🚨Ω🚨

@Coinbase's bank is being sued for predatory lending in a large class action lawsuit filed ~8 weeks ago.

It gets worse though... Because @CrossRiverBank is also starting to have to sue people for loans that are going bad. Financials only allow 1.6% loss. $COIN

ruh roh

@Coinbase's bank is being sued for predatory lending in a large class action lawsuit filed ~8 weeks ago.

It gets worse though... Because @CrossRiverBank is also starting to have to sue people for loans that are going bad. Financials only allow 1.6% loss. $COIN

ruh roh

https://twitter.com/Cryptadamist/status/1637661688047476737

@coinbase @crossriverbank 🧵2/Ω Kinda f'ed up other thread so I'm gonna copy these over here. tl;dr #seemsbad for @CrossRiverBank and $COIN.

https://twitter.com/Cryptadamist/status/1637661688047476737

Specific allegations about how @CrossRiverBank (@Coinbase's bank! $COIN) broke the law and allegedly defrauded a bunch of people w/predatory "debt relief" lending along with #NewCreditAmerica

https://twitter.com/Cryptadamist/status/1637663147946377217

🧵4/Ω

Getting sued obvs not ideal for @CrossRiverBank but it's just once. Though the lawsuits where they are the *plaintiff* are actually much worse:

#CrossRiverBank is starting to sue customers who aren't paying their loans.

Loss allowance is 1.6%.

Getting sued obvs not ideal for @CrossRiverBank but it's just once. Though the lawsuits where they are the *plaintiff* are actually much worse:

#CrossRiverBank is starting to sue customers who aren't paying their loans.

Loss allowance is 1.6%.

https://twitter.com/Cryptadamist/status/1637669227871055872

🧵5/Ω

Here's a lawsuit where @CrossRiverBank is suing someone for a $25,822.61 debt.

It can't cost less than $5,000 (more likely $10,000) to prosecute this case & collect. Shouldn't they sell this kind of case to a debt collector?

Or do they need the pennies that badly? $COIN

Here's a lawsuit where @CrossRiverBank is suing someone for a $25,822.61 debt.

It can't cost less than $5,000 (more likely $10,000) to prosecute this case & collect. Shouldn't they sell this kind of case to a debt collector?

Or do they need the pennies that badly? $COIN

🧵6/Ω

Another lawsuit where @CrossRiverBank is suing someone for $36,444

I'm confused because these lawsuits reference "the agreement" and "at all relevant times" but make reference to no exhibits? And there are no exhibits on file?

WTF? is NJ dumb or is $COIN's bank dumb?

Another lawsuit where @CrossRiverBank is suing someone for $36,444

I'm confused because these lawsuits reference "the agreement" and "at all relevant times" but make reference to no exhibits? And there are no exhibits on file?

WTF? is NJ dumb or is $COIN's bank dumb?

🧵7/Ω

Here's another lawsuit filed by @Coinbases's bank @CrossRiverBank against Randall Olsen for $18,750. $COIN

Here's another lawsuit filed by @Coinbases's bank @CrossRiverBank against Randall Olsen for $18,750. $COIN

🧵8/Ω

And one more for $15,274. This one is fun though because @CrossRiverBank (@Coinbases' bank) submitted a complaint that was already rejected by the court for being filed in the wrong venue, thus driving up the cost of recovery of this $15,274.

$COIN ngmi

And one more for $15,274. This one is fun though because @CrossRiverBank (@Coinbases' bank) submitted a complaint that was already rejected by the court for being filed in the wrong venue, thus driving up the cost of recovery of this $15,274.

$COIN ngmi

🧵9/Ω All this does not paint a particularly bright future for #CrossRiverBank when looked at at the same time as their financials, which I made a long thread about.

tl;dr they have a lot deposits that can be pulled quickly & can't take much loss on loans

tl;dr they have a lot deposits that can be pulled quickly & can't take much loss on loans

https://twitter.com/Cryptadamist/status/1637244019552972800

🧵10/Ω

As of Dec. Congress leveled accusations at @CrossRiverBank of profiting by ignoring massive #PPP/covid relief fraud.

SBA refused to forgive $300mm in loans. CRB's books are such that $300mm might kill them even if other loans are ok.

👆 not so ok.

As of Dec. Congress leveled accusations at @CrossRiverBank of profiting by ignoring massive #PPP/covid relief fraud.

SBA refused to forgive $300mm in loans. CRB's books are such that $300mm might kill them even if other loans are ok.

👆 not so ok.

https://twitter.com/Cryptadamist/status/1637018436575416328

🧵11/Ω

If the SBA won't forgive fraudulent #PPP loans issued by @CrossRiverBank they will have to try to collect.

Yesterday I found a bunch of weird "Client Scheduler" job listings for @CrossRiverBank.

@hlensss suggested they're related. I think I agree

If the SBA won't forgive fraudulent #PPP loans issued by @CrossRiverBank they will have to try to collect.

Yesterday I found a bunch of weird "Client Scheduler" job listings for @CrossRiverBank.

@hlensss suggested they're related. I think I agree

https://twitter.com/Cryptadamist/status/1637290617033113600

@crossriverbank @HLensss 🧵12/Ω

Note that the "Client Scheduler - Remote" job listings are all over the country and not well paid.

Perhaps these are process server positions? If you sue someone to collect a loan you can't just mail them the suit, you have to serve them in person...

Note that the "Client Scheduler - Remote" job listings are all over the country and not well paid.

Perhaps these are process server positions? If you sue someone to collect a loan you can't just mail them the suit, you have to serve them in person...

🧵13/Ω

The fact that:

1. @Coinbase just announced it may go offshore

2. @Circle just joined @CrossRiverBank but made a point to not leave any $ there

3. #SBA refused to forgive $300mm fraudulent loans

4. The lawsuits 👆

Is very bad for $COIN/CRB.

🩸Ω🩸

The fact that:

1. @Coinbase just announced it may go offshore

2. @Circle just joined @CrossRiverBank but made a point to not leave any $ there

3. #SBA refused to forgive $300mm fraudulent loans

4. The lawsuits 👆

Is very bad for $COIN/CRB.

🩸Ω🩸

https://twitter.com/Cryptadamist/status/1637624609531998209

🧵14/Ω

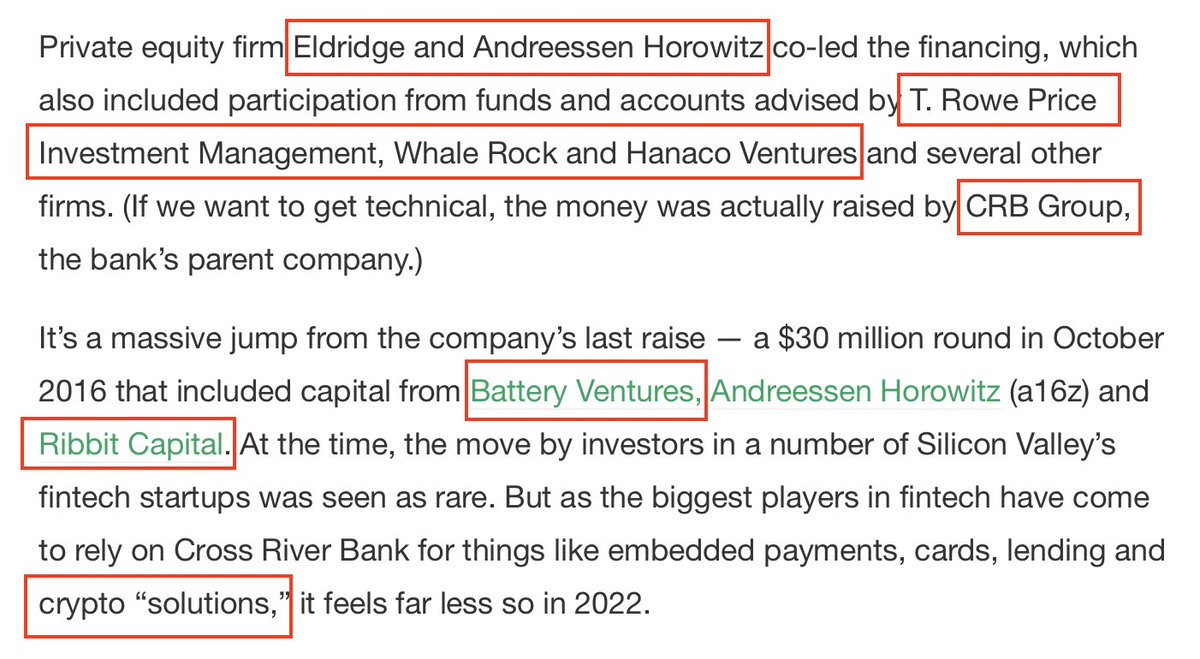

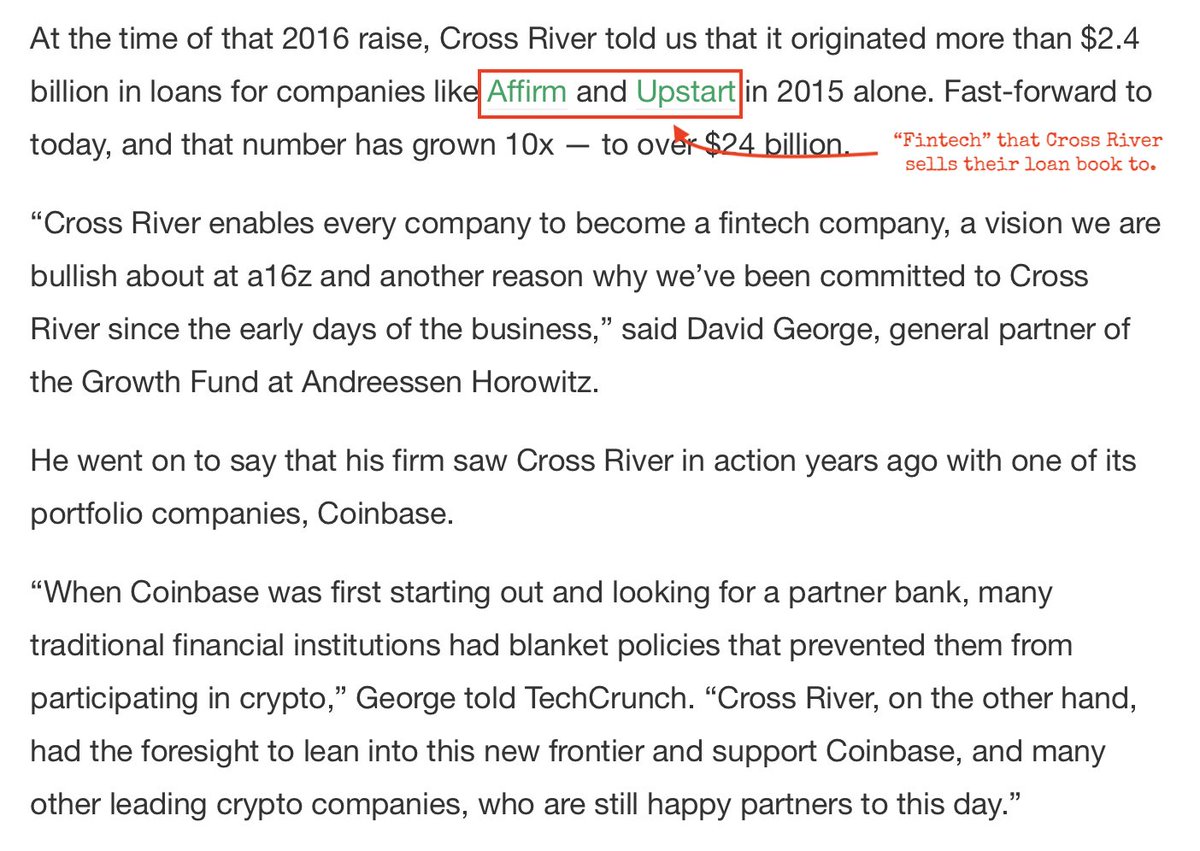

While I'm here, did anyone else not know that in 2018 @CrossRiverBank took a $100 million investment from the former head of #Malaysia's national police force?

@intel_jakal @Annihil4tionGod #slugsofa16z #VCapital #ShefaCapital #1mdb @braisincapital @csFraudAnalysis

While I'm here, did anyone else not know that in 2018 @CrossRiverBank took a $100 million investment from the former head of #Malaysia's national police force?

@intel_jakal @Annihil4tionGod #slugsofa16z #VCapital #ShefaCapital #1mdb @braisincapital @csFraudAnalysis

🧵15/Ω

Really looks like a bunch of that stolen #1MDB money made its way into a funding round for @CrossRiverBank...

Really looks like a bunch of that stolen #1MDB money made its way into a funding round for @CrossRiverBank...

