Think long term

Not SEBI registered .Views are not a recommendation.

2 subscribers

How to get URL link on X (Twitter) App

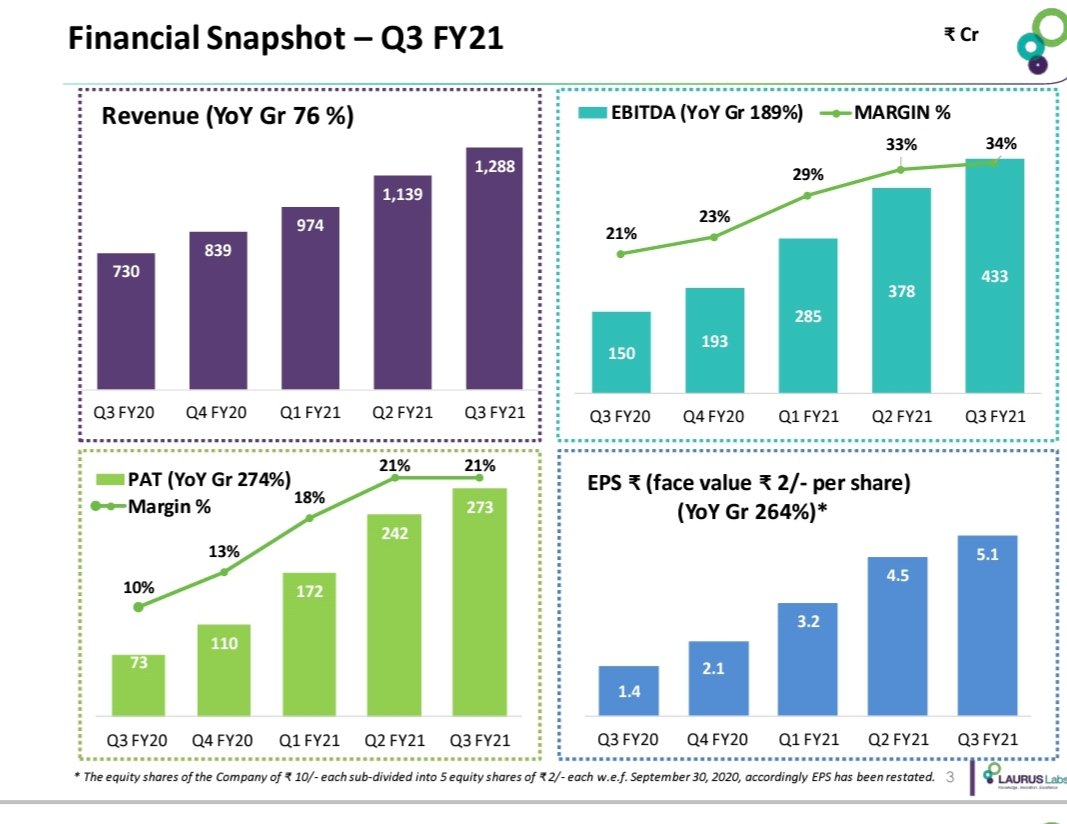

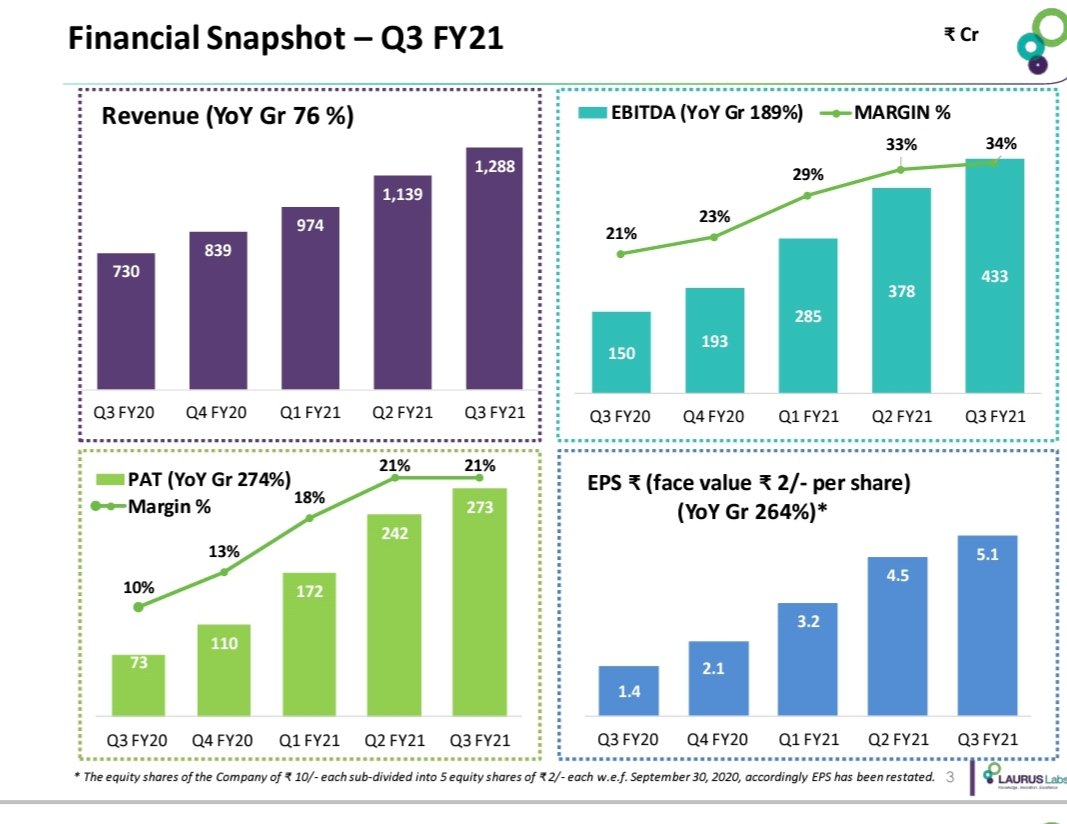

Extracts from the investor presentation by the company for March 2021

Extracts from the investor presentation by the company for March 2021

#lauruslabs

#lauruslabs

#lauruslabs 396

#lauruslabs 396

Revenue HLs

Revenue HLs

Formulations

Formulations

API Business

API Business

Airtel Business rev up by 9.2% yoy back of strong demand for connectivity and solutions

Airtel Business rev up by 9.2% yoy back of strong demand for connectivity and solutions

