Curious on how behavioral fallacies challenge financial markets (and cryptos). Always learning new things, getting to know new people, and having a bit of fun.

2 subscribers

How to get URL link on X (Twitter) App

ADXY (Asian Dollar Basket) vs. iShares JP Morgan USD Emerging Markets Bond ETF

ADXY (Asian Dollar Basket) vs. iShares JP Morgan USD Emerging Markets Bond ETF

2/11 #Europe is about to face a simultaneous endogenous & exogenous economic shock. The #COVID19 is creating multi-level disruptions, and the #EU will need to act swiftly to address them. However, history has shown that #EU's decision-making process is very rigid. #euro

2/11 #Europe is about to face a simultaneous endogenous & exogenous economic shock. The #COVID19 is creating multi-level disruptions, and the #EU will need to act swiftly to address them. However, history has shown that #EU's decision-making process is very rigid. #euro

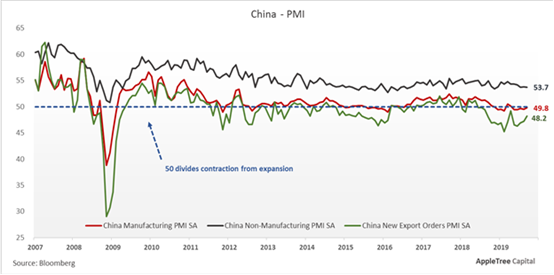

2) Why would China need to clamp down capital flight if the #Yuan is undervalued and/or FX reserves are more than enough, as China claims?

2) Why would China need to clamp down capital flight if the #Yuan is undervalued and/or FX reserves are more than enough, as China claims?

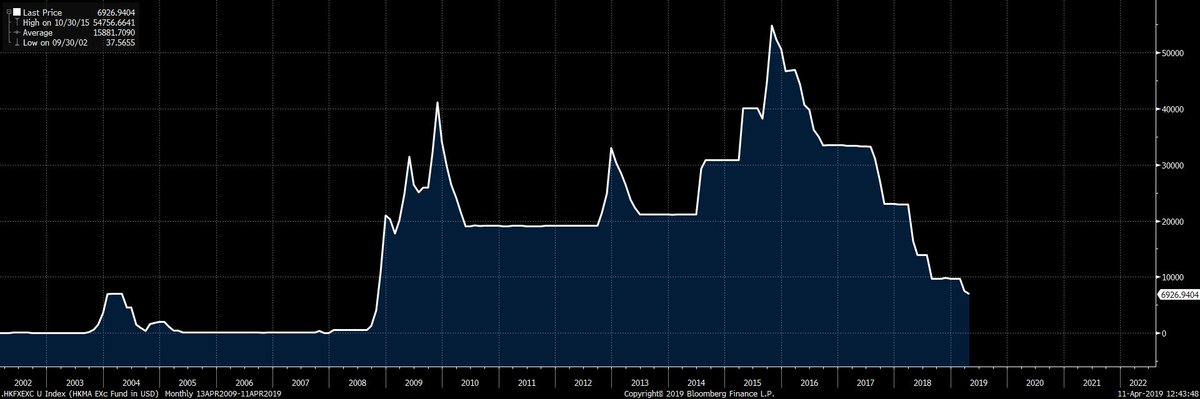

#HongKong has FX Reserves of $438bn (March 2019) plus another $6.9bn from the HKMA Exchange Fund which is there to stabilize the #HKD peg. Looking at the HKMA Exchange fund it is clear that money has been leaving HK. Since 2016 the fund has gone from $55bn to $7bn.

#HongKong has FX Reserves of $438bn (March 2019) plus another $6.9bn from the HKMA Exchange Fund which is there to stabilize the #HKD peg. Looking at the HKMA Exchange fund it is clear that money has been leaving HK. Since 2016 the fund has gone from $55bn to $7bn.