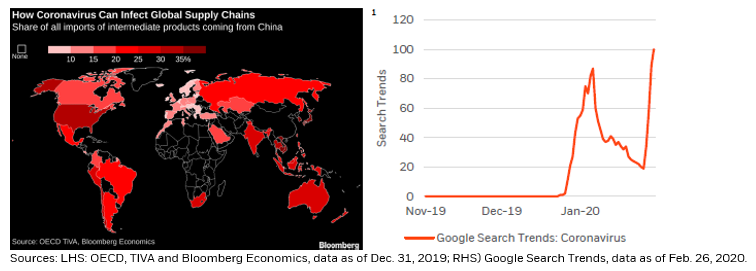

We’ve often suggested that #markets only focus on one thing at a time (perhaps two, if we include the political risk surrounding US elections), but the spread of #coronavirus is likely to re-rate the path of first half 2020 global #growth in a manner #investors should respect.

Yet, it’s critical to manage #portfolios through the short-term, with an eye always toward #investing for the medium-to-long-term: in other words, the recent extreme market #volatility is very unsettling, but at some point, it also delivers real opportunities.

And while the #Fed will do its part in maintaining #liquidity in the #financial system and in calming #volatile markets, for years we’ve counted on monetary policy to save the day. We think it’s time for a fiscal call to action, as #Fed influence on a health scare is limited.

• • •

Missing some Tweet in this thread? You can try to

force a refresh