Get ready to explore the world of Entangle - an upcoming, groundbreaking protocol that's revolutionizing cross-chain liquid staking through its innovative derivatives (#LSD).

Follow this visual thread as we take you on a journey into the future with @Entanglefi.

1/

Follow this visual thread as we take you on a journey into the future with @Entanglefi.

1/

Before we move forward, please note that this thread merely aims to share our understanding of the topic and should not be taken as financial advice.

Disclosure: This post is under a partnership with the @Entanglefi team.

2/

Disclosure: This post is under a partnership with the @Entanglefi team.

2/

In this visual thread we will cover as follows:

- Cross-Chain Illiquidity

- Liquidity Recycle Problem

- LSD and xLSD

- Entangle Multiverse

- LSD Intrachain

- xLSD Cross-Chain

- Oracle and Blockchain

- End-Users In Practice

- End-Protocol Benefits

3/

- Cross-Chain Illiquidity

- Liquidity Recycle Problem

- LSD and xLSD

- Entangle Multiverse

- LSD Intrachain

- xLSD Cross-Chain

- Oracle and Blockchain

- End-Users In Practice

- End-Protocol Benefits

3/

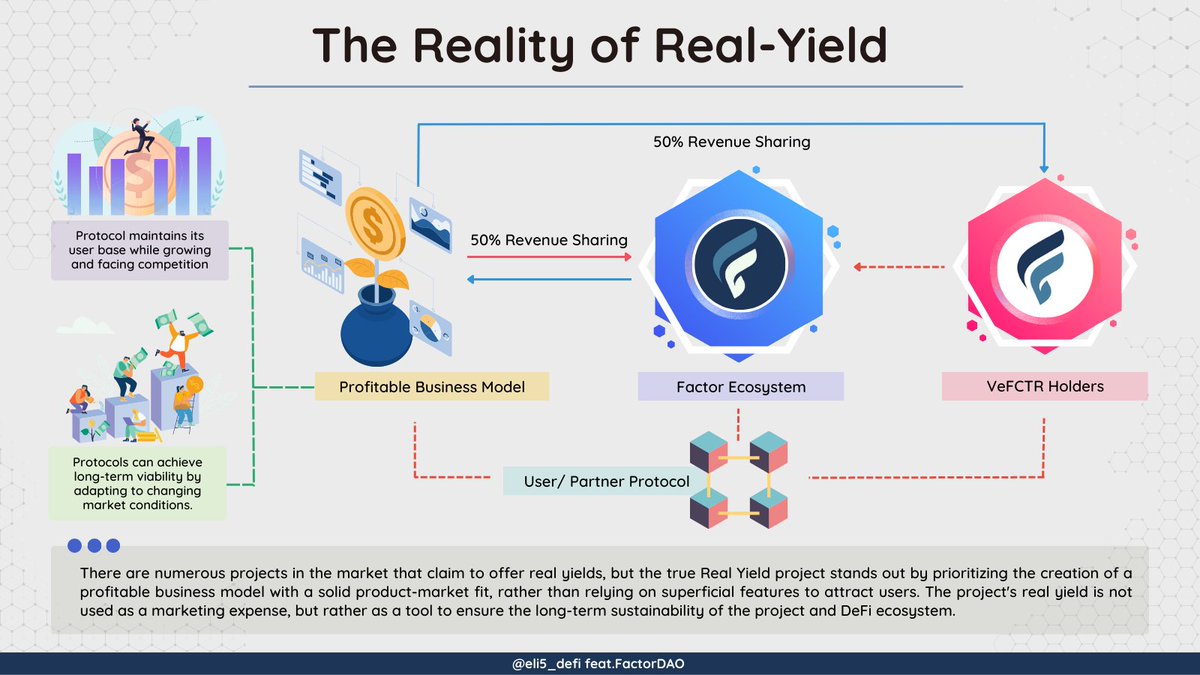

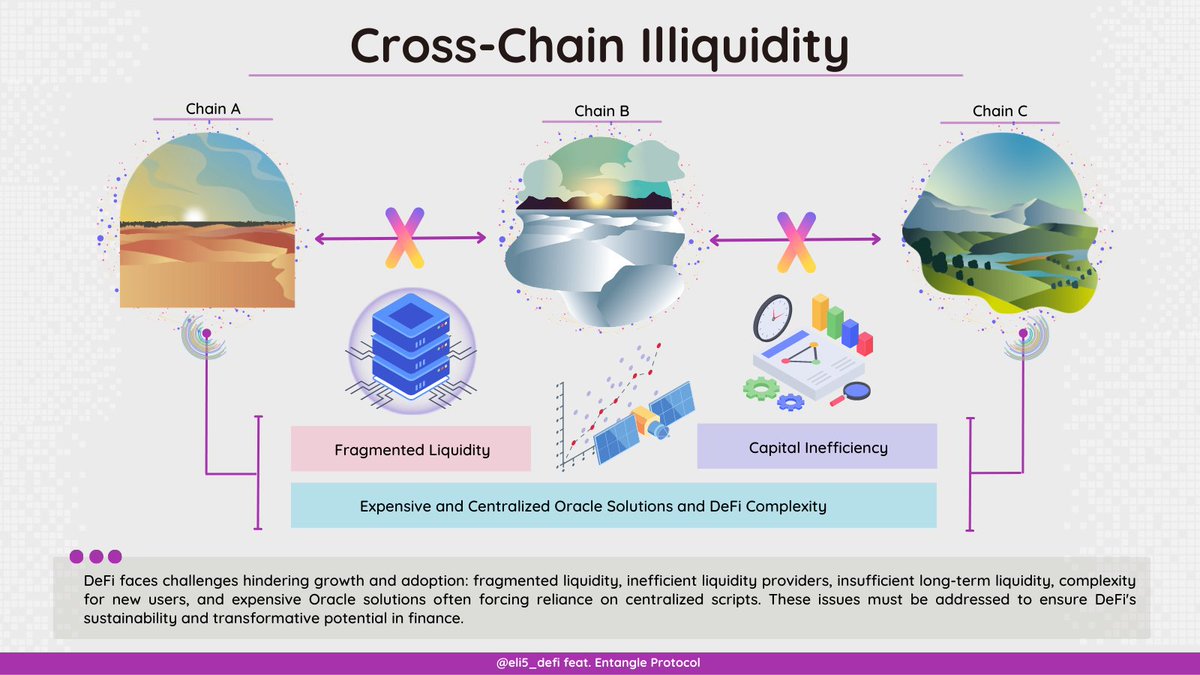

DeFi could revolutionize finance, but it's held back by fragmented liquidity, inefficient providers, and complex user experiences. Plus, the expensive Oracle solutions often force reliance on centralized scripts.

Addressing these issues is crucial for DeFi's growth.

4/

Addressing these issues is crucial for DeFi's growth.

4/

Derivatives protocols face challenges in attracting users due to a lack of interoperability.

The inability to recycle liquidity from other decentralized exchanges limits the ability of derivatives protocols to grow and expand.

5/

The inability to recycle liquidity from other decentralized exchanges limits the ability of derivatives protocols to grow and expand.

5/

Liquidity challenges can be addressed with the use of LSDs.

By tokenizing staked assets, uniform trading and interoperability on other protocols is made possible.

But what about cases where multiple blockchains are involved? This is where @Entanglefi #xLSD come in.

6/

By tokenizing staked assets, uniform trading and interoperability on other protocols is made possible.

But what about cases where multiple blockchains are involved? This is where @Entanglefi #xLSD come in.

