The Weekly Recap (12.06.23 ~ 16.06.23) 🧵

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

#MacroMonday #market

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

#MacroMonday #market

1. We kicked off the week with our CPI Preview, highlighting the importance of keeping an eye out for the #used cars and #shelter prints.

https://twitter.com/prometheusmacro/status/1668555331578855424?s=20

2. This was followed by an in-depth analysis of the #fiscal impulse. Overall, our assessment suggested that government #revenues continue to paint a picture of weak private sector conditions.

https://twitter.com/prometheusmacro/status/1668617645216911362?s=20

3. We also shared our insights comparing our CPI Preview vs Realized CPI. Both, #shelter and #used cars came in line with our expectations.

https://twitter.com/prometheusmacro/status/1669054599301308417?s=20

4. Next, in light of the recent Treasury Market dynamics, we provided a deep-dive into the forces driving the current pricing and complemented this with our expectations for the asset class.

https://twitter.com/prometheusmacro/status/1669272975357493249?s=20

5. This was followed by a break-down of the most recent CPI print and the key takeaways from the print. Overall, we reiterated that current inflationary dynamics will remain entrenched & the forces that supported a 60/40 portfolio will likely dissipate.

https://twitter.com/prometheusmacro/status/1669422720470208526?s=20

6. Next, we shared the latest insights for the weekly release of MBA Mortgage Applications data.

https://twitter.com/prometheusmacro/status/1669723842820947971?s=20

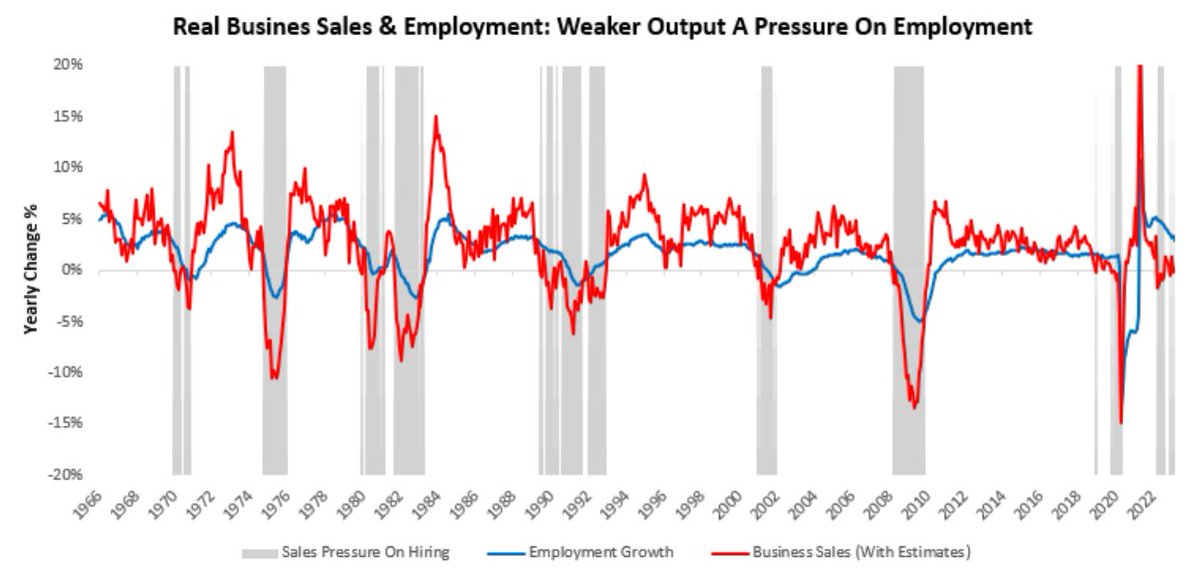

7. This was further complemented with an analysis of the Weekly Claims Data.

https://twitter.com/prometheusmacro/status/1669739618386714628?s=20

8. Finally, we concluded with the analysis of Retail Sales. Overall, we suggested that the recent increse in retail sales will likely flow through to an increase in #consumption, bringing real retail sales out of contractionary territory.

https://twitter.com/prometheusmacro/status/1670039452771557377?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter