How I explain Bitcoin to normies...

Bitcoin is the first invention of something on the Internet that cannot be copied. When something is scarce, it can store value, fine art and gold are some examples.

Here's some buckets that people store value in:

Gold: $8T

Stocks: $75T

Fiat: $90T

Real Estate: $220T

And now, we can store value online...

Bitcoin: $150B

We are in a post-industrial Internet age.

Bitcoin is growing from being a thimble to a bucket.

Gold: $8T

Stocks: $75T

Fiat: $90T

Real Estate: $220T

And now, we can store value online...

Bitcoin: $150B

We are in a post-industrial Internet age.

Bitcoin is growing from being a thimble to a bucket.

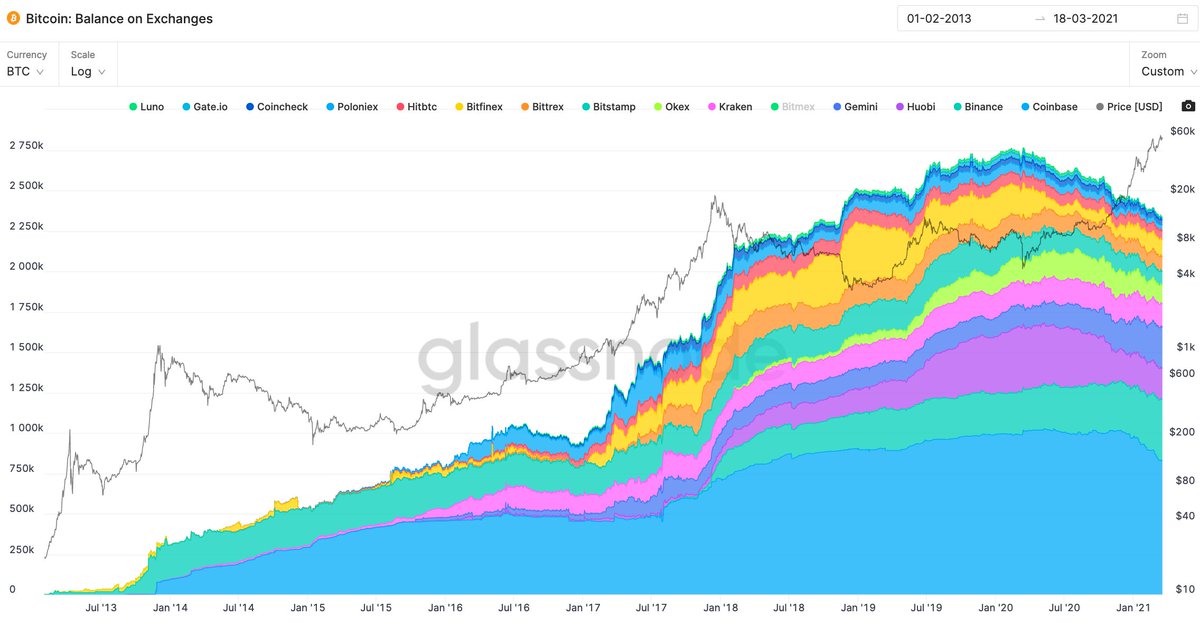

Let's look at how quickly it has grown in its 10 years.

It's on track to exceed M1 USD in the next 5 years... That's to say all the money in cash, credit card and cheque accounts, of the world reserve currency.

It's on track to exceed M1 USD in the next 5 years... That's to say all the money in cash, credit card and cheque accounts, of the world reserve currency.

What's happening, as we move from the Industrial Age to the Digital Age, is money itself is becoming digitally native and programmable.

Here's the 10,000 year view.

Here's the 10,000 year view.