3 horizon strategy

3 horizon strategy

Generic APIs

Generic APIs

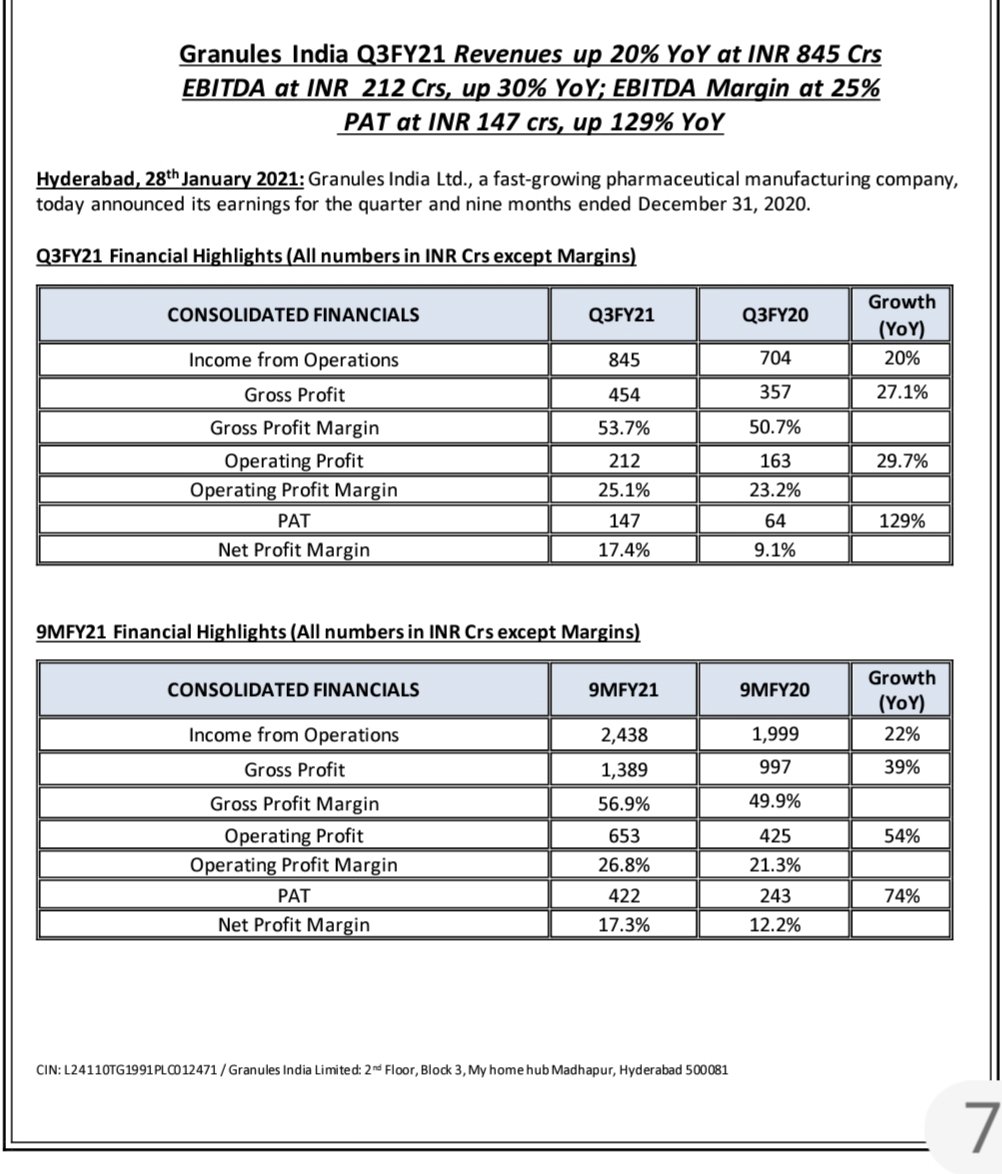

EBITDA up 29.7% yoy, +190 bps margin expansion yoy on changing product mix with higher contribution from FD and PFI , improved operational efficiencies from higher capacity utilization

EBITDA up 29.7% yoy, +190 bps margin expansion yoy on changing product mix with higher contribution from FD and PFI , improved operational efficiencies from higher capacity utilization

Popular segment sales down 6.7%, led by decline 5.7% in priority states Increased consumer prices, unfav state mix contributed to decline

Popular segment sales down 6.7%, led by decline 5.7% in priority states Increased consumer prices, unfav state mix contributed to decline

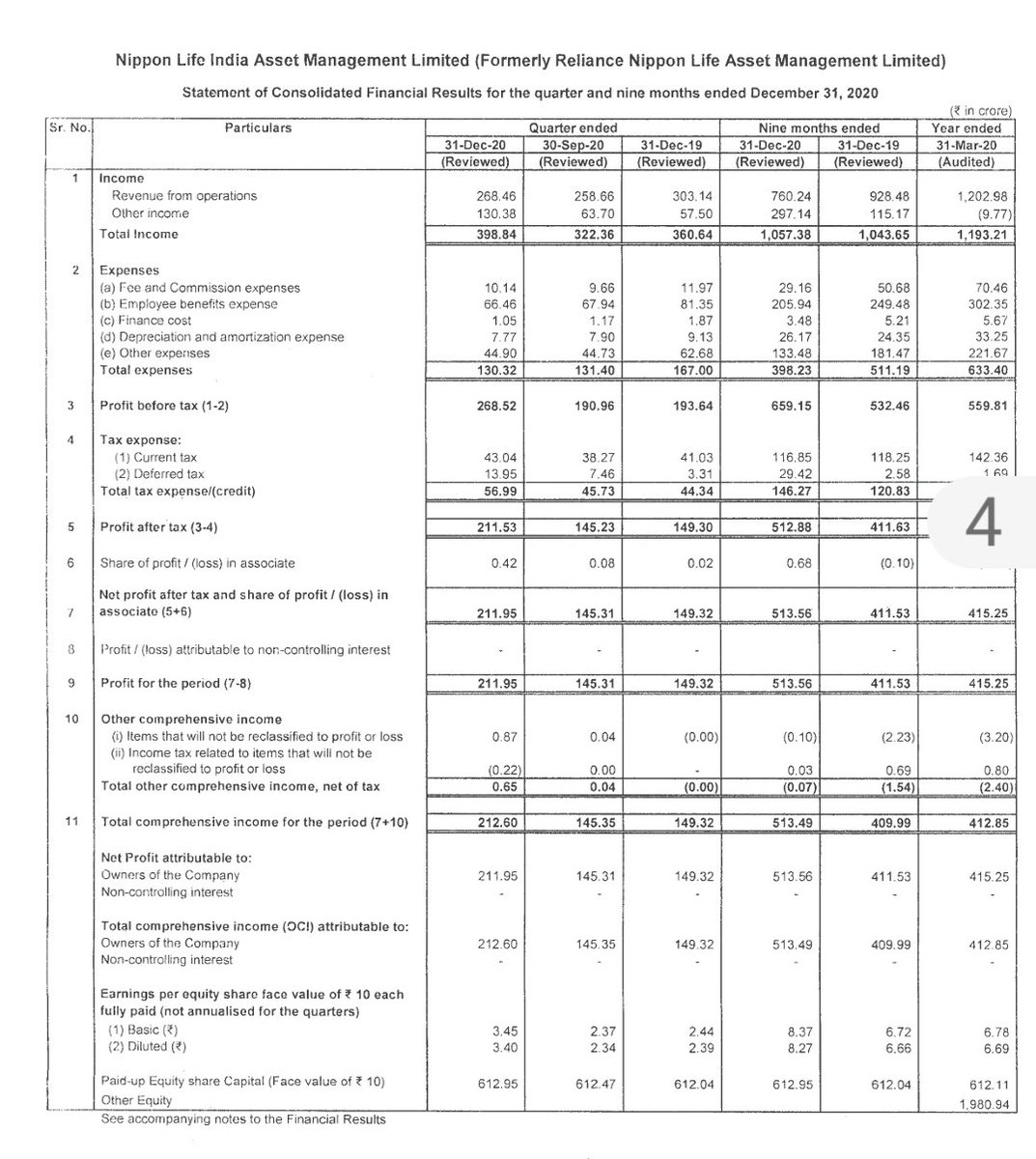

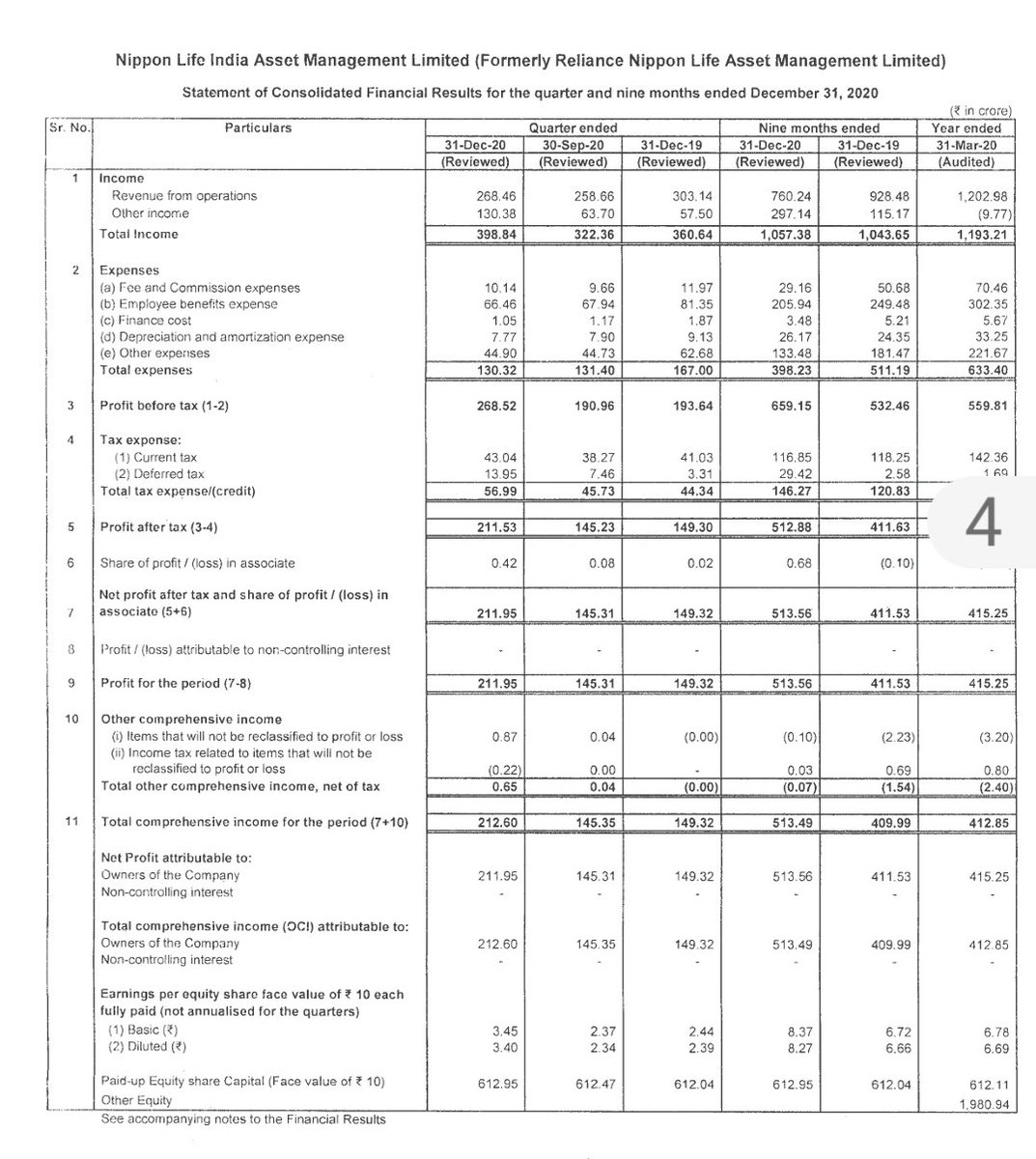

Retail assets 26% to NIMF's AUM

Retail assets 26% to NIMF's AUM

50 % mkt share in structural steel tubes 9mfy21,sales vol CAGR 27% fy11-20

50 % mkt share in structural steel tubes 9mfy21,sales vol CAGR 27% fy11-20

Wires&cables

Wires&cables

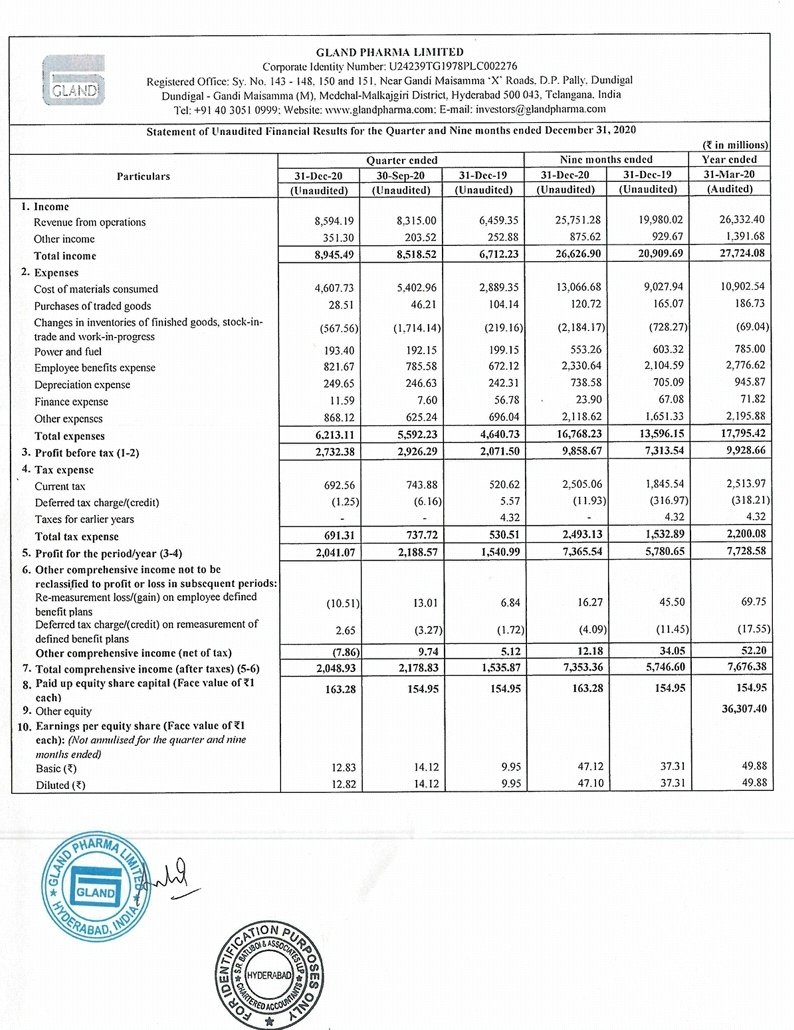

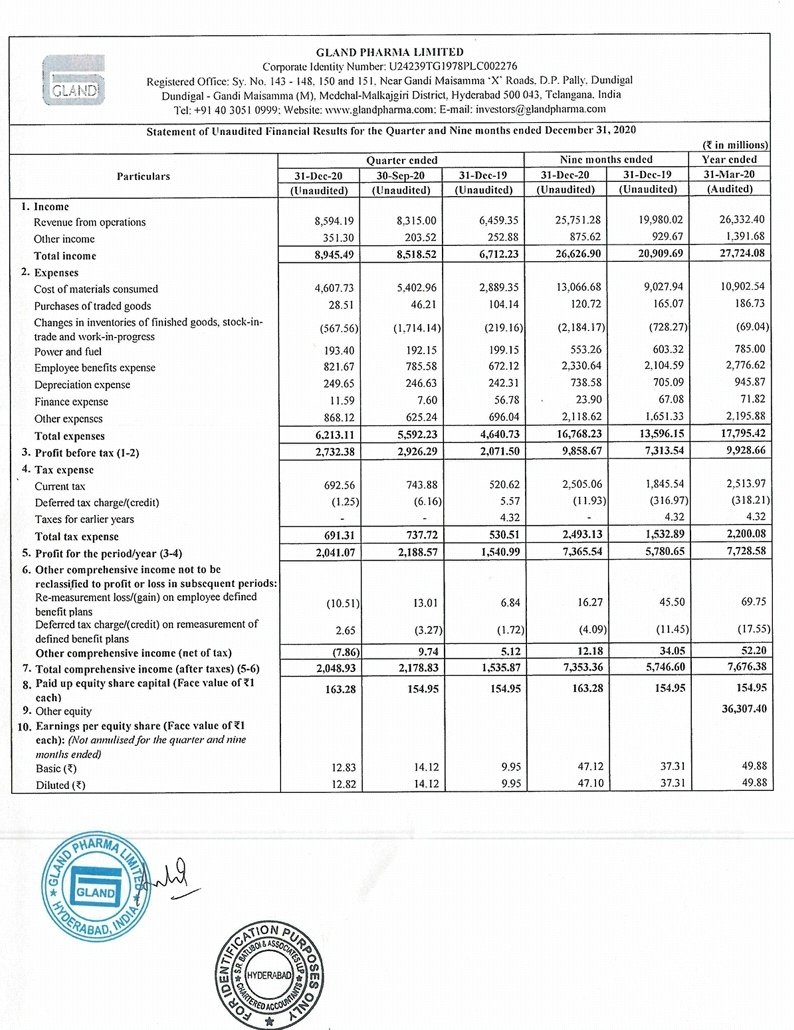

R&D expenses INR Mn

R&D expenses INR Mn

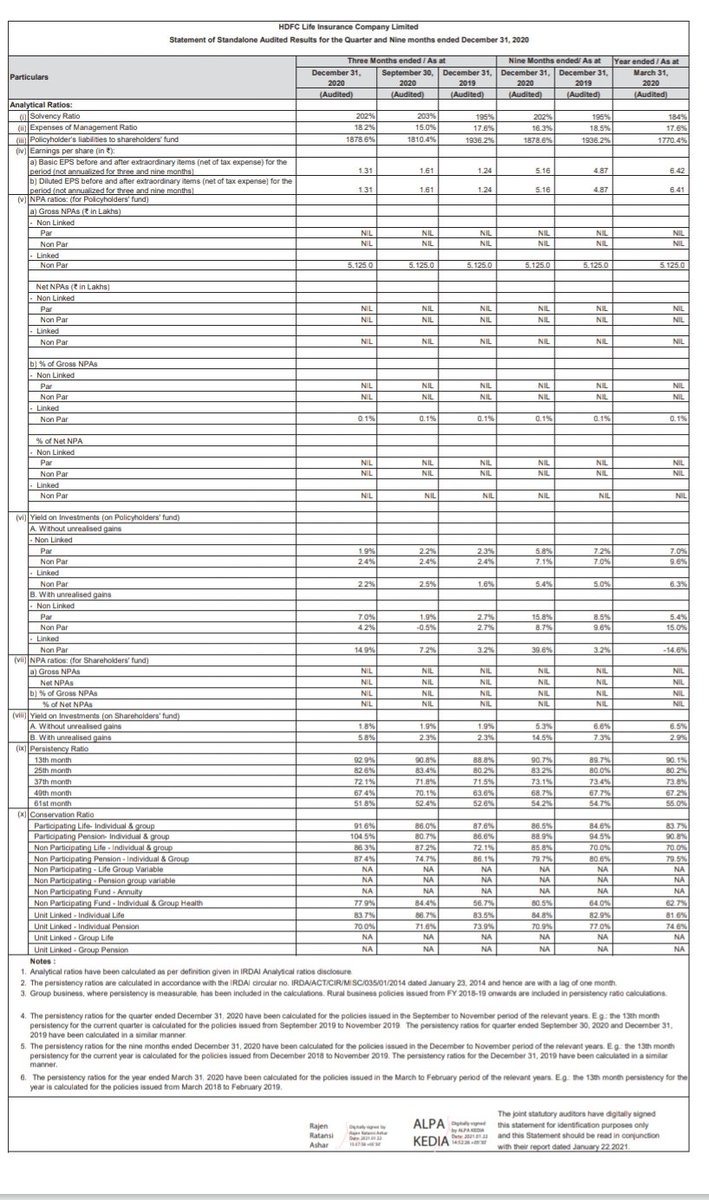

17% growth in Protection (Indl) and 42% growth in Annuity in APE terms

17% growth in Protection (Indl) and 42% growth in Annuity in APE terms

#Q3investorpresentations

#Q3investorpresentations