The Weekly Recap 🧵

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

1. We started the week with discussing our view ahead for markets. Our systematic view is that we are headed towards a stagflationary recession.

https://twitter.com/prometheusmacro/status/1663288910967889924?s=20

2. Re 1, we further contextualised our view by sharing our systematic updates on inflation & growth.

https://twitter.com/prometheusmacro/status/1663561137496154112?s=20

3. Next, we shared our Long Only Prometheus Cycle Strategy for stocks & bonds. This strategy leverages our algorithmic macro process to help us decide whether to be invested in stocks, bonds, or cash.

https://twitter.com/prometheusmacro/status/1663607860285313024?s=20

4. This was followed by our opinion thread on Profits, Wages, and Interest Expense in which we discussed that even though revenue growth and wages have moved in a direction consistent with a profit squeeze, corporate interest payments have not.

https://twitter.com/prometheusmacro/status/1663684408308629506?s=20

5. Then we shared our Market Regime Update.

https://twitter.com/prometheusmacro/status/1662955015395319808?s=20

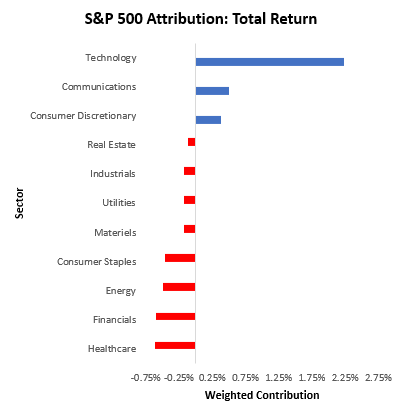

6. Next up, we delved deeper into the recent equity market performance and conducted an in-depth attribution analysis of the S&P 500. Overall, we concluded that recent moves in the equity market have been lopsided & caution is necessary.

https://twitter.com/prometheusmacro/status/1664031974422458368?s=20

7. We then reinforced the idea that particular points in the economic cycle offer an asymmetrically positive return on risk, either long or short assets that can be harvested using a systematic approach and shared the 'Prometheus Cycle Strategies'.

https://twitter.com/prometheusmacro/status/1658109945118617605?s=20

8. We revisted #CPI and provided a complete dissection of the four main components that contribute to most of it's variation.

https://twitter.com/prometheusmacro/status/1664768379675131904?s=20

9. Following the release of Personal Income and Personal Consumption Expenditure data, we also broke down every #component necessary to anlayse the state of the #consumer. Overall, our assessment suggested that the US consumer remains resilient.

https://twitter.com/prometheusmacro/status/1664363025694957568?s=20

10. Finally, we ended the week by sharing our latest updates to the Prometheus ETF #Portfolio and Prometheus Weekly #Trend Signals.

https://twitter.com/prometheusmacro/status/1664796484737409025?s=20

11. If you found this recap helpful, please feel free to share it around and #subscribe to @prometheusmacro.

This will help us further our mission of providing the most #actionable and best #macro research in the business!

This will help us further our mission of providing the most #actionable and best #macro research in the business!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter