@OCCRP Well worth a read...and #bandenia provides a really simple example of some really obvious flags I've pointed out more than once.

Lets just look at this statement....180m in unpaid share capital....OCCRP are being too kind by saying "possibly"....

View 2 - Me....within 1 minute of looking.

This is BS. The current assets are clearly a debt owed by the shareholders as they haven't paid for the equity they issued. #fraud

This is BS. The current assets are clearly a debt owed by the shareholders as they haven't paid for the equity they issued. #fraud

View 3 - The #muppet view (typically crypto related).

They company is in great shape. it not only has $80m in current and liquid assets it also has nearly $80m in capital reserves.

This is a solid company....stop the #FUD

They company is in great shape. it not only has $80m in current and liquid assets it also has nearly $80m in capital reserves.

This is a solid company....stop the #FUD

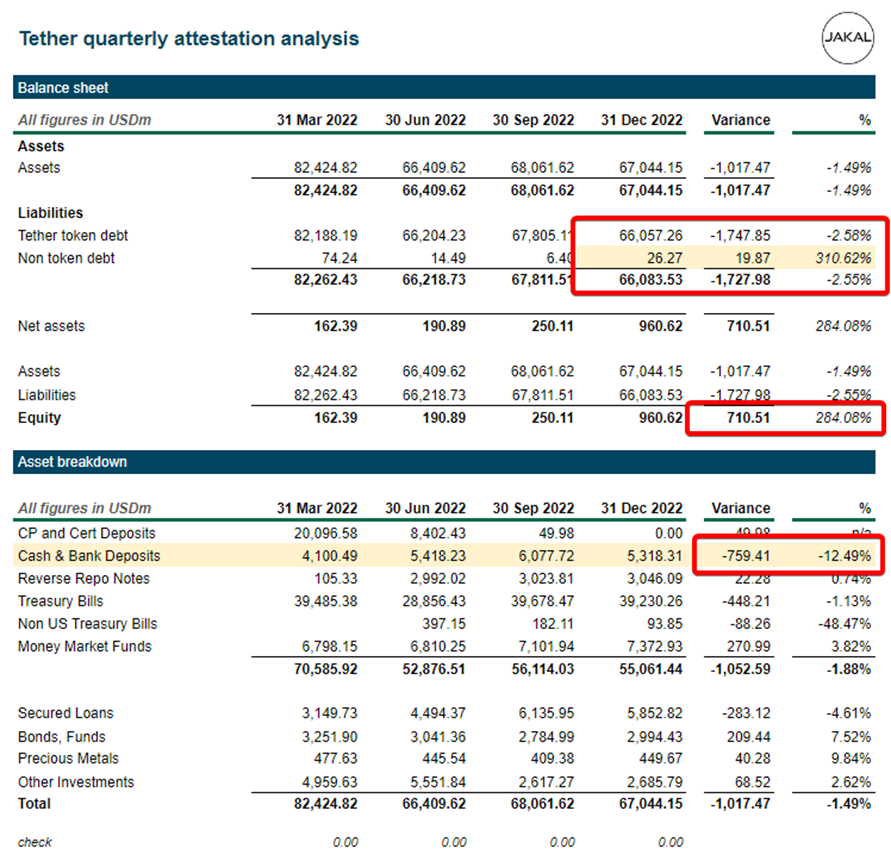

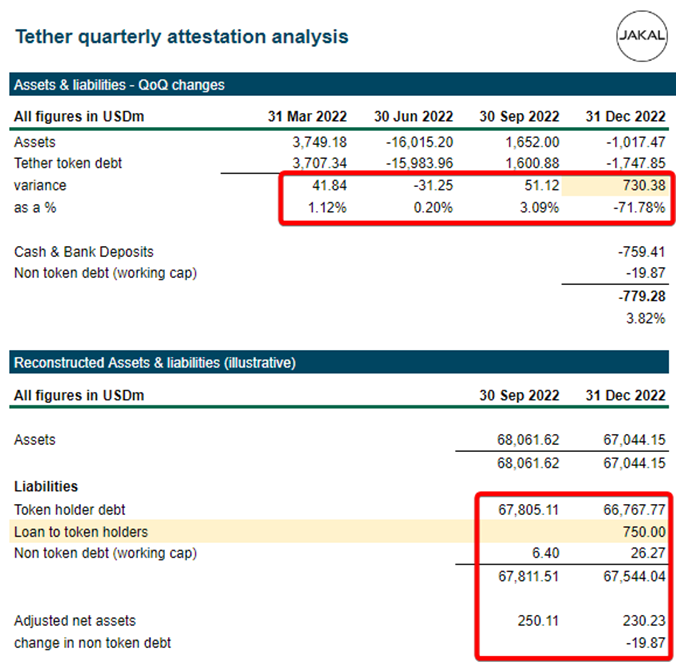

While obviously a pretty dumbed down and very obvious fraud. The issues are the same.

if a company is going to tell the world they make a PROFIT and every news site is going to spew that statement.

ffs force them to SHOW YOU HOW THEY MADE THE PROFIT. #cryptomuppets

if a company is going to tell the world they make a PROFIT and every news site is going to spew that statement.

ffs force them to SHOW YOU HOW THEY MADE THE PROFIT. #cryptomuppets

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter