⚡️Fueling the future of #crypto & #DeFi. Follow us to learn about fascinating #blockchain projects—努力推动区块链市场的发展。关注我们,一起了解更多迷人的 #blockchain 项目 ALWAYS NFA! DYOR!

How to get URL link on X (Twitter) App

1. Although we love crypto, we believe that many of the projects out there provide no/marginal utility to users. You rarely see protocols like @Bitcoin and @THORChain that actually offer a clear use case, solving real problems. We believe @VoltixVault could be another such case.

1. Although we love crypto, we believe that many of the projects out there provide no/marginal utility to users. You rarely see protocols like @Bitcoin and @THORChain that actually offer a clear use case, solving real problems. We believe @VoltixVault could be another such case.

1. @THORChain has recently reached the magic number of over 1million L1 swaps on Chaosnet, which is a significant milestone and an indication of increasing user demand.

1. @THORChain has recently reached the magic number of over 1million L1 swaps on Chaosnet, which is a significant milestone and an indication of increasing user demand.

1. With over 160 projects expected to launch on @terra_money next year, new markets will be needed to accommodate that many new tokens. However, many projects may find it difficult to list on an exchange due to the lack of liquidity, high fees and lengthy approval processes.

1. With over 160 projects expected to launch on @terra_money next year, new markets will be needed to accommodate that many new tokens. However, many projects may find it difficult to list on an exchange due to the lack of liquidity, high fees and lengthy approval processes.

1. Before we go into more details about @play_nity, let us first look at the NFT and gaming market in general. Recently the NFT market on Opensea noted more than a 1000% increase in monthly volume, with monthly transactions count reaching over 2million.

1. Before we go into more details about @play_nity, let us first look at the NFT and gaming market in general. Recently the NFT market on Opensea noted more than a 1000% increase in monthly volume, with monthly transactions count reaching over 2million.

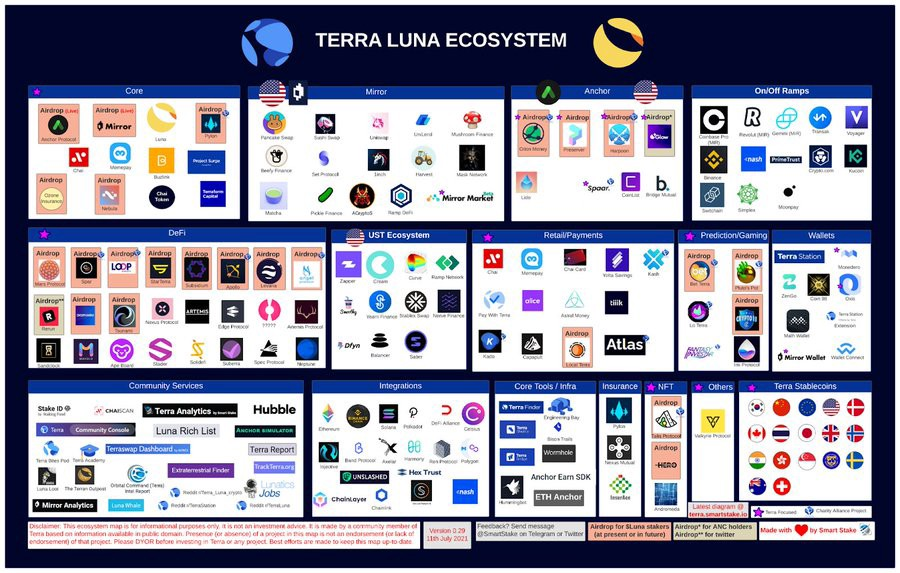

1. Before discussing 12 projects, lets introduce @terra_money. Terra is a smart contract blockchain network that offers stablecoins in a decentralized way. Terra stablecoins and the native LUNA token are both price-steady and growth-driven, thanks to its dual coin system.

1. Before discussing 12 projects, lets introduce @terra_money. Terra is a smart contract blockchain network that offers stablecoins in a decentralized way. Terra stablecoins and the native LUNA token are both price-steady and growth-driven, thanks to its dual coin system.

