How to get URL link on X (Twitter) App

2/9

2/9

Link to the indicator:

Link to the indicator:

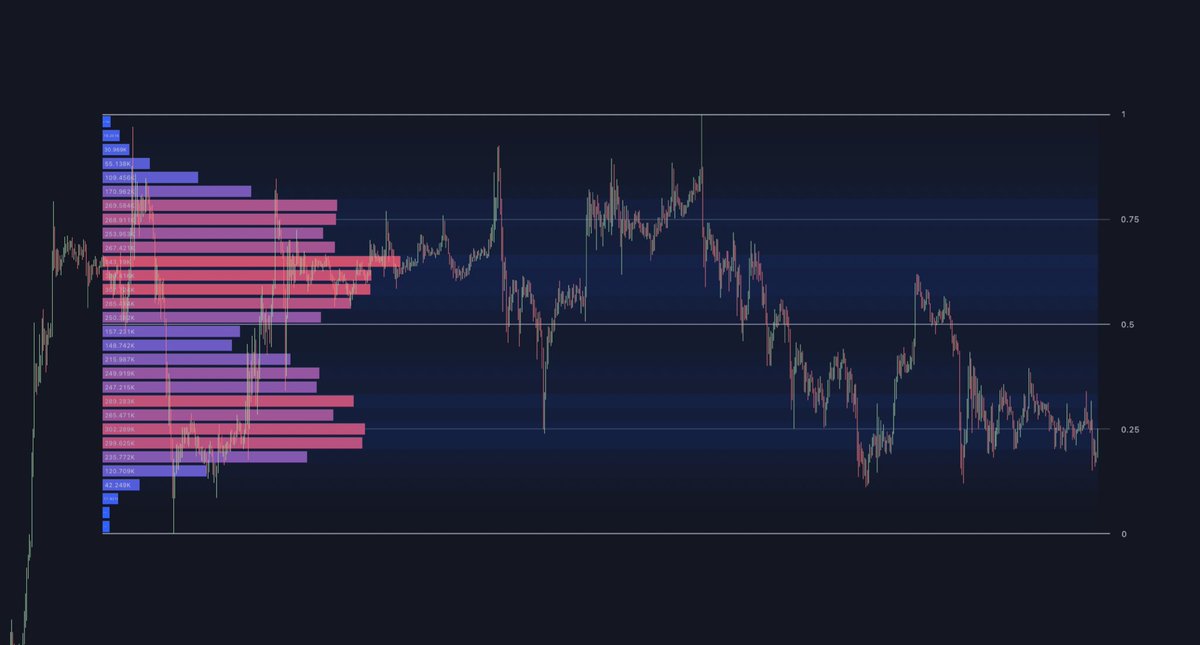

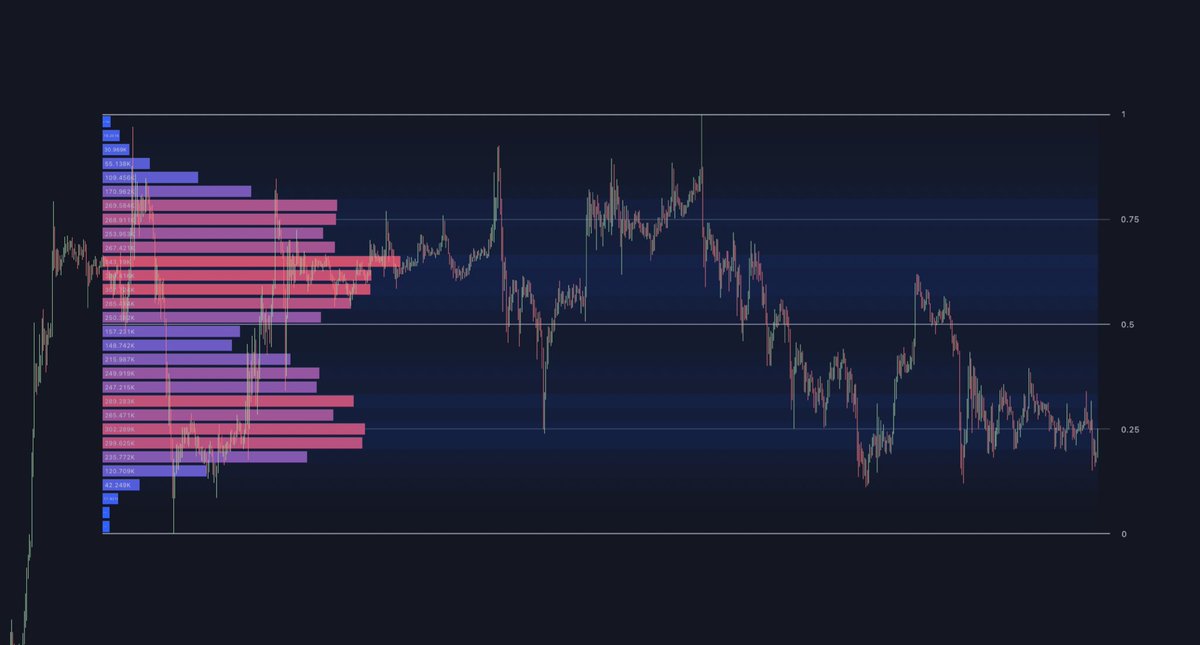

CRVOL is an experimental indicator I've created as part of my Volume Suite script on TradingView. Seeing no other indicators implementing this concept, I decided to publish it, as it has proven to be very useful and a great alternative to other similar volume-based tools like OBV… twitter.com/i/web/status/1…

CRVOL is an experimental indicator I've created as part of my Volume Suite script on TradingView. Seeing no