6/

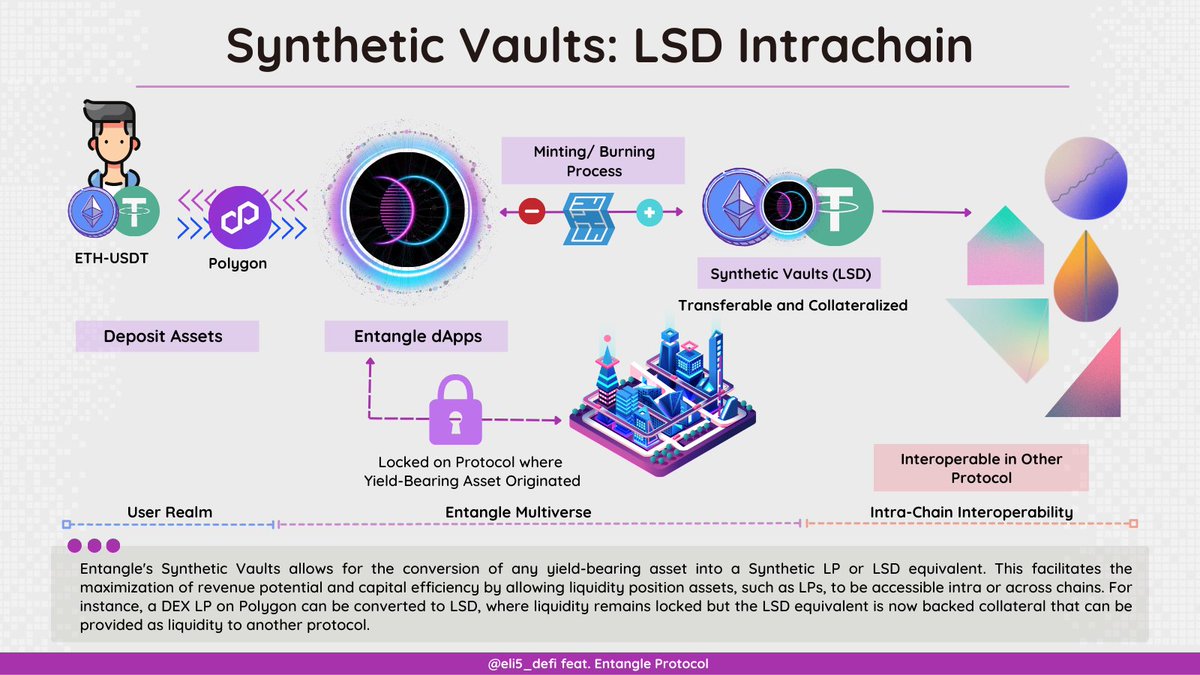

@Entanglefi is simplifying DeFi by connecting protocols across different chains and offering a cross-chain liquidity sub-layer through #xLSD called Synthetic Vaults (SV) powered by their Oracle Solution and Oracle-Centric Blockchain.

7/

7/

Entangle's Synthetic Vaults allow for the conversion of any yield-bearing asset into a Synthetic LP or #LSD equivalent.

This facilitates the maximization of revenue potential and capital efficiency by allowing liquidity position assets to be accessible intra-chains.

8/

This facilitates the maximization of revenue potential and capital efficiency by allowing liquidity position assets to be accessible intra-chains.

8/

Entangle's Oracle Solution and Oracle Centric Blockchain enable seamless cross-chain transactions for users.

This unlocks new revenue potential and capital efficiency, allowing liquidity position assets (xLSD) to be utilized across chains.

9/

This unlocks new revenue potential and capital efficiency, allowing liquidity position assets (xLSD) to be utilized across chains.

9/

Entangle's distributed oracle solutions and blockchain have the potential to scale DeFi protocol.

With affordable gas fees and effortless asset transfers between chains, it enables protocols to broaden their dApps' product offerings and increase liquidity across chains.

10/

With affordable gas fees and effortless asset transfers between chains, it enables protocols to broaden their dApps' product offerings and increase liquidity across chains.

10/

Here's how end-users benefit from using @Entanglefi in practice:

- Save capital and time efficiently

- Navigate user-friendly mechanics with ease

- Get exposed to cross-chain liquidity

11/

- Save capital and time efficiently

- Navigate user-friendly mechanics with ease

- Get exposed to cross-chain liquidity

11/

As the end-protocol, Entangle's solutions promote protocol stability, expand cross-chain offerings, and enable greater liquidity recycling for unprecedented market efficiency and growth.

12/

12/

To understand @Entanglefi more deeply, check out the thread created by @Cryptotrissy below.

13/

13/

https://twitter.com/Cryptotrissy/status/1636728593903677443

And another @Cryptotrissy thread that explains the @Entanglefi infrastructure further.

14/

14/

https://twitter.com/Cryptotrissy/status/1635262250511654912

@Entanglefi v1 testnet is currently live. Get yourself whitelisted by accessing the tweet below.

15/

15/

https://twitter.com/Entanglefi/status/1620495521931743232

Tagged my fellow DeFi threader:

@LouisCooper_

@ThorHartvigsen

@blocmatesdotcom

@Slappjakke

@JackNiewold

@rektdiomedes

@JiraiyaReal

@crypto_linn

@defi_mochi

@SimplifyDeFi

@jake_pahor

@Only1temmy

@Louround_

@2lambro

@DeFiMinty

@DefiIgnas

@launchy_

@archipelabro

16/

@LouisCooper_

@ThorHartvigsen

@blocmatesdotcom

@Slappjakke

@JackNiewold

@rektdiomedes

@JiraiyaReal

@crypto_linn

@defi_mochi

@SimplifyDeFi

@jake_pahor

@Only1temmy

@Louround_

@2lambro

@DeFiMinty

@DefiIgnas

@launchy_

@archipelabro

16/

I hope you've found this thread helpful.

Like/Retweet/Follow me @eli5_defi for more. Also, please share your thoughts and suggestions in the comments.

$ENTGL #LSD #DeFi #CrossChain

17/

Like/Retweet/Follow me @eli5_defi for more. Also, please share your thoughts and suggestions in the comments.

$ENTGL #LSD #DeFi #CrossChain

17/

https://twitter.com/eli5_defi/status/1638254180224860163

• • •

Missing some Tweet in this thread? You can try to

force a refresh