A new era is dawning for tax-saving funds.

ELSS won’t help you save #tax from Apr 1, 2023, if you pick the New Tax Regime.

Should you still invest in them for better returns?

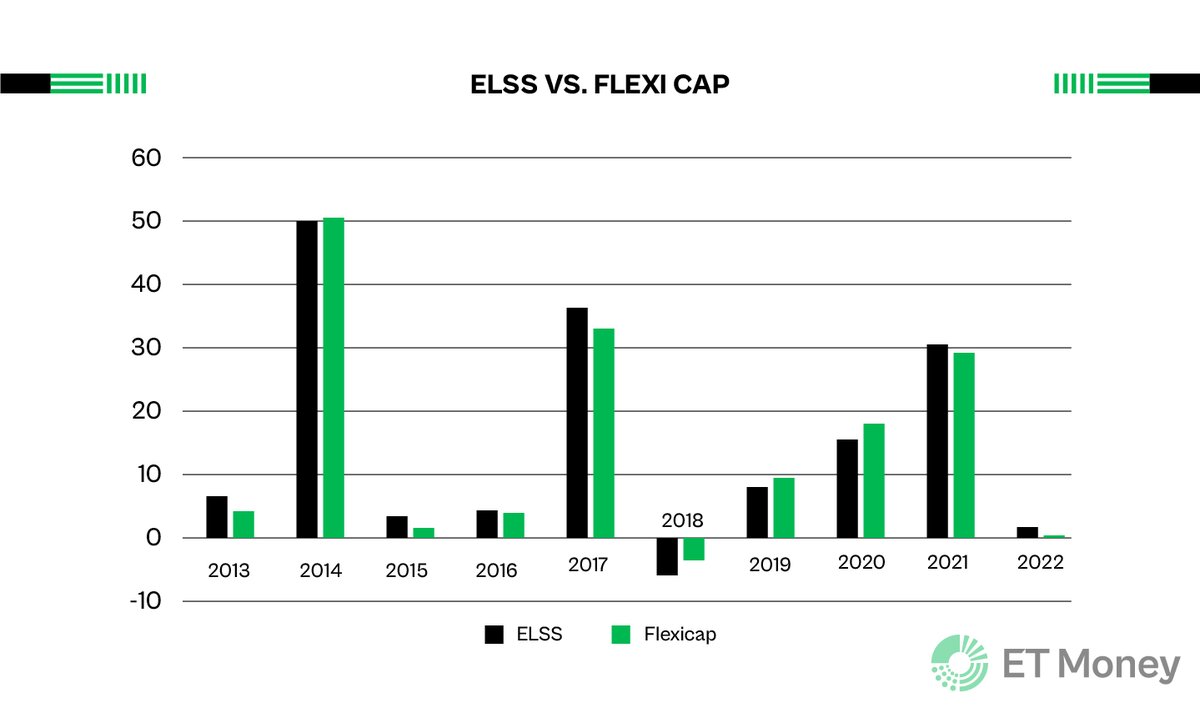

After all, they are one of the top-performing diversified equity categories (See image)

A detailed 🧵

ELSS won’t help you save #tax from Apr 1, 2023, if you pick the New Tax Regime.

Should you still invest in them for better returns?

After all, they are one of the top-performing diversified equity categories (See image)

A detailed 🧵

ELSS is a tax-saving product. But it also helps you create wealth.

The category has delivered an annualised return of over 15% in the past 10 years.

Hardly any other tax-saving option matches its performance.

The category has delivered an annualised return of over 15% in the past 10 years.

Hardly any other tax-saving option matches its performance.

There’s one clear conclusion from ELSS’ long-term performance.

Even if you choose the New Tax Regime, you can let your past investments in ELSS grow.

There’s no need to withdraw.

Let’s check if you should continue your investment if you choose the New Tax Regime.

Even if you choose the New Tax Regime, you can let your past investments in ELSS grow.

There’s no need to withdraw.

Let’s check if you should continue your investment if you choose the New Tax Regime.

Like all tax-saving options, ELSS also comes with a lock-in.

At times, the lock-in can be a benefit for fund managers.

They can take long-term investment calls without worrying about redemption pressure or short-term performance.

At times, the lock-in can be a benefit for fund managers.

They can take long-term investment calls without worrying about redemption pressure or short-term performance.

So, if you are opting for the New Tax Regime, does it make sense to lock in money without any tax benefits?

Why not invest in other diversified equity funds?

Let’s check some more data to get the answer.

Why not invest in other diversified equity funds?

Let’s check some more data to get the answer.

Apart from the lock-in, ELSS funds are just like Flexi Cap funds.

Both categories can invest across large, mid and small caps.

So, let’s see how they stack against each other.

Both categories can invest across large, mid and small caps.

So, let’s see how they stack against each other.

Say, you invested a lumpsum of Rs 1 lakh in ELSS and Flexi Cap.

Here’s the corpus you would have accumulated by 2022-end.

ELSS = Rs 3.77 lakh

Flexi Cap = Rs 3.67 lakh

Here’s the corpus you would have accumulated by 2022-end.

ELSS = Rs 3.77 lakh

Flexi Cap = Rs 3.67 lakh

We also checked the calendar year performance of both categories.

ELSS did better than Flexi Cap in 6 out of the past 10 years. (See graph)

Even in this case, ELSS scores over Flexi Cap funds.

ELSS did better than Flexi Cap in 6 out of the past 10 years. (See graph)

Even in this case, ELSS scores over Flexi Cap funds.

We delved deeper.

To check the consistency of returns, we looked at 5-year rolling returns of both categories in the last decade.

The average of the top 5 ELSS funds came out around 16%.

For Flexi Cap funds, this number was a tad lower at 15%.

To check the consistency of returns, we looked at 5-year rolling returns of both categories in the last decade.

The average of the top 5 ELSS funds came out around 16%.

For Flexi Cap funds, this number was a tad lower at 15%.

What does it mean for you?

ELSS funds have beaten Flexi Caps. But the difference isn’t much.

If you pick the New Tax Regime & don’t want lock-in, you can consider Flexi Caps over ELSS.

But do that only if you have discipline.

The lock-in in ELSS could be a blessing for many.

ELSS funds have beaten Flexi Caps. But the difference isn’t much.

If you pick the New Tax Regime & don’t want lock-in, you can consider Flexi Caps over ELSS.

But do that only if you have discipline.

The lock-in in ELSS could be a blessing for many.

Why is lock-in a blessing?

Most investors can bear losses.

When they see their hard-earned money lose value, they exit their investments.

However, in equities, you make money when you remain invested for the long term.

Most investors can bear losses.

When they see their hard-earned money lose value, they exit their investments.

However, in equities, you make money when you remain invested for the long term.

In a nutshell…

If you have been investing in ELSS for some time now, you don’t need to redeem when you opt for the new tax regime.

Let the money grow.

For fresh investments in future, you may pick other categories if you don’t like the lock-in.

If you have been investing in ELSS for some time now, you don’t need to redeem when you opt for the new tax regime.

Let the money grow.

For fresh investments in future, you may pick other categories if you don’t like the lock-in.

We put a lot of effort into creating such informative threads.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

For more threads, follow us.

Also, click on the bell icon in the profile section, so you don't miss any threads.🔔

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

For more threads, follow us.

Also, click on the bell icon in the profile section, so you don't miss any threads.🔔

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter