- Optimism as payrolls +2.5mn – largest increase on record.

- Skepticism as gain contrasts sharply w/ new unemployment benefit since April.

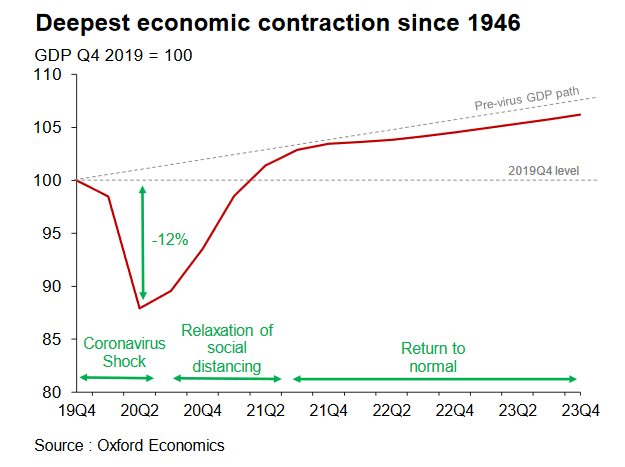

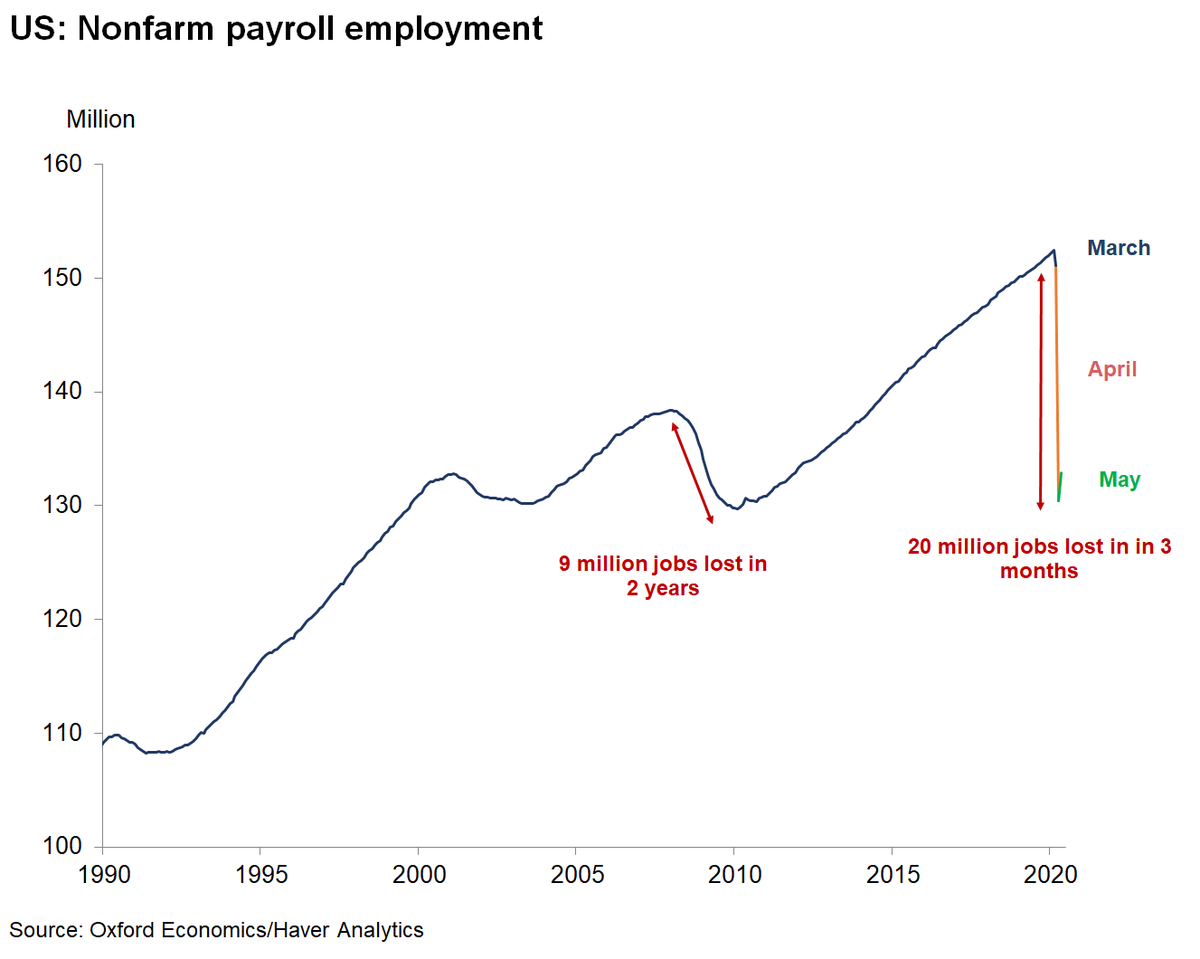

- Anguish as the cumulative 19.6mn job losses from GCR is 2* GFC

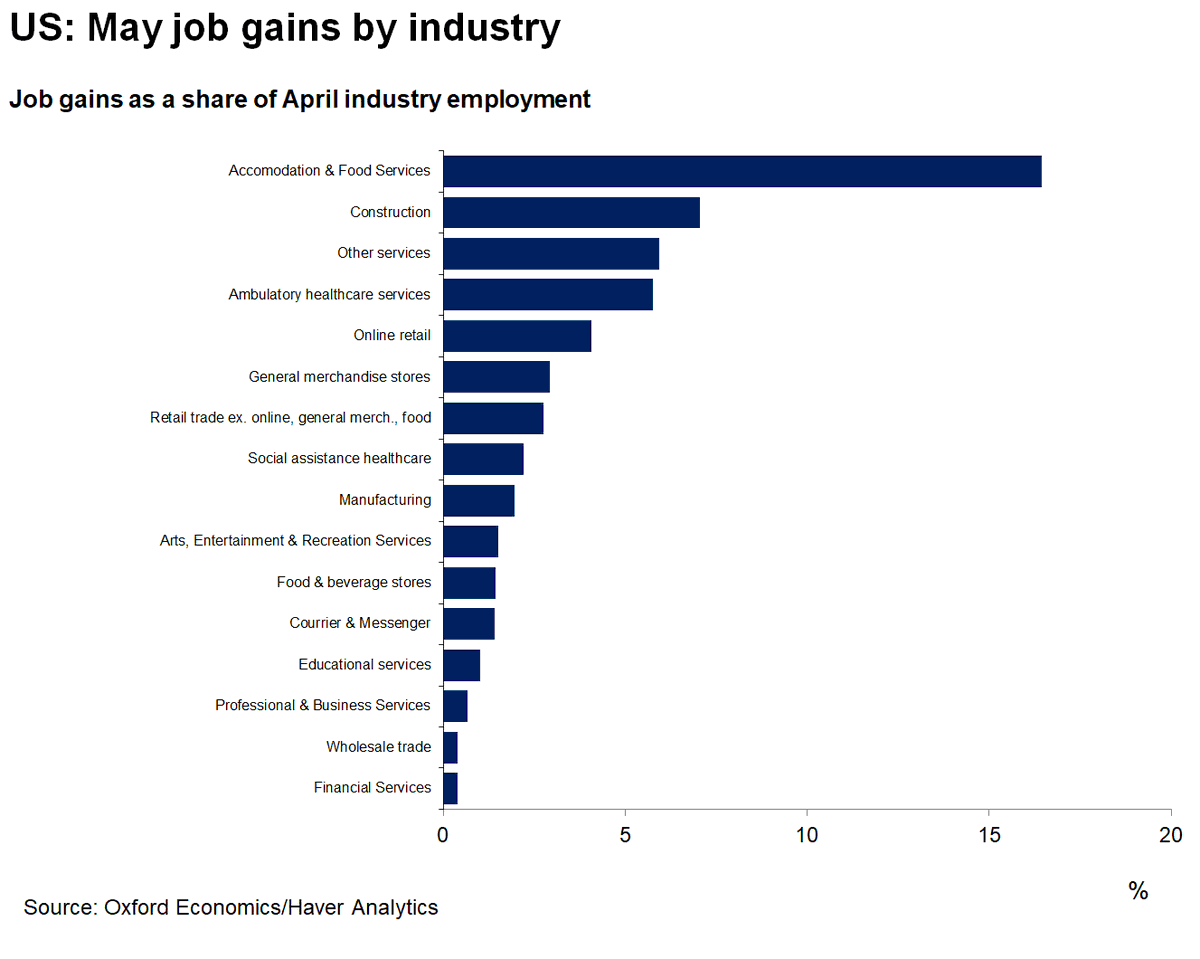

- leisure and hospitality (+1.2mn)