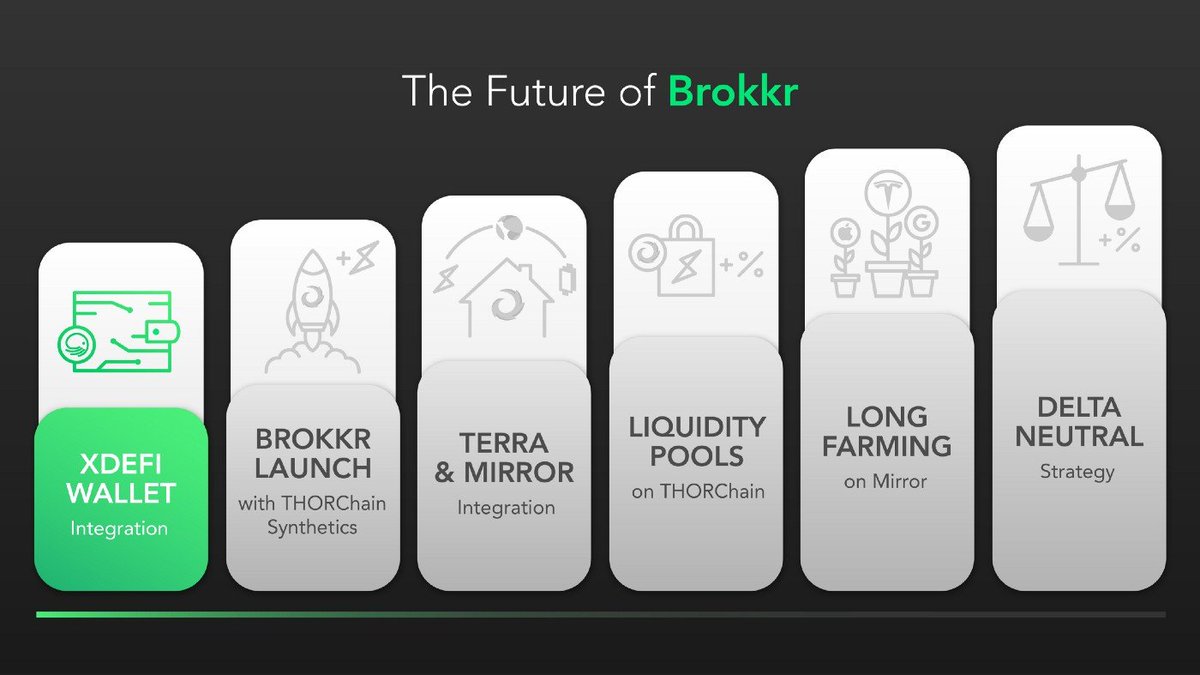

1. @BrokkrFinance's goal is to make DeFi investing accessible to everyone. They intend to be a one-stop platform for all types of investment services. Initially, this will include synthetics, saving, lending, borrowing, staking &ETFs, but in the future, their offering will expand

1. @BrokkrFinance's goal is to make DeFi investing accessible to everyone. They intend to be a one-stop platform for all types of investment services. Initially, this will include synthetics, saving, lending, borrowing, staking &ETFs, but in the future, their offering will expand

1. Lending against your collateral is a common practice in the Defi space. @anchor_protocol alone has a total borrowing volume of 1.28bln. If a loan surpasses 60% of its LTV on Anchor, the borrower's collateral gets liquidated, which is likely when prices fluctuate significantly.

1. Lending against your collateral is a common practice in the Defi space. @anchor_protocol alone has a total borrowing volume of 1.28bln. If a loan surpasses 60% of its LTV on Anchor, the borrower's collateral gets liquidated, which is likely when prices fluctuate significantly.

1. Normally, to receive rewards and airdrops, you need to place your LUNA token into a vault for a no. of days, which means that they become illiquid for that period. Alternatively, you can, e.g., generate bLUNA and then use it as collateral to take loans, provide liquidity, etc.

1. Normally, to receive rewards and airdrops, you need to place your LUNA token into a vault for a no. of days, which means that they become illiquid for that period. Alternatively, you can, e.g., generate bLUNA and then use it as collateral to take loans, provide liquidity, etc.

1. Blockchain interoperability is like using multiple blockchains as they were one, which means no barriers in communication between them exist. Many of the applications that run on one platform today will benefit the industry more if they run on multiple platforms simultaneously

1. Blockchain interoperability is like using multiple blockchains as they were one, which means no barriers in communication between them exist. Many of the applications that run on one platform today will benefit the industry more if they run on multiple platforms simultaneously

1. @WhiteWhaleTerra created a product that enables small players to profit from arbitraging opportunities that usually would only be available to large whale investors, bots, and technical experts, while also providing additional protection barriers to the @terra_money UST peg.

1. @WhiteWhaleTerra created a product that enables small players to profit from arbitraging opportunities that usually would only be available to large whale investors, bots, and technical experts, while also providing additional protection barriers to the @terra_money UST peg.

1. The @nebula_protocol is a revolutionary DeFi solution that allows users to create customized dynamic ETFs (clusters) and indeces that mimic the movement of multiple crypto assets.

1. The @nebula_protocol is a revolutionary DeFi solution that allows users to create customized dynamic ETFs (clusters) and indeces that mimic the movement of multiple crypto assets.

1. @ProtocolVoid provides a service where one can deposit a fixed amount to a contract and then withdraw it to a brand-new wallet with the help of a cryptic phrase, thus making the funds untraceable back to the original wallet.

1. @ProtocolVoid provides a service where one can deposit a fixed amount to a contract and then withdraw it to a brand-new wallet with the help of a cryptic phrase, thus making the funds untraceable back to the original wallet.

