Cryptocurrency fanboy, investor, independent analyst. In it for the money *and* the tech. eCash, #Bitcoin, #Ethereum ⟠, and beyond. Never financial advice.

How to get URL link on X (Twitter) App

2/ This number only gives an upper bound. We can be sure it is not more, but it could be less.

2/ This number only gives an upper bound. We can be sure it is not more, but it could be less.

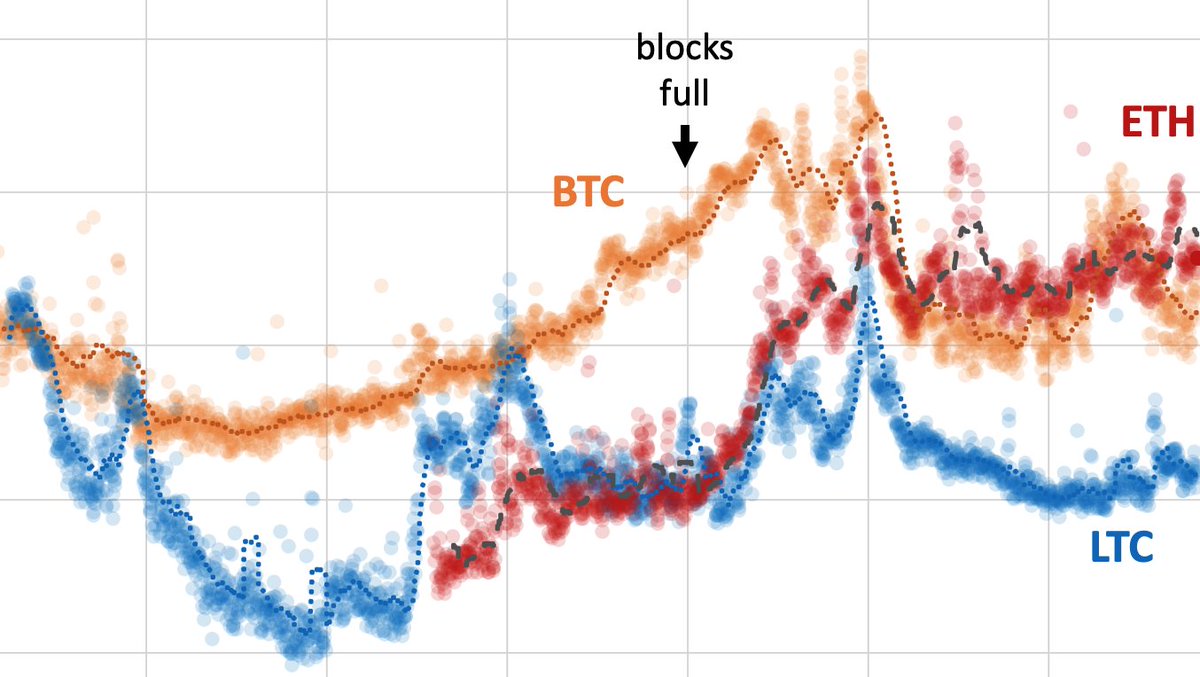

Bitcoiners often state that hash power is increasing, and therefore the security of the network must be increasing, too.

Bitcoiners often state that hash power is increasing, and therefore the security of the network must be increasing, too.