other indicators implementing this concept, I decided to publish it, as it has proven to be very useful and a great alternative to other similar volume-based tools like OBV… twitter.com/i/web/status/1…

How to get and use the script?

How to get and use the script?

Instructional article

Instructional article

How to get the indicator

How to get the indicator

How to get the indicator

How to get the indicator

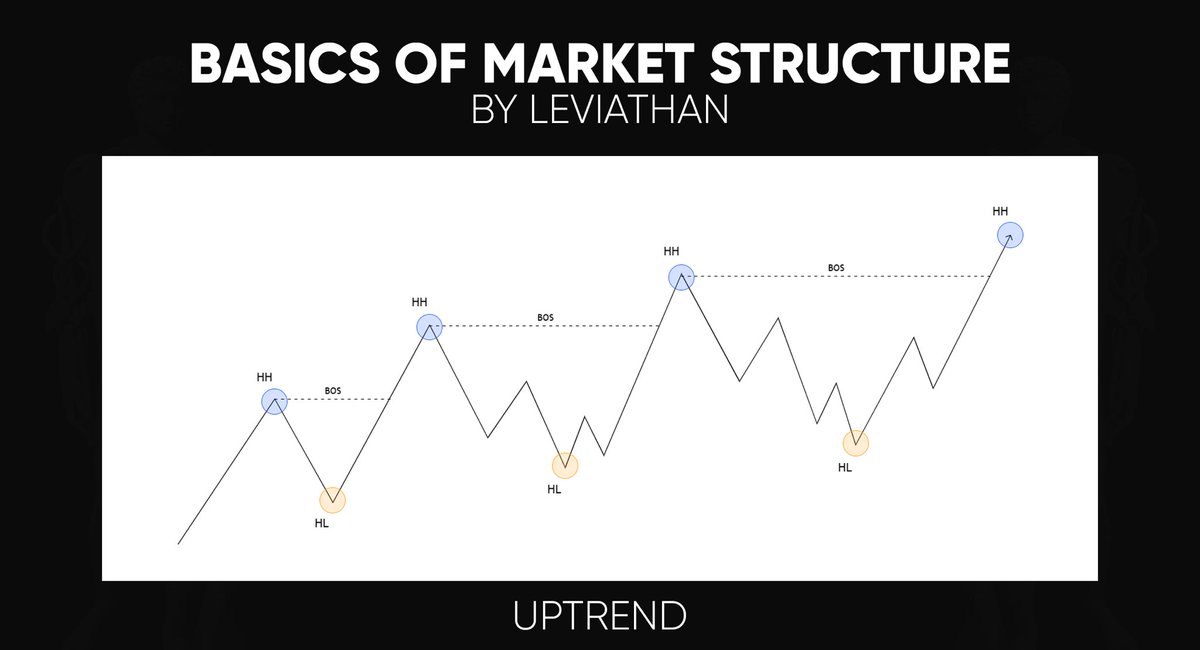

Here’s the theory behind weak and strong points and how to trade them.

Here’s the theory behind weak and strong points and how to trade them.

