How to get URL link on X (Twitter) App

https://twitter.com/Amberdataio/status/1618379639365439494

1. Things that have never happened before are bound to occur with some regularity. Always prepare for the unexpected.

1. Things that have never happened before are bound to occur with some regularity. Always prepare for the unexpected.

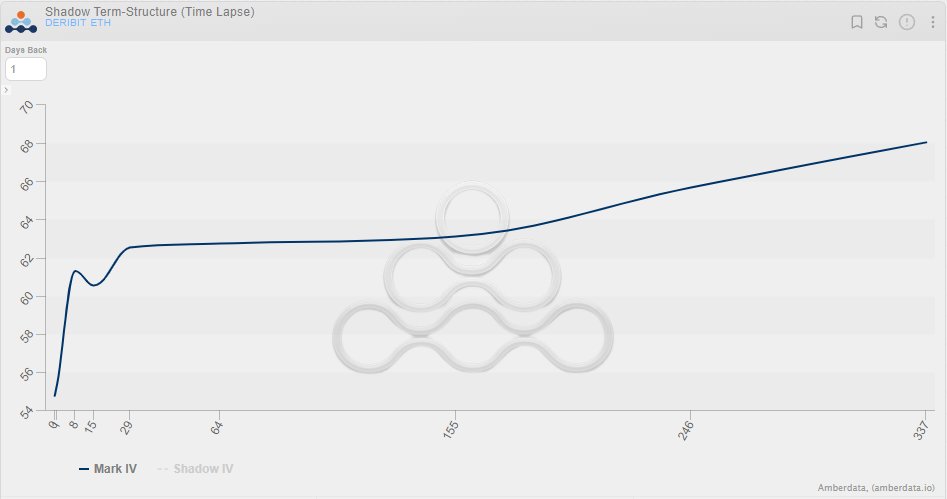

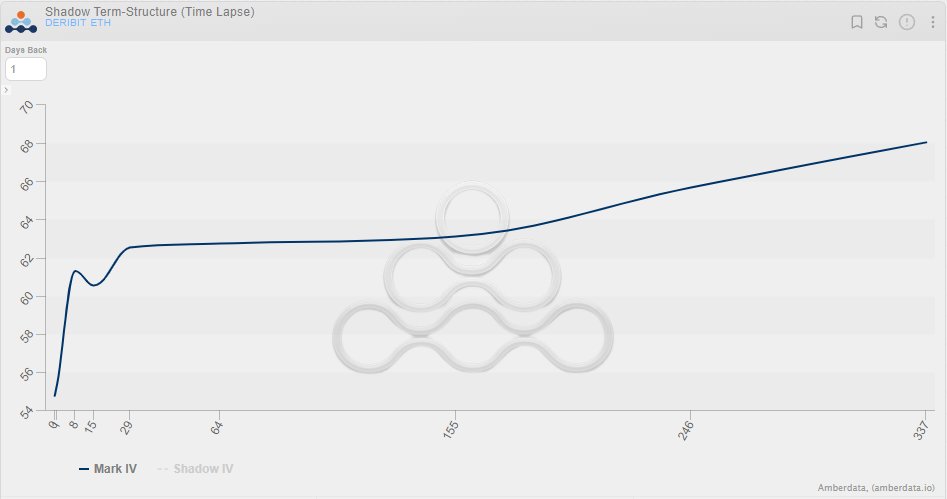

Implied volatility is one of the main parameters for pricing an option.

Implied volatility is one of the main parameters for pricing an option.