> with food services & drinking place (+1.4mn) making up 1/2 total gains

- construction (+464k)

- health services (+312k)

- #retail trade (+368k)

- #manufacturing (+225k)

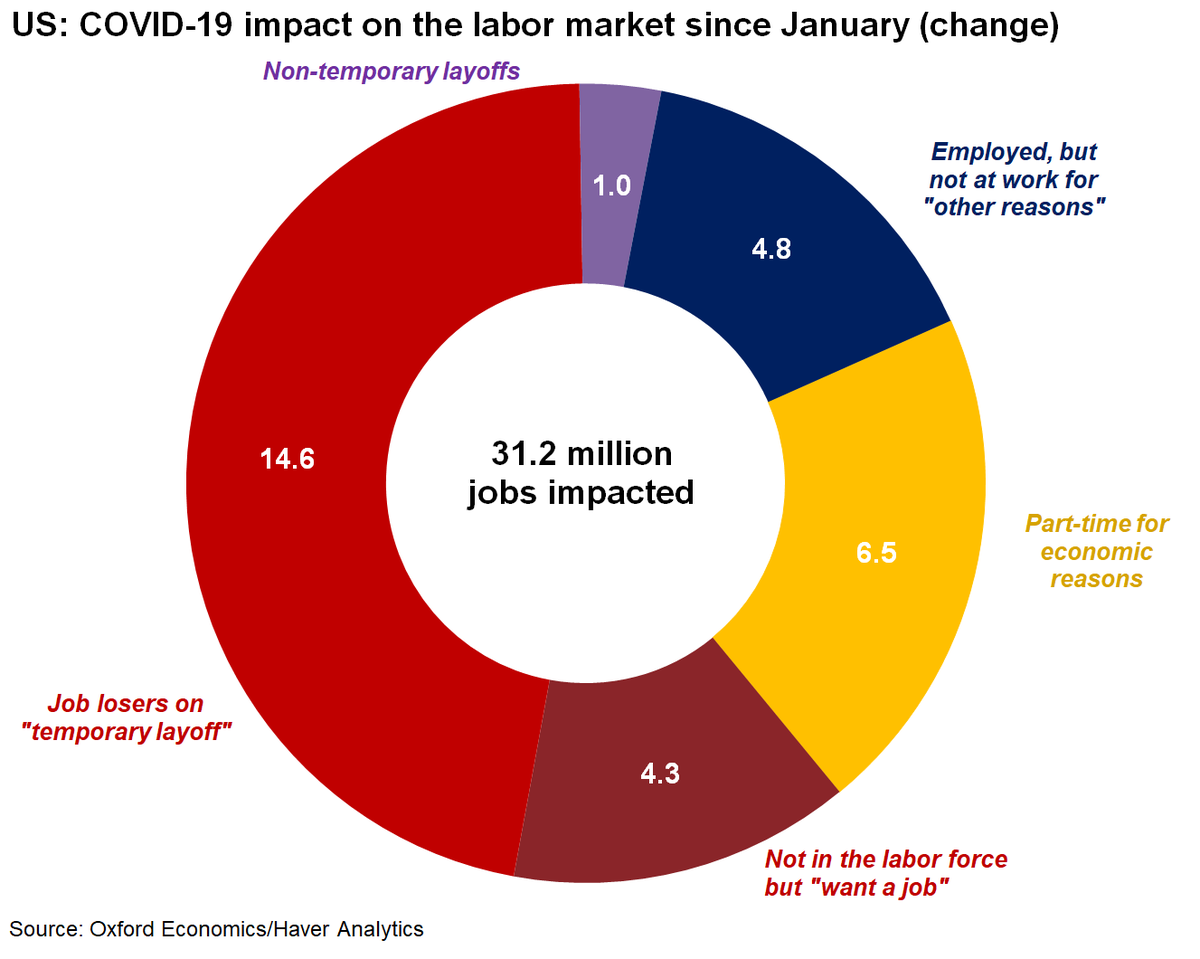

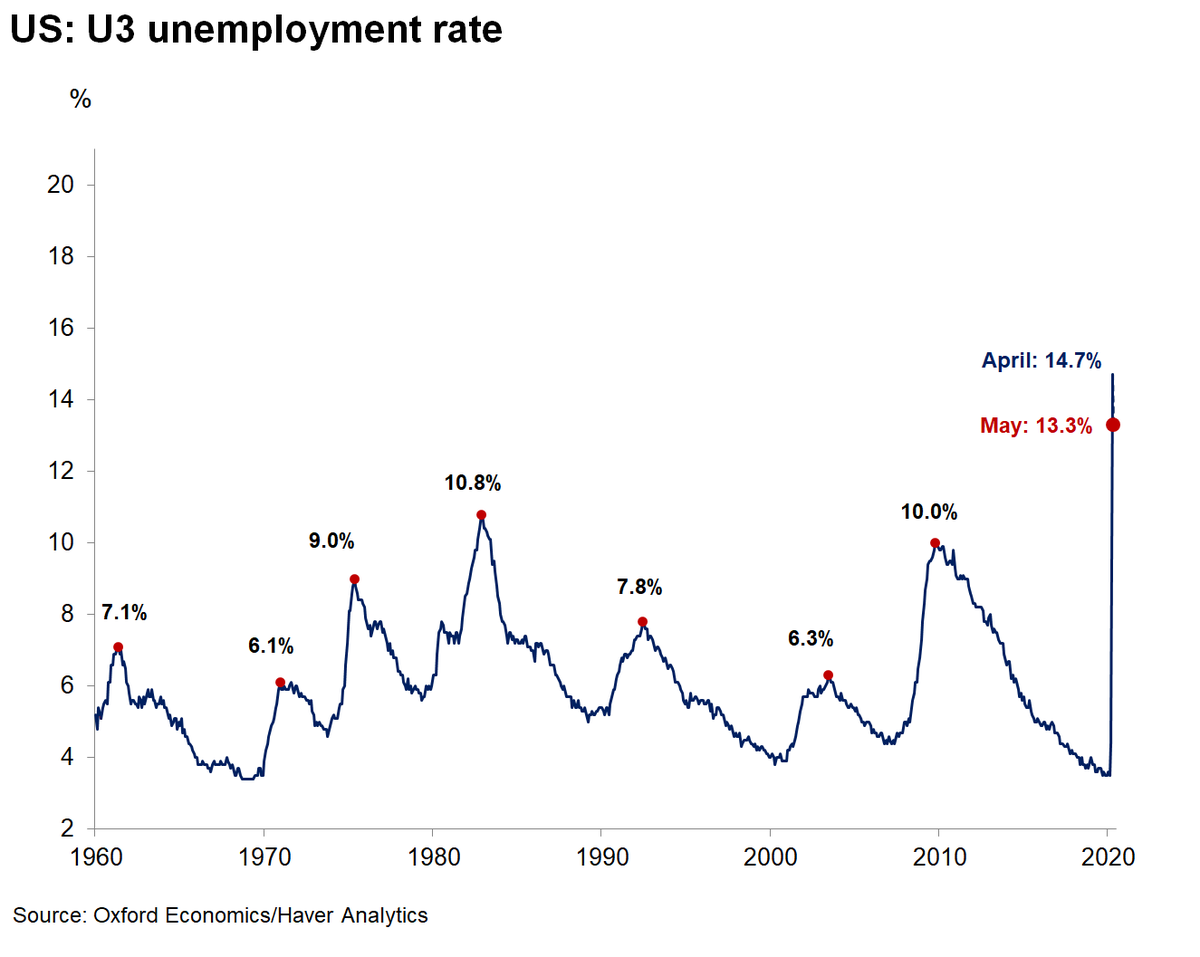

Still, w/ millions classifying themselves as “employed but absent from work” in May, this understated the true unemployment rate by 3pt

> 14.6mn more unemployed individuals

> 4.8mn more working but absent from work for “other reasons”

> 14.6mn more were working part-time for economic reasons

> 4.3mn falling out of labor force