($26 billion business) competes in is also young and growing fast. It competes with AWS ($80 billion business). Here is the total market for Cloud as estimated by Google. ($505 billion in 2022)

10/ From another source, and showing a smaller market estimate, here is a graph showing market share of the top few players providing #Cloud Infrastructure. #AWS leads the market with 32% share. Google is close to 10% .

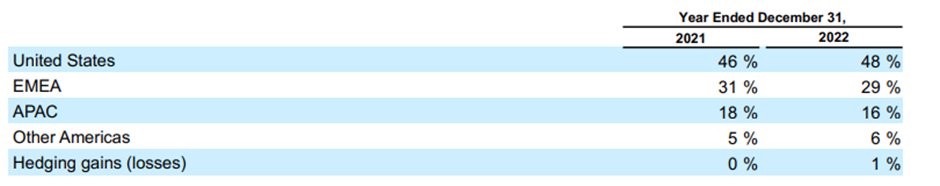

11/ Here is a table sharing the distribution of revenue across the world. 48% of its revenue is derived from US.

12/ As to how the key businesses perform, here is Operating Margin. Google Services (advertising) reports a 34% Operating Margin (~39% in 2021). Google Cloud and Other Bets are in a different phase and have been reporting Operating Losses which brings down the overall margin.

13/ Here is the Income Statement of the company.

Cost of Revenue includes Traffic Acquisition Cost (#TAC) paid to distribution partners (browser providers, mobile carriers etc).

The company spends heavily on R&D – has invested over $100 billion in last five years

Cost of Revenue includes Traffic Acquisition Cost (#TAC) paid to distribution partners (browser providers, mobile carriers etc).

The company spends heavily on R&D – has invested over $100 billion in last five years

14/ Here is the Balance Sheet and Cash Flow. Like #Apple, the company is cash positive and has been repurchasing stock steadily over the years. ($59 billion repurchase in 2022)

• • •

Missing some Tweet in this thread? You can try to

force a refresh