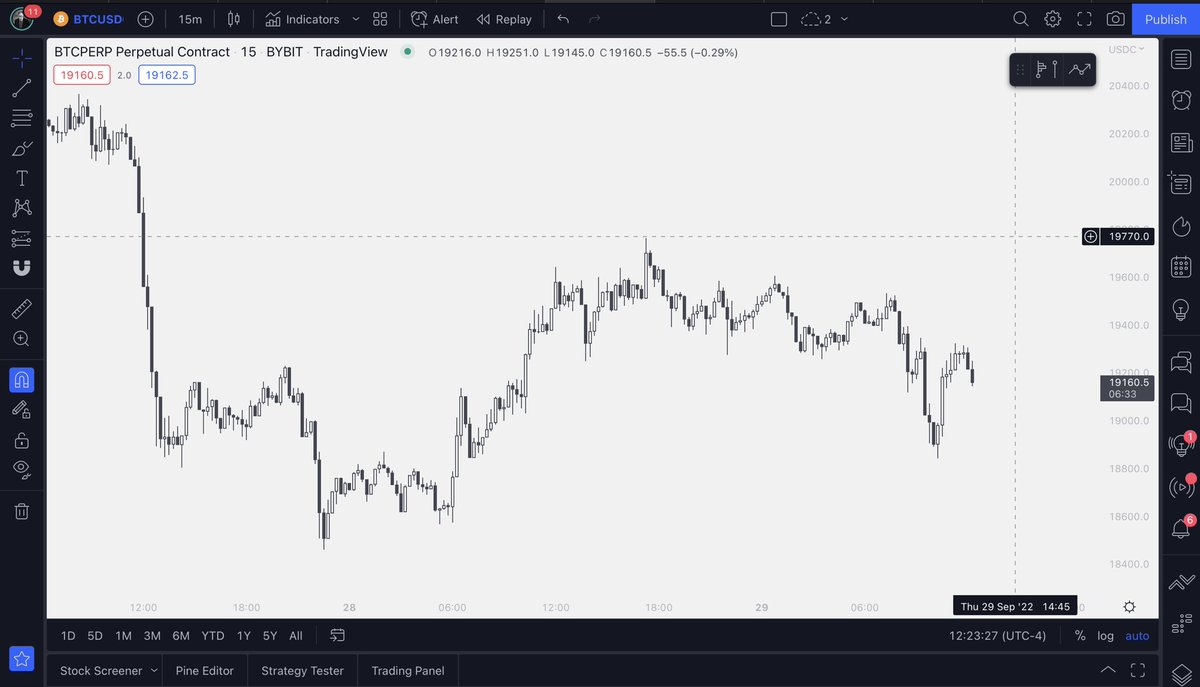

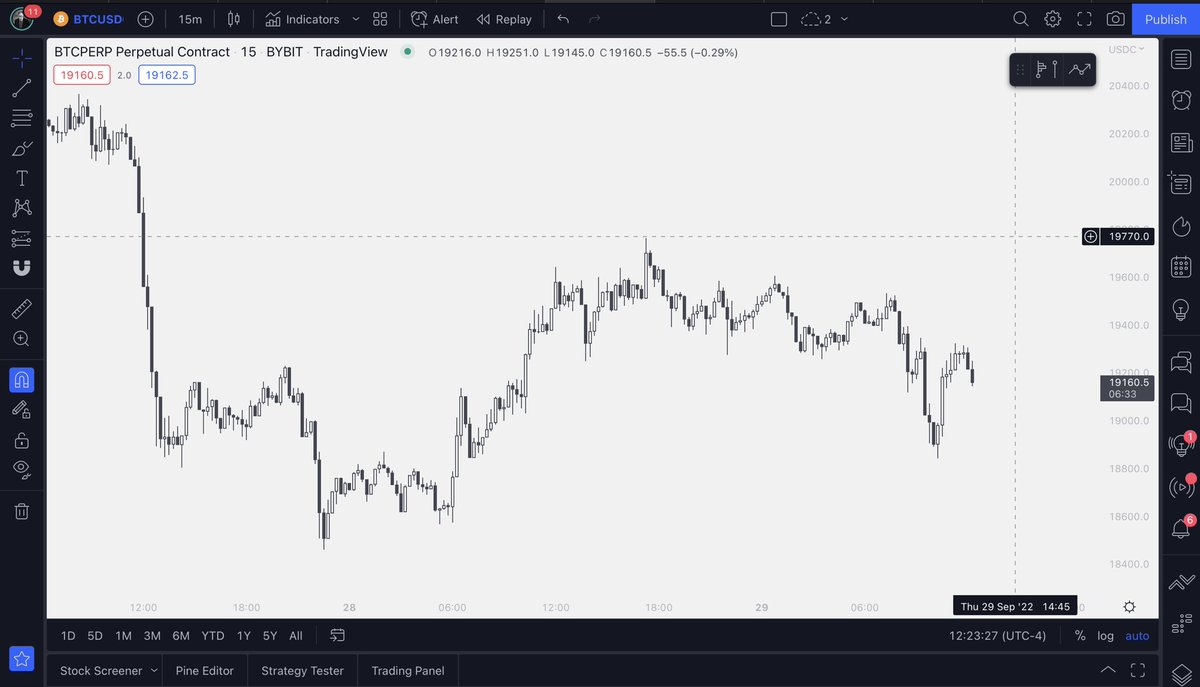

Uptrend - look for longs

Uptrend - look for longs

Support is a price level where a downtrend is expected to reverse due to a concentration of demand (interest to buy an asset)

Support is a price level where a downtrend is expected to reverse due to a concentration of demand (interest to buy an asset)