Huh? documentcloud.org/documents/6284…

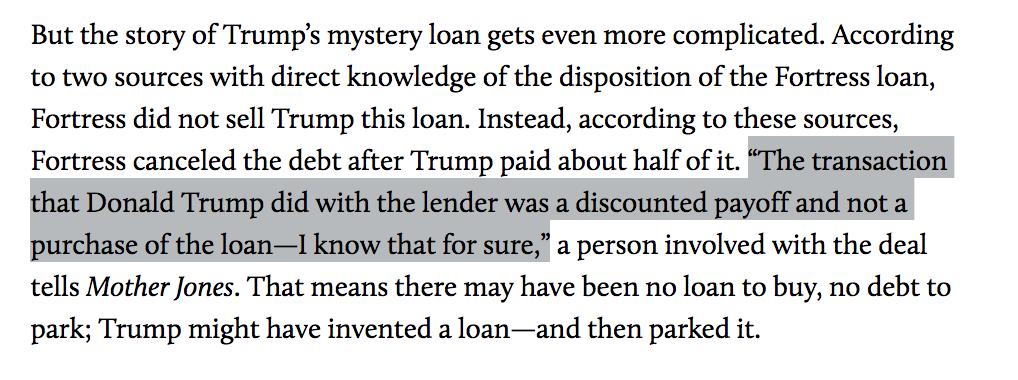

There were two loans associated with the Chicago project: a $640 million loan from Deutsche Bank and a $130 million loan through a NYC-based hedge fund called Fortress Investment Group

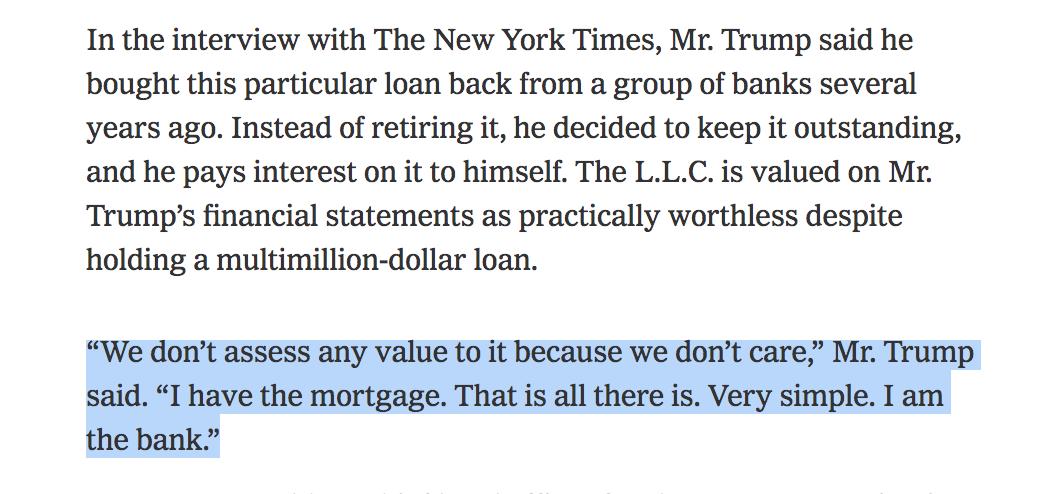

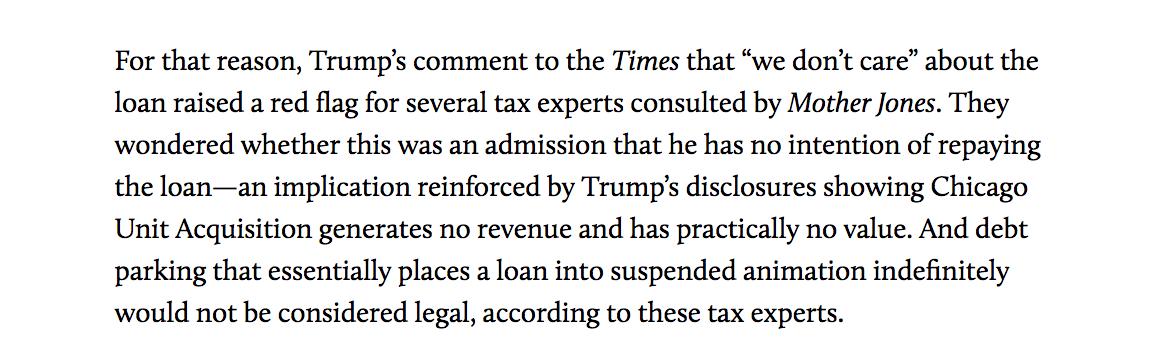

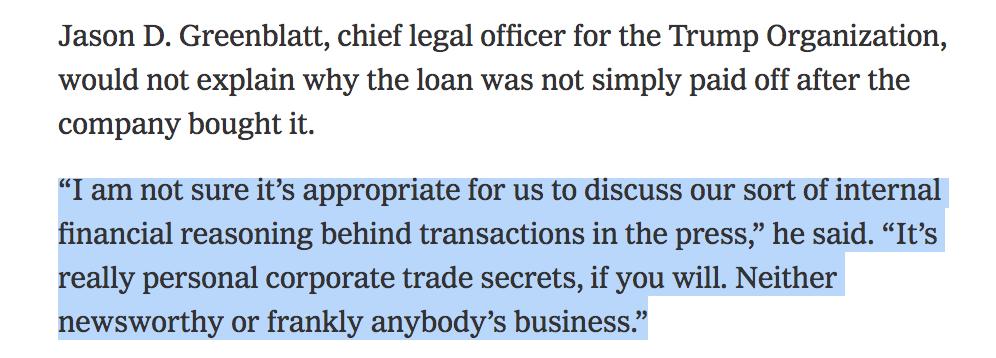

That leaves the Fortress debt.

But Trump did not purchase this debt, according to sources with direct knowledge of the transaction. The loan was cancelled.

Does this loan exist?

First, if you have a tip that advances this story, by all means get in touch motherjones.com/contribute/how…

There are also multiple investigations into Trump’s finances ongoing in New York, including one by the NY AG’s office.