On 12 April. I asked a pretty basic question 9over and over and over)...where did #elsalvador get the $800m to make the bond repayment in January....nothing but crickets (as always)

So I thought I'd go and have a look at El Salvador's finances....I'm working through the IMF's 2021 article IV consultation report

Why am I going through the 2021 report and not the current one......thanks for asking that's a very good question....pretty simple answer its because #elsalvador has yet to provide authorisation for its release.

Even though the IMF staff concluding statement was released 10 Feb....more than 2 months later the Staff report has not been authorised for release.

meanwhile this is the shit i wake up to. nice one @Bloomberg - can you tell me how the fk #elsalvador paid the $800m bond or is it not important?

@Bloomberg lets frame it another way - if you are going to tout #elsalvador wonderful financial alchemy.

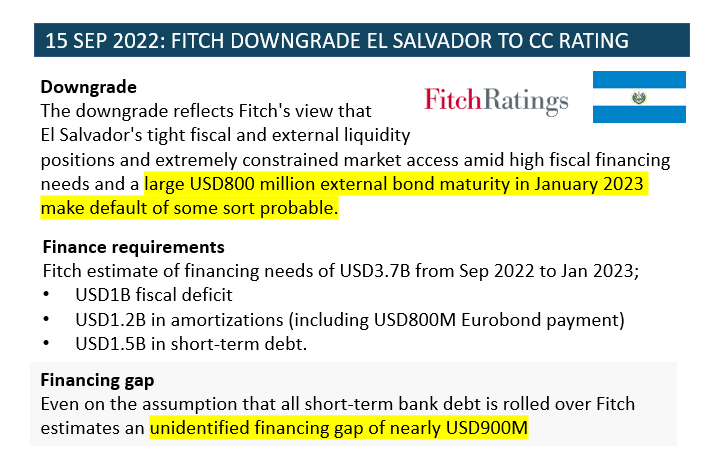

Then why are you not asking @FitchRatings how they managed to get their downgrade so absolutely wrong. Fitch was pretty confident that there was a pretty big hole of $900m.

Then why are you not asking @FitchRatings how they managed to get their downgrade so absolutely wrong. Fitch was pretty confident that there was a pretty big hole of $900m.

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter