CEO/Founder and Chief Market Strategist at Hilltower Resource Advisors LLC. Boutique natural resources research firm. Geopolitics. Host @MicDropMarkets podcast

21 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/chigrl/status/1539657331352412162Port of Los Angeles Kicks Off Peak Season with Record June gcaptain.com/port-of-los-an…

https://twitter.com/globaltimesnews/status/14630893439253504095M from India

https://twitter.com/staunovo/status/1463090038330298369?t=v4MQnkjy5joUdNLoqnvDIQ&s=19

You want to know what is so crazy about this? The US is about two bills away from this insanity.

You want to know what is so crazy about this? The US is about two bills away from this insanity.

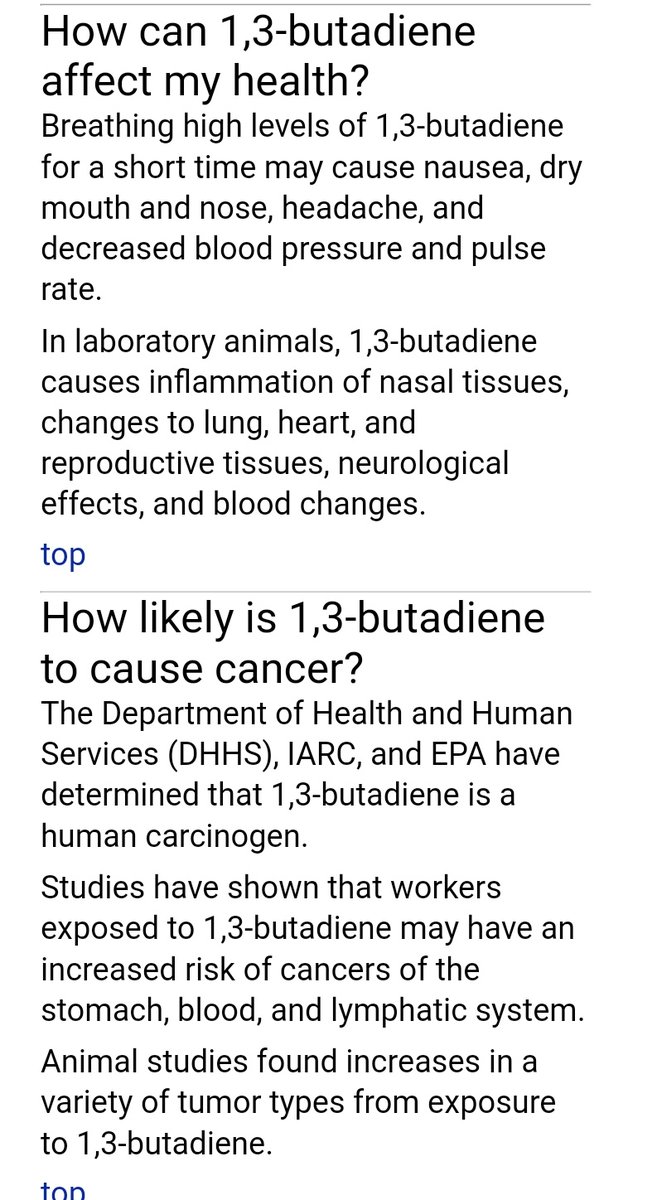

This site produces butadiene and raffinate. Combined production capacity for this facility is more than 900 million pounds per year. (both these chemicals are pretty nasty)

This site produces butadiene and raffinate. Combined production capacity for this facility is more than 900 million pounds per year. (both these chemicals are pretty nasty)

More on this (thread)

More on this (thread) https://twitter.com/JavierBlas/status/1172768100430864385?s=19

In fact they have made recent deals with #Russia >>

In fact they have made recent deals with #Russia >>