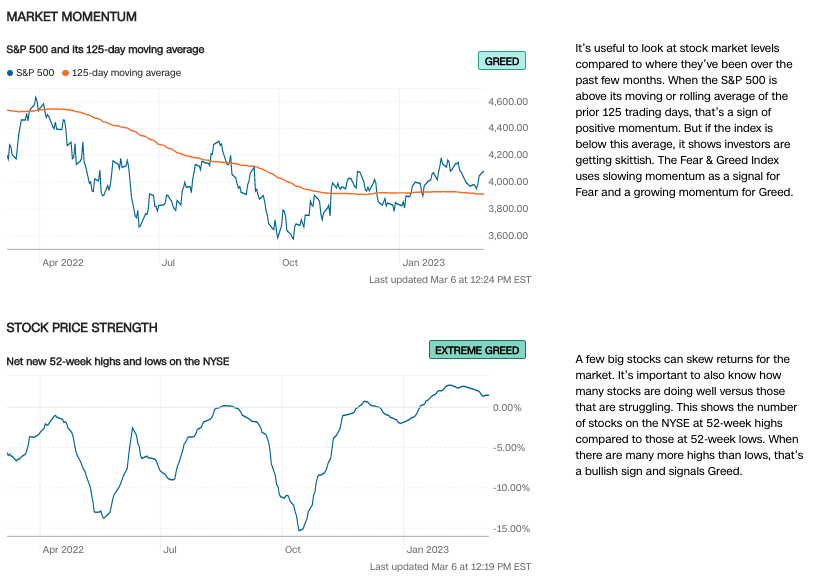

“The momentum is clear, and positioning is increasingly one-sided. Longs outnumber shorts by more than 9 to 1,” said @Citi strategists led by Chris Montagu. “The few remaining shorts are all in loss, but a short squeeze is not likely to significantly impact markets.” $SPY $SPX

“Market participants have added $21 billion in new long positions on the S&P 500 futures, @Citi data showed. The weekly flow of new longs was one of the largest seen in recent years, it added.” @markets @Bloomberg $SPY $SPX

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

What is your take (trade/positioning) on the S&P 500 major #StockMarket index? $SPY $SPX

• • •

Missing some Tweet in this thread? You can try to

force a refresh