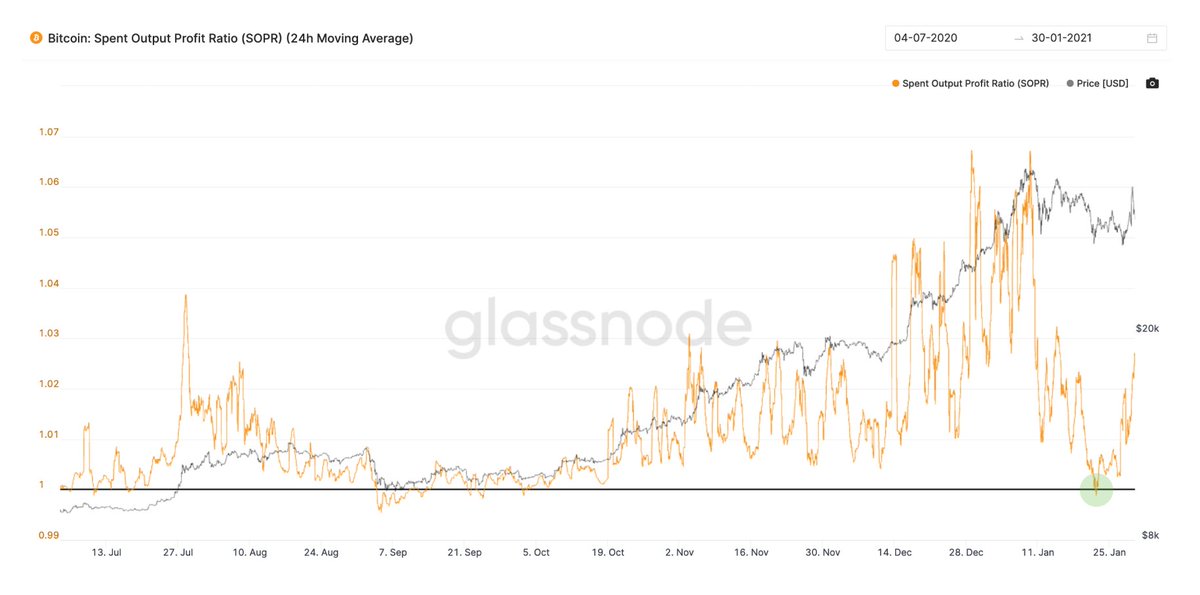

As the Bitcoin asset class inflates with value, it has outperformed every other asset class for its entire 10 year history.

Under the lens of ROI adjusted for risk, it's as performant today as it was in 2009, you haven't missed the boat.

Under the lens of ROI adjusted for risk, it's as performant today as it was in 2009, you haven't missed the boat.

After that, they'll usually ask about buying some Bitcoin.

I think my hit rate is +90%.

You may at this point warn them to avoid fake Bitcoins until they know exactly what they are, i.e. BCH and BSV. I say this in case they start going to bitcoin dot com by mistake.

I think my hit rate is +90%.

You may at this point warn them to avoid fake Bitcoins until they know exactly what they are, i.e. BCH and BSV. I say this in case they start going to bitcoin dot com by mistake.

I usually send them somewhere depending on their country.

Next year I'll recommend LVL when they do integrated banking and crypto accounts.

(Disclosure: I'm an LVL seed investor and yes that's a reflink)

lvl.co/woo

Next year I'll recommend LVL when they do integrated banking and crypto accounts.

(Disclosure: I'm an LVL seed investor and yes that's a reflink)

lvl.co/woo

Then I recommend Exodus Wallet as it's super intuitive and its best kept secret is amazing tech support (replies in under 15mins).

(Disclosure: I'm a seed investor in Exodus too, amazing product.)

exodus.io @exodus_io

(Disclosure: I'm a seed investor in Exodus too, amazing product.)

exodus.io @exodus_io

/ fini

Footnotes:

1) I do not go into technical underpinnings, when I buy a phone I don't need to know how an ARM chip works.

2) I do not go into the ethos of decentralisation, uncensorable, unconfiscatable money. People will rabbit hole after they have skin in the game

Footnotes:

1) I do not go into technical underpinnings, when I buy a phone I don't need to know how an ARM chip works.

2) I do not go into the ethos of decentralisation, uncensorable, unconfiscatable money. People will rabbit hole after they have skin in the game

Tweet References:

Bitcoin is the invention of an internet-native digital scarcity.

Bitcoin is the invention of an internet-native digital scarcity.

https://twitter.com/woonomic/status/1056377170338099200

• • •

Missing some Tweet in this thread? You can try to

force a refresh