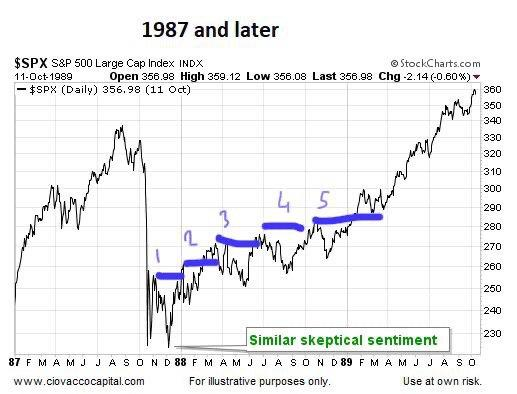

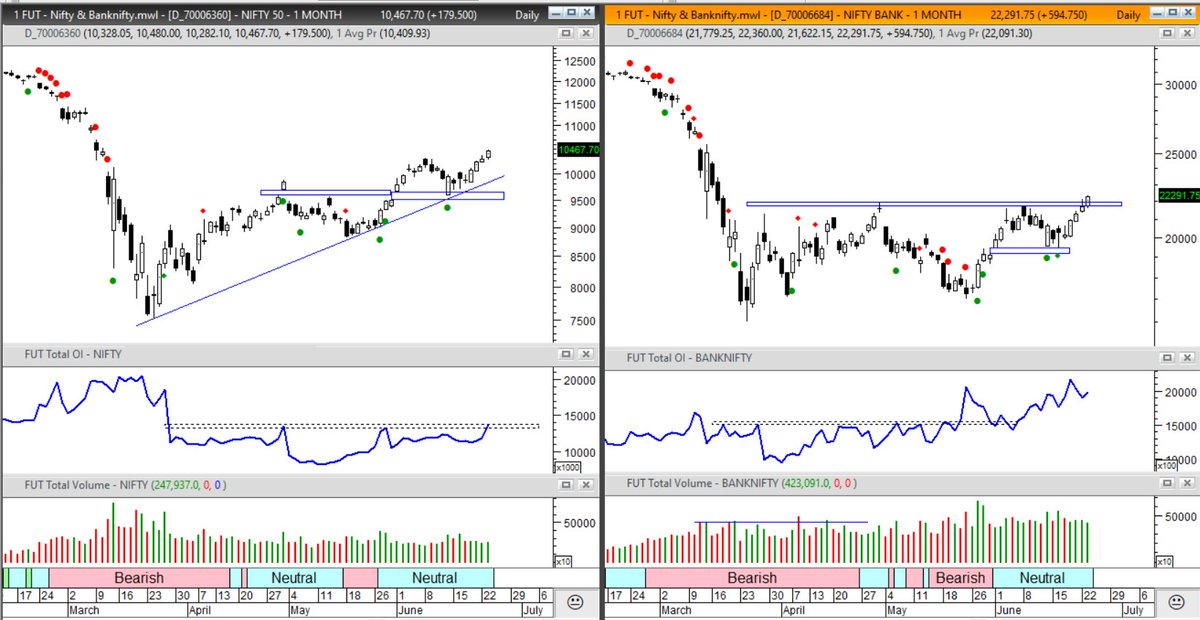

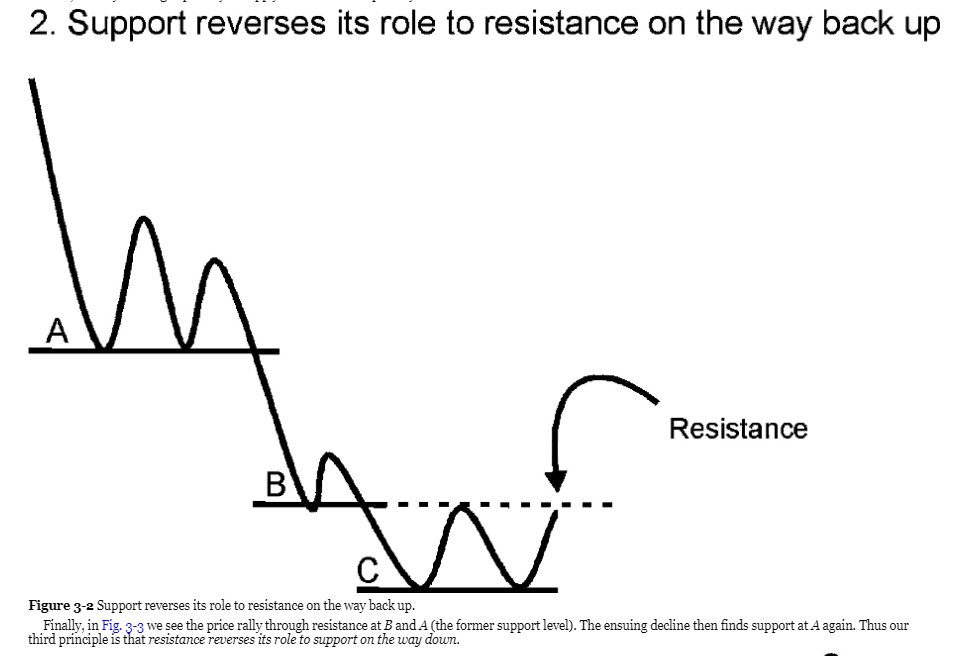

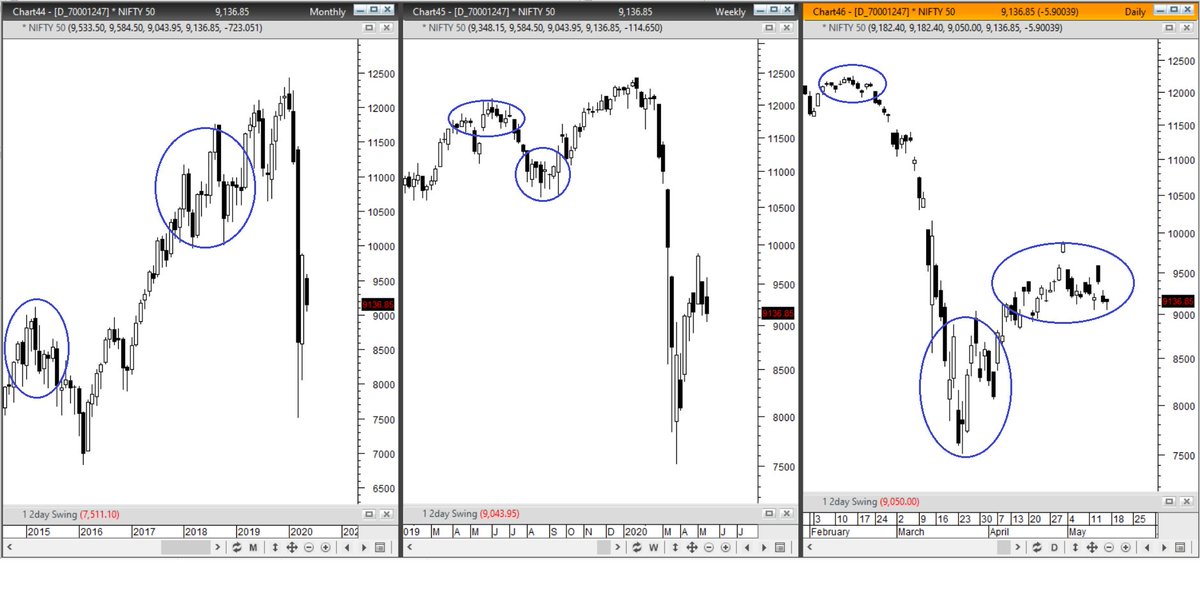

#Nifty50 Index chart shows "Step and Stairway pattern"

Classic Bullish Reversal #Nifty

• • •

Missing some Tweet in this thread? You can try to

force a refresh