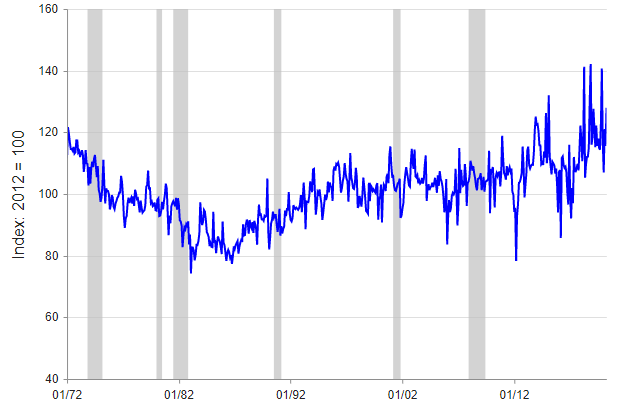

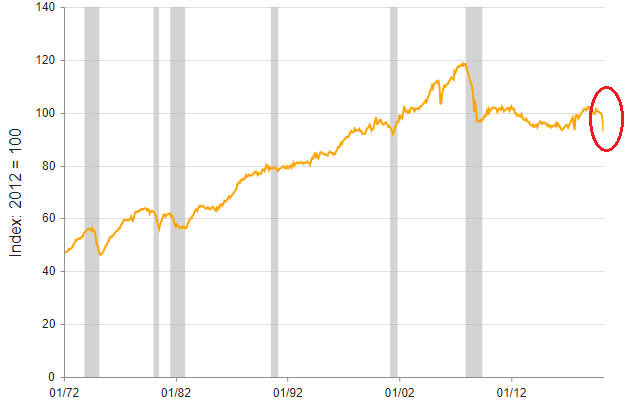

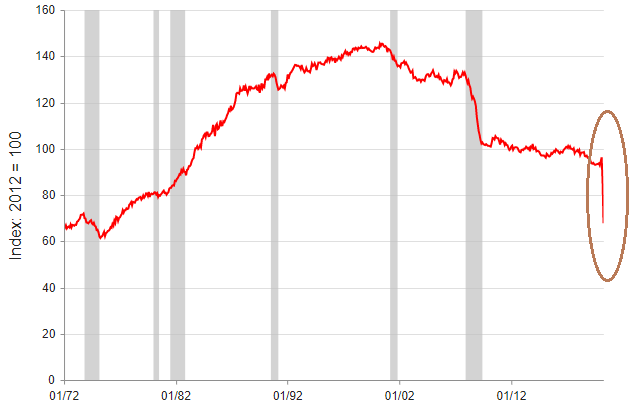

1. #MotorVehicles & Parts - down 80% in 2 months. It's the LOWEST since 1972. (2)

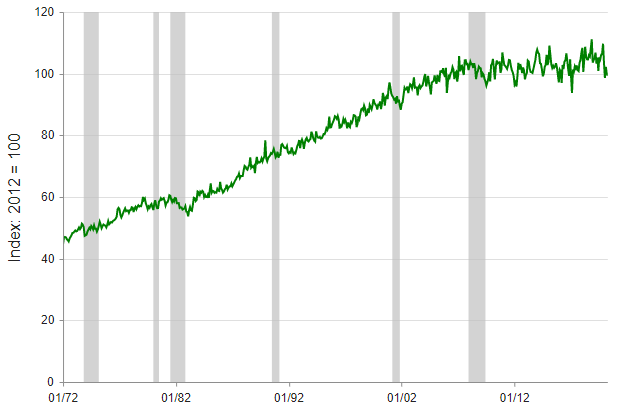

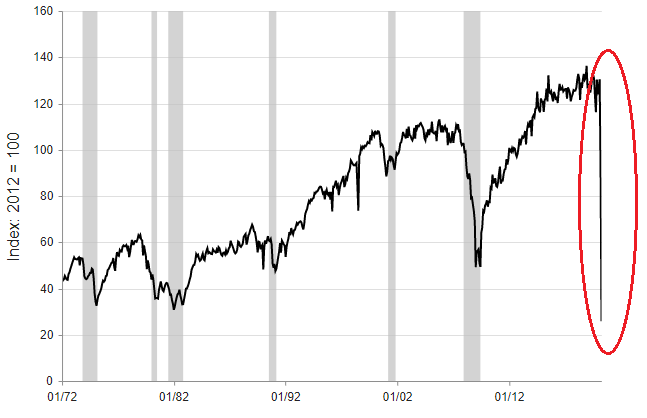

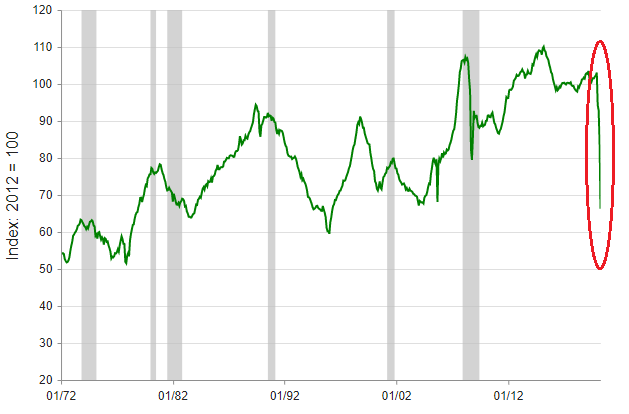

1. #NaturalGas distribution - up 5.7% in last 2 months; noisy data here but it's doing what utilities are expected to do i.e. stay relatively stable

(9)