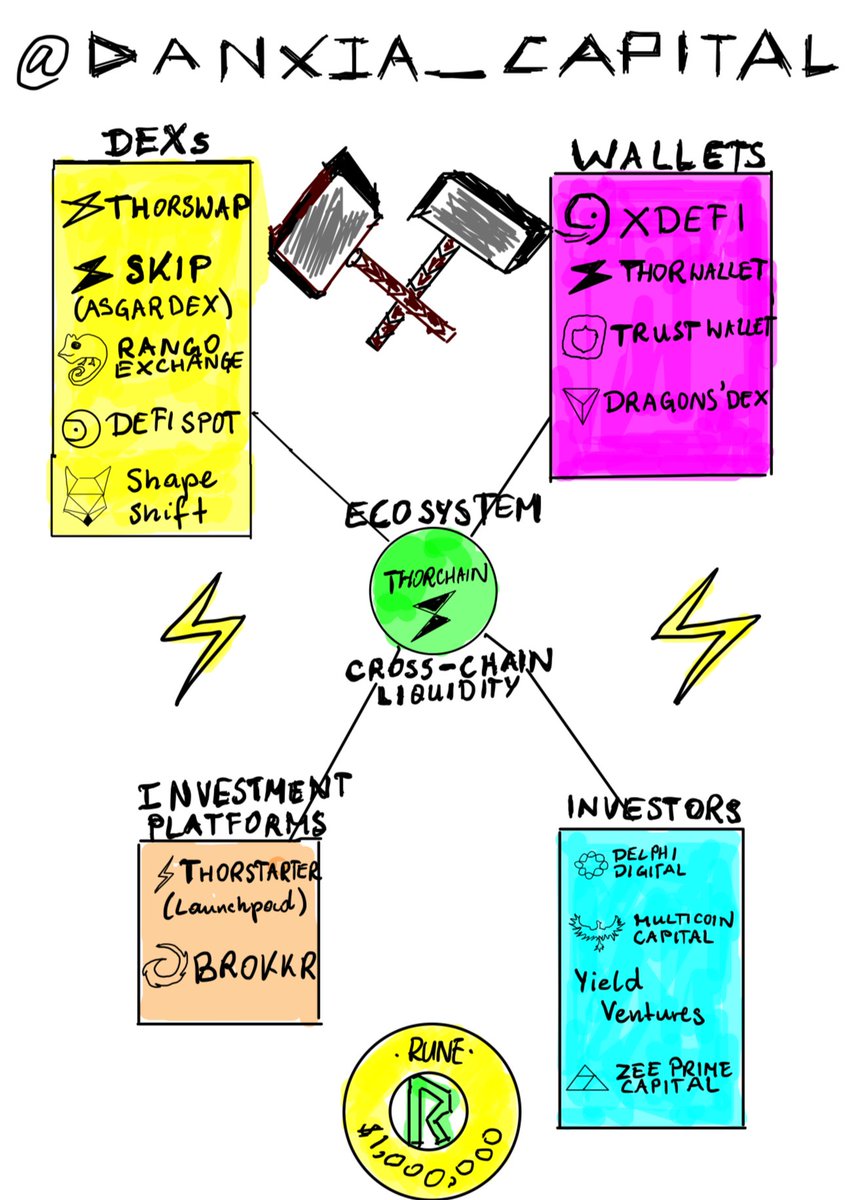

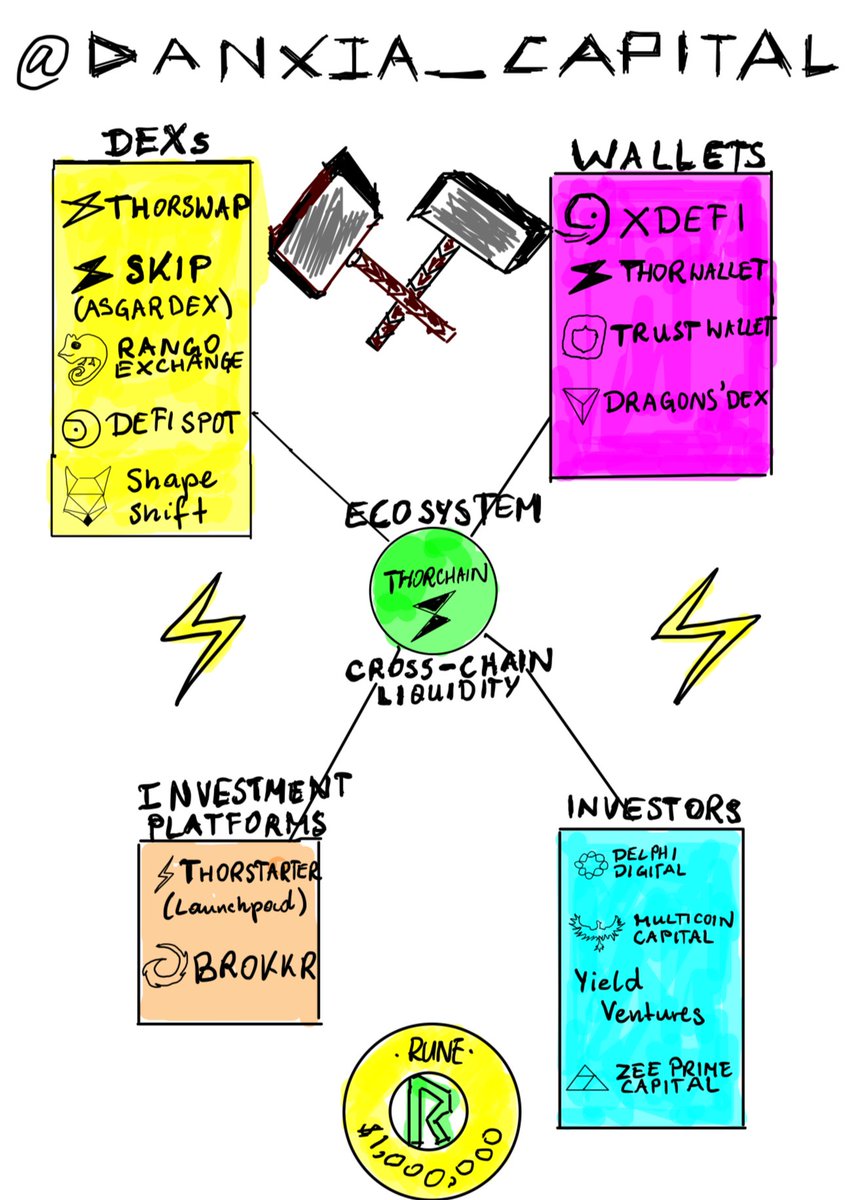

1 @THORSwap is the leading multi-chain DEX built on top of @THORChain, the world's most advanced cross-chain liquidity protocol. It allows swapping assets across chains in a permissionless, trustless, and non-custodial manner, something that has not been possible in crypto before

1 @THORSwap is the leading multi-chain DEX built on top of @THORChain, the world's most advanced cross-chain liquidity protocol. It allows swapping assets across chains in a permissionless, trustless, and non-custodial manner, something that has not been possible in crypto before

1. @astroport_fi is a next-generation AMM, where travellers from all over the Terra galaxy (Mirrans, Terrans, Anchorians, Martians, Levanians and more) meet to trustlessly exchange assets.

1. @astroport_fi is a next-generation AMM, where travellers from all over the Terra galaxy (Mirrans, Terrans, Anchorians, Martians, Levanians and more) meet to trustlessly exchange assets.

1. @THORChain is currently the most advanced operational liquidity protocol that, through its dApp @THORSwap, allows the cross-chain swapping of assets. This contribution to the #DeFi space is so significant that $RUNE has the potential to be amongst the top 10 crypto-tokens.

1. @THORChain is currently the most advanced operational liquidity protocol that, through its dApp @THORSwap, allows the cross-chain swapping of assets. This contribution to the #DeFi space is so significant that $RUNE has the potential to be amongst the top 10 crypto-tokens.

1. Some believe that THORSwap is just a DEX interface. NO! @THORSwap is much more than that. It provides a decentralised cross-chain trading experience offering many services and products that are laid out below.

1. Some believe that THORSwap is just a DEX interface. NO! @THORSwap is much more than that. It provides a decentralised cross-chain trading experience offering many services and products that are laid out below.

1. First, recall the difference between CEXs & DEXs. CEXs take custody of assets, provide liquidity by matching user requests through order books/P2P platforms. In contrast, DEXs never take custody of assets and liquidity is provided by liquidity providers through liquidity pools