https://twitter.com/ImDrinknWyn/status/1637841173417975813

🧵16/Ω

👆 was apparently over the target bc my account is now shadow banned. if you don't follow me you won't see my tweets searching for [@]crossriverbank despite many ❤️

Feel free to QT me or copy/paste any of this content to yr own tweets so more people can see what's coming

👆 was apparently over the target bc my account is now shadow banned. if you don't follow me you won't see my tweets searching for [@]crossriverbank despite many ❤️

Feel free to QT me or copy/paste any of this content to yr own tweets so more people can see what's coming

🧵17/Ω

Here's my original ultra-mega thread about Cross River Bank, beloved by both Coinbase and Circle (USDC issuer) as well as #PPP loan scammers the world over, Chinese organized crime, and Israelis.

Here's my original ultra-mega thread about Cross River Bank, beloved by both Coinbase and Circle (USDC issuer) as well as #PPP loan scammers the world over, Chinese organized crime, and Israelis.

https://twitter.com/Cryptadamist/status/1636778218907746311

🧵18/Ω

And here's my less mega thread going through the Congressional accusations against Cross River Bank (namely that they facilitated and perhaps participated in #PPP loan fraud)

And here's my less mega thread going through the Congressional accusations against Cross River Bank (namely that they facilitated and perhaps participated in #PPP loan fraud)

https://twitter.com/Cryptadamist/status/1637211823203123201

🧵19/Ω

It was suggested to me that perhaps these lawsuits might be mostly intended so #CrossRiverBank can make a show of pretending to try to collect on #PPP loans to try to convince the @SBAgov to forgive the $300m.

Hard to understand the total lack of exhibits otherwise tbh.

It was suggested to me that perhaps these lawsuits might be mostly intended so #CrossRiverBank can make a show of pretending to try to collect on #PPP loans to try to convince the @SBAgov to forgive the $300m.

Hard to understand the total lack of exhibits otherwise tbh.

• • •

Missing some Tweet in this thread? You can try to

force a refresh