A long standing, large, and permanent transition has taken place.

The panic of 2007-8 showed how the system can morph, but in a longer time horizon than we usually think of."

Gary Gordon @YaleSOM

- too little accrual in good times

- too much in bad times

- procyclical effects

Pecipitated shift to expected loan reserve model.

This front-loads credit loss. Direct hit to income. Likely procyclical.

Ryan @nyuniversity

Ryan @nyuniversity

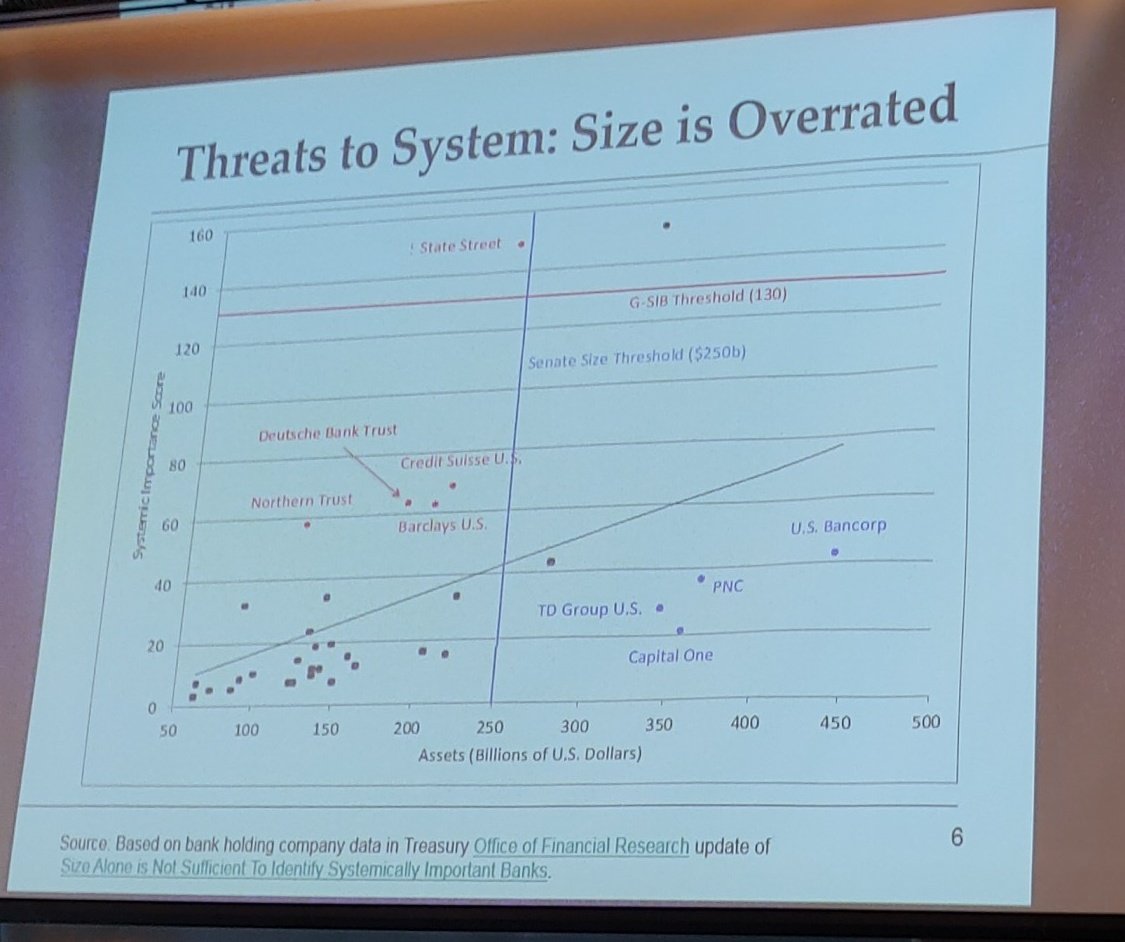

- Diminishing returns to regulation with adequately self insurance.

- Some aspects not cost effective.

- Considerable scope remains to strengthen financial system.

Kim Schoenholtz @nyuniversity

Kim Schoenholtz

+ cc @colinmclean

Recent actions overlook a number of opportunities to improve oversight.

Ex:

- UK has 3 regulators

- US has 100+

Operational risk has increased through shift to central clearing. Disclosure needed. And contingency plans.

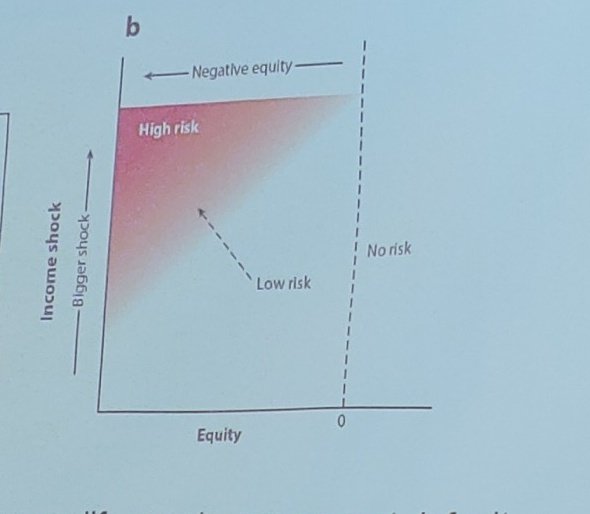

Modified double trigger model from Foote @BostonFed

Chris Foote @BostonFed

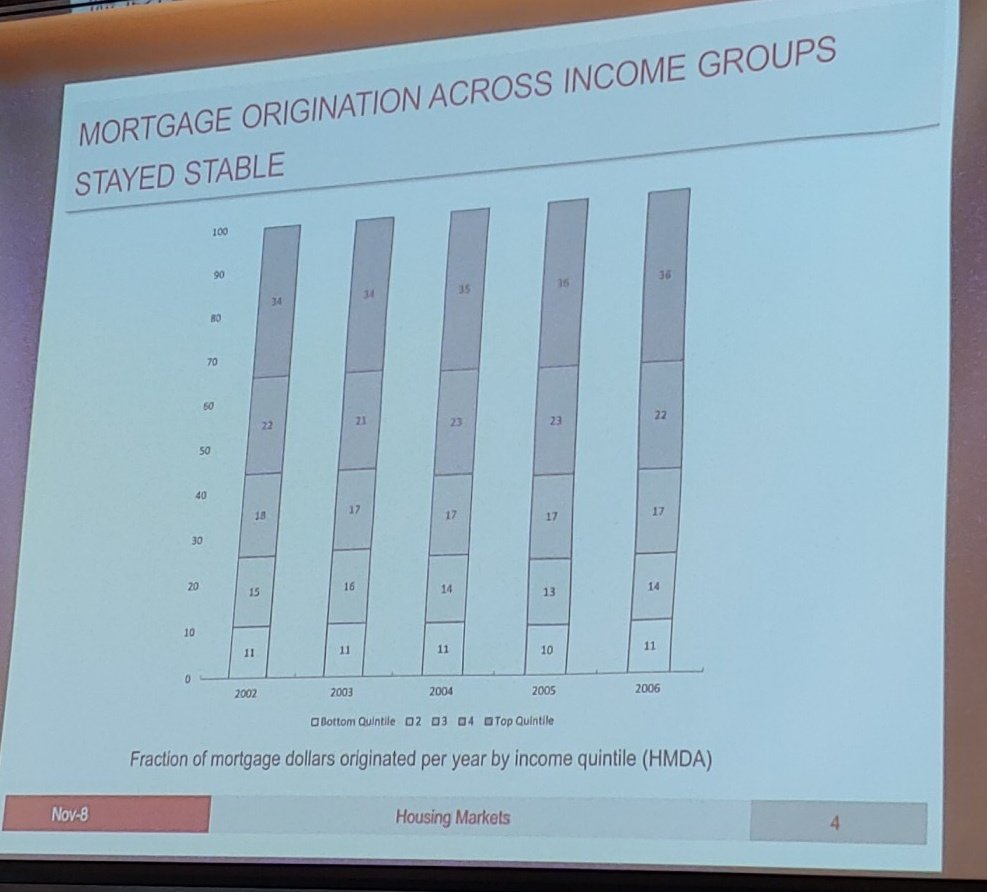

"There was no unilateral shift of credit allocation towards marginal or sub-prime borrowers."

Antoinette Schoar @MIT

Schoar (cont) #FinancialCrisisReview enfuego.

Now Deborah Lucas on the consequences of bailouts.

"Economists don't spend a lot of time looking at the cost of government actions."

Misplaced faith in large institutions."

- Bob Armstrong, President and CEO of AIG a/o February 2010.

Wasn't just one. A sustainable capital structure needed to evolve through cooperation amid chaos. Hancock et al modeled a $13B "peace dividend" to bring parties to. The table.

Peter Hancock, former CEO of AIG.

- Do not data mine. No defaults before doesn't mean none coming.

- Correlation structures are not constant.

- There are cheaters out there.

- Tim Geithner

Geithner (cont)

You have to design a system that works even if oversight isn't prescient."

- Tim Geithner

But picture this. Andrew Lo asks what dealing with the crisis was like for him physically.

Three, then five second pause....

"It was dark, hard, time."