1. First, recall the difference between CEXs & DEXs. CEXs take custody of assets, provide liquidity by matching user requests through order books/P2P platforms. In contrast, DEXs never take custody of assets and liquidity is provided by liquidity providers through liquidity pools

1. Before we go into explaining different projects, we first need to recall what @THORChain is. It is the world’s first operational liquidity protocol that enables via its many dApps the swapping of native assets across multiple blockchains.

1. Before we go into explaining different projects, we first need to recall what @THORChain is. It is the world’s first operational liquidity protocol that enables via its many dApps the swapping of native assets across multiple blockchains.

1. @CoinwebOfficial created a cross-chain computation platform that makes the blockchain ecosystem more user-friendly, more collaborative, better connected, and accessible to everyone.

1. @CoinwebOfficial created a cross-chain computation platform that makes the blockchain ecosystem more user-friendly, more collaborative, better connected, and accessible to everyone.

1.@Thorstarter is a decentralized launchpad that brings deep liquidity to long-tail crypto assets right from the beginning. On the contrary, many launchpads fail to provide enough liquidity to projects, thus leading to high slippage fees and dissatisfied users.

1.@Thorstarter is a decentralized launchpad that brings deep liquidity to long-tail crypto assets right from the beginning. On the contrary, many launchpads fail to provide enough liquidity to projects, thus leading to high slippage fees and dissatisfied users.

1. @THORChain is a liquidity protocol that thanks to its interface @THORSwap allows transactions across multiple blockchains. That is really powerful stuff given that no one else out there can do it now!

1. @THORChain is a liquidity protocol that thanks to its interface @THORSwap allows transactions across multiple blockchains. That is really powerful stuff given that no one else out there can do it now!