We harness the world's largest onchain/offchain database to automate alpha.

Backed by @TheWhale_hunter and @mrbenlilly

Channel: https://t.co/hxDOtWkeef

2 subscribers

How to get URL link on X (Twitter) App

2/ March through early May: Whales were quietly stacking.

2/ March through early May: Whales were quietly stacking.https://x.com/jlabsdigital/status/1919417303256756712

First off, what's ESG?

First off, what's ESG?

2/ Hitting some supply on this overnight pump.

2/ Hitting some supply on this overnight pump.

2/ The Merge is scheduled to take place on 9-15-2022

2/ The Merge is scheduled to take place on 9-15-2022

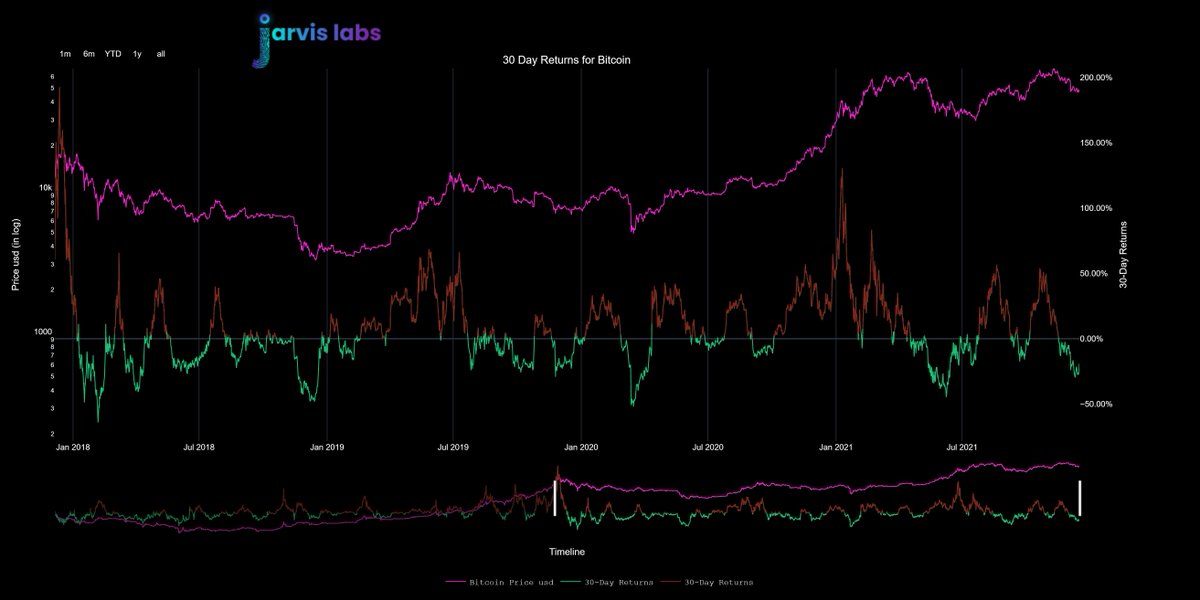

30D returns were diminishing last month. Post-December drop, the metric has seen a steady rise as the price kept bleeding, forming a strong bullish divergence. It's now back in the threshold, and closing in on the 0% line. Once cleared, we foresee a few good performance weeks.

30D returns were diminishing last month. Post-December drop, the metric has seen a steady rise as the price kept bleeding, forming a strong bullish divergence. It's now back in the threshold, and closing in on the 0% line. Once cleared, we foresee a few good performance weeks.

The last tweet thread covered 30d diminishing returns for BTC. Now it has bottomed and starting to put in higher lows (bullish divergences with the price). Good for the short term, likely that in coming weeks we see the metric rising back to 0%.

The last tweet thread covered 30d diminishing returns for BTC. Now it has bottomed and starting to put in higher lows (bullish divergences with the price). Good for the short term, likely that in coming weeks we see the metric rising back to 0%.